Markets

Ethereum Price at Risk as ETH 2.0 Withdrawals Rise 4,000%

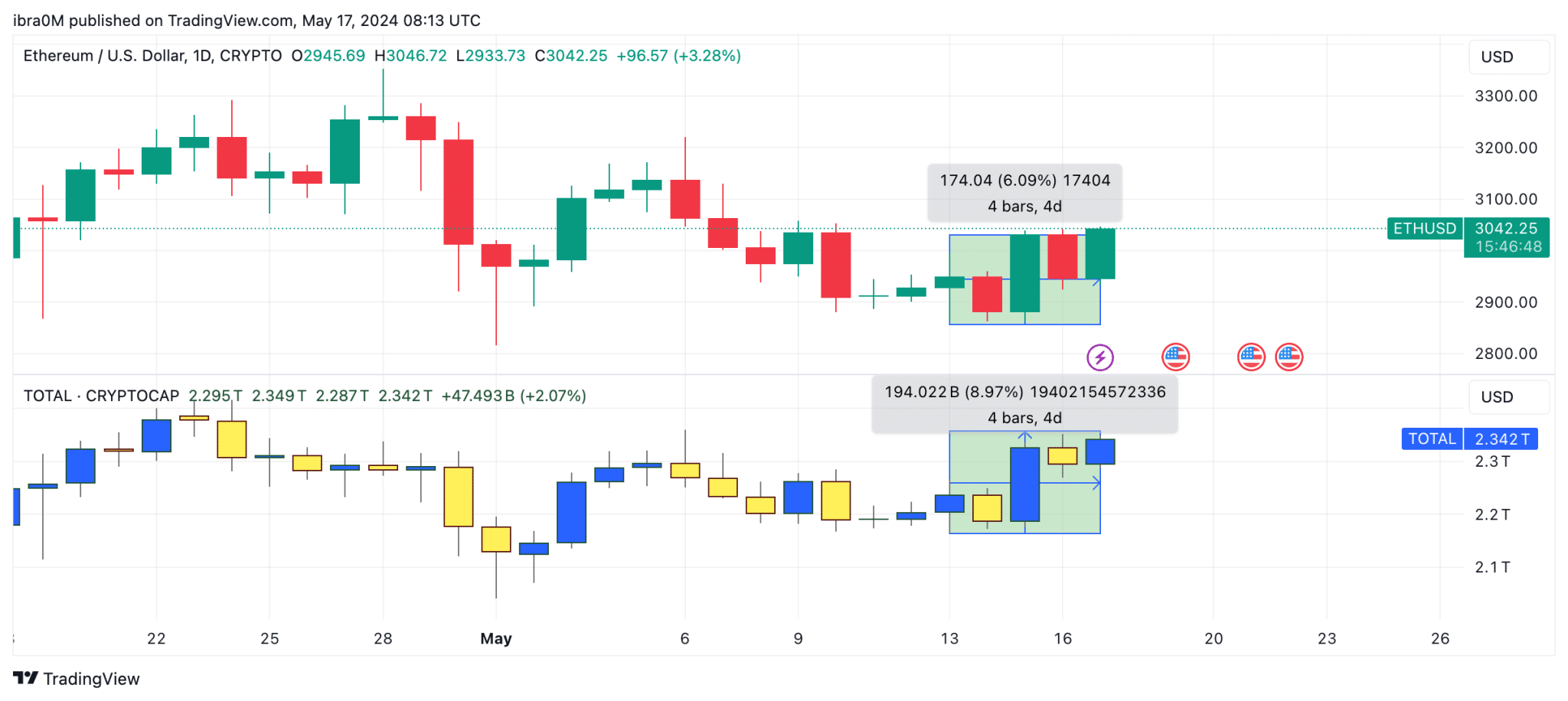

Ethereum price rose above $3,040 on May 17, up 6% from the 14-day low of $2,862 recorded on May 14, but spikes in ETH 2.0 staking withdrawals threaten to stall the phase recovery.

Ethereum Price Rise Lagging Behind Crypto Market Average

ETH failed to get its fair share of capital inflows as bullish momentum returned to crypto markets this week.

The latest CPI data release from the US Bureau of Labor Statistics on May 14 and the resurgence of the GameStop rally have emerged as key catalysts spurring bullish activity in crypto markets this week.

Led by mega-capitalized assets like Bitcoin (+9%), SUN (+22%) and PEPE (+70%), total crypto market capitalization has increased by $194 billion since the start of the week on May 13.

At the time of writing on May 17th, the price of Ethereum is currently hovering around the $3,042 territory, a 6% increase from May 13th. Compared to trends seen in rival mega-cap Tier 1 assets like Bitcoin and Solana, Ethereum’s price has underperformed. considerably.

ETH 2.0 withdrawal queue increases 4,000% in 5 days

Ethereum’s sluggish performance is well illustrated in the TradingView chart above. However, on-chain staking data from the ETH 2.0 beacon chain reveals even more worrying signs that could trigger intense volatility in Ethereum price action in the coming days.

The Validator Queue chart below provides real-time insights into the number of investors looking to join the ETH 2.0 staking pool versus those looking to withdraw their funds.

– Announcement –

At the start of the week, only 93 stakers moved to withdraw their staked ETH from the beacon chain on May 14. But that number has now skyrocketed to 3,868 addresses at the time of writing on May 17th.

This implies that the number of ETH node validators queuing to make withdrawals has increased by 4,000% in the last 3 days, raising concerns about imminent downward pressure. Meanwhile, last week, the ETH 2.0 deposit queue plummeted 97%, from 1,842 to 61 incoming addresses.

The combination of increased withdrawals and decreased deposits creates a double catalyst of downward pressure on the price of Ethereum, partly explaining why the price of ETH has failed to follow the broader market uptrend this week.

On the one hand, the rapid increase in withdrawals increases the circulating supply of ETH, potentially flooding the market. On the other hand, the sharp drop in new deposits signals a decline in long-term confidence among investors.

These critical factors could combine to exacerbate downtrends, leading to greater market volatility and sustained downward pressure on Ethereum prices.

ETH Price Prediction: Another Reversal Below $2,900?

The price of Ethereum is currently around the $3,040 mark at the time of publishing on May 17. However, as traders begin to react to the 4,000% increase in ETH 2.0 staking withdrawals, the price of Ethereum will likely fall below $2,900 in the near term.

The Bollinger band technical indicator also supports this bearish ETH price prediction.

As seen below, the upper boundary of the Bollinger Band indicator shows that ETH price is still some distance away from reclaiming the critical resistance level at $3,200, which would put bulls in control of the market dynamics.

However, if ETH price falls below short-term support at the 20-day SMA price level at $3,023, it could open the doors for a quick bearish reversal towards $2,825.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-