Fintech

Cross-border payments in Asia are at the forefront of innovation

As Asia continues its rapid rise to become the world’s economic powerhouse, the region’s fintech startups and financial institutions are revolutionizing cross-border payments

The cross-border B2B payments space is worth an astonishing $150 trillion, which offers immense opportunities for innovation.

However, challenges related to high costs, lack of transparency, limited liquidity and slow transactions persist.

In response, payments pioneers in Asia Pacific are leading the effort to build a faster, cheaper and more transparent cross-border payments ecosystem.

The frontier of B2B cross-border payments

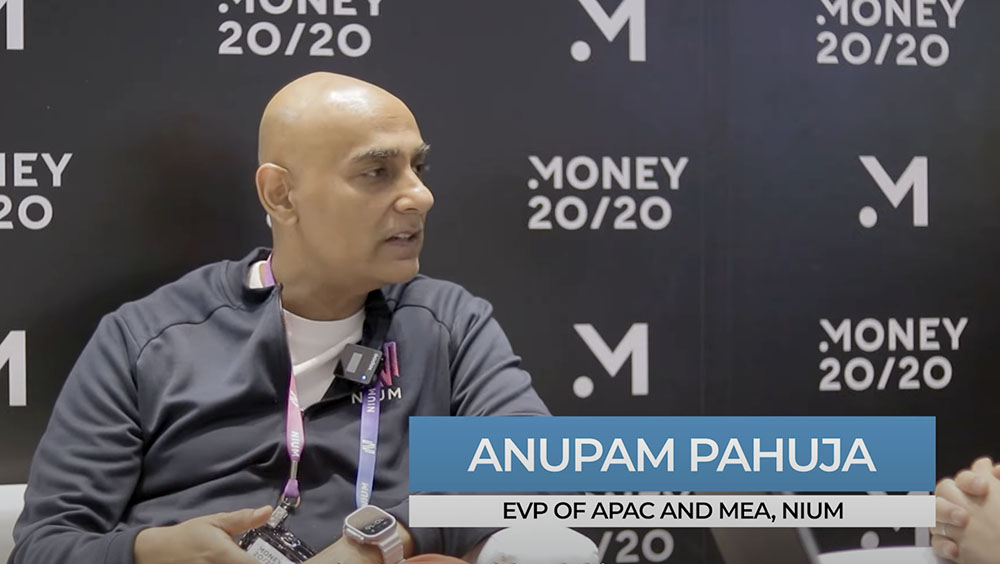

Anupam Pahuja, EVP, APAC & MEA, Nium comments on the state of cross-border payments in Asia

The B2B cross-border payments space represents a vast opportunity, dwarfing the B2C space at $100 trillion compared to $2.8 trillion. Yet inefficiencies abound.

Anupam Pahuja, Executive Vice President of APAC and MEA at Nohighlighted,

“It takes four to five days for a payment to go from one case to another. The cost is just crazy and there is no transparency. You don’t know where your payment is going to be.”

Nium, a Singapore-based fintech unicorn, has emerged as a powerhouse. Starting with consumer remittances in 2014, Nium has focused on B2B payments.

“We realize that there is a much larger space that we need to address on the B2B front than B2C fraud and within that space we are the Intel inside. We are not the computer. We are not outer space. We are not UI/UX. We are the infrastructure player that makes these payments,”

Anupam explained.

“Our revenue opportunity was $80 million years ago, reached $120 million last year, and this year we hit our goal of $170 million. Our travel business is booming in Asia Pacific, growing 100%, in part due to our status as one of the largest virtual credit card issuers globally,”

He added.

“We issue 40 million cards a year, and partnerships with companies like Tredd allow us to operate faster, better and more conveniently”

He said.

Empower consumers through targeted spending

Mitherpal Sidhu, COO of BigPay, comments on how targeted spending is driving cross-border payments

In the consumer space, fintech like BigPay innovates to “improve people’s lives one transaction at a time.”

Serving 1.4 million card consumers in Singapore and Malaysia, BigPay offers personal loans, microinsurance, card payments and cross-border payments.

“We found that foreign domestic workers, I mean, the myth is that they send small amounts monthly. They actually send about 80% of their salary. They send it in small pieces. This is because they don’t know what the other party will do with their funds.

said Mitherpal Sidhu, Chief Operating Officer at BigPay, revealing this key insight.

“BigPay is building targeted spending capabilities to solve this problem, allowing you to allocate funds to specific uses like education or medical expenses. ‘This feature is what we are building. And strategy comes into play,’”

– added Mitherpal.

Building highways for seamless cross-border payments in Asia

Farhan Ahmad, PayNet Group CEO, comments on how Project Nexus will reshape cross-border payments in Asia

Companies like Nium and BigPay aren’t the only ones pushing the innovation needle. Institutions also play a key role in enabling a faster, better and cheaper cross-border payment experience.

One example is PayNet, Malaysia’s national payment infrastructure, which has made many strides in cross-border payments.

Farhan Ahmad, CEO of the group Payment Network Malaysia (Paynet), he imagined “a world in which trade, commerce and travel are so fluid that for him the possibilities are endless.

“And I think this is a vision that will fuel the future of the planet,”

He said.

PayNet is collaborating Nesso Projecta multilateral, non-cloud solution for cross-border remittances.

Farhan elaborated,

“Nexus aims to be a pilot case for building a cross-border, non-cloud multilateral solution, primarily for remittances, P2P. We are working with Bank Negara Malaysia, supporting them in this mission to create this functionality to make remittances seamless. For example, I can send money to someone in any other country using a phone number. This brings enormous benefits to end users.”

By building the necessary infrastructure, PayNet and its partners ensure that Malaysians and others can use their existing payment devices across borders.

This effort is part of a larger global vision to create a transparent and seamless payments ecosystem, improving the ease of trade, exchange and travel.

Enabling payments pioneers

Cecilia Tan, Regional Vice President at Thredd, comments on how payment service providers play an important role in the entire cross-border payments ecosystem.

Behind-the-scenes players, like Thredd, play an equally important role. With their experience, they realize the magic of payments.

They have helped ambitious innovators like BigPay and Nium become digital payments pioneers.

Cecilia Tan, Regional Vice President of Sales (APAC) for Business Development at Threddshared,

“In the past we have actually helped several fintech unicorns like Revolution to Nium expand from one market to multiple markets. I think Thredd, as an issuer processor, is well positioned to help fintechs drive cost efficiencies and improve the payments experience.”

With over a decade of experience, Thredd helps Asian fintechs overcome payments complexities with its proven technical infrastructure, including APIs, transaction tools and tokenization.

“We have been in the industry for more than ten years. We are considered market leaders in our home market, the EU and the UK, and are able to leverage such rich experience and understanding of the complexity of payments to bring them to Asia Pacific,”

– Cecilia underlined.

The race to innovate cross-border payments in Asia

The race to innovate cross-border payments in Asia Pacific is heating up, with the ecosystem working together to build a more efficient, transparent and accessible payments future.

The impact of these innovations on Asia Pacific growth cannot be overstated, as the value of cross-border payments is expected to reach $250 trillion by 2027.

With cross-border payments still riddled with inefficiencies, the demand for innovation in this space is intensifying. From traditional to DLT-based payment systems, we expect to see rapid changes over the next decade.

These advances hinge on the future of trade, commerce and travel, promising a world where cross-border transactions are seamless, transparent and instantaneous.

Clock “$80 billion in cross-border payments in Asia Pacific” to see how innovation is transforming the region’s financial landscape.

Featured image credit: Edited by Youtube

Get the hottest Fintech Singapore news delivered to your inbox once a month