News

What’s next for crypto?: Stocks in Translation

Months after the long-awaited spot bitcoin ETFs hit the market, the cryptocurrency landscape continues to grow at a rapid pace. How have the markets reacted so far, and what new dynamics are shaping the world of digital assets? With crypto regulation still evolving, what initiatives are shaping the future of regulation both internationally and domestically? Also, what is the potential impact of digital currencies on traditional finance, banking sectors, and physical money globally ?

In this episode of Stocks In Translation, Yahoo Finance’s Jared Blikre is joined by BloxCross Global Head of Markets & Strategy Keith Bliss and Yahoo Finance Producer Sydnee Fried delve into the latest developments shaping the world of digital assets, factors driving market sentiment, Federal Reserve rate cut outlooks, and more.

This post was written by Angel Smith

Video Transcript

Welcome to Stocks in translation, our essential conversation cutting through the market, mayhem, the Noisy numbers and the hyperbole to give you the information you need for your portfolio.

I’m joined here today with by Keith Bliss, the founder and CEO of Blocks Cross and our producer, Sydney Fried Keith.

Just real quick.

Great to hear to have you here.

I remember I used to book you each week down at the New York Stock Exchange when I began my career here uh at Yahoo Finance in 2015.

Any quick words about that, that was a fun time in a different time when there were actually people on the floor of the New York Stock Exchange.

So yeah, the N is becoming an anachronism in our global financial system to still be relevant from what they do on a day to day basis, which is facilitating buyers and sellers just matching up the marketplace and trading stocks and trading money.

But you know, technology regulation and other things have conspired to disintermediate the human based traders.

So while you and I were down there, we would occasionally get knocked over and run over, especially on the opener of the close by my friends who are brokering uh stock trades, but that’s no longer the case.

A bit sad in my, in, in my mind.

But uh it’s a natural evolution.

That sounds like a fun time.

We’re not gonna throw any funerals here today just yet.

I do wanna go over the rundown and let everybody know else know what we’re gonna, we’re talking about today.

The theme is cycles and we’re gonna be talking about everything from market cycles to business cycles.

That is just a lens.

Uh Our word of the day is squeezed.

So, and maybe it’s just because I watched dumb money over the weekend, but it is an appropriate word today for more reasons than one.

Story continues

And this episode is brought to you by the number 12 that is the number of fed speakers on deck this week.

And uh just a reminder that for guidance is a marathon, not a sprint.

Uh Keith Sydney first story of the week.

It has been five months and we’re talking crypto here five months since we got those Bitcoin ETF S supposed to be a watershed moment.

Uh But we haven’t had a new high end Bitcoin for a couple of months.

Anything we should be worried about.

Well, I think there was some interesting analysis over the weekend.

Uh And if you look at the Bit Bitcoin uh ETF flows, you’ll see that they’re moving up and down with the price of Bitcoin, which is somewhat counterintuitive of what you thought the ETF S would do.

There is the thought that, you know, being able to marry Bitcoin into the traditional finance, uh, where people would be able to, you know, process Bitcoin participate in it through traditional finance in the form of ETF S would lead to an explosion in the price, uh because there would be demand, outstripping supply.

Uh We’ve just not seen that and the important analysis referring over the weekend um was about who’s actually participating in the ETF S and who’s actually participating in the on channel institutional retail versus institutional.

And there’s some important analysis back and forth.

Coinbase acts as a very good proxy to really view and peer into the marketplace to see what the flows are on Bitcoin and the other and the other coins.

Um I will say one note about that.

So, so the analysis on Coinbase, by the way is that the retail volumes are dramatically lower than they were three years ago and the institutional volumes are higher.

Now, I will tell you I have inside knowledge that Coinbase has been intentionally pivoting their business away from retail and into the institutional arena so that they’ve done that purposely.

And also think about back in 2021 everybody was sitting at home, you know, with face mask on and waiting for their vaccination so they could go out.

So what are they doing?

They start playing and participating in different things, you know, the ability to even buy Bitcoin or digital assets through your xbox, for example.

And it was like, hey, let me play a game for an hour and then go buy, put my GP U to use actually mining Bitcoin or buying Bitcoin.

So II I think what we’ll see is this kind of mating dance that’s going on between on chain activities with as relates to buying and selling Bitcoin and then how it’s gonna translate into traditional finance.

I do find what’s really interesting is that as soon as a Bitcoin ETF was allowed by the SEC, the number of products into the market was dramatic and this is also being a traditional financial guy who is now pivoted into, you know, web three and, and, and the new world of what we’re doing, decentralized finance.

It’s obvious what you do.

They have the most capital, the traditional financial guys.

Um and they see an opportunity to take the new technology but keep it in their wrapper which allows them to start accumulating all the money and that’s what we’re seeing, but Keith.

So for a while while there people were talking about defi decentralized finance and how it was gonna be this whole big thing, a whole movement.

It was supposed to kind of move away from that traditional regulated financial scheme.

Now we’re seeing things like these ETF S and they’re still, you know, these are regulated products.

So what am I missing here.

What happened to defi D I is still there and, and it still should be rolled out globally.

It’s, it’s absolutely when you think, when you think about, so let me take you back for a second one of the reasons that we launched Blocks Cross because we had the evolution, we launched that in 2021 and we had the ability to actually see what was happening in the crypto and Blockchain and defi world for six years.

And we started identifying which is what we do as Wall Street Professionals, you identify the problems that had been created and you try to create solutions to solve those problems.

So we saw lots of problems that had been created around the, the original adopters in this world.

So sorry, Sydney, I’m gonna give you a little bit of a longer explanation.

I need, I need that longer explanation.

Beers, soccer and D five.

We’ll, we’ll do that one day, Sydney equals all those things.

But you have to listen to my explanation.

OK. All right.

So anyway, um we started that because we, again, we had the, we had the ability to see problems that had been created.

And one of those was how could you accelerate adoption of the DFI world down into the institutional realm as well as the retail realm.

One of the big problems that you have, especially in the institutional realm is you’re gonna get massive resistance because what that implies is, you’re changing the way that governments, institutions and larger players behave and interact with one another.

And therefore you’re talking about moving money out of a system that they’re accustomed to.

They, they work every day, they understand the regulations.

They built these massive bureaucracies and infrastructure to comply with all that.

Now, we’re suddenly ripping that away from them and moving it into a decentralized world so that some smart person sitting in Zurich Switzerland can actually run the process.

It’s scary for a bureaucracy.

It’s scary for a government bureaucracy mostly.

And I’m gonna say something which I don’t think will get me in trouble, but we’ll throw it out there anyway.

It’s really scary for the United States if you see something like this happen.

I, I, I’ve said this to my friends and family over the last 12 months when the whole notion, you know, that China is floating some trial balloons, other people are floating some trial balloons like, hey, the dollar should not be the reserve currency anymore.

There’s a lot, those tribe balloons have been coming for decades.

Yes.

But the, but the drumbeat of them are getting louder and louder and louder, primarily because of a lot of the disruption that we’re seeing in the world, politically, economically, um, digital assets have nothing to do with this.

But it is the notion that, oh my gosh, there are other systems and apparatus and infrastructure that’s being built that would get in the way of the dollar becoming the reserve currency.

I’m, I’m interested to know your thoughts on uh central bank uh staple coins because that has been the, the f the inro for central banks around the world and the Federal Reserve has indicated and put a lot of resources into researching this.

We’ve seen it in China, we’ve seen these uh staple coin currencies, these digital currencies.

Does it change the game here?

Does it come here at all?

I, I think the US would like to institute a CBD C Central Bank digital currency.

Um because they probably see that as a way to maintain control over the monetary policy in the United States and maintain control is the dollar or dollar denominated token as the reserve currency.

The problem with CBD CS though is that there is no privacy at that point, they know exactly where all those digital tokens are at all times and every, every transaction, basically, every token will have a unique wallet address or a unique uh hash address underneath it.

They’ll be able to see what you buy when you bought it, where you’re traveling all these things.

So if you pop up in Belize, for example, and you pay with AC B DCU S dollar, that transaction is suddenly hitting the Blockchain that they’ve created for the CBD C. They know Jared Blier is in Belize and they also know what you just bought.

So that’s, that’s the real issue.

We have both here in the United States and in Europe, the notion of some very strong privacy laws which would negate a CBD C from actually being rolled out in that form.

That’s why I believe things like circle coin and tether and other things.

And there’s, there’s about a dozen dollar denominated, um, digital currency, stable coins.

Right now, you have to pick the best one that has the best collateral backing it, you know, in the form of us, treasuries and cash and it’s a certain amount of faith there as well.

Well, there is you, you gotta maintain, you’ve got to believe that the blockchains that are, that are managing the transactions that and we use, by the way, a blocks business we use, that’s, that’s a primary focus of our business is the stable coins for facilitating payments around the globe.

Um We have taken great comfort and done a lot of research and a lot of due diligence that we know the provenance of the digital currencies that we’re working on.

We know the wallets where they come from.

We go through all this due diligence to make sure that we’re not dealing with bad actors.

Um But you’ve also got to be comfortable with the stability and the viability of Circle and Tether as, as as two companies that can provide that.

So, Keith, how are you facilitating uh these payments?

That’s your business?

You’ve got it too.

Yeah.

So, so it’s, it’s a great question because uh you know, we, we, when we launch blocks, I was explaining earlier, we launched as a retail Cryptocurrency and digital assets trading platform.

We always had a roadmap for other products and services because there’s there’s great use cases for digital assets to supplant traditional finance.

So we launched.

So that’s where we saw the, the the biggest problems kind of in the value chain when retail investors are coming to the, to the market to buy and sell digital assets.

Um So that’s, that’s, that’s how we launched.

Uh And we built about a year, we took about a year and a half and built our own technology.

We, we looked at lots of platforms, we couldn’t find anything that gave us the scalability and the security that we knew was necessary as well as we’re all come from a regulated background.

We ran headlong into the regulations, the regulatory environment.

We were in Colombia in Colombia and around the globe.

People might ask why Colombia Colombia is so, is it another great question?

So when we, we iterated a lot on OK. A what are we gonna be?

And b what are we gonna be with it and how we’re gonna get into the marketplace?

And um so we kept landing back to a retail platform because that gave us the tools and the infrastructure to build out other products and services, which again in our product road map was taking us into traditional financial services, whether it’s banking products, trade finance, you name it, but you needed to have the core infrastructure built so that you could plug in all these various systems.

Because today you still gotta marry traditional finance, especially banking with the web three de decentralized finance.

You still got to blend and, and, and provide that connection.

So that’s why we built our own system.

We spent about 18 months, a lot of sweat equity, you know, some friends and family money, this classic story, right?

But I’m not some 25 year old kid sitting in the garage with an idea.

Me and my partner Diego Baez, who we collaborated for 25 years on various projects.

Anyway, we hit the market uh in probably at the very worst time, the beginning of the fourth quarter of 2023 2022 when the bottom was falling out.

FTX, the crypto winter was always well upon us and then FTX blows up and Keith, I’m gonna pause you there for one second because we do have to take a quick break for our viewers on our string platforms.

Uh We’ll be back in a minute and for everybody else, we’re gonna continue with the show.

We just left off with you in Colombia.

So you asked the question, why Colombia?

So when we were looking around the world, we were looking at places that had, you know, reduced competition, not a big roll out of the of the existing platforms like a Coinbase or a Binance or an FTX.

Uh but a but a pretty big addressable market.

Columbia gave us that uh in, in addition to the fact that my co founder, Diego is Colombian by birth, he’s a US citizen.

We have lots of connections down in, pardon me in the Colombian market, both in the industrial side, banking side, regulatory side.

So it was a natural fit for us.

We knew the market we could roll in there.

And then we were gonna, you know, roll into the rest of Latin America.

That was our game plan right from there.

We were, we never contemplated being a US company for lots of reasons.

Number one is you, you know, we just didn’t have the capital to compete against a Coinbase for retail offering nor did we want to, you know, drain any of our potential resources, you know, wrestling with the regulators uh on other things and getting licenses.

We are, we are money services business.

We’re regulated by that.

But we operate, the only thing we do in the US is facilitate payments from our, from our Latin American clients to vendors that they need to pay in the US.

So all we need to move on to our word of the day here and that is squeeze and guess what?

It’s not just for shorts.

Uh According to investopedia, the term squeeze is used to describe a variety of financial and business situations typically involving some sort of market pressure.

And uh let’s start out with the latest squeeze that we saw in meme stocks and, uh, you’re in crypto, but I’m sure you got an eye on the, the general market here and especially when gamestop starts dominating the headlines again.

What did you think last week?

Well, it’s interesting.

I mean, listen, you and I’ve seen in Sydney and we’ve seen short squeezes all over the place and when you get so the meme meme stocks are interesting.

I mean, my background is like a short squeeze that that would happen in like a Microsoft or, you know, an Amazon or something like that.

But, um, a, a again similar to crypto decentralized finance, I promise I won’t take us back down that rabbit hole.

But, um, similar to that the, the ability for anybody to see information, um, consume it and then act upon it very quickly, very easily is what you’re seeing with the meme stocks as we know, you know, a reddit thread starts off and, you know, Wall Street bets or whomever it may be.

And before, you know, at presto, you’ve got all these people piling into the stocks.

Um, that’s what happened on the first meme squeeze 2021.

Exactly.

You had all these institutional, um, investors, hedge funds.

And the, like I, as I said, I was watching the movie over the weekend and I had almost forgotten the timeline.

Lots of stuff happening, but that was in such a short condensed period of time.

Uh That’s what, that’s what I remember out of it.

Well, I, it’s also interesting.

So that goes back to the amount of information that’s out there that smart people can consume.

Um, somebody figured out that the institutions had these large short bets on these meme stocks, Gamestop A MC, you name it and Gamestop, by the way is a logic would tell you gamestop will be out of business in 10 years.

I mean, you should just tell you that unless they pivot to defy, unless they pivot to defy or they do some other things along that because if you think about it, like, like any retail establishment that conveys products and services that can now be consumed digitally from your home.

Look at all the stores that have gone out of business because of because of Amazon gamestop is kind of sits in that category.

I’m not making any comment about the management or their business model or what they do.

It’s just logic tells me it should work that way.

Yeah, but like, ok, on another level like bed bath and beyond was kind of a, was a game stock, right?

And that went out of business for a different reason.

Not because, but so what’s kind of the point we are, we just kind of kind of have a rotation for ever of these random stocks.

They get a lot of hype online.

Uh Where’s the end for something?

It’s the theme of the good thing about it.

So, so what I was gonna finish with gamestop, fundamentally, the meme traders don’t care whether that company goes bankrupt or not.

They just don’t.

All, they, all they identified was lots of institutions who were, who were fundamentally had the right plan.

Right.

Short, Gamestop companies shouldn’t be in business.

They retail establishment, bricks and mortar.

I can buy my next game on, on Xbox right from my home.

So they were doing their fundamental job and that was the problem that the information the meme traders came in and just ran them over by, by going long before, you know, it, they’re upside down in their short position.

They’ve got, they’re either covering out on their own or they’re getting bought in by their, by their prime broker and then it becomes a self fulfilling, you know, cyclist, I still think Keith Gill A K A Roy and Kitty, I think he cared just for the record.

I think he cared a bit whether or not these companies went out of business, especially gamestop.

Um But I wanna, we’re talking about squeezes here is there, there’s a different kind.

You can have a market squeeze, you can also have a business squeeze.

And I was reading about that in investopedia as well.

Um There’s a squeeze potentially going on.

That’s an echo of an operation that we saw before.

Maybe a decade ago.

Can you tell us what that’s about?

Yeah.

So I think you’re referring to Operation Chokepoint 2.0.

So the original Operation Chokepoint for your listeners and viewers was uh actually was the Department of Justice and the FDIC were found guilty of uh nefarious activities and actually paid some fines on the, on the original Operation Checkpoint.

What they were doing was squeezing businesses, squeezing businesses, really money services, businesses around areas that they just didn’t like, you know, whether it was, could be, firearms, could be firearms, marijuana related businesses, adults, uh, businesses, um, payday lenders, um, just legitimate business.

They were losing or having trouble maintaining their business accounts, uh, from a compliance perspective.

Well, they were just getting shut off.

So, here’s, here’s how, here’s how those, here’s how the choke points work is that?

Gosh, I’m sorry.

Um, spring allergies.

The, the doj in the government writ large will not take the political hit by walking into an industry and say, we don’t like what you do, let’s say Payday lenders.

We don’t like what you do.

We’re gonna do everything in our power to shut you down.

Well, they know they’ll never get legislation passed because as we know that’s the way our system works.

So they’ll never be a law that would land on, you know, Barack Obama’s or Joe Biden’s or Donald Trump’s desk just wouldn’t happen.

So, what do they do?

They, they use the power of the government through the regulatory offices to go to the, in this case, the banking institutions and say, hey, we see that you’ve got a few dozen payday lenders on your client roster.

You know that that’s an industry that potentially could be laundering money for bad guys coming out.

So, if you have those on your client roster, we’re going to look a lot closer at that.

So what do the banks do preemptively?

They just get the, the out with the bathwater?

Yeah.

And, and, and also in this country, somewhat disturbing is that banks don’t have to give you a reason for closing your account.

They just call you up and say where to send the check.

I remember during the GFC that happened to a lot of people just for no apparent reason whatsoever.

Yeah.

So, so operation, so that was the first operation, Chokepoint.

And again, the, the, the DOJ and the FDIC were found, you know, uh not negligent, but they were found to have some guilt and they paid fines and promised to change their policies.

Operation Chokepoint 2.0 is now occurring and it’s occurring in the crypto industry and there’s, and this goes back to something that we were starting to get into earlier uh on this conversation is that the US, in this is my opinion, the US has a real concern and a real fear that they will lose control over the dollar and therefore lose control over the monetary system and, and, and let me, let me put it this way.

And again, this will be another subject Sydney that we can do over beers.

We’ll add this to the list.

I’m ready for it.

Ask yourself this question, why is the US been able to run these massive budget deficits all these years?

But yet the US economy is still strong, the US markets still roll on.

They’re still, you know, I mean, for a dollar, arguably we’ve exported our inflation for decades around the world.

And that’s a, it’s a nice, it’s a nice position to be in if you can, you know, if you can get there.

Um We have, we do have to move on.

This is uh today we have uh a treat for all our viewers.

This is a rare three way race in this week’s who wore it better.

So there might be no phrase in finances, welcome and feared as record highs.

And we’re not even talking about stocks.

Today.

We’re judging gold, silver and copper, all these commodities hitting fresh record highs.

Only this week.

Each of them though has taken a markedly different path to arrive at these plateaus which may or may not be permanent.

And that is our question for you, Keith who is wearing their journey to all time.

Valle Hala High?

Is the best?

Is it copper, silver or gold?

I’m gonna go with copper and here’s and here’s my thinking.

So, doctor copper that reference there typically copper usually rises and falls based upon the the economic growth globally.

Right?

The thinking being is that copper is the essential component in electric transmission and other pieces of equipment that we create.

Therefore, if we’re building more plants, if we’re buying more computers, copper is gonna rally because supply starts or demand starts to outstrip, supply gold and silver are also industrial metals that go into a number of applications.

But their movements tend to be driven a lot, a lot more on inflation metrics and other financial metrics as as opposed to actual demand and supply dynamics for uses.

That’s why Doctor Copper has a phd, they say correct, correct.

So I I look at the world if you follow the news, especially around things like A I which has dominated the news cycle now for the last few weeks.

Um There’s a real concern certainly here in the US, but globally that we just don’t have enough data center capacity to run all these A I applications and really get the the most benefit out of them.

So therefore there’s gonna be a massive boom in data center construction and roll out across all kinds of, you know, venues and places around, around around the globe.

And therefore all those data centers and other machines, as well as all the A I machines and the GP US, you’re gonna need a heck of a lot of copper to do that.

And that’s just a trend that I don’t, don’t think will end.

So copper will trade.

It’ll get to as you know, Jared, I do a lot of copper gold ratios that and I do a lot of over bought and oversold conditions.

So it, it never goes straight up.

You know, there’ll be people that will come in and say, ok. Yeah, it’s, it’s way overbought.

Let’s start shorting or selling it.

But I think longer term copper is to play.

All right, we’re gonna leave it there.

Copper.

I’m gonna go gold.

I’m gonna go silver.

See how this show works out.

All right, we got to wind things down but definitely keep your dial tuned to Yahoo Finance.

Thanks for watching Stocks in translation.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

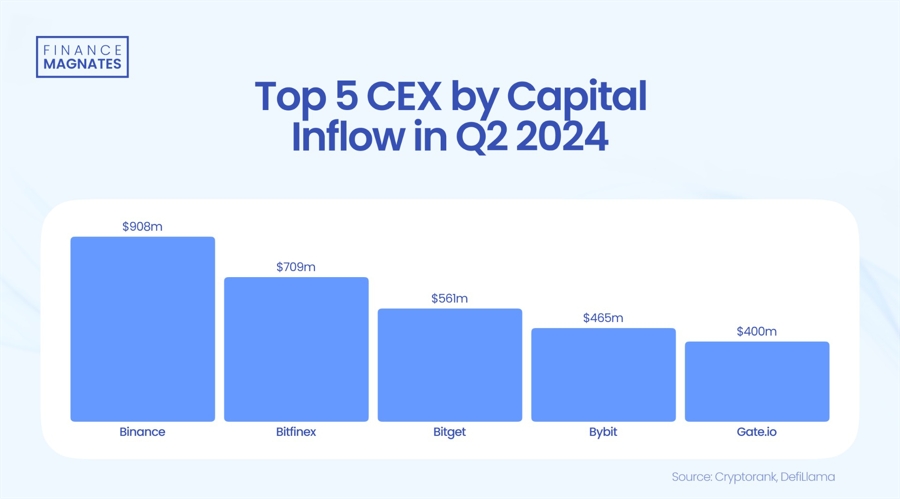

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos5 months ago

Videos5 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto