Fintech

Fintech thrives post-COVID-19 with customer growth above 50% – Fintech Switzerland Digital Finance News

Of Fintechnews Switzerland

May 13, 2024

Post-COVID-19, the global fintech sector has maintained its growth trajectory, driven by both growing consumer interest in fintech offerings and improved accessibility to digital financial services.

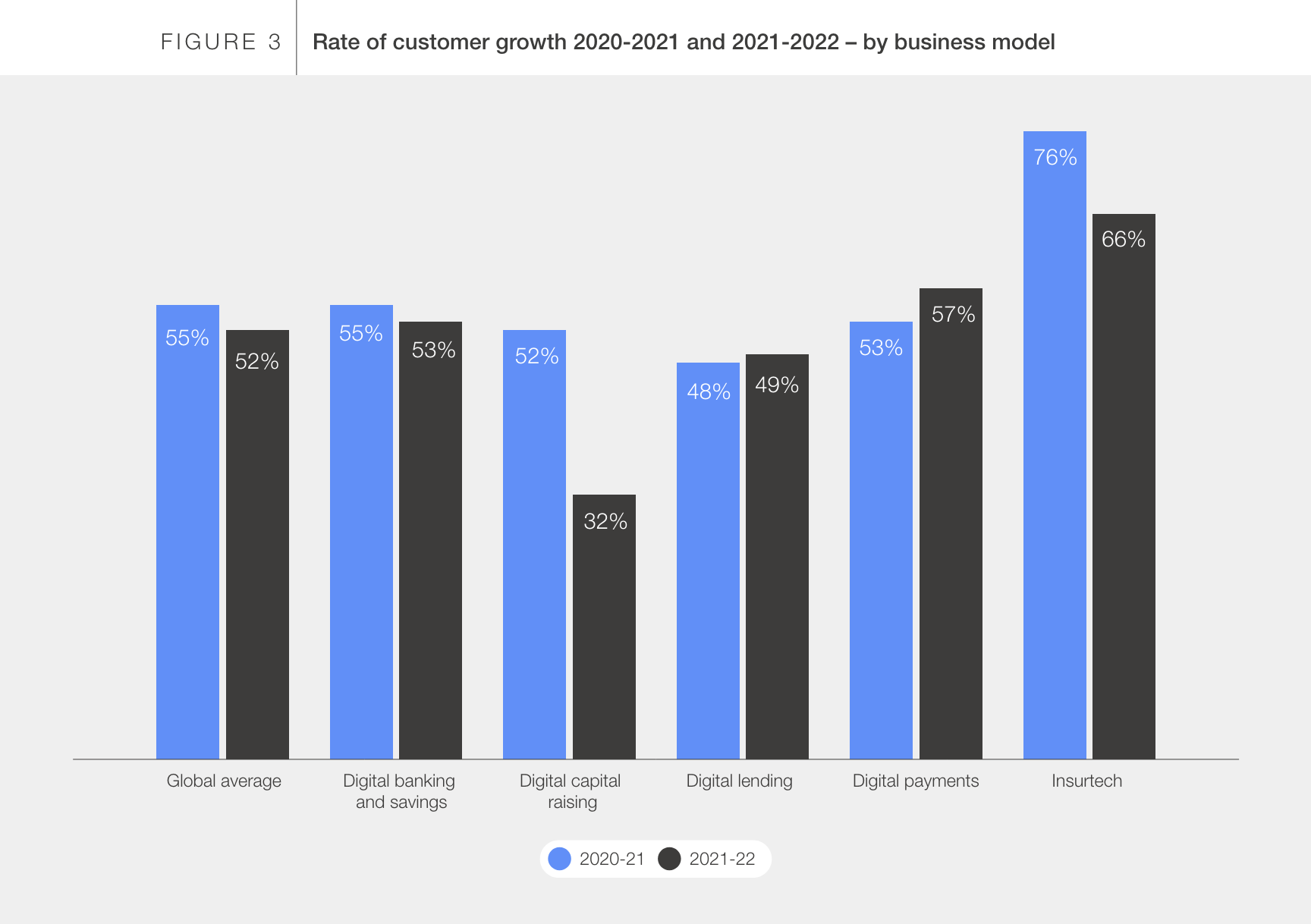

The results of a study conducted by the Cambridge Center for Alternative Finance (CCAF) and the World Economic Forum (WEF) revealed that the fintech sector has seen strong customer take-up since the pandemic, achieving a higher average annual growth rate to 50% in most major sectors, from 2020 to 2022.

The survey, which questioned Over 200 fintech companies across five verticals and six retail-facing regions found that fintech companies continued to expand post-COVID-19. With the exception of digital capital raising, which saw a significant decline related to a challenging environment and rising interest rates, all verticals have seen robust year-over-year (YoY) customer growth rates since 2020.

Notably, insurtech saw notable growth, particularly between 2020 and 2021 (-76%), but saw a slight decline between 2021 and 2022 (-66%). This decline is largely attributed to the disproportionate impact of COVID-19 on insurtech in emerging markets and developing economies (EMDEs), where higher value claims, a higher number of claims and a greater number of insurance policy expiries. Digital payments have also shown continued growth, increasing slightly between 2021 and 2022 from 53% to 57% and reflecting continued growth catalyzed during the COVID-19 pandemic.

Customer growth rate 2020-21 and 2021-22 – by business model, Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth, Cambridge Center for Alternative Finance and the World Economic Forum, January 2024

Strong customer growth was observed in various regions, except Sub-Saharan Africa (SSA), where rates were comparatively lower at 42% between 2020 and 2021 and then at 36% between 2021 and 2022, likely due to infrastructure challenges exacerbated during the pandemic. The North America, Middle East and North Africa (MENA) regions have emerged as leaders in customer growth, driven by increasing digitalisation and structured regulations around digital payment methods, banking and credit.

The study findings also reveal that consumer demand (51%) was the primary driver of growth, a consistent trend across all regions.

Customer growth rate 2020-21 and 2021-22 – by region, Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth, Cambridge Center for Alternative Finance and the World Economic Forum, January 2024

The challenges faced by fintech companies

Despite positive growth trends, fintech companies are also facing challenges. Macroeconomic factors, an unfavorable regulatory environment and an inadequate financing environment were identified as the main factors hindering growth, noted by 56%, 47% and 40% of respondents respectively, in the context of global inflation and interest rates all over the world.

Interestingly, while the challenges are diverse, regulatory concerns have consistently been ranked among the top three factors impacting fintech growth, reinforcing how critical regulation is to fintech growth.

Factors that support or hinder fintechs’ ability to grow, Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth, Cambridge Center for Alternative Finance and the World Economic Forum, January 2024

Regionally, fintech companies have faced different challenges, suggesting regional variations. European (52%) and North American (45%) fintech companies cited a highly competitive market as the main challenge for expanding their services to additional or new client sectors, while those in the MENA region highlighted high compliance requirements (52%) ). In Asia-Pacific (APAC), fintech companies identified consumer education as the most prevalent challenge (59%), followed by a highly competitive market (45%) and high compliance requirements (36%).

Most challenging factors in expanding services to additional or new customer segments: key drivers by region, Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth, Cambridge Center for Alternative Finance and the World Economic Forum, January 2024

Promote financial inclusion

The study findings also highlight the role of fintech in promoting financial inclusion. Globally, female, low-income, and rural or remote customers made up a substantial portion of the fintech customer base, averaging 39%, 40%, and 27%, contributing 39%, 26%, and 31% of the total, respectively. total value of transactions. This trend has been consistent across advanced economies (EAs) and EMDEs, with small disparities.

Regionally, fintech firms in SSA and MENA had the highest percentages of low-income and rural or remote customers, with 47% and 46% representation for low-income customers, as well as 34% and 32% for rural or remote customers. segments, respectively.

MENA countries have also been the first to challenge gender biases, with women making up 45% of fintech companies’ total customer base, followed closely by APAC and North America at 42% and 41% respectively . Women from MENA also contributed nine percentage points more to transaction values than the representation of their customer base and accounted for 54% of overall transaction values. In contrast, European fintech companies reported the lowest percentage of female transactions, at 28%.

AI, digital economy and integrated finance as the main trends in the sector

Looking to the future, fintech companies have identified artificial intelligence (AI) as the most relevant topic for the development of the sector in the next five years. Almost all verticals have recognized the importance of AI in bringing about changes in business models, customer engagement and regulatory frameworks.

Integrated finance, the digital economy and open banking are all almost tied as the second most relevant factors (53-54%). Companies surveyed said they expect the use of digital platforms to continue to grow, which will ultimately drive the digital economy and, in turn, the rise of integrated financial products. Ultimately, open banking and open finance are expected to play a critical role in enabling data sharing at scale with customer consent, fueling further innovations in business models and new products.

The most relevant, relevant and least important topics for the development of the fintech sector in the next five years, according to fintech companies, Source: The Future of Global Fintech: Towards Resilient and Inclusive Growth, Cambridge Center for Alternative Finance and the World Economic Forum, January 2024

Featured image credit: Edited by freepik

Receive the most interesting news from Fintech Switzerland once a month in your inbox