News

Approvazione dell’ETF su Ethereum per aprire le porte a più ETF sulle criptovalute

Se hai una parvenza di interesse per il trading di criptovalute, dovresti aver già sentito che l’approvazione dell’ETF Ethereum da parte della SEC (Securities and Exchange Commission) è a buon punto. Gli investitori in criptovaluta stanno per avere l’opportunità di acquistare alcuni nuovissimi prodotti quotati in Borsa nei prossimi giorni o settimane, in attesa della conferma finale da parte dell’ente regolatore.

L’opposizione di lunga data da parte del principale regolatore finanziario statunitense e del suo presidente Gary Gensler al fatto che la seconda criptovaluta più grande per capitalizzazione di mercato riceva un ETF dedicato quotato sulle borse statunitensi, è stata ampiamente superata, e non senza pressioni politiche.

In concomitanza con l’approvazione di un disegno di legge chiave relativo alle criptovalute da parte della Camera dei Rappresentanti degli Stati Uniti, chiamato FIT 21 mercoledì, il ETF sull’Ethereum l’approvazione potrebbe preparare il terreno per un più ampio rally del mercato delle criptovalute. Detto questo, il Financial Innovation and Technology in the 21st Century Act necessita ancora dell’approvazione del Senato per essere convertito in legge.

Pressioni politiche per l’approvazione dell’ETF sull’Ethereum

IL approvazione dell’ETF Ethereum c’è stato un netto cambiamento nell’opinione normativa: fino a questa settimana il mercato non aveva previsto un’approvazione del prodotto nell’immediato futuro, e la situazione è letteralmente cambiata con un paio di tweet. Probabilmente, il primo è stato inviato dall’analista senior di ETF di Bloomberg, Eric Balchunas.

Il conseguente rally di circa il 20%. Ethereum è stato brusco e ha colto di sorpresa parte del mercato, esacerbando il passaggio a un rally molto brusco nella tarda serata di lunedì. Dopo essersi consolidato in un ambito appena stabilito dopo la notizia, giovedì mattina un altro tweet bomba dello stesso autore ha evidenziato un nuovo sviluppo.

Un gruppo bipartisan di legislatori della Camera, tra cui il capogruppo della maggioranza Tom Emmer e il democratico del New Jersey Josh Gottheimer, ha inviato una lettera al presidente della SEC Gary Gensler sollecitando l’approvazione non solo degli ETF spot su Ether ma anche di altri ETF su asset digitali.

Un gruppo bipartisan di legislatori della Camera (tra cui il capogruppo della maggioranza Tom Emmer e il democratico del New Jersey Josh Gottheimer) hanno inviato a Gary Gensler una lettera sollecitando la SEC ad approvare gli ETF spot su Ether (e “altre” risorse digitali) perché offre agli investitori l’accesso alle criptovalute in una cassaforte regolamentata e trasparente. formato pic.twitter.com/YLSJh6n0lF

— Eric Balchunas (@EricBalchunas) 23 maggio 2024

I legislatori ne vedono l’approvazione spot ETP Bitcoin (prodotti negoziati in borsa) come una pietra miliare significativa sia per le risorse digitali che per i mercati finanziari. Ritengono che questi prodotti forniscano un veicolo di investimento sicuro e regolamentato per l’esposizione alla criptovaluta e riflettano l’impegno della SEC per la protezione degli investitori e la modernizzazione dei mercati finanziari.

La lettera sottolinea che i requisiti di trasparenza e rendicontazione degli ETP contribuiranno a mitigare la manipolazione del mercato e altre attività illecite. Il presidente della SEC Gensler è invitato ad applicare gli stessi principi utilizzati nell’approvazione degli ETP su Bitcoin quando esamina le richieste di ETP su Ethereum e sottolinea che le considerazioni legali per entrambi sono simili.

Con le imminenti elezioni americane e un Congresso ampiamente favorevole per quanto riguarda la nuova legislazione sulle criptovalute, la prossima fase di crescita per il settore potrebbe essere a pochi mesi di distanza. Nonostante i significativi shock di liquidità sul mercato, criptovalute sono stati legittimati come veicolo di investimento accessibile, nonostante la forte opposizione del presidente della SEC Gensler.

Spiegazione della legge sull’innovazione finanziaria e tecnologica

Mercoledì, democratici e repubblicani della Camera si sono uniti e hanno approvato un nuovo atto legislativo che mira a delineare definizioni più specifiche su quali criptovalute siano considerate titoli e ricadranno sotto l’ombrello normativo della SEC.

Se la blockchain utilizzata in una criptovaluta è funzionale e decentralizzata, cadrà sotto la supervisione della CFTC. Per quanto riguarda le reti blockchain centralizzate, queste saranno designate come titoli e rientreranno nella categoria più rigoroso controllo regolamentare della SEC.

Nonostante l’opposizione del presidente della SEC Gary Gensler, che ha sostenuto che ci sono lacune normative nel quadro proposto, FIT 21 è passato con i voti di 71 democratici e 208 repubblicani.

Gensler ha sottolineato che i problemi per gli investitori continuano ad essere ampi e causati principalmente dal mancato rispetto delle regole esistenti, piuttosto che dall’ambiguità normativa. Tuttavia, l’organismo di regolamentazione ha ritirato la sua opposizione all’approvazione di un ETF sull’Ethereum dopo pressioni politiche.

Il presidente della SEC ha espresso la sua preoccupazione per il fatto che FIT 21 consenta agli emittenti di autocertificare la decentralizzazione, sfuggendo così alla supervisione della SEC e operando potenzialmente in condizioni più leggere Regolamento CFTC.

Il vicepresidente del comitato per i servizi finanziari della Camera e presidente del nuovo sottocomitato incaricato di supervisionare tutte le aree relative alle risorse digitali e alla tecnologia finanziaria, il rappresentante French Hill, (R) AR ha difeso il disegno di legge, affermando che non crea scappatoie né deregolamenta le criptovalute ma fornisce chiarezza.

Il presidente dei servizi finanziari della Camera Patrick McHenry ha sottolineato che FIT 21 risolve la confusione normativa tra SEC e CFTC, offrendo regole chiare e forti barriere per l’impegno delle risorse digitali.

ETF oltre Bitcoin ed Ethereum

Resta da vedere come può un’azienda dimostrare che la blockchain che utilizza è decentralizzata, ma con le potenziali approvazioni dell’ETF per più asset digitali, il quadro normativo sulle criptovalute negli Stati Uniti è probabile che continui il suo sviluppo nei prossimi trimestri.

Gli eventi accaduti questa settimana potrebbero essere solo l’inizio della fine del pesante dominio di Bitcoin ed Ethereum sul mercato delle criptovalute che si è insinuato da quando sono circolate le prime voci sull’approvazione degli ETF.

Dato che la maggior parte delle criptovalute più piccole non riescono a cogliere il rally unico delle due più grandi catene di criptovalute, le speculazioni sul futuro dei futuri prodotti ETF relativi a più token digitali potrebbero iniziare proprio dietro l’angolo.

Se hai una parvenza di interesse per il trading di criptovalute, dovresti aver già sentito che l’approvazione dell’ETF Ethereum da parte della SEC (Securities and Exchange Commission) è a buon punto. Gli investitori in criptovaluta stanno per avere l’opportunità di acquistare alcuni nuovissimi prodotti quotati in Borsa nei prossimi giorni o settimane, in attesa della conferma finale da parte dell’ente regolatore.

L’opposizione di lunga data da parte del principale regolatore finanziario statunitense e del suo presidente Gary Gensler al fatto che la seconda criptovaluta più grande per capitalizzazione di mercato riceva un ETF dedicato quotato sulle borse statunitensi, è stata ampiamente superata, e non senza pressioni politiche.

In concomitanza con l’approvazione di un disegno di legge chiave relativo alle criptovalute da parte della Camera dei Rappresentanti degli Stati Uniti, chiamato FIT 21 mercoledì, il ETF sull’Ethereum l’approvazione potrebbe preparare il terreno per un più ampio rally del mercato delle criptovalute. Detto questo, il Financial Innovation and Technology in the 21st Century Act necessita ancora dell’approvazione del Senato per essere convertito in legge.

Pressioni politiche per l’approvazione dell’ETF sull’Ethereum

IL approvazione dell’ETF Ethereum c’è stato un netto cambiamento nell’opinione normativa: fino a questa settimana il mercato non aveva previsto un’approvazione del prodotto nell’immediato futuro, e la situazione è letteralmente cambiata con un paio di tweet. Probabilmente, il primo è stato inviato dall’analista senior di ETF di Bloomberg, Eric Balchunas.

Il conseguente rally di circa il 20%. Ethereum è stato brusco e ha colto di sorpresa parte del mercato, esacerbando il passaggio a un rally molto brusco nella tarda serata di lunedì. Dopo essersi consolidato in un ambito appena stabilito dopo la notizia, giovedì mattina un altro tweet bomba dello stesso autore ha evidenziato un nuovo sviluppo.

Un gruppo bipartisan di legislatori della Camera, tra cui il capogruppo della maggioranza Tom Emmer e il democratico del New Jersey Josh Gottheimer, ha inviato una lettera al presidente della SEC Gary Gensler sollecitando l’approvazione non solo degli ETF spot su Ether ma anche di altri ETF su asset digitali.

Un gruppo bipartisan di legislatori della Camera (tra cui il capogruppo della maggioranza Tom Emmer e il democratico del New Jersey Josh Gottheimer) hanno inviato a Gary Gensler una lettera sollecitando la SEC ad approvare gli ETF spot su Ether (e “altre” risorse digitali) perché offre agli investitori l’accesso alle criptovalute in una cassaforte regolamentata e trasparente. formato pic.twitter.com/YLSJh6n0lF

— Eric Balchunas (@EricBalchunas) 23 maggio 2024

I legislatori ne vedono l’approvazione spot ETP Bitcoin (prodotti negoziati in borsa) come una pietra miliare significativa sia per le risorse digitali che per i mercati finanziari. Ritengono che questi prodotti forniscano un veicolo di investimento sicuro e regolamentato per l’esposizione alla criptovaluta e riflettano l’impegno della SEC per la protezione degli investitori e la modernizzazione dei mercati finanziari.

La lettera sottolinea che i requisiti di trasparenza e rendicontazione degli ETP contribuiranno a mitigare la manipolazione del mercato e altre attività illecite. Il presidente della SEC Gensler è invitato ad applicare gli stessi principi utilizzati nell’approvazione degli ETP su Bitcoin quando esamina le richieste di ETP su Ethereum e sottolinea che le considerazioni legali per entrambi sono simili.

Con le imminenti elezioni americane e un Congresso ampiamente favorevole per quanto riguarda la nuova legislazione sulle criptovalute, la prossima fase di crescita per il settore potrebbe essere a pochi mesi di distanza. Nonostante i significativi shock di liquidità sul mercato, criptovalute sono stati legittimati come veicolo di investimento accessibile, nonostante la forte opposizione del presidente della SEC Gensler.

Spiegazione della legge sull’innovazione finanziaria e tecnologica

Mercoledì, democratici e repubblicani della Camera si sono uniti e hanno approvato un nuovo atto legislativo che mira a delineare definizioni più specifiche su quali criptovalute siano considerate titoli e ricadranno sotto l’ombrello normativo della SEC.

Se la blockchain utilizzata in una criptovaluta è funzionale e decentralizzata, cadrà sotto la supervisione della CFTC. Per quanto riguarda le reti blockchain centralizzate, queste saranno designate come titoli e rientreranno nella categoria più rigoroso controllo regolamentare della SEC.

Nonostante l’opposizione del presidente della SEC Gary Gensler, che ha sostenuto che ci sono lacune normative nel quadro proposto, FIT 21 è passato con i voti di 71 democratici e 208 repubblicani.

Gensler ha sottolineato che i problemi per gli investitori continuano ad essere ampi e causati principalmente dal mancato rispetto delle regole esistenti, piuttosto che dall’ambiguità normativa. Tuttavia, l’organismo di regolamentazione ha ritirato la sua opposizione all’approvazione di un ETF sull’Ethereum dopo pressioni politiche.

Il presidente della SEC ha espresso la sua preoccupazione per il fatto che FIT 21 consenta agli emittenti di autocertificare la decentralizzazione, sfuggendo così alla supervisione della SEC e operando potenzialmente in condizioni più leggere Regolamento CFTC.

Il vicepresidente del comitato per i servizi finanziari della Camera e presidente del nuovo sottocomitato incaricato di supervisionare tutte le aree relative alle risorse digitali e alla tecnologia finanziaria, il rappresentante French Hill, (R) AR ha difeso il disegno di legge, affermando che non crea scappatoie né deregolamenta le criptovalute ma fornisce chiarezza.

Il presidente dei servizi finanziari della Camera Patrick McHenry ha sottolineato che FIT 21 risolve la confusione normativa tra SEC e CFTC, offrendo regole chiare e forti barriere per l’impegno delle risorse digitali.

ETF oltre Bitcoin ed Ethereum

Resta da vedere come può un’azienda dimostrare che la blockchain che utilizza è decentralizzata, ma con le potenziali approvazioni dell’ETF per più asset digitali, il quadro normativo sulle criptovalute negli Stati Uniti è probabile che continui il suo sviluppo nei prossimi trimestri.

Gli eventi accaduti questa settimana potrebbero essere solo l’inizio della fine del pesante dominio di Bitcoin ed Ethereum sul mercato delle criptovalute che si è insinuato da quando sono circolate le prime voci sull’approvazione degli ETF.

Dato che la maggior parte delle criptovalute più piccole non riescono a cogliere il rally unico delle due più grandi catene di criptovalute, le speculazioni sul futuro dei futuri prodotti ETF relativi a più token digitali potrebbero iniziare proprio dietro l’angolo.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

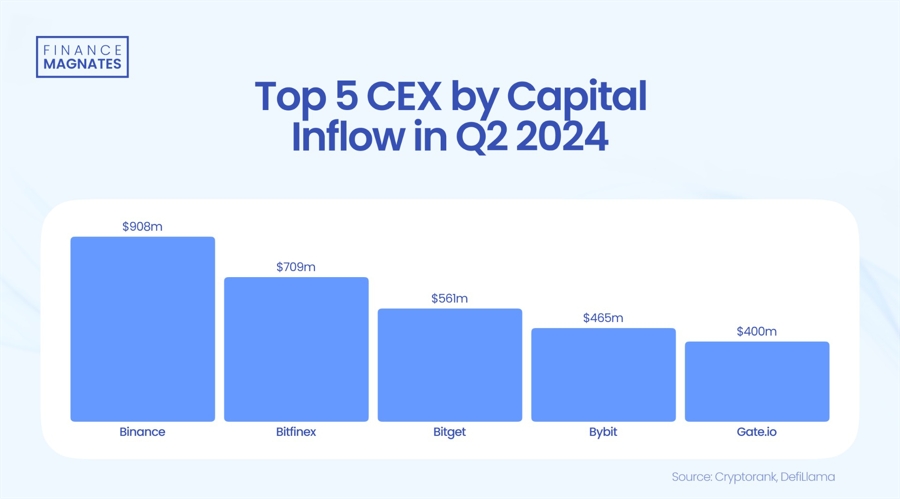

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi10 months ago

DeFi10 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech10 months ago

Fintech10 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News11 months ago

News11 months agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi10 months ago

DeFi10 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi10 months ago

DeFi10 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News11 months ago

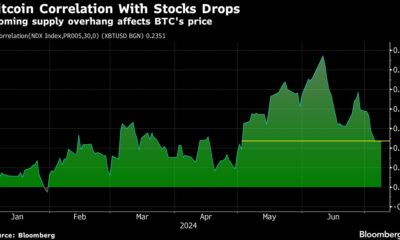

News11 months agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech10 months ago

Fintech10 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech10 months ago

Fintech10 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech10 months ago

Fintech10 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos4 months ago

Videos4 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

Markets1 year ago

Markets1 year agoCrypto Expert Provides Analysis of Top Altcoins, Market Sees Slight Rise