Fintech

Making sense of for-benefit accounts (FBO) and the future of Fintech

The recent Synapse failure represents one of the largest implosions in the history of the FinTech sector.

The ongoing chaos on the Banking-as-a-Service (BaaS) platform has affected over one hundred thousand US end users, including other FinTech activitiesand investigations into its fallout have uncovered an estimate $85 million shortfall between what Synapse depositors are entitled to and what the bankrupt FinTech’s accounts show.

According to a Thursday (June 13) relationship by the Chapter 11 Trustee, former and current FDIC Chairman Cravath, Swaine and Moore company Jelena McWilliams“At the time of writing, the Trustee has been advised by at least one partner bank that there is an approximate deficit of $65 – $96 million based on progress made to date in reconciliation.”

While there are still no definitive answers as to what happened to the tens of millions of dollars in missing funds, during a precedent creditor hearingformer CEO of Synapse Sankaet Pathak told the court that Synapse may have commingled end-user funds, operating and reserve funds from FinTech programs, and Synapse’s own operating funds in the FBO accounts.

These types of accounts allow banks and FinTechs to collaborate to provide customers access to advanced banking features without compromising security or privacy standards.

“For Benefit Of” or “FBO” accounts could be crucial both to understanding where the money at the center of the Synapse collapse disappeared and how to redistribute it once found.

to know more: Synapse’s collapse provides harsh lessons for its B2B partners

Synapse’s potentially shuffled funds to the Collapse Recovery Center

FBO accounts, which are custodial money pools that allow FinTech companies to manage funds on behalf of their users without taking legal ownership of the account, are a key component of the BaaS industry’s regulatory compliance programs.

Because they enable FinTech companies to manage customer funds while complying with legal requirements, FBO accounts are critical to the operational integrity, regulatory compliance and customer trust that underpin the fintech industry.

Chapter 11 trustee McWilliams’ top priority is to restore end-user access to their funds by untangling the inner workings of Synapse’s proprietary accounting system. It promises to be a difficult task, due to the alleged mixing of funds into FBO accounts.

In essence, the problem is that without Synapse’s cooperation in establishing access to the information it controls, money held in FBO accounts under Synapse’s name cannot be returned to the beneficiary end users of those accounts.

As a result, other FinTech customers are suffering. Like PIMNTI reportedaround 85,000 FinTech startups Yottacustomers of – who held a total of $112 million in savings – were locked out of their accounts, in just one example of the ripple effect of Synapse’s collapse, while Copperanother FinTech that used Synapse announced it will shut down at least some of its offerings, including bank deposit accounts and debit cards.

to know more: FDIC warnings and “fake” deposit insurance claims highlight non-bank risks

Changing compliance needs in the digital banking age

According to Thursday’s report, Synapse’s trustee “has begun to learn from partner banks, fintech partners and other stakeholders about challenges in the reconciliation process precipitated by Synapse’s bankruptcy and abrupt liquidation. The Trustee was made aware of situations where partner banks lost access to Synapse systems, had reason to believe there were inaccuracies in Synapse’s ledger, and identified unexpected deficiencies in FBO accounts held by them. At the time of the trustee’s appointment, the partner banks did not have open lines of communication or protection mechanisms in place to facilitate data sharing between them.”

“In hindsight it’s very clear that Synapse was not running on his duty to reconcile the dollars,” Amias Geretia partner at QED Investorstold PYMNTS in an interview published Monday (June 17), noting that many other companies make sure that each FinTech that works with a bank has a FBO account dedicated to that FinTech with that bank, meaning there is no possibility of commingling of funds.

The importance of BaaS best practices comes against the backdrop of approximately two-thirds of banks and credit unions having entered into at least one FinTech partnership in the past three years, with 76% of banks deeming FinTech partnerships necessary to meet expectations of customers, second PYMNTS Intelligence.

In terms of some sort of resolution, like a status report filed on June 6, Synapse Brokerage’s FBO funds could be funneled into a single account and the trustee/court would determine what would be paid to each end user. General Synapse FBO accounts held elsewhere may result in partial payments or payments to FBO accounts that can be fully reconciled, or perhaps there may be no payments until each individual account is finally reconciled.

See more in: Baas, banking, Bank as a service, failure, Digital bank, first digital bank, FBO, FinTech, for the benefit of, legal, News, PIMNTI news, Synapses

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi9 months ago

DeFi9 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech9 months ago

Fintech9 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News9 months ago

News9 months agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi9 months ago

DeFi9 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News9 months ago

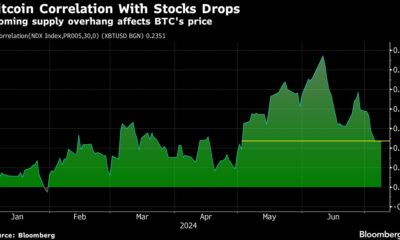

News9 months agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

DeFi9 months ago

DeFi9 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

Fintech9 months ago

Fintech9 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech9 months ago

Fintech9 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech9 months ago

Fintech9 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

Videos2 months ago

Videos2 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

News11 months ago

News11 months agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Markets11 months ago

Markets11 months agoCrypto Expert Provides Analysis of Top Altcoins, Market Sees Slight Rise