Markets

Bitcoin traders pull in $3.5 billion as BTC price plummets 11%, what lies ahead?

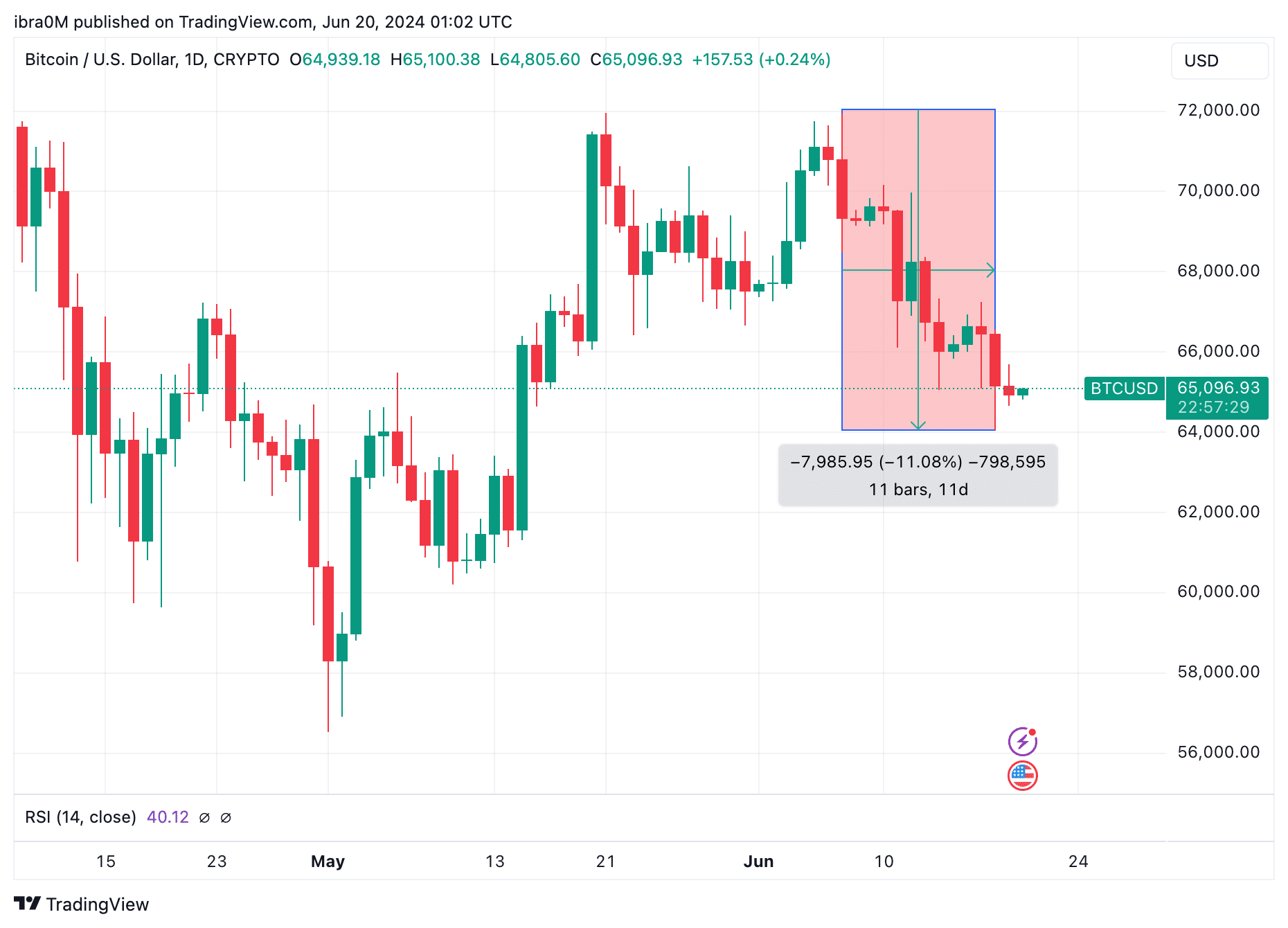

Bitcoin price fell below $64,050 on June 18, 2024 as bears force BTC’s month-long downtrend to 35-day low, but current dynamics in derivatives markets signal bullish resilience among traders.

Bitcoin price drops to 35-day low

After a promising start to the month, the price of Bitcoin retested the $71,900 mark on June 6. But since the release of overheated labor market data by US authorities on June 7, which signaled relentless inflation, BTC has succumbed to downward pressure.

On June 18, Bitcoin’s downtrend reached a record level not seen in more than 30 days since May 15, triggering massive liquidations in the rest of the world. crypto markets.

Looking at the TradingView chart above, Bitcoin’s pullback to $64,047 brings its monthly losses to 11%. But over the past 48 hours, bull traders have made frantic buying to cover the downtrend.

Consequently, at the time of writing on June 19, Bitcoin price managed to stage an instant recovery above the $65,000 mark.

Bull Traders Showing Resilience Despite Market FUD

Interestingly, BTC’s recovery phase was subdued by retail traders exiting the market to imitate stock markets when the S&P 500 reached a new all-time high on June 19.

However, a rare market data trend observed in derivatives markets signals hopes of a more pronounced rally in the coming days.

The Coinglass open interest chart shows the total dollar value of all active derivative BTC futures contracts listed on recognized companies. exchanges and trading platforms.

When compared to prevailing price trends, the open interest chart provides important information about the dominant sentiment of speculative traders regarding the assets’ short-term prospects.

As seen above, Bitcoin open interest was at $37.65 billion on June 6, just before the price drop began. But although the price of BTC has retreated 11% since then, open interest has only reduced by $3.51 billion, reflecting a 9% decline as it fell to $34.14 billion at the time This article was written on June 19th.

This means that the price of Bitcoin has fallen 2% faster than the open interest in the last 14 trading days.

When an asset’s price falls faster than open interest during a market crash, it suggests that traders are reluctant to close their positions.

This could indicate that there is still significant interest and engagement in the market despite the price drop, potentially highlighting the strong conviction among Bitcoin traders that the current price drop is temporary and they are holding their positions in anticipation of a recovery. .

If this scenario comes to fruition, the price of Bitcoin could be set for a major breakout towards $70,000 when market sentiment turns bullish again.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-