Fintech

Artificial Intelligence Becomes Key to Detecting Financial Statement Fraud in the Digital Age – Fintech Schweiz Digital Finance News

Free Newsletter

Get the latest Swiss Fintech news once a month in your inbox

The proliferation of technology in modern businesses has created new opportunities for financial statement fraud, but has also provided sophisticated tools to detect and prevent such fraud.

In particular, artificial intelligence (AI)-based approaches have the potential to be more efficient and accurate at identifying fraud, especially new patterns that traditional methods may miss, according to a recent paper by Karina Kasztelnik, PhD, and Eva K. Jermakowicz, PhD, CPA, of Tennessee State University in Nashville.

The article, published in June, explores the evolving landscape of financial statement fraud detection, highlighting the role of artificial intelligence in improving the accuracy and efficiency of identifying fraudulent activity compared to traditional methods.

Fraud in financial statements

Financial statement fraud involves the intentional creation of false or misleading information on financial statements. It is typically perpetrated by owners or managers to deceive stakeholders and is intended to present a false picture of a company’s financial health, often to inflate stock prices, meet financial goals, or secure favorable financing terms.

Although financial statement fraud is one of the least frequent types of fraud, its impact can be serious. Several real cases demonstrate this.

Wirecard, a German payment processing company, collapsed in June 2020 after it was revealed that €1.9 billion allegedly held in its accounts had disappeared, leading to its insolvency and the arrest of several executives on fraud and embezzlement charges. The company had inflated its revenues and profits to deceive investors and creditors.

Wells Fargo Employees created millions of unauthorized bank and credit card accounts between 2002 and 2016 to meet aggressive sales targets, without customers’ knowledge or consent. This led to widespread legal and regulatory repercussions, including a $3 billion settlement in 2020, significant fines, and a major overhaul of the bank’s management and practices.

Finally, Enron, once a successful energy company, collapsed in December 2001, after it was revealed that it had committed widespread accounting fraud to hide its financial losses and inflate its earnings. The scandal led to the company’s bankruptcy, the conviction of several top executives, and the implementation of new regulations to improve corporate accountability and financial transparency.

The challenge of detecting fraud in financial statements

Detecting financial statement fraud is a multifaceted challenge due to the complexity and adaptability of fraudulent schemes, the complexity and volume of financial data, inherent human limitations, and the ever-evolving nature of fraudulent activity.

First, financial statement fraud schemes are becoming increasingly sophisticated, making them difficult to detect. Fraudsters often have in-depth knowledge of their company’s operations and internal controls, allowing them to design complex schemes that are well hidden in normal financial reporting processes and difficult to detect.

Second, the volume and complexity of financial data further complicate fraud detection. Modern businesses generate huge amounts of financial data, and financial statements often include complex transactions, multiple subsidiaries, and various forms of accounting treatments, making it difficult to identify irregularities without advanced tools. This overwhelms traditional analysis methods.

Human limitations also play a significant role in the challenge of detecting fraud. Auditors have limited time and resources to conduct detailed examinations of every transaction and financial statement item. As a result, they may miss subtle signs of fraud, especially when dealing with large data sets or when the fraud involves collusion between multiple parties.

Finally, fraud techniques are constantly evolving. As detection methods improve, fraudsters develop new techniques to circumvent these measures, creating an ever-evolving challenge.

Artificial Intelligence-Based Approaches for Financial Statement Fraud Detection

According to the report, modern AI-based approaches are emerging as powerful technologies for more accurate and efficient fraud detection, in the context of ever-evolving fraud patterns and increasing amount and complexity of financial data.

Artificial intelligence encompasses a range of techniques, including machine learning (ML), natural language processing (NLP), robotic process automation (RPA), computer vision, and expert systems. These techniques enable machines to analyze large amounts of data, learn from experience, and make decisions based on changing patterns and rules.

Machine learning (ML), a subset of AI, involves developing algorithms to recognize patterns in data and make predictions or decisions based on those patterns; NLP, another subfield of AI, deals with the interaction between computers and human languages, focusing on unstructured data; and data mining involves using statistical techniques and ML to extract meaningful information from large data sets.

RPA involves the use of software robots to automate tasks performed by humans and improve efficiency, while finally, predictive analytics, a subset of data analytics, involves the use of statistical algorithms and machine learning to examine historical data and make predictions about future events or behaviors.

Advantages of Artificial Intelligence Techniques

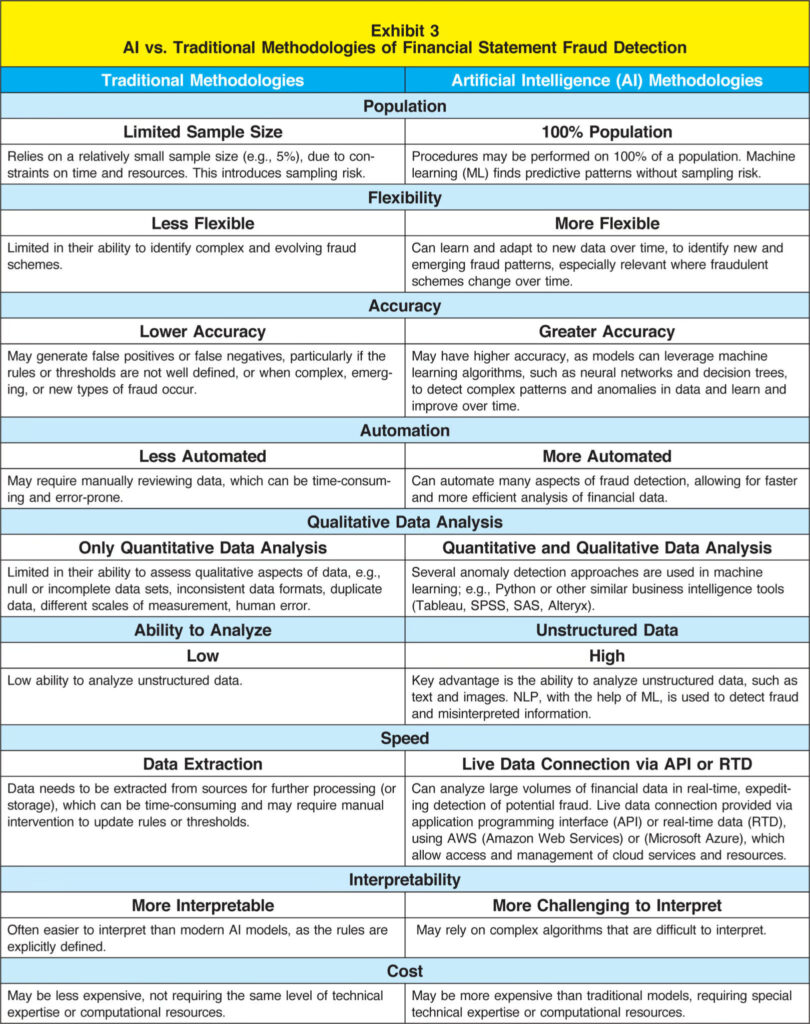

According to the report, artificial intelligence and data mining techniques offer significant advantages over traditional methods.

AI approaches use ML algorithms to learn from past examples of fraudulent and non-fraudulent financial data. These algorithms can automatically detect patterns and anomalies in data without relying on predefined rules and are better at detecting new and previously unknown fraud patterns, adapting to changes in the data and fraud landscape over time.

Additionally, AI can analyze large volumes of data faster and more accurately than humans can manually. This allows AI models to detect fraud faster and more efficiently, reducing an entity’s financial losses.

In comparison, traditional rule-based approaches rely on a set of predefined rubrics that are programmed to detect specific patterns or anomalies in financial data. These rules are typically based on expert knowledge and experience and require human intervention to update or modify the rules when new fraud patterns emerge.

Featured image credit: edited by free