Markets

Polkadot and Dogecoin seek new ATH as KangaMoon leads the pre-sale market

Disclosure: This article does not represent investment advice. The content and materials presented on this page are for educational purposes only.

Polkadot and Dogecoin soar amid bull run as analysts predict emerging memecoin KangaMoon could follow DOGE’s success with significant growth potential.

Polkadot (DOT) along with the memecoin Dogecoin (DOGE) are red hot in the crypto space at the moment following a recent bull run that pushed their prices to new highs. While DOT and DOGE tokens look to record another all-time high in price, analysts are now turning their attention to emerging memecoins like KangaMoon (KANG), predicting that they could follow in DOGE’s footsteps and become the next big success stories.

KangaMoon: a new memecoin with significant traction

KangaMoon (KANG) has carved out a unique niche at the intersection of GameFi and SocialFi and has been successful in the pre-sale market. Last week, KangaMoon achieved several notable milestones including listings on CoinGecko and CoinMarketCap and now expects additional listings on Tier 1 exchanges such as BitMart and Uniswap in the coming weeks. The memecoin project has also raised over $7.4 million in presale funding, with hopes of reaching $8 million before the presale comes to an end.

However, the uniqueness of the KANG token transcends its presale perspective. Notably, the native KANG token serves as the backbone of KangaMoon’s upcoming “Kangaverse” ecosystem. Here, KANG holders will enjoy governance rights and use their tokens as in-game currency, fostering a dynamic and engaged community. Participants in this fun-filled ecosystem can also participate in battle-themed contests and speculative betting to win KANG tokens and other valuable in-game assets.

Additionally, KangaMoon has been widely recognized as one of the most promising memecoins, attracting a significant following of over 32,000 registered members, including nearly 10,000 token holders. In its ongoing bond presale phase, which was preceded by five consecutive successful presale phases, the KANG price rose 400% from an initial offering price of $0.005 to $0.025, providing thus substantial returns for first-time buyers.

At this rate, market analysts predict that KangaMoon could reach a price of $1 by the end of the year, potentially attracting the attention of a wider audience to its offerings. As more people participate in social media challenges for the KANG token, its popularity is expected to grow, further solidifying its position among the top memecoins to watch in the market.

Polkadot Network: Capitalizing on TikTok Integration Plans

Polkadot (DOT) made headlines with its ambitious plan to integrate TikTok into the web3 ecosystem. This bold move has sparked considerable interest in Polkadot’s native cryptocurrency, DOT. Despite recent market fluctuations, the DOT token has demonstrated resilience, growing nearly 14% in the last 30 days and a 28% increase in the year to date.

Notably, TikTok’s integration into the Polkadot network is expected to have far-reaching implications. By leveraging Polkadot’s decentralized infrastructure, the new TikTok platform will prioritize protecting user data and empowering the creator.

However, the potential acquisition and rebuilding of TikTok by a US-based consortium led by billionaire Frank McCourt further underlines the importance of this move. Following these recent developments, analysts project a new all-time high for the DOT token.

Dogecoin: Analyst forecasts diverge after strong year-to-date performance

Analysts believe that Dogecoin (DOGE) has significant growth potential in 2024. Renowned analyst Mags predicts a 700% price increase, pushing the price of DOGE from $0.15 to $1.12. This prediction is based on recent improvements in Dogecoin’s on-chain metrics, indicating an upward trend for the coin.

In contrast, Captain Toblerone expects a 30% price drop, with the DOGE token falling to around $0.108 before rising again. Furthermore, the potential launch of a Dogecoin ETF following the approval of Spot Ethereum ETFs could significantly increase the price of DOGE.

Additionally, analyst James Seyffart notes that the success of Spot Bitcoin ETFs in helping Bitcoin reach a new ATH in March suggests that a Dogecoin ETF could have a similar impact. Furthermore, the DOGE price has already demonstrated excellent performance in 2024. With a 117% YTD (YTD)) won, the DOGE token still holds a place among the best memecoins to invest in 2024.

Conclusion

KangaMoon’s unique features, a successful pre-sale that raised over $7.4 million, and integration into the SocialFi and Play-to-Earn gaming marketplaces position it among the top memecoins to invest in. Analysts project that KANG will topple DOGE as its future listings on tier-1 exchanges such as BitMart could increase its price to $1, a feat that not even DOGE has yet been able to accomplish.

To learn more, visit the Cangamoon website or join them telegram community.

Disclosure: This content is provided by third parties. crypto.news does not endorse any products mentioned on this page. Users should do their own research before taking any action related to the company.

Markets

Crypto Markets Rebound as Spot Bitcoin ETFs Attract Massive Inflows

This week saw $722 million worth of Bitcoin spot ETF inflows, including the largest daily inflow in a month.

Cryptocurrency markets rallied on Wednesday, driven by inflows into spot Bitcoin exchange-traded funds (ETFs).

The price of Bitcoin (BTC) is up 3% over the past 24 hours to last change hands at $65,200, according to CoinGecko. Ethereum (ETH) is up 2% and is trading at $3,471. Solana (SUN) and Polkadot (POINT) increased by 4%.

Bitcoin spot ETFs saw $422 million in daily inflows on Tuesday, the highest in the past 30 days, according to Far side data, . The all-time record for a single day was $1.05 billion on March 12.

Among Tuesday’s top contributors, BlackRock’s IBIT led with $260 million in inflows, followed by Fidelity’s FBTC with $61 million. This week has already seen more than $722 million in inflows.

Among the top 100 cryptocurrencies by market cap, Worldcoin (WLD) led with a 28% increase, followed by Helium (HNT) with 20% and Lido DAO (LDO) with 15%.

Worldcoin, a decentralized identity project led by OpenAI CEO Sam Altman, announced is extending the lockups for early investors and team members. This means that tokens will be gradually released through 2029, instead of the original 2027 plan. Token unlocks are generally seen as a negative because they increase supply and early investors can sell their tokens for profit.

Meanwhile, XRP, the token of the XRP Ledger network, jumped 8% after the CME and CF benchmarks introduced new indices and reference rates for XRP.

U.S. stocks faced a downturn on Wednesday. The S&P 500 fell 1%, while the Nasdaq Composite and Dow Jones Industrial Average both fell 2%.

Markets

Altcoins on the cusp of a major breakout – WLD, AR, and INJ prices could surge by 20% in the coming days

Crypto markets appear to have been taken over by the bulls as major tokens have surged above their crucial resistance zone. Bitcoin surged above $65,000 while Ethereum was above $3,500, and XRP, which had remained passive for quite some time, surged over 40% in the past few days to hit $0.6. The uptrend has been captured in most altcoins, with Worldcoin (WLD), Arweave (AR), and Injective (INJ) leading the rally. Here’s what to expect for these tokens in the coming days.

Worldcoin (WLD) Price Analysis

O Worldcoin Price has been trading inside a descending wedge since it marked a new ATH near $12 in the final days of Q1 2024. The recent price action helped the price break out of the upper resistance of the wedge, breaking above the crucial resistance zone between $2.21 and $2.39. Market sentiments have changed, but technicals suggest that the bulls may remain passive for a while, which could offer some room for a bearish pullback.

The price broke out of the wedge with a significant increase in volume, but the current volume suggests that the bulls have taken a step back. Meanwhile, the RSI is about to reach the upper boundary, which could attract bearish forces. Additionally, the DMI has undergone a bullish crossover, but the decline in the ADX suggests that the rally may remain consolidated above the gains. Therefore, the WLD price is expected to maintain a horizontal consolidation between $3 and $3.3 and trigger a fresh rally to $4.4 during the next bullish rally.

Arweave (AR) Price Analysis

Arweave formed a strong base around $25, which helped the rally trigger a recovery during the bearish attack. Mt. Gox and German terror forced the price to fall below $20. However, the recent price action has brought the altcoin within the bullish range and raised expectations of maintaining a decent uptrend for a few more days.

AR price has hit one of the major resistances around $30 to $31.5, which could act as a strong base once overcome. The buying volume is slowly increasing, which could keep the bullish hopes for the rally high. Moreover, the supertrend has just flashed a buy signal, indicating a clean reversal of the trend. Therefore, AR price seems primed to maintain a healthy uptrend and rally above $40. However, if the bulls maintain a similar trend, making new highs above $50 may not be a tedious task for the bulls.

Price Analysis of Injective (INJ)

Injective price has been showing sharp strength since the beginning of the year and hence, the recent turnaround is expected to revive a good uptrend going forward. The bears engulfed the rally to a large extent, but the recent price action suggests that the bulls have regained their dominance. Therefore, INJ price is expected to maintain a strong uptrend with a bearish interference on the way down.

INJ price has surged above the lower support zone and has registered consecutive bullish candles. Although the volume is below the required levels, the OBV is maintaining a sharp uptrend. Furthermore, the Ichimoku cloud lead span B is heading towards the lead span A and a healthy crossover indicates the start of a new uptrend. However, INJ price may be out of the bears’ reach once it secures the resistance zone between $30.77 and $32.12, which seems to be on the horizon.

Markets

Ethereum at $3.5K, Exchange Supply Hits 34-Month High

Ethereum (ETH) supply on exchanges has hit a 34-month high as the asset’s price surpassed the $3,500 mark.

ETH has risen 2.3% over the past 24 hours and is trading at $3,490 at the time of writing. The second-largest cryptocurrency — with a market cap of $419 billion — briefly touched an intraday high of $3,517 earlier today.

ETH Price, Whale Activity, RSI, and Exchange Supply – July 17 | Source: Santiment

Ethereum’s daily trading volume also increased by 7.6% to reach $19.8 billion.

According to data provided by Santiment, the supply of Ethereum on exchanges has reached $19.52 million ETH. This level was last seen in September 2021, when the asset was trading around the same price.

On the other hand, data from the market intelligence platform shows that the number of whale transactions has fallen by 12% in the last day — falling from 8,730 to 7,629 unique transactions per day.

The move shows that the supply of Ethereum on exchanges has been increasing with small deposits rather than large transactions from whales.

Additionally, the ETH Relative Strength Index (RSI) is currently hovering at the 60-mark, per Santiment. The indicator shows that Ethereum is slightly overbought at this price point, but it may not be in a critical position due to its large market cap.

One of the main drivers of Ethereum price increase is ETH spot expectations ETFs in the US Investment products are scheduled to start trading on July 23rd.

Markets

Bits + Beeps: How to Play the ‘Trump Trade’ in Cryptocurrencies After the Assassination Attempt

Also, how much will the Fed cut rates (and when)? What will be the inflows into ETH ETFs? And what is the near future for Bitcoin?

Posted on July 17, 2024 at 12:00 PM EST.

Listen to the episode at Apple Podcasts, Spotify, Capsules, Source, Podcast Addict, Pocket molds, Amazon Musicor on your favorite podcast platform.

In this episode of Bits + Bips, hosts James Seyffart, Alex Kruger and Joe McCann, joined by guest Jack Platts, dive into the market reaction to the recent assassination attempt on former President Donald Trump, analyzing how this event will influence the 2024 US presidential election and the cryptocurrency markets.

They also cover potential rate cuts: Could there be a cut in July? How big could the September rate cut be? Could the decision be influenced by the upcoming election?

They also give their predictions on what percentage of BTC ETF inflows the ETH ETFs will reach, and James talks about what he expects for Grayscale’s ETHE (hint: his outlook would be positive for ETH).

Finally, they delve into what’s next for Bitcoin as the German government runs out of BTC and Mt. Gox distributions begin. Just now?

Program Highlights:

- Whether Trump’s shooting decided the election and whether the event caused a “flight to safety”

- How election markets are becoming a place to watch election probabilities and whether cryptocurrencies “lean right”

- Whether rate cuts will occur in July or September and by how much they will cut: 25 bps or 50 bps

- How Joe sees the relationship between global liquidity cycles, rate cuts, and the potential rise of Bitcoin

- What are the new updates about Ethereum ETFs and their expected launch?

- Why Solana Hasn’t Performed Significantly Better Since Trump News

- What Market Breadth Indicates About the Current Market Rally and the Impact of Rates on Small Caps

- Everyone’s predictions on ETH ETF inflows and how much outflow we’ll see on Grayscale’s ETHE

- What’s Next for BTC After German Government Exits Bitcoin and Mt. Gox Giveaways Starting This Week

Hosts:

Guest:

- Jack PlattsCo-Founder and Managing Partner of Hypersphere Ventures

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

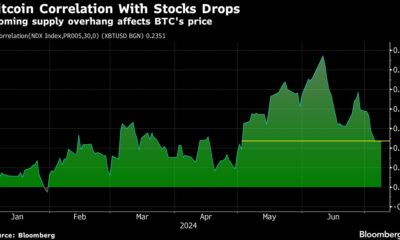

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto