News

Distretto meridionale di New York | Fondatori e CEO del servizio di mixaggio di criptovalute arrestati e accusati di riciclaggio di denaro e reati di trasmissione di denaro senza licenza

Damian Williams, procuratore degli Stati Uniti per il distretto meridionale di New York; Thomas Fattorusso, l’agente speciale responsabile dell’ufficio locale di New York dell’Internal Revenue Service, Criminal Investigation (“IRS-CI”); e James Smith, vicedirettore responsabile dell’ufficio locale di New York del Federal Bureau of Investigation (“FBI”), hanno annunciato oggi l’apertura di un atto d’accusa contro KEONNE RODRIGUEZ, amministratore delegato e co-fondatore di Samourai Wallet (“Samourai”) e WILLIAM LONERGAN HILL, Chief Technology Officer e anche co-fondatore di Samourai, con associazione a delinquere per commettere riciclaggio di denaro e associazione a delinquere finalizzata alla gestione di un’attività di trasferimento di denaro senza licenza. Queste accuse derivano dallo sviluppo, dal marketing e dal funzionamento da parte degli imputati di un mixer di criptovaluta che ha eseguito transazioni illegali per oltre 2 miliardi di dollari e facilitato più di 100 milioni di dollari in transazioni di riciclaggio di denaro da mercati illegali del dark web, come Silk Road e Hydra Market; un’intrusione nel server web; uno schema di spearphishing; e schemi per frodare molteplici protocolli finanziari decentralizzati. RODRIGUEZ è stato arrestato questa mattina e dovrebbe essere presentato oggi o domani davanti a un giudice statunitense nel distretto occidentale della Pennsylvania. HILL è stato arrestato questa mattina in Portogallo sulla base delle accuse penali statunitensi. Gli Stati Uniti chiederanno l’estradizione di HILL per essere processato negli Stati Uniti. Il caso è assegnato al giudice distrettuale americano Richard M. Berman.

In coordinamento con le autorità di contrasto islandesi, i server web e il dominio di Samourai (https://samourai.io/) sono stati sequestrati. Inoltre, sul Google Play Store è stato notificato un mandato di sequestro per l’applicazione mobile di Samourai. Di conseguenza, l’applicazione non sarà più disponibile per il download dal Google Play Store negli Stati Uniti.

Il procuratore degli Stati Uniti Damian Williams ha dichiarato: “Come affermato, Keonne Rodriguez e William Lonergan Hill sono responsabili dello sviluppo, del marketing e della gestione di Samourai, un servizio di mixaggio di criptovalute che ha eseguito transazioni illegali per oltre 2 miliardi di dollari e che è servito da rifugio per i criminali per impegnarsi in grandi operazioni. riciclaggio di denaro su larga scala. Rodriguez e Hill avrebbero consapevolmente facilitato il riciclaggio di oltre 100 milioni di dollari di proventi criminali provenienti da Silk Road, Hydra Market e da una serie di altre campagne di pirateria informatica e frode. Insieme ai nostri partner delle forze dell’ordine, continueremo a perseguire e smantellare incessantemente le organizzazioni criminali che utilizzano la criptovaluta per nascondere comportamenti illeciti”.

L’agente speciale responsabile dell’IRS-CI, Thomas Fattorusso, ha dichiarato: “2 miliardi di dollari in transazioni con un trasmettitore di denaro senza licenza significano che 2 miliardi di dollari sono fluiti senza alcuna supervisione, da chiunque e ovunque. A causa del disprezzo della società per la regolamentazione, si presume che Samourai Wallet abbia riciclato più di 100 milioni di dollari di proventi criminali. Gli agenti speciali delle unità informatiche di IRS:CI New York e IRS:CI LA hanno collaborato con i nostri partner delle forze dell’ordine federali e internazionali non solo per arrestare i fondatori e l’amministratore delegato, ma anche per impossessarsi dei loro domini. Samourai Wallet è ora chiuso per affari.”

James Smith, vicedirettore responsabile dell’FBI, ha dichiarato: “Gli autori delle minacce utilizzano la tecnologia per eludere il rilevamento delle forze dell’ordine e creare ambienti favorevoli all’attività criminale. Per quasi 10 anni, Keonne Rodriguez e William Hill avrebbero gestito una piattaforma mobile di mixaggio di criptovalute che forniva ad altri criminali un rifugio virtuale per lo scambio clandestino di fondi illeciti, la facilitazione di oltre 2 miliardi di dollari in transazioni illegali e 100 milioni di dollari in denaro del dark web. riciclaggio. L’FBI è impegnata a smascherare schemi finanziari segreti e a garantire che nessuno possa nascondersi dietro uno schermo per perpetuare illeciti finanziari”.

Secondo le accuse contenute nell’atto d’accusa svelato oggi presso la Corte federale di Manhattan:[1]

Sfondo su Samourai

Dal 2015 circa fino al febbraio 2024, RODRIGUEZ e HILL hanno sviluppato, commercializzato e gestito un servizio di mixaggio di criptovalute noto come Samourai, un’attività di trasmissione di denaro senza licenza da cui hanno guadagnato milioni di dollari in commissioni. Samourai ha combinato illegalmente molteplici funzionalità uniche per eseguire transazioni finanziarie anonime per un valore di oltre 2 miliardi di dollari per i suoi clienti. Pur offrendo Samourai come servizio di “privacy”, gli imputati sapevano che era un rifugio per i criminali coinvolti nel riciclaggio di denaro su larga scala e nell’evasione delle sanzioni. In effetti, come gli imputati intendevano e ben sapevano, una parte sostanziale dei fondi processati da Samourai erano proventi criminali passati attraverso Samourai a scopo di occultamento. Durante il periodo in questione, Samourai ha riciclato oltre 100 milioni di dollari di proventi di reato provenienti, tra le altre fonti criminali, dai mercati illegali del dark web, come Silk Road e Hydra Market; vari schemi di frode telematica e frode informatica, tra cui un’intrusione di server web, uno schema di spearphishing e schemi per frodare più protocolli finanziari decentralizzati; e altre attività illegali.

RODRIGUEZ e HILL hanno iniziato a sviluppare Samourai intorno al 2015. Samourai è un’applicazione mobile che gli utenti possono scaricare sui propri cellulari e l’applicazione è stata scaricata oltre 100.000 volte. Dopo che gli utenti hanno scaricato Samourai, possono memorizzare le proprie chiavi private per qualsiasi indirizzo BTC che controllano all’interno del programma Samourai. Queste chiavi private non sono condivise con i dipendenti Samourai, ma Samourai gestisce un server centralizzato che, tra le altre cose, supervisiona e facilita le transazioni tra gli utenti Samourai e crea nuovi indirizzi BTC utilizzati durante le transazioni. Samourai è utilizzato da clienti in tutto il mondo, compresi i clienti situati negli Stati Uniti e nel distretto meridionale di New York.

RODRIGUEZ e HILL hanno progettato Samourai per offrire almeno due funzionalità intese ad aiutare le persone coinvolte in una condotta criminale a nascondere la fonte dei proventi delle loro attività criminali. Innanzitutto, Samourai offre un servizio di mixaggio di criptovalute noto come “Whirlpool”, che coordina lotti di scambi di criptovaluta tra gruppi di utenti Samourai per impedire il tracciamento di proventi criminali da parte delle forze dell’ordine sulla Blockchain. In secondo luogo, Samourai offre un servizio chiamato “Ricochet”, che consente a un utente Samourai di creare transazioni intermedie aggiuntive e non necessarie (note come “hop”) quando invia criptovaluta da un indirizzo a un altro. Allo stesso modo, questa funzionalità potrebbe impedire alle forze dell’ordine e/o agli scambi di criptovaluta di riconoscere che un particolare lotto di criptovaluta proviene da attività criminali. Dall’inizio del servizio Whirlpool intorno al 2019, e del servizio Ricochet intorno al 2017, oltre 80.000 BTC (per un valore di oltre 2 miliardi di dollari applicando i tassi di conversione BTC-USD al momento di ciascuna transazione) sono passati attraverso questi due servizi gestito da Samourai. Samourai riscuote una commissione per entrambi i servizi, stimata in circa 3,4 milioni di dollari per le transazioni Whirlpool e 1,1 milioni di dollari per le transazioni Ricochet nello stesso periodo di tempo.

Conoscenza e intenzione di RODRIGUEZ e HILL di riciclare i proventi criminali da parte di Samourai

RODRIGUEZ e HILL gestivano account Twitter che incoraggiavano e invitavano apertamente gli utenti a riciclare i proventi criminali attraverso Samourai. Ad esempio, intorno a giugno 2022, l’account Twitter di Samourai, gestito da RODRIGUEZ, ha pubblicato il seguente messaggio riguardante gli oligarchi russi che cercavano di eludere le sanzioni:

Allo stesso modo, in un messaggio privato intorno al 27 agosto 2020, HILL, utilizzando un account Twitter con il nome utente “Samourai Dev”, ha discusso l’uso di Samourai da parte di criminali che operano nei mercati neri online come Silk Road in messaggi privati con un altro Twitter. utente (l'”Utente Twitter”) (enfasi aggiunta):

Utente Twitter: Silk Road è il motivo per cui ho trovato Bitcoin per la prima volta e il desiderio di continuare a impegnarsi in questi tipi di mercati è uno dei motivi per cui voglio difendere/rafforzare questi casi d’uso. . .

Samourai Dev: No, per niente. Probabilmente abbiamo opinioni diverse su alcuni principi fondamentali del bitcoin, tu ed io, quindi a ciascuno il suo, per così dire. A Samourai siamo interamente concentrati sulla resistenza alla censura e sull’economia circolare nera/grigia. Ciò non implica un’adozione di massa prevedibile, sebbene i mercati neri/grigi abbiano già iniziato ad espandersi durante il covid e continueranno a farlo anche dopo il covid.. . . .

Inoltre, in risposta all’Europol che ha evidenziato Samourai come una “principale minaccia” alla capacità delle forze dell’ordine di tracciare i proventi di attività criminali, HILL ha pubblicato un messaggio intorno a marzo 2021 suggerendo che Samourai non avrebbe cambiato le sue pratiche in risposta alle accuse secondo cui Samourai veniva utilizzato per il riciclaggio di denaro:

Allo stesso modo, RODRIGUEZ e HILL possedevano e trasmettevano a potenziali investitori materiali di marketing che discutevano di come la base di clienti di Samourai fosse destinata a includere criminali che cercavano la privacy o la sovversione delle garanzie e dei requisiti di segnalazione da parte delle istituzioni finanziarie. Ad esempio, nei materiali di marketing di Samourai, RODRIGUEZ e HILL riconoscono allo stesso modo che le persone che hanno maggiori probabilità di utilizzare un servizio come Samourai includono individui coinvolti in attività criminali, inclusi i “mercati limitati”.

Nell’estratto seguente del materiale di marketing di Samourai, RODRIGUEZ e HILL riconoscono che i suoi ricavi deriveranno dai “partecipanti al mercato oscuro/grigio” che cercano di “scambiare i loro bitcoin con più parti” per evitare di essere scoperti:

Nei materiali di marketing di Samourai, RODRIGUEZ e HILL hanno promosso il Portafoglio di Samourai e il suo “Servizio di Mixing” come un “Servizio di Privacy Premium” per transazioni che coinvolgono i proventi di beni e servizi che includono, tra le altre cose, “Attività illecite”.

* * *

RODRIGUEZ, 35 anni, di Harmony, Pennsylvania, e HILL, 65 anni, cittadino americano arrestato in Portogallo, sono accusati ciascuno di un’accusa di associazione a delinquere finalizzata al riciclaggio di denaro, che comporta una pena massima di 20 anni di prigione, e di un’accusa di associazione a delinquere finalizzata al riciclaggio di denaro. di associazione a delinquere finalizzata alla gestione di un’attività di trasferimento di denaro senza licenza, che comporta una pena massima di cinque anni di reclusione.

Le pene massime potenziali sono prescritte dal Congresso e sono fornite qui solo a scopo informativo, poiché qualsiasi condanna degli imputati sarà determinata dal giudice.

Il signor Williams ha elogiato il lavoro investigativo dell’IRS-CI e dell’FBI. Ha anche riconosciuto l’assistenza dell’Ufficio per gli affari internazionali del Dipartimento di Giustizia. Il signor Williams ha inoltre ringraziato l’Europol, la polizia giudiziaria portoghese, la polizia islandese, l’ufficio locale dell’FBI a Pittsburgh, la divisione delle operazioni internazionali dell’FBI e l’ufficio locale dell’IRS-CI a Los Angeles per la loro assistenza nelle indagini su questo caso.

Il caso è gestito dall’Unità Frodi complesse e criminalità informatica e dall’Unità Finanze illecite e riciclaggio di denaro dell’Ufficio. Gli assistenti procuratori statunitensi Andrew K. Chan e David R. Felton sono responsabili dell’accusa.

Le accuse contenute nell’accusa sono semplici accuse e gli imputati sono presunti innocenti a meno che e fino a prova contraria.

[1] Come indica la frase introduttiva, l’intero testo dell’accusa e la descrizione dell’accusa qui contenuta costituiscono solo accuse, e ogni fatto descritto dovrebbe essere trattato come un’accusa.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

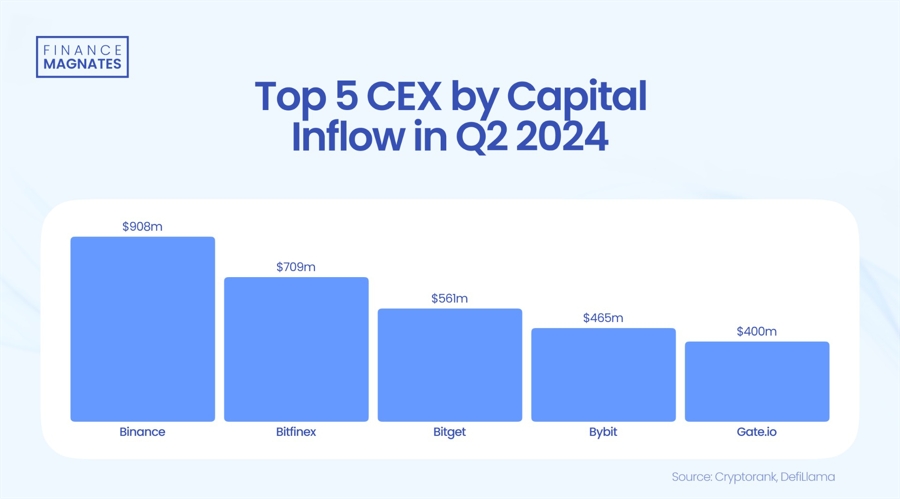

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos5 months ago

Videos5 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto