News

Tokenization empowers investors and shocks Wall Street

Disclosure: The views and opinions expressed herein are solely those of the author and do not represent the views and opinions of the crypto.news editorial.

“The Times They Are-A Changin”: This classic opening line from one of Bob Dylan’s catchiest songs has become the most appropriate statement when talking about contemporary patterns of asset holding.

A detailed market study conducted by one of the big four accounting firms, Ernst&Young (E&Y), last year highlighted a significant increase in allocation to digital assets and interest in tokenization. The report revealed that institutional investors are becoming increasingly confident in the long-term value of blockchain and digital assets. According to the E&Y survey, 57% of institutional investors expressed interest in investing in tokenized assets, with 93% of respondents believing in the long-term value of blockchain or digital technology and digital assets.

Interestingly, not only were they eager to tokenize assets, but most had a clear strategy on how to proceed. For example, 71% of institutional asset managers surveyed intended to tokenize their assets through partnerships with digital native or tokenization companies. Meanwhile, 21% planned to build infrastructure in-house and 5% were looking forward to acquiring a tokenization startup.

What benefits do these experienced fund managers see that compel them to plan tokenization so meticulously?

The empowering potential of tokenization

In one of them explainers, McKinsey & Company defines tokenization as the “process of issuing a digital, unique, anonymous representation of a real thing.” On a practical level, tokenization requires a blockchain on which to carry out the process. Institutional investors show a marked preference for publicly licensed blockchains for tokenizing their assets, followed by private chains (40%) and public chains (22%).

One of the most appealing aspects of tokenization is its inclusiveness, allowing a wide range of assets to be tokenized. These include real estate, art, bonds and stocks, intellectual property, and even identities and data.

There are numerous examples of real-world assets being tokenized and becoming available to an expanded base of new customers and investors. Consider gold, for example, which has long been one of the most reliable assets throughout human history. Last year, the combined market capitalization of tokenized gold assets passed $1 billion.

Tokenized gold involves physical gold bars whose ownership rights are stored as digital tokens on a blockchain. While physical gold remains in safe custody off-chain, protected by financial institutions, those offering tokenized gold mint digital tokens on a blockchain to indicate ownership rights to physical gold bars or coins. Equivalence, such as an on-chain token representing one gram of physical gold stored off-chain, is determined by the issuing company.

Many companies now offer tokenized gold coins. For example, New York-based fintech firm Paxos Trust Company offers Pax gold coins (PAXG), while well-known blockchain entity Tether offers Tether gold coins (XAUT).

Like gold, art is another asset class that has enthusiastically embraced tokenization. For example, in April 2023, a soon-to-launch blockchain platform, Freeport, declared that it had completed its SEC review and was ready to launch its tokenized art platform featuring four iconic Warhol collectors, including the legendary Baby Jane Holzer. While the platform didn’t resist, it made a helpful observation in its press release; It She said:

“Blockchain technology has opened access to unique investment opportunities that were once out of reach of the average retail investor, especially today’s younger generations. However, in the case of fine art, the entry threshold remains too high for everyday retail investors, preventing them from participating in an investment class that has outperformed the S&P 500 Index for the past 25 years and is often insulated from broader market conditions.”

Freeport was right on target. The world has already witnessed Sygnum Bank’s tokenization of Pablo Picasso’s 1964 masterpiece, Fillette au Beret, which allowed 50 investors to collectively own the artwork through 4,000 tokens. Further exemplifying this shift, renowned artists such as Damien Hirst and celebrated digital artist Beeple have done so participated the growing chorus of successful painters to embrace tokenization.

As this trend accelerates, tokenization of real-world assets is transforming several other asset classes. Second According to the Boston Consulting Group, the total size of tokenized assets, including those considered less liquid, such as real estate and natural resources, could exceed $16 trillion by 2030.

Tokenization of global illiquid assets by 2030 | Source: Boston Consulting Group

But what is behind this massive surge in value? How is it becoming possible that such a new technology as blockchain can unlock trillions in untapped liquidity? Several factors are driving the growth of this market.

The factors that make asset tokenization successful

One of the main factors that make asset tokenization an immediate winner is its potential to make asset holding more democratic, fair and inclusive. These are the intrinsic properties of the blockchain, which imagines a world free from prohibitive and burdensome intermediaries. This vision extends perfectly to the field of tokenization of real-world assets.

Take, for example, artistic precious metals or high-value real estate, which are generally out of reach of the average retail investor. Thanks to fractional ownership through digital tokens, investing in such assets has become more accessible. Imagine 50 investors collectively purchasing a Picasso masterpiece or shares in a luxury property. Tokenization democratizes the process, allowing buyers to own a slice of something extraordinary.

This innovative approach operates through automated smart contracts within the systematic framework of blockchain protocols, powered by cryptographically secure tokens. It effectively dismantles the monopoly of brokers, from local real estate agents to the top investment figures who sit and dictate the market from their swanky offices on Wall Street. Now, retail investors no longer need their services. They can invest comfortably from home, equipped only with a digital wallet and an internet connection.

Tokenized assets and the potential for democratic ownership also lead to improved price discovery and reduced costs. In return, the market can reach a whole new group of investors who were hesitant to invest in asset classes like art or luxury real estate. As a result, liquidity increases manifold.

Asset holding, particularly in categories such as real estate, has often been plagued by fraud. Statistically speaking, one in ten Americans have done so state a target of real estate fraud, with half of these victims even suffering financial losses. Such a scale of real estate fraud is alarming. After all, this translates into annual financial losses worth $446 million, with average consumer losses due to real estate fraud reaching $70,000 per incident.

Asset tokenization brings greater transparency and much tighter security to the system. The confluence of blockchain, smart contracts and decentralized oracle networks reduces reliance on intermediaries. It becomes much easier to verify the authenticity of tokenized property as it comes with immutable ownership records stored on a blockchain ledger. These logs make provenance tracking possible and come with verifiable data trails.

Investing in tokenized assets is also more efficient. Programmable smart contracts help simplify the backend and make the process free from potential administrative errors. Therefore, it is no wonder that tokenization is on the rise. Who wouldn’t want a more democratic, efficient, inclusive and cost-effective investment environment?

The future of tokenization: innovation and ingenuity

As the market is expected to grow to billions of dollars in the coming years, it will attract innovation and creative solutions. Interoperability plays a crucial role, bringing isolated systems together under a single operational paradigm, improving scalability, transparency and efficiency with enterprise-grade infrastructure and programmable logic.

Tokenization is spreading rapidly in several areas, including the financial services sector, where cash tokenization is gaining momentum. McKinsey & Company estimates that $120 billion of tokenized cash is in circulation in the form of fully reserved stablecoins. In a world grappling with climate change and global warming, carbon credit tokenization offers an innovative solution. These tokens contain all the information and functionality of the credits within them.

Carbon credits can now be issued natively on-chain, making their attributes public. This transparency encourages greater acceptability and adoption, and these credits are transferable onto the blockchain via carbon bridges. These bridges can eventually be connected to traditional registries such as Verra and Gold Standard.

The potential of tokenization goes beyond empowerment. Anyone with a digital wallet can participate, regardless of their financial situation. Tokenization has democratized access to high-value assets that were once just ambitions, such as a lucrative real estate or an art masterpiece.

Previously, such assets could only be admired from afar by most investors. Now, through tokenization, investors can own a portion of these assets, even if only partially, and exploit their exceptional growth potential.

This means that an empowered, intermediary-free class of investors can now optimize their returns and explore their opportunities as broadly as possible, depending on the asset classes they are interested in.

Cloris Chen

Cloris Chen is the CEO of Cogito Finance, a defi platform that offers institutional-grade investment products by tokenizing fixed income assets and equities. Cloris combines a banking background with practical experience in the financial sector. He spent six years at HSBC and served as treasury director for a unicorn startup. This diverse CEO experience helps Cogito address defi challenges such as unsustainable yield farming, credit risk and regulatory uncertainty through tokenization. As a partner of SingularityNET, Cogito leverages Ben Goertzel’s expertise in artificial intelligence for business processes, including portfolio management.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

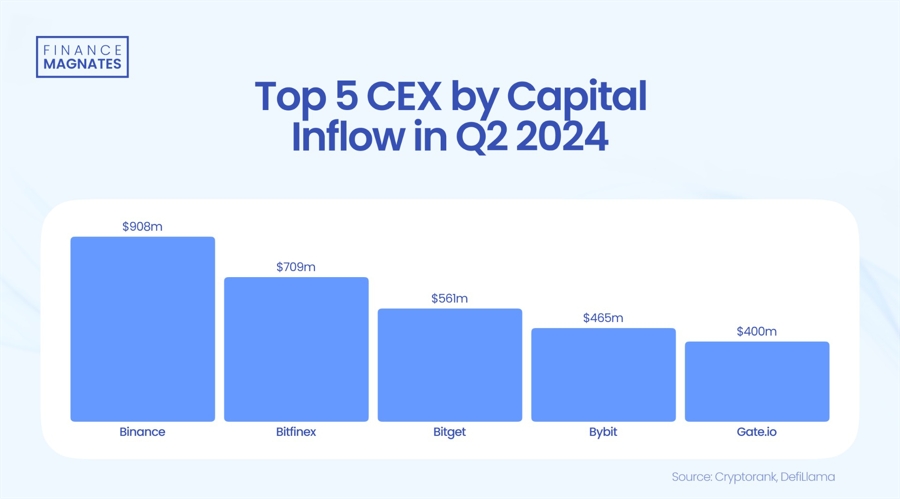

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

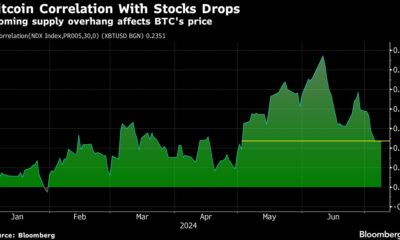

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto