News

Stocks Slump as Bitcoin Approaches $68K; Gold Closes at Record

Equity Indexes Wrap: Chip Stocks Extend Rally; Apple and Tesla Tumble

March 04, 2024 04:16 PM EST

The Dow

Intel (INTC) was one of several semiconductor stocks that soared Monday, gaining 4.1%.

Boeing (BA) ticked up 0.3% after American Airlines placed an order for 260 planes, including 85 Boeing 737 Max 10s.

Apple (AAPL) tumbled 2.5% after it was fined 1.8 billion euros ($2 billion) by EU regulators over its App Store practices.

Healthcare stocks lagged, with Merck (MRK) falling 2.3%, UnitedHealth Group (UNH) dropping 1.6%, and Johnson & Johnson (JNJ) slipping 1.4%.

The S&P 500

Gold miner Newmont Corp. (NEM) rose 5.6% as gold futures surged to a record high.

Morgan Stanley (MS) gained 4.2% as it launched a pre-IPO trading service.

Ford (F) gained 2.2% after it said U.S. vehicle sales increased 10.5% on a year-over-year basis in February.

American Airlines (AAL) fell 5.4% after ordering 260 planes from Boeing, Airbus, and Embraer. It also forecast that 80% of revenue in 2024 will come from loyalty program members and customers buying premium tickets.

The Nasdaq 100

Nvidia (NVDA) led the semiconductor rally, rising 3.6% after gaining 4% on Friday. Qualcomm (QCOM) and Advanced Micro Devices (AMD) added 2.1% and 1.3%, respectively.

Tesla (TSLA) tumbled 7.2% after preliminary data suggested it shipped fewer cars from its Shanghai factory in February than in any month since December 2022.

Entertainment companies Warner Bros. Discovery (WBD) and Paramount Global (PARA) fell 6.5% and 5.9%, respectively.

Alphabet (GOOGL) slid 2.8%.

Tesla Stock Slumps on Falling Shipments in China

March 04, 2024 03:41 PM EST

Tesla Inc. (TSLA) shares slumped Monday after new sales data showed deliveries from its Shanghai Gigafactory at their lowest level in a year as domestic competition heated up.

The automaker delivered 60,365 vehicles from its China factory in February, according to preliminary data from China’s Passenger Car Association (CPCA) on Monday. That marked the lowest level since December 2022 and was 16% lower than in January.

Vehicle sales are prone to a seasonal slowdown in China around the Lunar New Year early each calendar year, but the latest figures come amid a backdrop of slower electric vehicle (EV) sales and increased competition in the country.

Tesla is also facing stiff competition from domestic EV rivals such as the Warren Buffett-backed BYD (BYDDY) and Xpeng Inc. (XPEV).

Tesla shares were off 6.7% at $189.06 late in the session on Monday, with the stock now down about 24% year-to-date.

Nvidia Leads as Semiconductor Stock Rally Continues

March 04, 2024 02:44 PM EST

Shares of semiconductor companies climbed Monday, extending Friday’s rally on the back of Dell’s better-than-expected earnings report.

Nvidia (NVDA) shares were up more than 5% Monday afternoon, while American Depositary Receipts of contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSM) climbed nearly 4%. Advanced Micro Devices (AMD), which gained 9% last Thursday and 5% on Friday, rose another 2%.

Chip stocks were given a boost last Friday when Dell (DELL) beat earnings expectations, citing robust demand for AI-optimized servers.

Sea Limited Gets a Boost From Its E-Commerce and Financial Services Units

March 04, 2024 02:15 PM EST

American Depositary Receipts (ADRs) of Sea Limited (SE) gained Monday after the Southeast Asian consumer internet company posted better-than-expected results on higher sales at its e-commerce and digital financial services units.

The Singapore-based firm reported a fourth-quarter loss of $0.19, with revenue increasing 4.8% to $3.62 billion. Both were above forecasts. Full-year net income came in at $162.7 million, its first annual profit since going public in 2017.

Quarterly sales at the company’s Shopee online shopping site rose 23.2% to $2.6 billion, and they were up 24.3% to $472.4 million at its SeaMoney financial services platform. Revenue slumped 46.2% to $510.8 million at its Garena digital entertainment business.

Sea Limited ADRs were up about 5% at $53.54 Monday afternoon but down about 18% over the past year.

TradingView

Apple Fined Nearly $2B by EU Over App Store Practices

March 04, 2024 01:11 PM EST

The European Union (EU) fined Apple (AAPL) around $2 billion (1.8 billion euros) for “abusive App store rules for music streaming providers” in a move that the iPhone maker says could bolster Spotify (SPOT).

The European Commission said in a press release Monday that it fined the company for violating EU antitrust rules and that Apple “abus[ed] its dominant position on the market for the distribution of music streaming apps to iPhone and iPad users (‘iOS users’) through its App Store.

The iPhone maker based in Cupertino, California responded that it intends to appeal the EU’s decision, which it said would bolster the already dominant position of Swedish company Spotify.

The fine comes ahead of the Digital Markets Act (DMA) going into effect on March 6. The new law regulates big tech companies to promote competition, consumer choice, and innovation in the EU. Apple, which the Commission has designated as a “gatekeeper,” has already made changes to some of its systems, including the App Store and Apple Pay, to comply with the DMA.

Apple shares were down about 3.2% at $173.84 Monday afternoon. Spotify shares, meanwhile, were up 1.8% at $268.36, their highest price since November 2021.

BofA Raises S&P 500 Year-End Target to Highest on Wall Street

March 04, 2024 12:16 PM EST

Bank of America’s betting that the good times are ripe to continue for the S&P 500—in the long run, anyway.

The bank on Sunday raised its year-end target for the index to 5,400 from 5000, implying a 5% upside from Friday’s close.

The new target makes BofA one of the most bullish major international firms on Wall Street. Its target matches that of UBS, which became the Street’s most optimistic firm when raised its target last month.

BofA’s U.S. Equity and Quantitative Strategy lead Savita Subramanian said in a note that swings in interest rates and inflation haven’t hurt margins, with earnings surprising to the upside. Companies, she said, have shifted their focus to productivity, and as a result, there is an upside to the firm’s 2024 EPS forecast of $235.

In support of BofA’s bullish thesis is the observation that pension fund allocations to public equities are still at 20-year lows. Additionally, the euphoria that typically signals the end of a bull market, analysts say, is currently “thematic and secular.” The bull market has room to “broaden beyond” the themes of artificial intelligence and weight-loss drugs.

There are caveats, however. A small pullback is likely “after four months with no meaningful drop.” Plus, Subramanian wrote, “our bullish conviction has cooled since publishing our 2024 Outlook [in November] amid improving sentiment across Wall Street.”

JetBlue, Spirit Airlines Terminate $3.8 Billion Merger, Spirit Stock Skids

March 04, 2024 11:33 AM EST

JetBlue (JBLU) and Spirit Airlines (SAVE) have called off their $3.8 billion proposed merger after regulators blocked the deal.

Spirit Airlines stock fell 15% Monday morning, while shares in JetBlue were trading almost 4% higher.

The deal, announced in July 2022, would have created the fifth-largest carrier in the United States and that brought antitrust scrutiny from regulators. A federal judge ruled against the airlines at the beginning of this year.

While the companies said they still believed in the merits of the transaction, they are giving up on the merger since they won’t be able to acquire the necessary approvals by the July 2024 deadline. JetBlue will pay Spirit $69 million to settle the termination of the deal.

With Monday’s decline, Spirit Airlines shares have lost more than 70% of their value since the merger was first announced.

TradingView

Super Micro Computer Stock Jumps on S&P 500 Inclusion

March 04, 2024 10:46 AM EST

Shares in Super Micro Computer (SMCI) jumped more than 20% in premarket trading Monday following an announcement that it will be included in the large-cap S&P 500 Index.

Super Micro and Deckers Outdoor Corp. (DECK) will nudge out whitegoods maker Whirlpool (WHR) and regional bank Zions Bancorporation (ZION) from the blue-chip index, with the changes taking effect before the start of trading on March 18, according to S&P Global.

The San Jose, California company, whose stock price has more than tripled since the start of the year, has seen its market capitalization surge to more than $50 billion amid an AI-fueled buying frenzy.

Source: TradingView.com.

Super Micro shares have remained in a steady uptrend since the 50-week moving average crossed above the 200-week moving average in May 2020 to generate a golden cross buy signal. Impressively, the few retracements the stock had in 2023 didn’t manage to reach the 50-week moving average, highlighting the uptrend’s strong momentum.

More recently, gains have accelerated on above-average volume after the price broke above a period of four-month consolidation in the form of an ascending triangle—a chart pattern that suggests a continuation of the current longer-term trend. If the stock sees a wave of profit-taking, monitor the $300 to $350 level where a pullback may find support from the triangle’s top trendline and rising 50-week moving average.

Macy’s Buyout Offer Jumps to $6.6B as Arkhouse and Brigade Raise Their Bid

March 04, 2024 10:03 AM EST

Macy’s (M) shares surged 16% in early trading Monday after the investor group whose previous offer for the embattled department-store chain was rejected raised its bid by nearly $1 billion.

Real estate-focused Arkhouse Management and asset manager Brigade Capital Management said Sunday that they are now offering to acquire the Macy’s stock they don’t already own for $24 a share, or $6.6 billion—up from December’s $21-per-share offer that valued the retailer at around $5.8 billion and 33% higher than the shares’ $18.01 close on Friday.

Arkhouse remains “open to increasing the purchase price further subject to the customary due diligence,” Managing Partners Gavriel Kahane and Jonathon Blackwell said in a statement. Outlining financing plans, Kahane and Blackwell said they were backed by investors Fortress and OneIM.

Macy’s board said it will review and evaluate the latest proposal.

Stocks Making the Biggest Move Premarket

March 04, 2024 09:23 AM EST

Gains:

- Super Micro Computer Inc. (SMCI): Shares of the data center company jumped 16% after S&P Dow Jones Indices said it would be added to the S&P 500 effective March 18. Shoe company Deckers Outdoor Corp. (DECK), which was also named to the index, rose about 5%.

- Macy’s Inc. (M): Shares climbed more than 14% after investors Arkhouse Management and Brigade Capital, who offered to buy the department store for $21 per share in December, raised their takeover offer price by nearly $1 billion.

- Coinbase Global Inc. (COIN): Shares of the cryptocurrency exchange jumped 6% as the price of Bitcoin climbed above $65,000 for the first time since 2021.

Losses:

- Li Auto Inc. (LI): Shares of the Chinese carmaker fell more than 7%, extending losses from Friday when it unveiled its first full-electric car with a slightly higher price tag than analysts were expecting.

- Apple Inc. (AAPL): Shares of the iPhone maker slipped nearly 2% after the European Union fined the company 1.8 billion euros ($2 billion) over its treatment of music streaming apps that compete with its Apple Music.

- Zions Bancorp. (ZION): Shares of the regional lender slipped about 1% after it was bumped from the S&P 500 to the mid-cap S&P 400 by Super Micro Computer. Whirlpool (WHR) also slid 1% after getting the boot.

Stock Futures Dip Before Markets Open

March 04, 2024 08:36 AM EST

Futures contracts connected to the Dow Jones Industrial Average were down 0.4% in premarket trading on Monday.

S&P 500 futures slipped about 0.1%.

Nasdaq 100 futures were little changed about an hour before markets opened.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

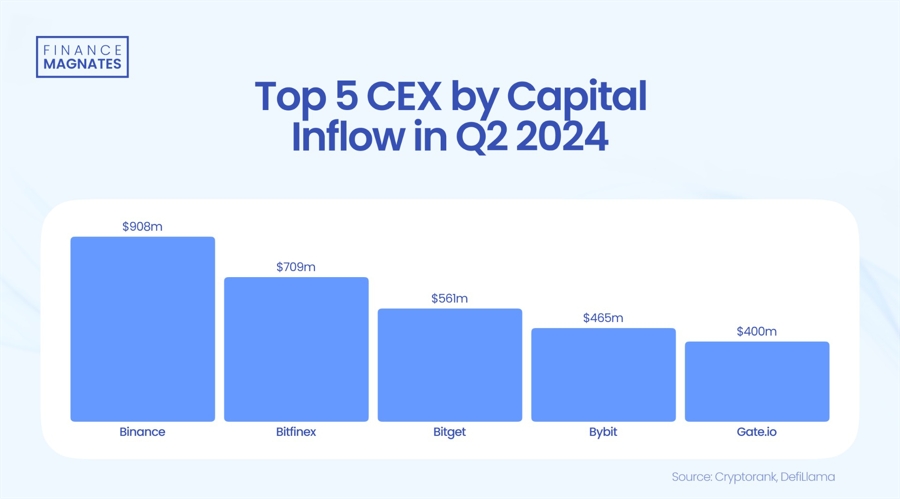

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

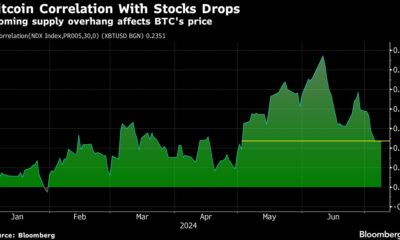

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto