DeFi

Deciphering DeFi App Development Costs, Types & Features

The current financial system, with its inefficiencies, high fees, limited accessibility, and lack of transparency, often leaves significant portions of the global population, especially in underbanked areas, at a disadvantage. Decentralized finance (DeFi) emerges as a solution to these issues, utilizing blockchain technology to remove intermediaries, thereby reducing costs and enhancing security. This shift towards DeFi offers a more inclusive, transparent, and efficient financial ecosystem, aiming to better serve and integrate wider segments of society.

Given the transformative impact of decentralized finance (DeFi), developing a DeFi app is a strategic move for stakeholders aiming to innovate in the financial sector. The development process involves multiple stages, including ideation, technical design, coding, testing, and deployment.

The DeFi app development cost varies depending on the overall platform complexity and the specific features required. It’s crucial for FinTech businesses to understand these details so as to effectively navigate the future of finance and capitalize on DeFi’s potential to create a more inclusive and efficient system. On average, the cost of building a decentralized app can range from $40,000 to $500,000 or more.

In this blog, we will deeply delve into the factors influencing DeFi application development costs, exploring the decentralized app’s various types, features, development process, and the challenges involved.

But first let’s begin with how a decentralized finance app works!

How a DeFi App Works

A DeFi (Decentralized Finance) app uses blockchain technology and smart contracts to facilitate financial transactions without relying on traditional intermediaries. The users engage with the app through an intuitive interface, conducting transactions such as lending, borrowing, or trading digital assets. These transactions are automatically executed by smart contracts, self-executing agreements programmed in code.

Once initiated, transactions are verified by nodes on the blockchain network and permanently recorded on the blockchain, ensuring transparency and immutability. This streamlined process enhances financial operations, lowers costs, and improves accessibility.

The adoption of DeFi applications has surged due to their exponential market growth. According to a report by Grand View Research, the total value locked in the DeFi market is expected to surpass $231.19 billion by 2030.

This expansion is propelled by the rising demand for decentralized financial services, the growing use of blockchain technology, and the potential for substantial investment returns. As the DeFi ecosystem progresses and becomes more sophisticated, it is poised to become a major player in the future of finance, providing innovative solutions and challenging traditional financial systems.

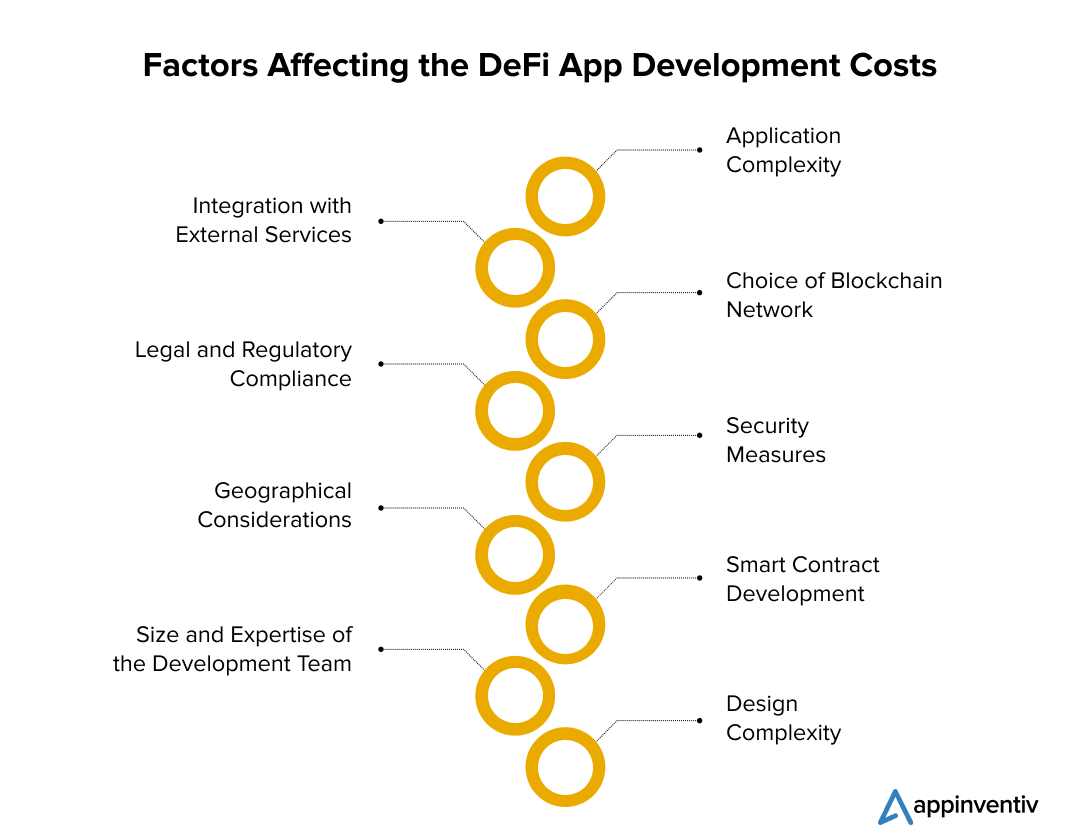

Factors Affecting Decentralized Finance App Development Costs

Developing a DeFi app involves various considerations that can impact the overall cost. These include the app’s feature set, security measures, and the selected blockchain platform. Additionally, the expertise of the development team and the need for ongoing maintenance play significant roles in determining the overall decentralized finance app development cost. Let’s have a detailed look at the factors.

Application Complexity

The DeFi app development cost increases with the complexity of its features and functionalities. Complications can arise from adopting complex smart contracts, combining several blockchain networks, or creating intricate financial tools. Furthermore, the application’s complexity may rise if sophisticated tokenomics and decentralized governance methods are included.

These intricacies frequently necessitate more involved testing, development, and auditing procedures, which drives up expenses. Moreover, additional work may be involved in integrating with current DeFi protocols or ecosystems since it could be necessary to ensure smooth compatibility and conform to current standards.

Choice of Blockchain Network

The selection of a blockchain network, such as Ethereum, Binance Smart Chain, or Polkadot, may impact the DeFi application development cost. Certain blockchain networks might incur higher costs or require more extensive labor for integration services. Additionally, factors such as scalability, security, and community support of the blockchain network significantly impact the development cost.

For example, Ethereum’s popularity can result in increased fees and resource competition, while emerging networks like Polkadot might offer more affordable alternatives but demand more integration time. Thus, the chosen network’s ecosystem and the available development tools also play a vital role in determining the overall decentralized finance app development costs.

Security Measures

Security is crucial in DeFi applications but thorough security controls, audits, and testing usually increase the decentralized finance app development cost. Furthermore, the protection of user assets and data depends on implementing sophisticated security mechanisms like multi-signature wallets, secure coding techniques, and frequent security audits by third-parties.

Also, adding decentralized governance systems and integrating with decentralized identification solutions might improve security but may also raise the DeFi application development costs. Furthermore, the development process may become more complicated and expensive to ensure adherence to legal standards and security best practices.

Also Read: How Blockchain is Revolutionizing Mobile App Security

Smart Contract Development

Smart contracts are the foundation of DeFi apps. The complexity and number of smart contracts needed for the app will impact costs. Furthermore, as well-written contracts can lower transaction fees and enhance overall performance, the effectiveness and optimization of smart contracts might also impact the DeFi app development cost.

Integration with pre-existing smart contracts or protocols can also affect the development budget because it might need to be modified or customized to meet the unique needs of the DeFi app. Furthermore, it is important to ensure the security and reliability of smart contracts by conducting thorough testing and auditing procedures, which may raise the cost to build a DeFi app.

Also Read: How to Create Cardano Smart Contracts?

Design Complexity

DeFi apps require a well-thought-out and intuitive interface. UI/UX design expenditures may raise the overall DeFi platform development costs. Moreover, adding interactive components, user-friendly navigation, and flexible design might improve user engagement, but they might also need more time and money for development.

Additionally, while conducting usability testing and user research to enhance the UI/UX design may be costly, however, the investment will lead to more successful and user-friendly DeFi software.

Integration with External Services

The decentralized finance app development costs may rise due to the need for integration with external services, such as decentralized oracles for external data feeds. Furthermore, the DeFi development process may become more complex and expensive if external payment gateways or decentralized identity solutions like safe user authentication or fiat onramps are included.

Furthermore, the DeFi app’s functionality can be improved by integrating with external services for features like automated trading, asset management, or lending protocols, but doing so might involve more work and resources in the development process.

In addition, it is imperative to ensure the reliability and safety of external service integrations using comprehensive testing and auditing procedures. Although these are essential, they can still lead to elevated development expenses.

Legal and Regulatory Compliance

Ensuring the DeFi development process complies with all applicable rules and regulations, including KYC/AML standards, can be more challenging and costly. Moreover, adding a layer of complexity to assure compliance with data protection rules by implementing privacy-enhancing technology, including zero-knowledge proofs, may raise the DeFi app development costs.

Post-development costs may also rise due to ongoing monitoring and adjustments needed to comply with evolving regulatory requirements. The total cost of creating a DeFi app also includes legal advice and documentation needed to guarantee adherence to global compliances and standards.

Geographical Considerations

When considering the cost of developing a DeFi app, it’s essential to note that hiring developers from nations like the US or the UK can incur higher labor costs. In contrast, opting for developers from countries like India can offer cost optimization without compromising on quality. India has a big talent pool of skilled DeFi developers proficient in blockchain technology and smart contract development.

By tapping and hiring this skilled talent pool, businesses can ensure high-quality work while managing development costs. This approach optimizes expenses and provides access to a skilled workforce capable of delivering advanced DeFi solutions.

Size and Expertise of the Development Team

The development team’s size and expertise can greatly affect the cost of building a decentralized app. Highly experienced DeFi developers with expertise in multiple blockchain technologies may demand higher fees.

Furthermore, sophisticated projects could require a larger development team, which raises costs. Typically, a DeFi app development team includes blockchain developers, smart contract developers, front-end and back-end developers, UI/UX designers, and quality assurance testers. A skilled and experienced team, however, can ensure a faster development cycle and superior results, often justifying the additional costs through enhanced efficiency and quality.

Also Read: How to Hire a Dedicated Development Team?

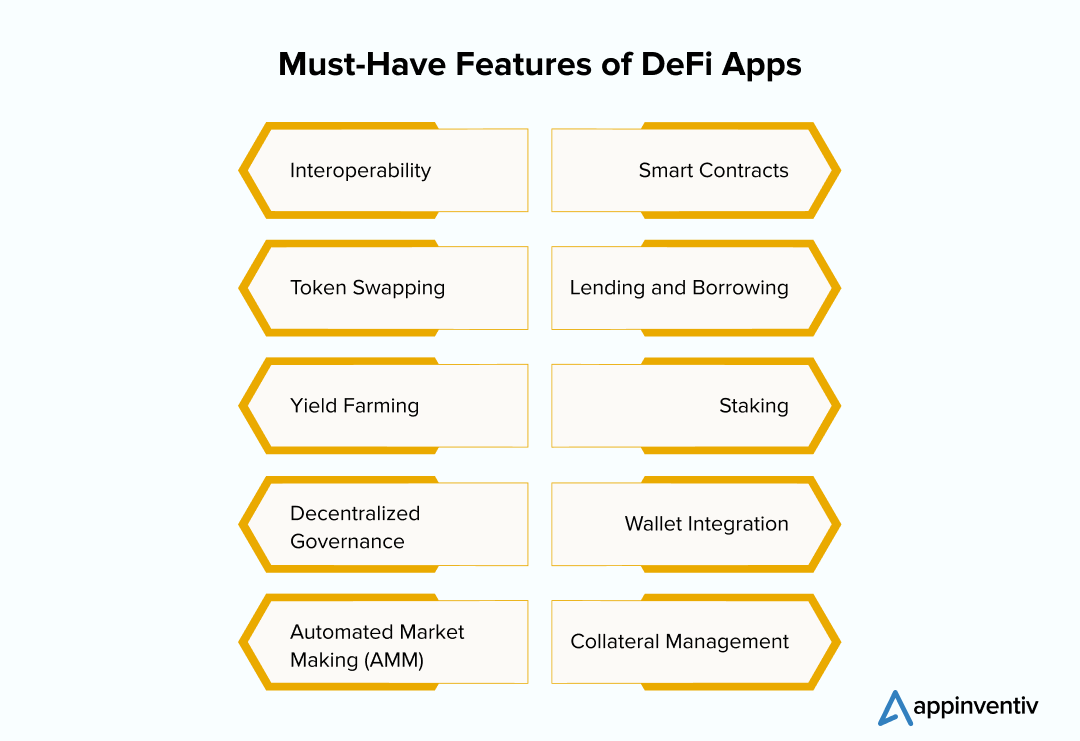

Core Characteristic Features of DeFi Apps

DeFi applications have various features that distinguish them in the FinTech world. These features of DeFi app improve functionality, security, and user experience, making them essential tools for decentralized finance. Let’s look at some of the top DeFi features.

- Interoperability: Integration with various DeFi platforms and blockchains for seamless functionality.

- Smart Contracts: Executes automated transactions based on predefined conditions without human intervention.

- Token Swapping: Facilitates direct exchanges between different cryptocurrencies.

- Lending and Borrowing: Users can leverage automated, decentralized processes to lend or borrow digital assets.

- Yield Farming: Provides rewards to users who supply liquidity to DeFi protocols.

- Staking: Enables users to lock up their assets to support network operations and earn returns.

- Decentralized Governance: Empowers users to participate in platform decision-making through voting mechanisms.

- Wallet Integration: Connects seamlessly with various crypto wallets for easy asset management and transactions.

- Automated Market Making (AMM): Utilizes algorithms to provide liquidity and set trading prices in decentralized pools.

- Collateral Management: Monitors and manages collateral assets for securing loans and other financial activities.

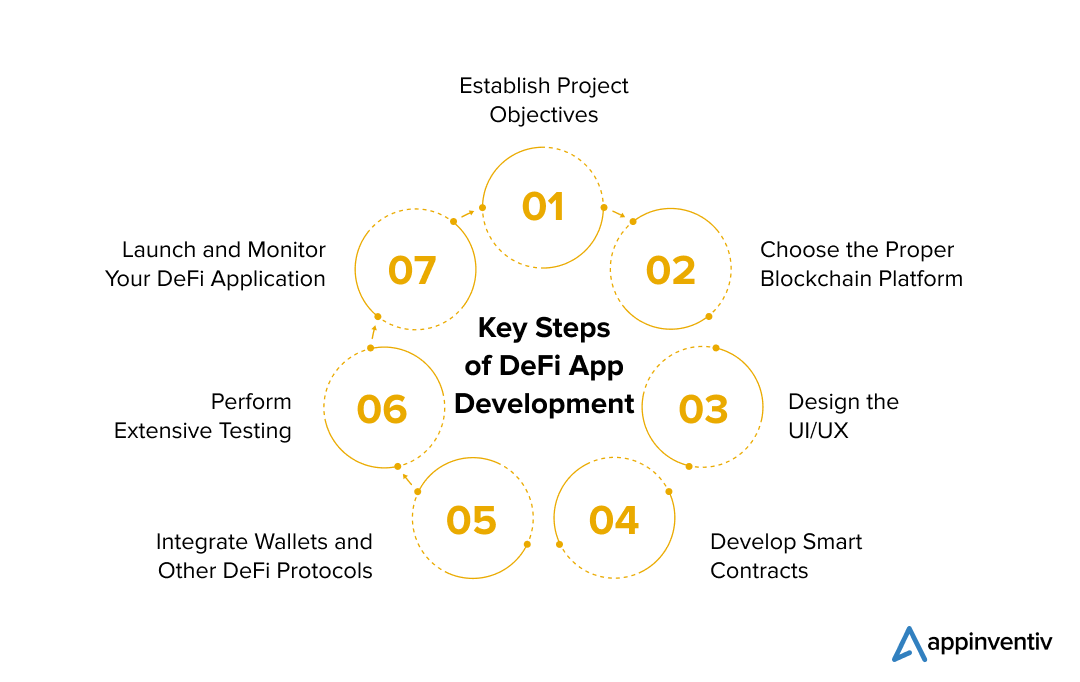

Essential Stages of DeFi App Development

DeFi app development involves several essential steps, including setting clear project goals, choosing an appropriate blockchain platform, designing a user-friendly interface, and developing secure smart contracts. This structured approach ensures the development of a reliable and effective application that caters to user needs. Let’s have a look at the key steps involved in the DeFi development process in detail below.

Establish Project Objectives

First, ensure your DeFi app’s goal and the features are well established. This could entail yield farming, lending, borrowing, or decentralized exchanges. Conduct in-depth market research to determine your target market and the app’s distinct value proposition.

Create a thorough project roadmap that outlines the stages of development and includes reasonable deadlines. Before the DeFi development process starts, interact with potential users to get their feedback and improve the concept of your app.

Choose a Proper Blockchain Platform

Decide on a blockchain platform that complements your project’s objectives. Ethereum, Binance Smart Chain, and Polkadot are well-liked options. When making your choice, take into account elements like developer community support, scalability, security, and transaction speed.

Analyze the transaction costs as well as the tools and libraries available to make development on the selected platform easier. In addition, consider the blockchain platform’s governance structure and long-term viability to ensure it can support your project’s growth.

Design the UI/UX

Develop a user-friendly interface, emphasizing intuitive design, seamless interaction, and accessibility. Utilize wireframes to visualize the user journey and gather feedback prior to development.

Incorporate user feedback and perform usability testing to enhance the UI/UX, ensuring it meets user expectations and addresses any challenges. Iterate on the design feedback to create an engaging and user-centric experience.

Develop Smart Contracts

In the development stage, you need to clearly define the contract’s terms & conditions and then implement them using blockchain programming languages like Solidity. Include strong error handling and security measures to protect against vulnerabilities. Conduct comprehensive testing, such as unit, integration, and real-world scenario tests.

Have security professionals audit the smart contracts to identify and address any issues. After successful testing and auditing, deploy the smart contracts to the blockchain to ensure they are secure and fully functional.

Integrate Wallets and Other DeFi Protocols

Ensure your application is compatible with well-known cryptocurrency wallets such as Coinbase Wallet, Trust Wallet, and MetaMask. To improve your app’s functionality, you can integrate different DeFi protocols, including liquidity pools or Oracle services, for real-time data.

To safeguard user wallets and data, utilize secure authentication and encryption techniques. Perform extensive testing to guarantee smooth integration and functionality with different wallets and protocols.

Perform Extensive Testing

Conduct thorough testing to verify and confirm the functionality of your DeFi app. Begin with unit testing to ensure individual components work correctly, followed by integration testing to verify the interactions between these components. Perform regular security audits to detect and address vulnerabilities, ensuring your app is secure. Promptly address any issues to guarantee a smooth launch and a seamless user experience.

Launch and Monitor Your DeFi Application

After completing testing, it’s time to launch your DeFi app on the selected blockchain platform. Consider launching a beta version to gather feedback and make any necessary final adjustments. Provide consistent updates and support to address issues and improve functionality over time. Monitor user feedback and app performance to ensure ongoing success. Establish channels for community engagement to gather feedback, enhance user experience, and cultivate a loyal user base over time.

Additionally, it’s crucial to consider app maintenance, as it can significantly impact the overall DeFi app development cost. Maintenance costs typically include hosting fees, ongoing development work for updates and enhancements, and customer support expenses.

Also Read: What is the Cost of Maintaining an App in 2024?

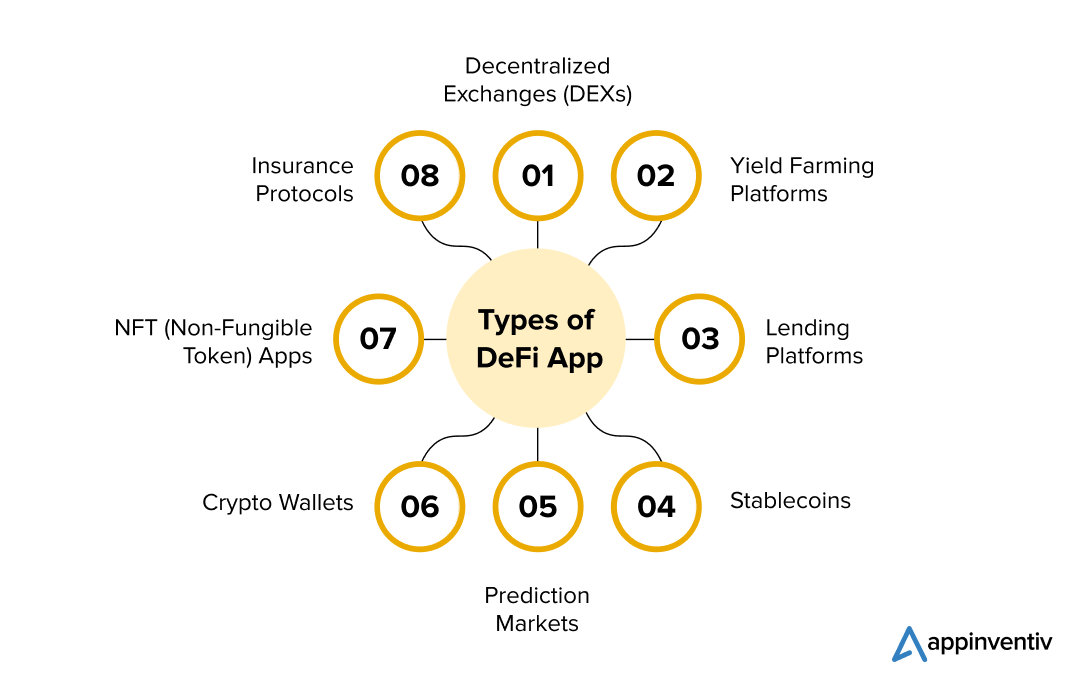

A Brief Overview on the Types of DeFi Apps You Can Consider Building

DeFi applications are transforming the financial sector by providing decentralized solutions that boost accessibility, transparency, and security. These decentralized finance applications offer cutting-edge financial services, enabling users to manage their assets and transactions independently. Let’s check out some of the top DeFi app types.

Decentralized Exchanges (DEXs)

Unlike centralized exchanges, decentralized exchanges (DEXs) give customers more control and privacy over their money while enabling them to trade cryptocurrencies straight from their wallets. They accomplish this by using smart contracts, which make trade easier and eliminate the need for a reliable third party.

Yield Farming Platforms

Yield farming platforms encourage users to contribute liquidity to DeFi protocols by offering them more tokens or interest. These sites allow users to generate passive income from their cryptocurrency holdings. For instance, Curve Finance focuses on stablecoin trading and liquidity provision, with low slippage and costs, whereas Yearn Finance is recognized for optimizing yield farming tactics across many protocols.

Lending Platforms

DeFi lending platforms enable users to earn interest on their cryptocurrency holdings by lending them to borrowers, who can utilize the funds for diverse purposes. These platforms leverage smart contracts to directly automate the lending and borrowing processes, removing the necessity for conventional financial intermediaries.

Aave, Compound, and MakerDAO are prominent examples, each offering unique features such as a diverse range of lending assets, algorithmic interest rates, and stablecoin issuance through collateralized debt positions (CDPs).

Stablecoins

Stablecoins are digital currencies that are intended to reduce price volatility by maintaining a fixed value and being correlated with a stable asset, usually the US dollar. While USDC is a controlled stablecoin produced by a consortium that includes Coinbase and Circle, both of which are extensively utilized for lending and trading in the DeFi ecosystem, DAI is a decentralized stablecoin issued by MakerDAO.

Prediction Markets

Prediction markets are online platforms that leverage blockchain technology to let users wager on the results of future events such as financial markets, sporting events, and elections. Notable instances of decentralized prediction markets are Augur and Gnosis, which allow users to purchase and sell shares in the results of events, with the market price indicating the likelihood of event occurrence.

Crypto Wallets

Crypto wallets are digital tools that securely store, manage, and facilitate cryptocurrency transactions. They support various cryptocurrencies and often provide functions for token transfers and conversions. Trust Wallet, for example, is Binance’s official exchange wallet, allowing users to buy and stake cryptocurrencies, store NFT tokens, and use a dApp browser for decentralized exchange transactions.

Also Read: How to Build an App Like Exodus Cryptocurrency Wallet?

NFT (Non-Fungible Token) Apps

Blockchain-based applications like NFT (Non-Fungible Token) let users generate, purchase, sell, and exchange NFTs. These apps help digital artists, musicians, game developers, and other creators establish ownership in the digital space by tokenizing their creations. NBA Top Shot, Rarible, and OpenSea are well-known NFT marketplaces.

Insurance Protocols

Insurance protocols such as Cover Protocol, Nexus Mutual, and Unslashed Finance offer decentralized solutions for risks like smart contract failures and hacks in blockchain and cryptocurrency settings. These platforms use blockchain technology and smart contracts to provide transparent, automated, and community-governed insurance coverage, enhancing security and trust within the DeFi insurance ecosystem.

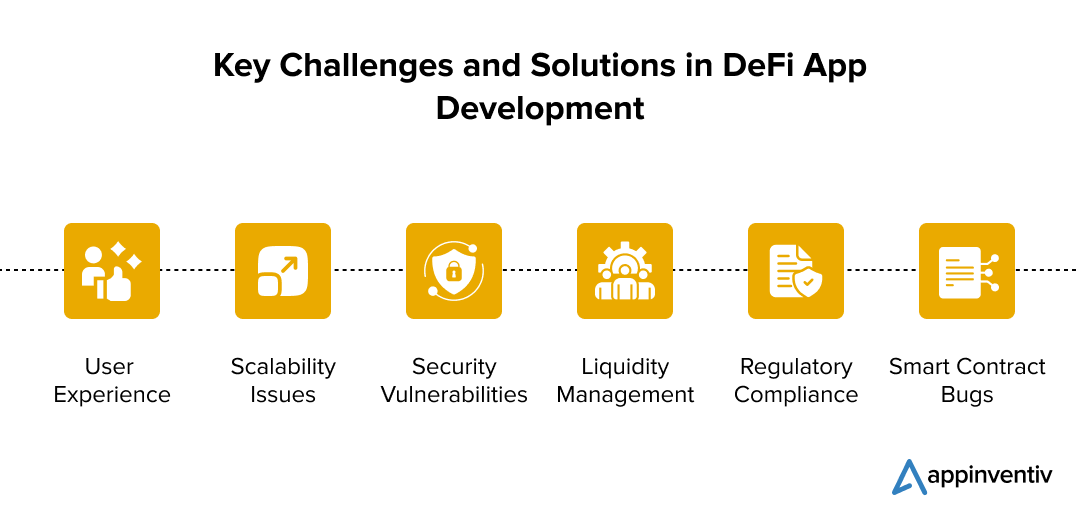

DeFi App Development: Common Challenges and Solutions

Developing DeFi applications involves overcoming various obstacles to ensure a successful launch and adoption. By implementing effective DeFi development strategies, businesses can address these challenges and create robust, user-friendly apps.

User Experience

DeFi apps can be complex and intimidating for new users, characterized by technical terminology, intricate interfaces, and the need to grasp complex concepts such as liquidity pools, yield farming, and securing digital wallets.

Focus on intuitive UI/UX design, provide clear instructions, and offer customer support to guide users through the app. Simplifying the onboarding process can enhance user experience.

Scalability Issues

High transaction volumes can often lead to complex network congestion and increased transaction fees.

Opt for scalable blockchain solutions or layer-2 scaling technologies such as sidechains or state channels. Exploring platforms with higher throughput can also mitigate scalability problems.

Security Vulnerabilities

DeFi apps are prime targets for cyberattacks due to the significant value they manage.

Conduct rigorous security audits, employ robust encryption techniques, and continuously monitor for vulnerabilities. Engaging third-party security tools can bolster the app’s security.

Also Read: How Does Blockchain Resolve Data Privacy and Security Issues for Businesses?

Liquidity Management

Ensuring sufficient liquidity for user transactions can be challenging, especially in the initial stages.

Attract liquidity providers through incentives and partnerships. Implementing automated market makers (AMMs) can help maintain liquidity.

Regulatory Compliance

Navigating the complex and ever-transforming intricate regulatory landscape can be challenging.

Stay informed about relevant regulations and work with legal experts to ensure compliance. Implementing compliance features within the app can help users adhere to local laws.

Smart Contract Bugs

Errors in smart contract code can lead to significant financial losses.

Implement thorough testing procedures, including unit tests and integration tests. Regular code reviews and third-party audits can help identify and fix potential issues before deployment.

Innovate in DeFi and Develop Your App with Appinventiv’s Expertise

Decentralized Finance applications are revolutionizing the traditional financial landscape, offering innovative solutions that are more accessible, transparent, and efficient. These apps have streamlined lending, borrowing, trading, and asset management, eliminating the need for traditional intermediaries.

The future of DeFi is promising, with anticipated expansion in decentralized exchanges, yield farming, and stablecoins. As the ecosystem matures, innovations such as cross-chain interoperability and enhanced security measures will likely drive further adoption and trust in decentralized financial solutions.

Appinventiv stands at the forefront of DeFi app development, offering expertise and experience in creating advanced solutions. With an elaborate understanding of blockchain technology and a solid record of developing secure and scalable DeFi applications, we are well-positioned to help you realize your DeFi app vision.

As a trusted blockchain software development company, we have established a great reputation for delivering exceptional results. Our extensive portfolio boasts over a thousand successful applications, including notable names such as Nova and Empire. Our remarkable 95% client satisfaction rating is a proof of our constant dedication to innovation and excellence in the DeFi app development process.

Are you prepared to transform your DeFi experience? Together, we can develop a state-of-the-art application that surpasses your expectations and caters to your particular demands.

Partner with us to tap into the potential of DeFi and shape the future of finance.

FAQs

Q. How much does it cost to develop a DeFi app?

A. The DeFi app development cost varies depending on a number of criteria, making it a potentially large investment. The intricacy of the application, encompassing its features and functionalities, is vital.

The cost of building a decentralized app with basic features can fall between $40,000 and $100,000. However, more complicated applications with additional features, such as decentralized exchanges or intricate lending protocols, can cost up to $500,000 or more. Connect with the best DeFi developers now to get the complete cost estimation.

Q. What are some of the top DeFi trends?

A. Some of the top DeFi trends include:

- Rise of Decentralized Exchanges (DEXs)

- Growth of decentralized lending platforms

- Emergence of yield farming and liquidity mining

- Development of decentralized stablecoins

- Integration of Non-Fungible Tokens (NFTs) into DeFi applications

Give this blog a quick read to learn more about the top DeFi trends of 2024.

Q. Which essential technology stack is utilized in the DeFi app development process?

A. DeFi technology stack usually comprises blockchain platforms like Ethereum, Binance Smart Chain, or Polkadot, which provide smart contract capabilities. Businesses can utilize languages such as Solidity for smart contract coding, web3.js for blockchain interaction, and frameworks like Truffle or Hardhat for smart contract testing and deployment.

Check out this blog to learn more about the fundamentals of blockchain programming languages.

Q. What is DeFi dApp development?

A. DeFi dApp development involves crafting decentralized applications (dApps) that provide financial services like lending, borrowing, trading, and asset management, all without relying on traditional intermediaries. These dApps are constructed on blockchain platforms and leverage smart contracts to automate operations, ensuring both security and transparency.

![]()

THE AUTHOR

chirag

Blockchain Evangelist

Source

DeFi

DeFi Technologies Appoints Andrew Forson to Board of Directors

TORONTO, July 31, 2024 /PRNewswire/ – DeFi Technologies Inc. (the “DeFi Technologies”)Business” Or “DeFi Technologies“) (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company pioneering the convergence of traditional capital markets with the world of decentralized finance (“Challenge“), is pleased to announce the appointment of Andrew Forson to its Board of Directors (the “Advice“).

Andrew Forson is a financial and risk engineer, software architect, and trusts and estates specialist. He currently serves as Head of Investments and Ventures for Hashgraph Group, the commercialization and enablement arm of Hedera, where he has been instrumental in driving strategic investments and driving innovation in the digital asset sector.

Mr. Forson brings a wealth of experience gained through his extensive background in developing structured financial products and his deep knowledge of the digital asset landscape. His expertise will be invaluable as DeFi Technologies continues to expand its suite of innovative financial products and services.

“We are thrilled to welcome Andrew to our Board of Directors,” said Olivier Roussy Newton, CEO of DeFi Technologies. “His extensive background in financial engineering and forward-thinking approach to digital assets will be a tremendous asset to our company as we continue to lead the way in the digital asset space.”

Andrew Forson holds an MBA from the prestigious Edinburgh Business School. His arrival on the board is part of DeFi Technologies’ drive to strengthen its management team and enhance its strategic capabilities in the evolving digital finance sector.

About DeFi Technologies

DeFi Technologies Inc. (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT) is a financial technology company that is at the forefront of the convergence of traditional capital markets with the world of decentralized finance (DeFi). By focusing on cutting-edge Web3 technologies, DeFi Technologies aims to provide investors with widespread access to the future of finance. Backed by a team of esteemed experts with extensive experience in financial markets and digital assets, we are committed to revolutionizing the way individuals and institutions interact with the evolving financial ecosystem. Join the DeFi Technologies digital community on Linkedin And Twitterand for more details visit https://defi.tech/

About Valour

Valor Inc. and Valor Digital Securities Limited (together, “Value“) issues exchange-traded products (“AND P”) that allow retail and institutional investors to access digital assets like Bitcoin simply and securely through their traditional bank account. Valor is part of DeFi Technologies Inc.’s (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT).

In addition to their new digital asset platform backed by physical media, which includes 1Valour Carbon Neutral Physical Bitcoin AND P, 1Valour Ethereum Physical StakingAnd 1Valor Internet Computer Physical StakingValour offers fully hedged digital asset ETPs with low to no management fees, with product listings on European exchanges, banks and brokerage platforms. Valour’s existing product range includes Valour Uniswap (United), Cardan (ADA), Peas (POINT), Solana (GROUND), Avalanche (AVAX), Cosmos (ATOM), Binance (BNB), Ripple (XRP), Toncoin (TONNE), Internet computer (PCI), Chain link (LINK), Heart (HEART), Close (CLOSE), Enjin (ENJ), Valor Bitcoin Staking (Bitcoin), Bitcoin Carbon Neutral (BTCN), Hedera (HBAR), Valor 10 Digital Asset Basket (VDAB10) And 1Valour STOXX Bitcoin Suisse Digital Asset Blue Chip ETPs with low management fees. Valour’s flagship products are Bitcoin Zero and Ethereum Zero, the first passive investment products fully hedged with Bitcoin (Bitcoin) and Ethereum (ETH) as underlyings which are completely free of fees.

For more information about Valour, to subscribe, or to receive updates and financial information, visit valor.com.

Caution regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, the appointment of Mr. Forson; the regulatory environment regarding the growth and adoption of decentralized finance; the Company’s and its subsidiaries’ pursuit of business opportunities; and the potential merits or returns of such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but are not limited to, the growth and development of the decentralized finance and digital asset industry; the rules and regulations relating to decentralized finance and digital assets; and general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results to differ from those anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update forward-looking statements, except in accordance with applicable securities laws.

CBOE CANADA EXCHANGE ACCEPTS NO RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

![]() Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

SOURCE DeFi Technologies Inc.

DeFi

Is Zypto Wallet a Reliable Choice for DeFi Users?

Zypto wallet is a newcomer in the crypto landscape and has already made waves for its exclusive benefits and security features.

In this article, we will take a look at the Zypto crypto wallet and how it can help users securely manage their digital assets, interact with Web3 applications, and explore the world of Challenge.

What is Zypto Wallet?

Zypto App is a newly launched versatile crypto wallet that supports a wide range of coins and tokens, along with seamless access to Web3 applications, token exchanges, virtual crypto cards, a gift card marketplace, and a payment gateway.

What are the pros and cons of Zypto Wallet?

Benefits

- User-friendly: Zypto’s user interface is very intuitive with a simple setup process.

- Multi-Chain DEX Swaps: Zypto facilitates trading between thousands of cryptocurrencies, thanks to its versatile multi-chain token swap feature.

- Built-in dApp Browser: You can access Web3 applications directly in your wallet using the in-app dApp browser.

- Live Customer Support: The wallet has an in-app live customer support team that responds quickly to all your queries.

- Rewards Program: Zypto has a loyalty program that allows you to earn rewards, improving the overall user experience.

- Virtual crypto cards: The wallet makes it easy and reliable to use digital currencies for everyday transactions through its range of virtual cryptocurrency cards.

The inconvenients

- Limited analysis tools: Zypto offers advanced charting features and limited technical analysis tools that might not appeal to experienced cryptocurrency traders.

What DeFi products and services does Zypto Wallet offer?

Zypto allows you to securely manage a wide range of cryptocurrencies across multiple blockchains, acting as a user-friendly entry point into the Web3 ecosystem.

Multi-Chain Wallet

As a multi-chain wallet, Zypto supports hundreds of thousands of digital assets across different blockchains. Zypto is also committed to adding support for more chains in the coming months, expanding its universe of explorable assets.

Multi-Chain Exchange Functionality

Instead of the tedious process of selling one token on one exchange and buying another of the same type hosted on a different blockchain, Zypto offers a cross-chain swap feature.

DApp Browser

Another easy-to-use feature is the in-app dApp browser. Simply bring up the browser from the small globe icon at the bottom of your screen and it will first take you to the Zypto homepage.

The browser provides all the features under one application so you don’t miss anything that warrants opening a separate browser.

Zypto DeFi Wallet Review

User experience

Zypto’s ease of use is one of its main advantages. Once the app is downloaded, you can view your wallet from the home screen. Other buttons at the bottom of your screen will take you to prepaid virtual cards, an Explore Zypto page, where you can send, receive, exchange, buy and sell tokens, or access the dApp browser and your contact list.

Zypto requires KYC information before processing cards, as it is part of regulatory compliance. Contacts are another benefit: instead of tediously copying and pasting long addresses, simply save them under a contact name.

How to set up your Zypto wallet?

To start using Zypto, simply download the app. Once installed, you’re ready to go.

You can create a new wallet by pressing the Create Wallet button or import an existing wallet by writing (or pasting) your passphrase to verify your identity. You can also import it in read-only mode, in which case you only need the wallet name and address.

Conclusion: The Verdict

Zypto is relatively new in the DeFi space, but it’s already gaining popularity among different types of users. Those who prefer everything neatly organized in one place will find the app appealing, as will those who prefer its rich features and integration with fiat payment methods over on- and off-ramp cryptocurrencies.

DeFi

Switchboard Revolutionizes DeFi with New Oracle Aggregator

Switchboard, a leading oracle network known for its permissionless and fully customizable features, has launched a revolutionary oracle aggregator. This new tool enables seamless integration of data across multiple oracle networks, including household names like Chainlink and Pyth Network. In doing so, it provides users with access to a wide range of data sources, improving the versatility and reliability of decentralized finance (DeFi) applications.

Addressing security and cost challenges in DeFi

The Oracle Aggregator is designed to address significant security and cost challenges in the DeFi sector. In 2023, the Web3 industry saw losses exceeding $500 million due to price manipulation attacks, a notable increase from $403.2 million in 2022. These attacks accounted for 33% of the total value lost due to hacks. By expanding the diversity and volume of data sources, Switchboard aims to strengthen the resilience of data streams against such malicious activities, thereby improving the overall security of DeFi platforms.

Empowering developers with customizable data streams

Switchboard’s new Oracle Aggregator allows developers to design custom data feeds that draw from a wide range of sources, both within and outside of the Switchboard platform. This flexibility allows developers to create tailored feeds that meet their specific needs, moving away from rigid templates. The platform’s permissionless nature and lack of gatekeepers ensure developers have complete control over the data feeds they create.

Switchboard CEO Chris Hermida noted that the company’s philosophy has always been to empower developers rather than constrain them. By launching Oracle Aggregator, Switchboard allows developers to use data from a variety of sources, including Pyth and Chainlink, enabling innovation and customization of their projects. Hermida noted that this new capability allows developers to break away from traditional models and take a more personalized approach to data integration.

Plug-and-Play approach for enhanced security

Switchboard’s Oracle Aggregator offers a plug-and-play approach that allows users to leverage multiple Oracle networks, enhancing data security and reliability. By aggregating data from multiple sources, developers can improve the scalability and redundancy of their data feeds, setting a new industry standard as the first generalized Oracle aggregator. This scalability ensures that projects can mitigate risks associated with data manipulation and other vulnerabilities.

One of the most notable features of Oracle Aggregator is its customizable nature. Developers can selectively choose trusted data sources, eliminating those that do not meet their standards. This level of control is crucial for projects that aim to protect their operations from potential threats.

Innovative use of secure execution environments

Switchboard uses Trusted Execution Environments (TEEs) to ensure that data aggregation occurs entirely off-chain. This innovative approach minimizes gas costs associated with on-chain operations while preserving data integrity. Aggregated data is then shared with users in a single on-chain transaction, simplifying the process and reducing operational expenses.

Mitch Gildenberg, Switchboard’s CTO, highlighted the platform’s developer-centric design. He noted that the platform is designed to put developers in control, allowing them to fine-tune each data flow to their specific needs. This approach reflects Switchboard’s commitment to understanding and meeting developer needs.

Expansion and impact on the industry

Since its launch in 2021, Switchboard has seen significant growth, amassing over 180,000 users and achieving a total valuation of $1.6 billion. The company’s commitment to user autonomy and inclusion has been a driving force behind its rapid expansion in the Web3 ecosystem. Earlier this year, Switchboard raised $7.5 million in a Series A funding round co-led by Tribe Capital and RockawayX, with additional support from leading investors including the Solana Foundation, Aptos Labs, Mysten Labs, Subzero Ventures, and Starkware.

Conclusion

As the DeFi industry continues to evolve, tools like Switchboard’s Oracle Aggregator will play a crucial role in building robust and secure decentralized applications. By giving developers the ability to integrate and customize data feeds from multiple sources, Switchboard is setting new industry standards, driving innovation, and improving the overall security of the Web3 ecosystem.

DeFi

Bitcoin is the solution to inevitable hyperfinancialization

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial team.

If there is one thing that is becoming clear, it is that hyperfinancialization is inevitable, and our best chance of achieving it successfully is through Bitcoin (Bitcoin). This decentralized cryptocurrency, known for its fixed supply and robust security, offers a unique solution to the coming problem of wealth inequality and concentrated power. By embracing Bitcoin, we can create a more transparent and resilient financial future, or we risk losing our financial sovereignty to a handful of corporations.

The hyper-financialization of the world has already begun, with the financial sector becoming a relatively larger part of the economy, in terms of size and importance. Financial structures are also expanding rapidly in other sectors.

For example, in 2023, Americans spent more than $100 billion on state-run lotteries, according to According to The Economist, the poorest citizens spent huge amounts on tickets. In addition, the online sports betting market, valued at more than $100 billion, is projected to generate nearly $46 billion in revenue this year, with a user penetration rate of 3.9%.

Moreover, Robin HoodRobinhood, a commission-free investment platform popular with retail investors, saw its funded customers climb to 23.9 million and its assets under custody soar to $129.6 billion, another prime example of the hyper-financialization trend. Robinhood began to gain traction during the COVID-19 pandemic in 2020, and the hyper-financialization trend was exacerbated. For people stuck at home, the online world became their primary means of entertainment and social interaction.

Governments then injected billions of dollars into the market, encouraging people to bet their money on the markets. The subsequent surge in inflation and the weakness of the global economy further intensified this trend, with people having to bear the burden of survival.

This has led to an increased proliferation of financial structures in different spheres of life, meaning that both manufacturers and consumers are taking this route.

As we can see, cryptocurrency has grown from less than $150 billion in March 2020 to $2.7 trillion today. This explosive growth not only accelerates the trend towards the hyperfinancialization of finance with yield farming, resttaking, points, rewards and meme coins, but also that of art via NFTs, social dynamics via social tokens and platforms like Friendtech, game with play-to-win conceptsand physical assets through tokenization.

There are also prediction markets that allow people to bet on all sorts of events. These range from the outcome of the 2024 US presidential election to whether Bitcoin will hit $100,000 by the end of the year, whether Drake’s verse in “Wah Gwan Delilah” is an AI, what the opening weekend box office of “Bad Boys: Ride or Die” will be, or whether the Fed will raise rates this year.

This growing trend towards hyper-financialization is detrimental to society because it widens already large wealth gaps by increasing wealth concentration and contributing to economic inequality. Not to mention that it will lead to even larger asset bubbles, a focus on the short term at the expense of the long term, and an increased interest in speculative investments.

Here, cryptography can help find a better way to address hyperfinancialization. After all, the wealth is in the middlemen, and using blockchain technology removes this third party from the equation, bringing reliability, traceability, and immutability to the market. Blockchain actually allows hyperfinancialization to be fair and transparent.

Before the advent of cryptocurrencies, not everyone was allowed to participate in markets. But through disintermediation and permissionlessness, cryptocurrencies have made markets more efficient and accessible. Not to mention, everyone gains full control over their data, mitigating the risk of data manipulation and privacy violations.

This is where Bitcoin offers the perfect solution. This decentralized peer-to-peer network enables financial inclusion and censorship resistance, which is critically important in today’s world where organizations and governments are encroaching on people’s rights. This network has a decade-and-a-half-old history behind it, providing a robust and secure platform for people to achieve financial sovereignty.

This trillion-dollar asset class also serves as a hedge against inflation, allowing holders to preserve their wealth over time. Unlike fiat currencies, which are devalued by politicians, Bitcoin’s fixed supply and decentralization protect it from such pressures, making it the perfect asset to own in a world where everyone is competing to extract value.

The largest crypto network is now also seeing experimentation, as developers and investors use it as a foundation to build a truly decentralized future of finance and value.

For so long, Bitcoin has been a low-activity blockchain, with its key role being to store value. While Bitcoin has played a passive role in the blockchain world for all these years, it has finally changed with Taproot Upgrade which brought NFTs into the Bitcoin world. Then there was a growing interest in tokenization, also from institutions like Blackrock.

This drive to expand Bitcoin’s utility has sparked a wave of innovation, and the day is not far when BTC could dethrone Ethereum as the go-to blockchain for decentralized finance. Several aspects, including Bitcoin’s robust security framework, widespread acceptance, and institutional interest, position Bitcoin at the forefront of defi innovation.

So, with these developments, Bitcoin is now evolving to begin its new era of utility and innovation after realizing its original vision of being a peer-to-peer electronic currency system.

As everything becomes a financial asset and tradable, attention, which is a scarce resource, will become even more crucial. Bitcoin has already cemented its position in the attention economy, and the newfound interest in regulatory complaints and widespread adoption of BTC to boost productivity will allow it to lead the future of digital economies. This portends a world where crypto leads the charge towards hyperfinancialization, with BTC in the driver’s seat.

So, to conclude, the resilient Bitcoin network that has spectacularly survived the test of time may have started as a means to facilitate the seamless flow of monetary value, but today, it has become a foundation of hope not only to protect against a future that is going to be super fixated on the financial aspect, but also to take advantage of it to create wealth and prosper.

Jeroen Develter

Jeroen Develter is the Chief Operating Officer at Persistence Labs and a seasoned professional in financial and tech startup environments. With a decade of international consulting, management, entrepreneurship and leadership experience, Jeroen excels at analyzing complex business cases, establishing streamlined operations and creating scalable processes. With Persistence, Jeroen oversees all product and engineering efforts and is deeply passionate about improving the adoption of Bitcoin defi, or BTCfi, and using intents to develop scalable, fast, secure and user-friendly solutions. His work at Persistence Labs addresses the significant interoperability challenges between Bitcoin L2s. In addition, Jeroen is also a co-host of the Stacked Podcast, a platform to gain knowledge about Bitcoin and cryptography from prominent Bitcoin creators.

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto