Fintech

Apps That Will Help You Achieve Your Financial Goals

Social media, connection and woman typing on a phone to communicate, apps and chat. Web, search… [+] and a corporate employee reads a conversation on a cell phone, networks and sends messages on a mobile app

getty

The ad-supported wonder Mint had to shut down in March because it wasn’t making enough money. Unfortunately, those who subscribed to its services were no longer able to access their data on the app, and all of their data was lost. Intuit®, which was in debt to Mint and other platforms like TurboTax® and QuickBooks®, tried to convince everyone to migrate to Credit Karma. One user asked in a Reddit forum why anyone would want to continue working with these companies now that they’ve sent all their customers to hell and back trying to get their data and information back? And users still haven’t gotten their data back.

Your eyes may glaze over as you try to find a replacement app for all your budgeting, tax, estate planning, and investing needs. Any free version of the app can seem anemic at best and leave you wanting more of its capabilities. So, what apps do you need to manage your day-to-day finances and financial planning for now, retirement, and the future? Remember that in this day and age, you want to do it all without breaking the bank.

Here are some great apps that are leading the charge. These apps have comprehensive and integrated add-on solutions that will make a difference in a safer future for the savvy consumer.

1. Origin

While all of these apps offer valuable features, Origin’s comprehensive approach to financial management sets it apart. By integrating tax reporting, estate planning, budgeting, and investment management into one app, Origin eliminates the need for multiple financial tools and, more importantly, multiple fees. The all-in-one solution not only saves time and money, but also offers a seamless user experience. Its “AI assistant” is the equivalent of a lightweight financial advisor who helps you with budgeting, decision making, and understanding your money. Origin’s ability to offer personalized advice and insights into all aspects of your financial life makes it the ultimate one-stop shop for those looking to achieve financial wellness.

Origin is a pioneer in the financial app market, seamlessly combining multiple essential services into one platform. It offers robust tools for tax reporting, estate planning, budgeting, and investing, making it a complete and holistic financial solution. Users can manage their entire financial life through a single app, ensuring streamlined processes and reduced stress. Its intuitive interface and personalized advice cater to both beginners and experienced financial planners, making Origin a top choice for anyone who wants an easy way to take full control of their finances.

Cost: $12.99 per month, $99 per year

Free version: No

2. Monarch Money

Monarch Money excels at offering a highly customizable budgeting experience. It allows users to create personalized financial plans and track their progress with ease. The app’s collaborative features make it a favorite among families and couples who want to manage their finances together. Monarch Money will look at both sides of a couple’s input and help you determine which one has the forward-thinking solution that will give you a better outcome. Since Monarch Money is an app, there is no bias, so there are fewer issues to argue about. It will introduce you to better solutions than you could come up with on your own.

Cost: $14.99 per month, $99 for one year (after 7-day trial)

Free version: No

3. Quicken Simplify

Quicken Simplifi is known for its powerful budgeting tools and real-time expense tracking. It helps users stay on top of their finances with minimal effort, providing insights and recommendations based on individual spending patterns and guiding you toward actions that will help you reach your financial goals faster.

Cost: $5.99 per month, $47.99 per year

Free version: No

4. You need a budget (YNAB)

YNAB promotes a proactive approach to budgeting, encouraging users to assign every dollar a task. Its educational resources and supportive community help users develop better financial habits and reach their goals. You’ll learn what a budget really entails and discover the process to make your financial future brighter with fewer mistakes. YNAB tells it like it is: You need a budget, and it will help you get there with less confusion and trauma.

Cost: $14.99 per month, $99 per year (after 34-day trial)

Free version: No

5. Enhance

Empower is a fantastic combination of budgeting and banking with all the features and personalized financial coaching you need to succeed. Empower is designed to help users take control of their finances with expert guidance and automated tools. You get a complete financial planning and investing tool, with a budgeting feature that is built to be surprisingly easy to use. You will be truly empowered.

Costs: Commissions for investment management services only

Free version: Yes

6. Credit Karma

Credit Karma offers free credit scores and reports, along with personalized financial product recommendations. It helps users monitor their credit health and make informed financial decisions you never thought possible. You’ll see the results of your financial planning reflected in your credit score and create a plan to increase it even further. Financial product recommendations have been studied and proven to help people reach their goals.

Without costs

Free version: Yes

7. EveryDollar

EveryDollar, created by Dave Ramsey, promotes zero-based budgeting, where every dollar is accounted for. It is a great tool for those who follow Ramsey’s financial philosophy with the premium version offering access to coaching. If you listen to Dave Ramsey and have an insight into his practical approach, you will know you are in good hands. EveryDollar is a great choice for beginners in the world of budgeting. You will learn, you will grow, and if you are precise in following the program, you will achieve success.

Cost: $17.99 per month, $79.99 per year (after 14-day free trial)

Free version: Yes

8. Co-pilot

Copilot uses artificial intelligence (AI) to provide personalized financial advice and insights. It helps users optimize their spending and saving habits to achieve better financial outcomes. Copilot uses predictive analytics that predict future spending based on historical data, a popular feature that we recommend. AI is smarter than we are, so why not use it to help you peek into dark corners and point you in the right direction. Copilot is your co-pilot, sitting in your seat and you will feel supported.

Cost: $13/month, $95/year (after one month free trial)

Free version: No

9. Pocket Protection

PocketGuard makes budgeting easy by showing users how much they can safely spend after accounting for bills, goals, and needs. It’s a straightforward approach that makes it easy to stay on track. Users can set custom spending limits for various categories and get real-time alerts to help prevent overspending. PocketGuard is there to protect you from yourself, the one who sometimes has no control. PocketGuard encourages you to be the best version of yourself with your money.

Cost: $12.99 per month, $74.99 per year

Free version: Yes, extremely limited functionality

10. Racial Money

Rocket Money offers an uncommon standout feature: its subscription monitoring tool, which identifies and helps cancel unwanted recurring charges, saving users significant amounts over time. Did you know that the average person starts collecting around $1000 per month in unwanted subscriptions? Unique to Rocket Money is its ability for premium users to detect hidden fees and negotiate refunds on behalf of its users, alerting you to unwanted subscriptions, further maximizing savings for you.

Cost: $6-$12 per month (after 7-day free trial)

Free version: Yes

11. Rocket Dollar

Rocket Dollar is a mobile banking app and fintech platform that helps people use IRAs and 401(k)s so they can invest in alternative assets like real estate, startups, and other cryptocurrencies. Rocket Dollar allows you to diversify your portfolio in a way that someone could invest for you and control your money. This app invests your money with a trust company as custodian that can approve your alternative investments so you don’t end up on a list of prohibited investments that you don’t want to be in. The Rocket Money app helps you track your spending and find ways to save money and is accredited by the Better Business Bureau.

Cost: $4 to $12 per month (after free trial)

Free version: yes, but it’s a bit limited

12. Bitcoin Checking Account

Bitcoin IRA is a free app that allows you to invest in cryptocurrency and build your retirement account with an alternative investment. Some say it is the most trusted cryptocurrency IRA app in the world, allowing you to invest freely in your retirement accounts. There are definite advantages to investing directly in cryptocurrency as a cryptocurrency IRA. You can withdraw your assets once you are eligible for withdrawals and you can use it as a self-directed IRA. Bitcoin IRA has multiple levels of protection on customer funds.

Cost: 0.99% to 4.99% – one-time service fee charged in advance

Free version: No, and it has one of the highest monthly service fees

We hear that there is an economic crisis and everyone’s finances are in the toilet. You don’t want to be part of that crowd and you don’t have to. You can live in prosperity by taking care of your money more precisely with one of these apps. Here you will get the help you need for your financial future.

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

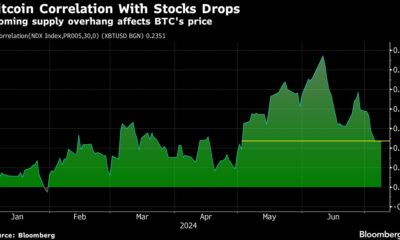

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto