DeFi

Unveiling The Players Of 2024

June 6, 2024 by Diana Ambolis

42

The institutional crypto lending market is a dynamic landscape with a growing number of players vying for a piece of the pie. Let’s delve into the key players, analyze their offerings, and explore the evolving competitive landscape. Institutional Crypto Lending Platforms: Unveiling the Players of 2024 As the cryptocurrency market matures and institutional adoption gathers

The institutional crypto lending market is a dynamic landscape with a growing number of players vying for a piece of the pie. Let’s delve into the key players, analyze their offerings, and explore the evolving competitive landscape.

Institutional Crypto Lending Platforms: Unveiling the Players of 2024

As the cryptocurrency market matures and institutional adoption gathers pace, the demand for secure and reliable crypto lending platforms tailored for sophisticated investors is skyrocketing. In 2024, a vibrant landscape of institutional crypto lending platforms is poised to shape the future of digital asset financing. Here, we delve into the key players, their unique offerings, and the evolving dynamics of this dynamic market:

The Established Players: A Legacy of Trust and Security

- Bakkt (Intercontinental Exchange): Leveraging the heritage and trust of the Intercontinental Exchange (ICE), Bakkt offers a regulated and institutional-grade platform for crypto custody, trading, and lending. Catering to large institutions and accredited investors, Bakkt prioritizes security, compliance, and seamless integration with existing financial infrastructure.

- Fidelity Digital Assets: A subsidiary of the financial services giant Fidelity Investments, Fidelity Digital Assets provides a comprehensive suite of crypto custody, trading, and lending solutions for institutional clients. Their focus on institutional-grade security, regulatory compliance, and deep industry expertise positions them as a trusted partner for large investors entering the crypto space.

- State Street Digital: State Street, a leading global custodian bank, has established State Street Digital, a dedicated platform offering secure custody, trading, and financing solutions for digital assets. Leveraging their established relationships with institutional investors and robust risk management practices, State Street Digital fosters trust and facilitates the entry of traditional finance players into the crypto lending market.

The Rising Stars: Innovation and Niche Expertise

- BlockFi: A pioneer in the retail crypto lending space, BlockFi is expanding its offerings to cater to institutional investors. BlockFi emphasizes high-yield interest accounts on deposited crypto assets, catering to institutions seeking attractive returns on their digital holdings. Their user-friendly platform and focus on transparency are attracting a growing base of institutional clients.

- Celsius Network: Another player transitioning from retail to institutional crypto lending, Celsius Network boasts a unique model that rewards users with its native CEL token for holding assets on their platform. This value proposition, coupled with competitive interest rates, is attracting institutions seeking a combination of yield and potential token appreciation.

- Genesis (Digital Currency Group): A subsidiary of Digital Currency Group, Genesis is a prominent institutional crypto prime brokerage offering a wide range of services, including lending, over-the-counter (OTC) trading, and asset management. Their focus on deep liquidity, customized solutions, and strong credit risk management caters to the specific needs of hedge funds, asset managers, and other sophisticated investors.

The Decentralized Disruptors: DeFi Lending Protocols

- Compound: A leading decentralized finance (DeFi) protocol, Compound allows institutions to lend and borrow crypto assets in a permissionless and transparent manner. Leveraging smart contracts and automated liquidity pools, Compound offers competitive interest rates and eliminates the need for intermediaries, potentially disrupting traditional lending models.

- Aave: Another prominent DeFi lending protocol, Aave provides a flexible platform where institutions can lend and borrow a wider range of crypto assets compared to centralized platforms. Its focus on community governance and innovative features like flash loans is attracting institutions seeking a more dynamic and customizable lending experience.

- MakerDAO: The pioneer of decentralized stablecoin lending, MakerDAO allows institutions to mint DAI, a decentralized stablecoin pegged to the US dollar, by depositing crypto assets as collateral. This innovative model offers a unique way for institutions to access USD liquidity without relying on traditional financial channels.

The Evolving Landscape: Key Considerations for Institutional Investors

- Regulation and Compliance: Regulatory uncertainty and evolving compliance requirements remain key considerations for institutional investors. Platforms with robust compliance frameworks, clear risk management practices, and a commitment to regulatory adherence will be well-positioned to attract institutional capital.

- Security and Custody: The security of digital assets is paramount for institutional investors. Platforms with a proven track record of secure custody solutions, robust insurance policies, and rigorous penetration testing will be favored by risk-averse institutions.

- Liquidity and Counterparty Risk: Institutional investors require deep liquidity pools to ensure efficient execution of large-scale lending and borrowing transactions. Platforms with strong partnerships with other institutions and robust risk management practices will mitigate counterparty risk and ensure the timely settlement of transactions.

- Yield and Risk Management: Maximizing returns while managing risk is crucial for institutional investors. Platforms offering competitive interest rates, flexible lending options, and sophisticated risk management tools will attract institutions seeking optimal returns on their crypto investments.

Collaborative Future for Institutional Crypto Lending

The institutional crypto lending market in 2024 promises to be a dynamic space characterized by collaboration and competition. Established players with a legacy of trust and security will vie for market share with innovative DeFi protocols offering decentralized lending solutions. Ultimately, institutional investors will benefit from a diverse range of platforms

The Competitive Landscape: New Entrants and Strategic Alliances

The institutional crypto lending space is attracting new entrants, further intensifying the competition and fostering innovation. Here, we explore the influx of new players and the strategic alliances being forged in this dynamic market:

New Entrants: Disrupting the Status Quo

- Traditional Financial Institutions: Major investment banks, commercial banks, and asset management firms are actively exploring the launch of their own institutional crypto lending platforms. Their established infrastructure, regulatory expertise, and existing client relationships position them as potential game-changers in the market. However, overcoming internal resistance to crypto adoption and navigating complex regulatory hurdles remain challenges they need to address.

- Crypto-Native Custodians: Existing crypto custody providers are expanding their offerings to encompass lending services. Their deep understanding of the crypto ecosystem, secure custody solutions, and established client base in the crypto space give them a significant competitive edge. However, they may need to bolster their experience in traditional finance and risk management to cater effectively to the needs of institutional investors.

- FinTech Startups: Agile and innovative FinTech startups are emerging with specialized crypto lending platforms targeting specific niches within the institutional investor landscape. Their focus on cutting-edge technology, user-friendly interfaces, and niche expertise allows them to cater to specific investor needs. However, building trust and brand recognition in a crowded market and competing with established players for market share are key challenges they face.

Strategic Alliances: A Collaborative Approach to Growth

- Legacy Finance and Crypto Expertise: Established financial institutions are forging strategic partnerships with crypto-native platforms to leverage their expertise in crypto custody, lending protocols, and market insights. These collaborations bridge the gap between traditional finance and the crypto ecosystem, fostering innovation and accelerating institutional adoption of crypto lending services.

- DeFi Integration with TradFi Infrastructure: DeFi lending protocols are exploring partnerships with traditional financial institutions to leverage their established infrastructure and regulatory expertise. This integration could allow DeFi protocols to offer their competitive interest rates and seamless lending experience to a wider range of institutional investors, while traditional institutions gain exposure to the innovative potential of DeFi.

- Consortium Models for Risk Mitigation: Collaboration among multiple institutions to create consortium-based lending platforms is a nascent trend. By sharing the risks and rewards associated with crypto lending, these consortiums can mitigate counterparty risk and attract a broader pool of institutional investors seeking a more diversified approach to crypto exposure.

The Impact of New Entrants and Alliances

The influx of new entrants and the formation of strategic alliances will significantly impact the institutional crypto lending landscape in several ways:

- Increased Competition and Innovation: The entry of new players will intensify competition, leading to more competitive interest rates, innovative lending products, and a wider range of services tailored to meet the specific needs of various institutional investors.

- Enhanced Security and Regulatory Compliance: New entrants with established expertise in traditional finance can contribute to enhanced security protocols and robust compliance frameworks within the crypto lending space. This will foster trust and confidence among institutional investors with stringent risk management requirements.

- Improved Liquidity and Market Efficiency: The combined efforts of established players and new entrants will contribute to deeper liquidity pools within the institutional crypto lending market. This ensures efficient execution of large-scale transactions and fosters greater market stability.

- Democratization of Crypto Lending: Strategic alliances between DeFi protocols and traditional financial institutions can potentially democratize access to crypto lending services. A wider range of institutional investors, from large hedge funds to smaller asset managers, will gain access to this innovative financing tool.

A Thriving Ecosystem for the Future

The institutional crypto lending space is poised for significant growth and transformation. The influx of new entrants, coupled with the formation of strategic alliances, will create a thriving ecosystem characterized by fierce competition, continuous innovation, and a focus on security, compliance, and risk management. As this market matures, institutional investors will benefit from a diverse range of lending platforms, sophisticated products, and competitive interest rates, ultimately unlocking the full potential of crypto lending in the financial landscape.

The Future Unfolds: A Maturing Market

The competitive landscape for institutional crypto lending is likely to become increasingly crowded. As the market matures, we can expect to see several key trends emerge:

- Regulation and Standardization: Regulatory clarity and the establishment of standardized practices will be crucial for fostering long-term institutional adoption. Governments and industry bodies are likely to collaborate on developing clear regulatory frameworks that address issues like anti-money laundering (AML) and Know Your Customer (KYC) compliance, while promoting innovation and mitigating systemic risks.

- Focus on User Experience and Automation: Platforms will prioritize user experience by offering intuitive interfaces, streamlined onboarding processes, and advanced analytics tools. Automation of key tasks, such as collateral management and risk assessment, will become increasingly prevalent, improving efficiency and reducing operational costs for both lenders and borrowers.

- Integration with Traditional Finance: Seamless integration with existing financial infrastructure will be essential for widespread institutional adoption. This may involve the development of standardized messaging protocols, interoperability between traditional and crypto lending platforms, and the creation of regulated crypto custody solutions.

- The Rise of Tokenization: The tokenization of traditional assets like real estate, debt, and private equity is expected to unlock new opportunities for institutional crypto lending. Tokenized assets can be easily fractionated and traded on secondary markets, facilitating greater liquidity and attracting a broader range of institutional investors.

- Convergence of DeFi and CeFi: A potential convergence of Decentralized Finance (DeFi) and Centralized Finance (CeFi) could emerge. DeFi lending protocols may integrate features like regulatory compliance and KYC procedures to attract institutional investors, while CeFi platforms may incorporate elements of DeFi, such as permissionless lending and automated market makers, to offer more competitive rates and innovative products.

The Evolving Role of Institutional Investors

As the institutional crypto lending market matures, we can expect to see a shift in the role of institutional investors:

- From Early Adopters to Market Makers: Early adopters who entered the market for speculative purposes may transition to a more strategic role, acting as market makers by providing liquidity and facilitating efficient price discovery within the crypto lending ecosystem.

- Increased Demand for Diversification and Yield Enhancement: Institutional investors will continue to seek out crypto lending as a means to diversify their portfolios and generate attractive returns in a low-interest-rate environment. Platforms offering a wider range of crypto assets, innovative lending products, and sophisticated risk management tools will be well-positioned to cater to these demands.

- Active Participation in Governance: Institutional investors with a vested interest in the long-term sustainability of the market may become more actively involved in the governance of DeFi lending protocols. This could involve shaping protocol parameters, proposing upgrades, and contributing to the overall health and security of the DeFi ecosystem.

A Bright Future for Institutional Crypto Lending

The future of institutional crypto lending is undeniably bright. As the market matures, regulations evolve, and technology advances, we can expect to see a vibrant ecosystem emerge, characterized by fierce competition, innovation, and a focus on security, compliance, and risk management. This will ultimately unlock the full potential of crypto lending, transforming the way institutional investors access liquidity, manage their crypto holdings, and participate in the burgeoning digital asset economy. By staying informed about the evolving landscape and adapting their strategies accordingly, institutional investors can seize the vast opportunities presented by this transformative financial instrument.

Also, read – Staking vs. Lending Crypto: Top 10 Amazing Ways to Maximize Your Returns In A Bear Market

Conclusion: A Buyer’s Market for Institutions

The expanding pool of institutional crypto lending platforms offers a buyer’s market for institutions. By carefully comparing loan terms, interest rates, security features, and the overall client experience, institutions can select a platform that best aligns with their specific needs and risk tolerance. As the market matures and competition intensifies, innovation, security, and exceptional client service will be the key drivers of success for institutional crypto lending platforms.

DeFi

DeFi Technologies Appoints Andrew Forson to Board of Directors

TORONTO, July 31, 2024 /PRNewswire/ – DeFi Technologies Inc. (the “DeFi Technologies”)Business” Or “DeFi Technologies“) (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company pioneering the convergence of traditional capital markets with the world of decentralized finance (“Challenge“), is pleased to announce the appointment of Andrew Forson to its Board of Directors (the “Advice“).

Andrew Forson is a financial and risk engineer, software architect, and trusts and estates specialist. He currently serves as Head of Investments and Ventures for Hashgraph Group, the commercialization and enablement arm of Hedera, where he has been instrumental in driving strategic investments and driving innovation in the digital asset sector.

Mr. Forson brings a wealth of experience gained through his extensive background in developing structured financial products and his deep knowledge of the digital asset landscape. His expertise will be invaluable as DeFi Technologies continues to expand its suite of innovative financial products and services.

“We are thrilled to welcome Andrew to our Board of Directors,” said Olivier Roussy Newton, CEO of DeFi Technologies. “His extensive background in financial engineering and forward-thinking approach to digital assets will be a tremendous asset to our company as we continue to lead the way in the digital asset space.”

Andrew Forson holds an MBA from the prestigious Edinburgh Business School. His arrival on the board is part of DeFi Technologies’ drive to strengthen its management team and enhance its strategic capabilities in the evolving digital finance sector.

About DeFi Technologies

DeFi Technologies Inc. (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT) is a financial technology company that is at the forefront of the convergence of traditional capital markets with the world of decentralized finance (DeFi). By focusing on cutting-edge Web3 technologies, DeFi Technologies aims to provide investors with widespread access to the future of finance. Backed by a team of esteemed experts with extensive experience in financial markets and digital assets, we are committed to revolutionizing the way individuals and institutions interact with the evolving financial ecosystem. Join the DeFi Technologies digital community on Linkedin And Twitterand for more details visit https://defi.tech/

About Valour

Valor Inc. and Valor Digital Securities Limited (together, “Value“) issues exchange-traded products (“AND P”) that allow retail and institutional investors to access digital assets like Bitcoin simply and securely through their traditional bank account. Valor is part of DeFi Technologies Inc.’s (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT).

In addition to their new digital asset platform backed by physical media, which includes 1Valour Carbon Neutral Physical Bitcoin AND P, 1Valour Ethereum Physical StakingAnd 1Valor Internet Computer Physical StakingValour offers fully hedged digital asset ETPs with low to no management fees, with product listings on European exchanges, banks and brokerage platforms. Valour’s existing product range includes Valour Uniswap (United), Cardan (ADA), Peas (POINT), Solana (GROUND), Avalanche (AVAX), Cosmos (ATOM), Binance (BNB), Ripple (XRP), Toncoin (TONNE), Internet computer (PCI), Chain link (LINK), Heart (HEART), Close (CLOSE), Enjin (ENJ), Valor Bitcoin Staking (Bitcoin), Bitcoin Carbon Neutral (BTCN), Hedera (HBAR), Valor 10 Digital Asset Basket (VDAB10) And 1Valour STOXX Bitcoin Suisse Digital Asset Blue Chip ETPs with low management fees. Valour’s flagship products are Bitcoin Zero and Ethereum Zero, the first passive investment products fully hedged with Bitcoin (Bitcoin) and Ethereum (ETH) as underlyings which are completely free of fees.

For more information about Valour, to subscribe, or to receive updates and financial information, visit valor.com.

Caution regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, the appointment of Mr. Forson; the regulatory environment regarding the growth and adoption of decentralized finance; the Company’s and its subsidiaries’ pursuit of business opportunities; and the potential merits or returns of such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but are not limited to, the growth and development of the decentralized finance and digital asset industry; the rules and regulations relating to decentralized finance and digital assets; and general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results to differ from those anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update forward-looking statements, except in accordance with applicable securities laws.

CBOE CANADA EXCHANGE ACCEPTS NO RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

![]() Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

SOURCE DeFi Technologies Inc.

DeFi

Is Zypto Wallet a Reliable Choice for DeFi Users?

Zypto wallet is a newcomer in the crypto landscape and has already made waves for its exclusive benefits and security features.

In this article, we will take a look at the Zypto crypto wallet and how it can help users securely manage their digital assets, interact with Web3 applications, and explore the world of Challenge.

What is Zypto Wallet?

Zypto App is a newly launched versatile crypto wallet that supports a wide range of coins and tokens, along with seamless access to Web3 applications, token exchanges, virtual crypto cards, a gift card marketplace, and a payment gateway.

What are the pros and cons of Zypto Wallet?

Benefits

- User-friendly: Zypto’s user interface is very intuitive with a simple setup process.

- Multi-Chain DEX Swaps: Zypto facilitates trading between thousands of cryptocurrencies, thanks to its versatile multi-chain token swap feature.

- Built-in dApp Browser: You can access Web3 applications directly in your wallet using the in-app dApp browser.

- Live Customer Support: The wallet has an in-app live customer support team that responds quickly to all your queries.

- Rewards Program: Zypto has a loyalty program that allows you to earn rewards, improving the overall user experience.

- Virtual crypto cards: The wallet makes it easy and reliable to use digital currencies for everyday transactions through its range of virtual cryptocurrency cards.

The inconvenients

- Limited analysis tools: Zypto offers advanced charting features and limited technical analysis tools that might not appeal to experienced cryptocurrency traders.

What DeFi products and services does Zypto Wallet offer?

Zypto allows you to securely manage a wide range of cryptocurrencies across multiple blockchains, acting as a user-friendly entry point into the Web3 ecosystem.

Multi-Chain Wallet

As a multi-chain wallet, Zypto supports hundreds of thousands of digital assets across different blockchains. Zypto is also committed to adding support for more chains in the coming months, expanding its universe of explorable assets.

Multi-Chain Exchange Functionality

Instead of the tedious process of selling one token on one exchange and buying another of the same type hosted on a different blockchain, Zypto offers a cross-chain swap feature.

DApp Browser

Another easy-to-use feature is the in-app dApp browser. Simply bring up the browser from the small globe icon at the bottom of your screen and it will first take you to the Zypto homepage.

The browser provides all the features under one application so you don’t miss anything that warrants opening a separate browser.

Zypto DeFi Wallet Review

User experience

Zypto’s ease of use is one of its main advantages. Once the app is downloaded, you can view your wallet from the home screen. Other buttons at the bottom of your screen will take you to prepaid virtual cards, an Explore Zypto page, where you can send, receive, exchange, buy and sell tokens, or access the dApp browser and your contact list.

Zypto requires KYC information before processing cards, as it is part of regulatory compliance. Contacts are another benefit: instead of tediously copying and pasting long addresses, simply save them under a contact name.

How to set up your Zypto wallet?

To start using Zypto, simply download the app. Once installed, you’re ready to go.

You can create a new wallet by pressing the Create Wallet button or import an existing wallet by writing (or pasting) your passphrase to verify your identity. You can also import it in read-only mode, in which case you only need the wallet name and address.

Conclusion: The Verdict

Zypto is relatively new in the DeFi space, but it’s already gaining popularity among different types of users. Those who prefer everything neatly organized in one place will find the app appealing, as will those who prefer its rich features and integration with fiat payment methods over on- and off-ramp cryptocurrencies.

DeFi

Switchboard Revolutionizes DeFi with New Oracle Aggregator

Switchboard, a leading oracle network known for its permissionless and fully customizable features, has launched a revolutionary oracle aggregator. This new tool enables seamless integration of data across multiple oracle networks, including household names like Chainlink and Pyth Network. In doing so, it provides users with access to a wide range of data sources, improving the versatility and reliability of decentralized finance (DeFi) applications.

Addressing security and cost challenges in DeFi

The Oracle Aggregator is designed to address significant security and cost challenges in the DeFi sector. In 2023, the Web3 industry saw losses exceeding $500 million due to price manipulation attacks, a notable increase from $403.2 million in 2022. These attacks accounted for 33% of the total value lost due to hacks. By expanding the diversity and volume of data sources, Switchboard aims to strengthen the resilience of data streams against such malicious activities, thereby improving the overall security of DeFi platforms.

Empowering developers with customizable data streams

Switchboard’s new Oracle Aggregator allows developers to design custom data feeds that draw from a wide range of sources, both within and outside of the Switchboard platform. This flexibility allows developers to create tailored feeds that meet their specific needs, moving away from rigid templates. The platform’s permissionless nature and lack of gatekeepers ensure developers have complete control over the data feeds they create.

Switchboard CEO Chris Hermida noted that the company’s philosophy has always been to empower developers rather than constrain them. By launching Oracle Aggregator, Switchboard allows developers to use data from a variety of sources, including Pyth and Chainlink, enabling innovation and customization of their projects. Hermida noted that this new capability allows developers to break away from traditional models and take a more personalized approach to data integration.

Plug-and-Play approach for enhanced security

Switchboard’s Oracle Aggregator offers a plug-and-play approach that allows users to leverage multiple Oracle networks, enhancing data security and reliability. By aggregating data from multiple sources, developers can improve the scalability and redundancy of their data feeds, setting a new industry standard as the first generalized Oracle aggregator. This scalability ensures that projects can mitigate risks associated with data manipulation and other vulnerabilities.

One of the most notable features of Oracle Aggregator is its customizable nature. Developers can selectively choose trusted data sources, eliminating those that do not meet their standards. This level of control is crucial for projects that aim to protect their operations from potential threats.

Innovative use of secure execution environments

Switchboard uses Trusted Execution Environments (TEEs) to ensure that data aggregation occurs entirely off-chain. This innovative approach minimizes gas costs associated with on-chain operations while preserving data integrity. Aggregated data is then shared with users in a single on-chain transaction, simplifying the process and reducing operational expenses.

Mitch Gildenberg, Switchboard’s CTO, highlighted the platform’s developer-centric design. He noted that the platform is designed to put developers in control, allowing them to fine-tune each data flow to their specific needs. This approach reflects Switchboard’s commitment to understanding and meeting developer needs.

Expansion and impact on the industry

Since its launch in 2021, Switchboard has seen significant growth, amassing over 180,000 users and achieving a total valuation of $1.6 billion. The company’s commitment to user autonomy and inclusion has been a driving force behind its rapid expansion in the Web3 ecosystem. Earlier this year, Switchboard raised $7.5 million in a Series A funding round co-led by Tribe Capital and RockawayX, with additional support from leading investors including the Solana Foundation, Aptos Labs, Mysten Labs, Subzero Ventures, and Starkware.

Conclusion

As the DeFi industry continues to evolve, tools like Switchboard’s Oracle Aggregator will play a crucial role in building robust and secure decentralized applications. By giving developers the ability to integrate and customize data feeds from multiple sources, Switchboard is setting new industry standards, driving innovation, and improving the overall security of the Web3 ecosystem.

DeFi

Bitcoin is the solution to inevitable hyperfinancialization

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial team.

If there is one thing that is becoming clear, it is that hyperfinancialization is inevitable, and our best chance of achieving it successfully is through Bitcoin (Bitcoin). This decentralized cryptocurrency, known for its fixed supply and robust security, offers a unique solution to the coming problem of wealth inequality and concentrated power. By embracing Bitcoin, we can create a more transparent and resilient financial future, or we risk losing our financial sovereignty to a handful of corporations.

The hyper-financialization of the world has already begun, with the financial sector becoming a relatively larger part of the economy, in terms of size and importance. Financial structures are also expanding rapidly in other sectors.

For example, in 2023, Americans spent more than $100 billion on state-run lotteries, according to According to The Economist, the poorest citizens spent huge amounts on tickets. In addition, the online sports betting market, valued at more than $100 billion, is projected to generate nearly $46 billion in revenue this year, with a user penetration rate of 3.9%.

Moreover, Robin HoodRobinhood, a commission-free investment platform popular with retail investors, saw its funded customers climb to 23.9 million and its assets under custody soar to $129.6 billion, another prime example of the hyper-financialization trend. Robinhood began to gain traction during the COVID-19 pandemic in 2020, and the hyper-financialization trend was exacerbated. For people stuck at home, the online world became their primary means of entertainment and social interaction.

Governments then injected billions of dollars into the market, encouraging people to bet their money on the markets. The subsequent surge in inflation and the weakness of the global economy further intensified this trend, with people having to bear the burden of survival.

This has led to an increased proliferation of financial structures in different spheres of life, meaning that both manufacturers and consumers are taking this route.

As we can see, cryptocurrency has grown from less than $150 billion in March 2020 to $2.7 trillion today. This explosive growth not only accelerates the trend towards the hyperfinancialization of finance with yield farming, resttaking, points, rewards and meme coins, but also that of art via NFTs, social dynamics via social tokens and platforms like Friendtech, game with play-to-win conceptsand physical assets through tokenization.

There are also prediction markets that allow people to bet on all sorts of events. These range from the outcome of the 2024 US presidential election to whether Bitcoin will hit $100,000 by the end of the year, whether Drake’s verse in “Wah Gwan Delilah” is an AI, what the opening weekend box office of “Bad Boys: Ride or Die” will be, or whether the Fed will raise rates this year.

This growing trend towards hyper-financialization is detrimental to society because it widens already large wealth gaps by increasing wealth concentration and contributing to economic inequality. Not to mention that it will lead to even larger asset bubbles, a focus on the short term at the expense of the long term, and an increased interest in speculative investments.

Here, cryptography can help find a better way to address hyperfinancialization. After all, the wealth is in the middlemen, and using blockchain technology removes this third party from the equation, bringing reliability, traceability, and immutability to the market. Blockchain actually allows hyperfinancialization to be fair and transparent.

Before the advent of cryptocurrencies, not everyone was allowed to participate in markets. But through disintermediation and permissionlessness, cryptocurrencies have made markets more efficient and accessible. Not to mention, everyone gains full control over their data, mitigating the risk of data manipulation and privacy violations.

This is where Bitcoin offers the perfect solution. This decentralized peer-to-peer network enables financial inclusion and censorship resistance, which is critically important in today’s world where organizations and governments are encroaching on people’s rights. This network has a decade-and-a-half-old history behind it, providing a robust and secure platform for people to achieve financial sovereignty.

This trillion-dollar asset class also serves as a hedge against inflation, allowing holders to preserve their wealth over time. Unlike fiat currencies, which are devalued by politicians, Bitcoin’s fixed supply and decentralization protect it from such pressures, making it the perfect asset to own in a world where everyone is competing to extract value.

The largest crypto network is now also seeing experimentation, as developers and investors use it as a foundation to build a truly decentralized future of finance and value.

For so long, Bitcoin has been a low-activity blockchain, with its key role being to store value. While Bitcoin has played a passive role in the blockchain world for all these years, it has finally changed with Taproot Upgrade which brought NFTs into the Bitcoin world. Then there was a growing interest in tokenization, also from institutions like Blackrock.

This drive to expand Bitcoin’s utility has sparked a wave of innovation, and the day is not far when BTC could dethrone Ethereum as the go-to blockchain for decentralized finance. Several aspects, including Bitcoin’s robust security framework, widespread acceptance, and institutional interest, position Bitcoin at the forefront of defi innovation.

So, with these developments, Bitcoin is now evolving to begin its new era of utility and innovation after realizing its original vision of being a peer-to-peer electronic currency system.

As everything becomes a financial asset and tradable, attention, which is a scarce resource, will become even more crucial. Bitcoin has already cemented its position in the attention economy, and the newfound interest in regulatory complaints and widespread adoption of BTC to boost productivity will allow it to lead the future of digital economies. This portends a world where crypto leads the charge towards hyperfinancialization, with BTC in the driver’s seat.

So, to conclude, the resilient Bitcoin network that has spectacularly survived the test of time may have started as a means to facilitate the seamless flow of monetary value, but today, it has become a foundation of hope not only to protect against a future that is going to be super fixated on the financial aspect, but also to take advantage of it to create wealth and prosper.

Jeroen Develter

Jeroen Develter is the Chief Operating Officer at Persistence Labs and a seasoned professional in financial and tech startup environments. With a decade of international consulting, management, entrepreneurship and leadership experience, Jeroen excels at analyzing complex business cases, establishing streamlined operations and creating scalable processes. With Persistence, Jeroen oversees all product and engineering efforts and is deeply passionate about improving the adoption of Bitcoin defi, or BTCfi, and using intents to develop scalable, fast, secure and user-friendly solutions. His work at Persistence Labs addresses the significant interoperability challenges between Bitcoin L2s. In addition, Jeroen is also a co-host of the Stacked Podcast, a platform to gain knowledge about Bitcoin and cryptography from prominent Bitcoin creators.

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

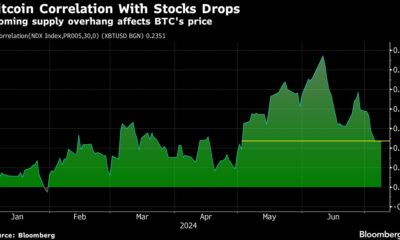

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto