Fintech

an interview with the Isle of Man’s Ros Lynch and Kurt Roosen

Ros Lynch and Kurt Roosen | Images of the Tynwald (IoM Parliament) and IoM capital Douglas [Global Government Fintech montage using photos by IoM Department for Enterprise and Ian Hall]

Two public sector leaders came together to discuss their organisations’ innovation agendas with Global Government Fintech editor Ian Hall

The Isle of Man (IoM) is a self-governing British Crown Dependency located in the Irish Sea, almost equidistant from England, Northern Ireland and Scotland.

Home to just 84,000 people (those from the Isle of Man are known as ‘Manx’), it markets itself to footloose international capital through low tax rates – including zero per cent corporate income tax and low personal tax rates. It is keen to promote itself as a good place locate and grow tech-focused businesses, including fintech companies.

As part of this strategy, the IoM government put its weight behind the ‘Innovation Challenge 2024’ – a successor initiative to a ‘Fintech Innovation Challenge’ (2023). The competition saw 13 finalists present their solutions in across fintech, data and artificial intelligence (AI), and ‘CleanTech’ categories during a ‘finale’ event on 13 June – all with the broader aim of showcasing the IoM as a pro-innovation jurisdiction and encouraging collaboration between the public- and private-sectors.

Global Government Fintech met the IoM Financial Services Authority (FSA)’s Ros Lynch and Digital Isle of Man’s Kurt Roosen – during the ‘finale’ event, held at a hotel outside the island’s capital Douglas, to explore their organisations’ approach to innovation.

Topics discussed include: enhancing regulatory supervision and compliance through data modernisation; digital ID; and even the potential of cryptocurrency for the public sector.

RELATED ARTICLE Isle of Man government-backed ‘innovation challenge’ competition winners revealed – a news article (14 June 2024) on the teams that emerged triumphant in the ‘Innovation Challenge 2024’

FSA’s data modernisation

Lynch is head of supervisory practices and innovation strategy at the FSA, which has about 92 staff. (For comparison, the UK’s Financial Conduct Authority had 3,791 full-time equivalent employees in 2022).

The authority supervises about 350 regulated entities that provide financial services, as well as a further 320 designated non-financial businesses and professions (DNFBPs). The latter group spans sectors and professions seen as being susceptible to being used for money-laundering purposes: for example, accountants, tax advisers and estate agents.

Lynch leads a team of four, which – although constituting one of the FSA’s smallest divisions – is getting bigger (she is recruiting for the new role of data architect), with a focus on data modernisation.

This growth is mainly in anticipation of the IoM’s next international anti-money laundering (AML) assessment: specifically, a visit – expected in about two years – from ‘MONEYVAL’, the Financial Action Task Force (FATF)-style monitoring body of the Council of Europe that assesses compliance with the principal international standards on AML and countering the financing of terrorism (CFT).

“Our ‘data story’ feeds into our evidencing our effectiveness against this assessment,” Lynch – who joined the FSA six years ago – explains.

*** GLOBAL GOVERNMENT FINTECH’S ‘DATA‘ TOPIC SECTION ***

Navigating with a new Atlas

The FSA receives about 2,500 different types of ‘returns’ (document filings) annually. These are, for example, quarterly prudential returns submitted by banks, sector-specific statistical returns and insurance returns covering regulatory balance-sheet and solvency capital requirements. The returns each contain between about 200 to 7,000 ‘data points’.

“When you’ve got a cohort of about 600-700 entities [that need to file documents], that is a huge amount of data to consume,” Lynch says.

Over the past five years the FSA has (working alongside external developers and using Microsoft Dynamics) built its own ‘back office’ data system, called ‘Atlas’, to house its supervisory activity. This is integrated with a ‘data warehouse’ (for returns data).

In October 2023 the FSA announced that, alongside the IoM Gambling Supervision Commission (GSC), it was rolling out a new data collection and risk assessment tool – ‘STRIX ALM’ – to support AML/CFT supervision. The two authorities are collaborating with Vienna (Austria)-based software development firm Financial Transparency Solutions on implementation.

‘The solution enables supervisors to gain a deeper understanding of AML/CFT risk, and to focus their resources on the firms and sectors that pose the biggest threats,’ the announcement stated. ‘Benefits include the streamlining of data collection and analytics, greater automation of the risk assessment process, and the accurate identification of firms with an elevated ML/TF risk,’ it continued, adding that it also ‘makes it easier for firms to provide the required data through a dedicated online portal’.

*** JOIN GLOBAL GOVERNMENT FINTECH’S LINKEDIN COMMUNITY ***

Helping the FSA’s ‘consumers’

In February 2024 the FSA also announced a collaboration with a Luxembourg-based company, Regsearch, to use AI for compliance-related interactions with companies.

The link-up stemmed from an ‘InsurTech Acceleration Programme’ (a similar initiative to the IoM’s fintech and ‘innovation’ challenges).

Regsearch is offering use of REGI to the FSA free of charge (and says it would do likewise to any other regulator – it charges an annual recurring licence fee to companies to use its ‘Software as a Service’ solution called ‘Regsearch GMT’, where GMT stands for ‘Governance Management Technology’).

“Effectively it will create a ChatGPT-like component on our website – it’ll be called ‘Ask REGI’ or something like that,” Lynch says. “It will be able to answer regulatory questions, such as: ‘how do I become regulated on the Isle of Man’; ‘what does “this” mean, what does “that” mean?’”, she explains.

“We have a lot of work to do to get there,” she continues. “I’ve seen the first version of the beta this week, actually. We’ve already been providing quite a lot of feedback. Now, if we can get that live and launch, that will be something that we think that will help our ‘consumers’.”

RELATED ARTICLE Isle of Man regulator to use AI tool for compliance-related interactions – a news story (26 February 2024) on the FSA announcing the collaboration with Regsearch

‘Game-changing’ data progress

Assessing the FSA’s data modernisation journey to date, Lynch says that the FSA now has access to “five years’ worth of amazingly powerful data” (she describes its database prior to that as being “rudimentary, to say the least”).

“The system now enables us to receive [data] seamlessly. It ingests it, pre-validates it and because of the way we’ve structured [the database], we’re now able to report – at the touch of a button – on trends, exceptions, risk. It’s like a game-changer,” she says.

As well as MONEYVAL, Lynch also mentions all this data’s usefulness for a ‘National Risk Assessment’ (NRA), scheduled for publication early in 2025. This is examining current and emerging risks in relation to the IoM’s financial and specified non-financial sectors, and measures in place to mitigate those risks. The findings ‘will inform national policies and help to focus resources where they are most needed’, the government has said. It will be the IoM’s third NRA (after reports published in 2015 and 2020).

Lynch speaks, more broadly, of moving towards “reaping the rewards” of the FSA’s data modernisation. “I think that our data journey, as a regulator, has… well, it’s been sweat, blood and tears on occasion [but] it’s really worth it,” she says.

“Once we’ve got – and sort of ‘consume’ significant data – I think we would like to look at machine learning and AI [artificial intelligence] sitting on top of that. But that’s an aspiration,” she continues. “We have to get all the foundations right before we can look at that.”

*** JOIN GLOBAL GOVERNMENT FINTECH ON LINKEDIN ***

Sharing ‘small nation’ experiences

The FSA co-ordinates closely with the other Crown dependencies – most notably the Channel Island of Jersey (which has a population slightly bigger than the IoM at about 103,000) – as well as being a member of the Global Financial Innovators Network (GFIN).

Lynch describes the FSA’s counterpart authority in Jersey as “on a very similar journey to us” and speaks of “sharing ideas”.

“We have to do on a small budget, what [other] regulators have massive budgets to do,” she says.

In this regard, she highlights that the FSA has, since 2009, hosted an executive education programme called the Small Countries Financial Management Centre (SCFMC). The initiative, run in conjunction with Oxford University, attracts representatives from finance ministries, central banks and regulatory bodies to the IoM from locations such as Africa and the Caribbean. Sessions use case studies to provide insight into how other small countries have tackled common challenges. The next gathering is from 29 June to 11 July 2024.

“The Isle of Man has overcome many issues that are still being experienced by other small nations and the SCFMC provides an opportunity to share that knowledge,” Lynch says.

RELATED ARTICLE SupTech on the rise: financial supervisors explore innovative technology – a write-up of a session at the Global Government Fintech Lab 2023 during which representatives from Norway, Croatia and Bermuda described how their authorities are using SupTech and barriers to greater uptake

Sandbox and Financial Innovation Hub

On the question of institutional arrangements to help companies with innovative propositions to interact with the authorities (and vice versa), the IoM has both a regulatory sandbox (virtual test-space to allow testing of products and services developed by private firms using innovative technology in a controlled environment) and Financial Innovation Hub.

An increasing number of countries have (or in the process of setting up) such structures. For example, the FCA in the UK has a regulatory sandbox and digital sandbox; while, across the sea to the west, the Central Bank of Ireland is launching a sandbox later this year.

Sandboxes across the world differ in the way they work: some (like the FCA’s regulatory sandbox) are ‘always open’ while the Irish sandbox will run according to themes.

At present just one firm is involved with the IoM sandbox, which is of the ‘always open’ variety. “We wanted to get it established and to get people working through it, and obviously as well – as a regulator – you want to learn how to operate these things efficiently and effectively,” Lynch says.

“We might consider some sprint-type elements through the Hub,” she adds (a ‘sprint’ is used by regulators to define time-limited hackathon-esque activity focused on a particular challenge).

‘Observatory’ in development

Kurt Roosen and Ros Lynch photographed at the ‘Innovation Challenge 2024’ | Credit: Ian Hall

Kurt Roosen and Ros Lynch photographed at the ‘Innovation Challenge 2024’ | Credit: Ian Hall

With Digital Isle of Man being one of the Financial Innovation Hub’s three co-ordinating organisations (alongside the FSA and Finance Isle of Man), it’s a natural moment for Roosen to join the conversation.

Roosen, who is head of innovation at Digital Isle of Man (an executive agency within the Department for Enterprise), says the authorities are looking to continue to evolve its fintech innovation offering by establishing two “pathways” that companies can follow when engaging with its Financial Innovation Hub, which itself only launched in January.

The first path would be for firms to go through an assessment process viewed by all the reviewing parties and be deemed to fall within the realm of existing regulations. If accepted, this type of entrant would then be managed by the FSA in its sandbox, using conditional licensing.

The second path follows the same initial review route but would not be deemed to be a regulated activity yet or may be an item specifically related to regulated activity in its own right. As an example, ranges of products categorised as SupTech (supervisory technology) and RegTech (regulatory technology) would fall into this category. These entrants, if accepted, would be managed by government agencies through a newly created ‘Observatory’.

“There may be a combination of things placed in the Observatory,” Roosen explains. “It may be something that hasn’t been regulated yet, but that might be in the future. Or it might be something that’s connected to the fintech ecosystem that might be legislated but not really ‘regulated’, like digital ID.”

“We might conclude: ‘you’ve got to the end of our interactive process and we don’t think it is a good fit within the Isle of Man ecosystem”, or we might conclude ‘that’s something we want to support in the future through regulation’,” he says. “Overall, we believe the combination of these two tracks in the same place is a unique proposition that we believe may make the whole process of integrating fintech with the regulator easier, for both sides.”

‘Learning exercise’ important

So, what is the current status of the ‘Observatory’? “We’ve set up a structure and we haven’t yet actively promoted it,” Roosen says.

“We’ve still got one or two considerations about the workflows and how we make them hang together with appropriate resourcing and SLAs [service level agreements]. Who manages what is a key factor. The Observatory is non-regulatory, it’s managed by the Digital and Finance agencies [Digital Isle of Man and Finance Isle of Man], but the FSA will still have visibility, as the power of the proposition is that all innovations in the fintech arena go through the same hub.”

Would the Observatory have full-time staff? “It’s something we are considering because the worst thing for us to do would be launch something and then not be able to really support it,” Lynch says.

Roosen comments further on the Observatory’s overall aim.

“The ‘learning exercise’ is really important to us,” he says. “I think the Observatory gives us, as a government, an opportunity to say: ‘we don’t know about this subject, and we want to invite you in for us to learn alongside you’. The speed of innovation needs this type of collaborative and open approach.”

RELATED ARTICLE Sandboxes could ‘amplify problems’: IMF analysis questions many test-spaces’ impact – a news story (11 September 2023) based on an International Monetary Fund (IMF) paper titled ‘Institutional Arrangements for Fintech Regulation: Supervisory Monitoring’

Digital ID: different perspective

Asked about fintech-related topics that are prominent in the IoM, Roosen mentions digital ID. “Digital ID is kind of an underpinning of how people talk to each other and how they identify each other,” he says.

“But our perspective is somewhat different from other governments,” he continues. “A lot of governments are putting frameworks together starting on the basis that they have to identify their own citizens and provide their own IDs. For us, that isn’t an imperative. Access to services is relatively straightforward [here], so we’re looking at it from the other perspective.”

The focus in the IoM has been on ‘beneficial owners’ (someone who owns or controls more than 25 per cent of a legal entity), he says. “When we looked at the register of beneficial owners, we said, ‘so how do we validate all of these people who say they come from other places and they own parts of our companies?’; and the best way to do that, we felt, was to latch onto other places’ IDs and therefore become agnostic towards IDs.”

“The Isle of Man government is building an ‘orchestration layer’ that will ‘talk to’ multiple ID providers so we can look at accepting IDs that are certified on frameworks elsewhere,” he says. “So, we’re looking worldwide at where we can accept things from. And actually, when you talk to the ID providers, this is a bit of a game-changer for them as well – when you’re starting to orchestrate these things on their behalf, as well as for the owners of the ID.”

“There’s an idiosyncrasy about digital ID,” Roosen continues. “If you go to any ID provider and say: ‘Can you provide a digital ID for me?’, then the first thing I have to do is deliver them some analogue information, i.e. a copy of passport, driving licence and things like that.”

He gives a specific example of thinking from the IoM: age verification for people to be served alcohol in pubs. “Our legislation allows us to do ‘pure’ digital ID, unlike the UK, which doesn’t allow that,” he says. “So, to seed that process, our education department provides student ID cards, and it knows who they are. It’s a government body, so it could issue digital ID when people get to 18 and start the whole process off. Currently, digital ID providers said ‘we can’t do that because you’ve got to create a card first that we can read’. So, we’re kind of re-engineering the process somewhat to say: ‘don’t start halfway down the journey, we can actually start at the beginning’.”

*** GLOBAL GOVERNMENT FINTECH’S ‘ID VERIFICATION’ TOPIC SECTION ***

IoM’s ‘analogue stablecoin’

Central bank digital currencies (CBDCs), another prominent fintech-related topic for many governments worldwide, are also mentioned by Roosen.

The Bahamas and Jamaica (both relatively small island states) are among the few jurisdictions where CBDCs are (fully) ‘live’.

Is a Manx CBDC a possibility? The IoM has its own currency, the Manx pound, which is pegged to sterling (GBP). Roosen refers to it, with a grin, as an “analogue stablecoin” – a reference to a crypto-currency that is pegged to a fiat currency or a commodity. “It’s a fact that it exists that way,” he says.

“It means that, as a test-bed, we certainly have the capability to test and refine how a digital currency works, without having to get into the nuances of the central bank,” he says, adding that at least one international payments company has shown interest in such a project in the IoM.

He broadens out this point about the IoM’s test-bed potential. “Certainly if we get the Financial Innovation Hub running effectively, there can be a lot of things that are ‘test-bedded’ here, because we can ‘contain’ them very well. So, you can look at things that ultimately might not work but see how they can develop over time within a safe environment,” he says.

*** GLOBAL GOVERNMENT FINTECH’S ‘DIGITAL CURRENCIES’ TOPIC SECTION ***

Crypto’s possibilities

Roosen also brings up cryptocurrency in the context of government accepting payments in crypto – a relatively leftfield topic that has relatively few examples to date (one example comes from Switzerland, where payments to city of Lugano’s municipality can now be made in Bitcoin and Tether – a move described by the municipality’s crypto payments champion as ‘pioneering’ for the public sector).

“On the island itself, there’s a very thriving bitcoin community”, he says, mentioning the Lightning Network as an example. “There’s quite a number of businesses that accept bitcoin for payments, such as in pubs – you can buy a car that way if you want to.”

“It’s not that we [government] are going to hold crypto accounts,” he continues. “It’s that we could use the gateways to do the conversions for us and open up a whole number of things.”

He says that conversations have been had with the Isle of Man Treasury. “My point [to them] was, if you’re working through a [payment] gateway, that gateway converts [crypto] into fiat and puts your required amount of pounds into an account,” he says. “If a person wanted to pay in goats… if someone was willing to convert those goats into pounds, what difference does it make to you? The risk is elsewhere.”

“As long as you’re not taking the currency risk, then accepting what an exchange will deal with shouldn’t be a problem,” he continues. “We’re not going to accept taxes paid in dollars [for example] because we’re a sterling jurisdiction. But ultimately, someone could pay through our gateway, and the gateway converts from the dollars into sterling, so that makes no difference to us. So as long as that boundary exists, there is no reason why not to.”

*** JOIN GLOBAL GOVERNMENT FINTECH ON X (TWITTER) AND INSTAGRAM ***

Balancing risk and reward

Thoughts race as to the possibilities. But not everything fintech-related on the IoM is running to timetable.

In July 2022 Digital Isle of Man published an article stating that a ‘significant amount of effort is being invested in defining our context in [the] “brave new fintech world”, building to a specific and globally competitive Isle of Man Fintech Strategy by the end of 2022.’ This strategy’s publication date has, however, slipped. Roosen says that publication target date is now autumn 2024. Expect to see the Financial Innovation Hub feature prominently.

“It’s a meeting of minds because we [FSA] are naturally very risk averse,” says Lynch, smiling. “So, our fintech strategy, if we wrote it, would be like ‘closing the doors’ [on innovation]. If these guys [Digital Isle of Man] wrote it, they’d be opening the floodgates.”

“And you’ve also got to put everything we do in the backdrop of MONEYVAL,” she continues. “You have to balance the risk with the reward.”

Roosen has the final word. “The Isle of Man is never going to have the people resource that other places do,” he says. “So, if you want to maintain a parity with things happening elsewhere in the world, we do them smarter. We have no choice but to do that.”

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi11 months ago

DeFi11 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech11 months ago

Fintech11 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News12 months ago

News12 months agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi11 months ago

DeFi11 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi11 months ago

DeFi11 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News12 months ago

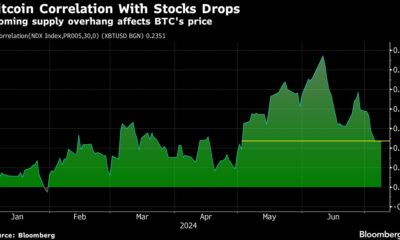

News12 months agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech11 months ago

Fintech11 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos5 months ago

Videos5 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto