Fintech

Global Cross-Border Payments to Grow 53% by 2030, Fueled by Digital Innovations – Fintech Schweiz Digital Finance News

Free newsletter

Get the most interesting news from Fintech Switzerland once a month in your inbox

Cross-border payment flows are expected to increase 53% between 2023 and 2030, from $190 trillion to $290 trillion. This growth will be driven by the rise of innovative payment technologies and trends, including real-time payments (RTP), blockchain and embedded finance, which are poised to make transactions faster, easier and more transparent, according to a new report by Convera, an American business-to-business (B2B) cross-border payments company, states.

The report, titled “Fintech 2025+: Trends, Technology and Transformation in Global Trade,” provides an overview of the cross-border payments landscape, shares industry projections and explores emerging trends.

According to the report, cross-border payments are expected to witness strong growth over the next seven years, fueled by digitization efforts of industry stakeholders and technological advancements.

RTP systems are highlighted as a key growth driver, praised for their ability to improve liquidity and financial stability by unlocking working capital and reducing transaction times. Around the world, RTPs have proliferated in recent years, driven by government support.

They have contributed to their growth by establishing and enforcing regulatory frameworks that create a standardized and secure environment for RTP systems. These regulations address data privacy, fraud prevention, and consumer protection, ensuring that the RTP ecosystem is safe and reliable.

In addition to regulatory support, governments have also invested in and supported the development of national RTP infrastructure. Examples include India’s Unified Payments Interface (UPI) and Brazil’s PIX, both direct results of government initiatives to modernize payment systems.

Governments are now working on integrating RTPs with cross-border payments. In Europe, Sweden participated the Eurosystem’s TARGET Instant Payment Settlement (TIPS) in February 2024, becoming the first non-euro area country to join the instant cross-border payment scheme with its national currency, the Swedish krona. Meanwhile, the European Payments Council Instant One-Leg Out Credit Transfer scheme, which left live last year, aims to streamline international transactions within and outside Europe.

In Southeast Asia, Vietnam, Indonesia, Malaysia, Thailand, the Philippines and Singapore they joined hands to connect their RTP systems, emphasizing the use of QR code for retail. This collaboration aims to strengthen trade and resilience across the region.

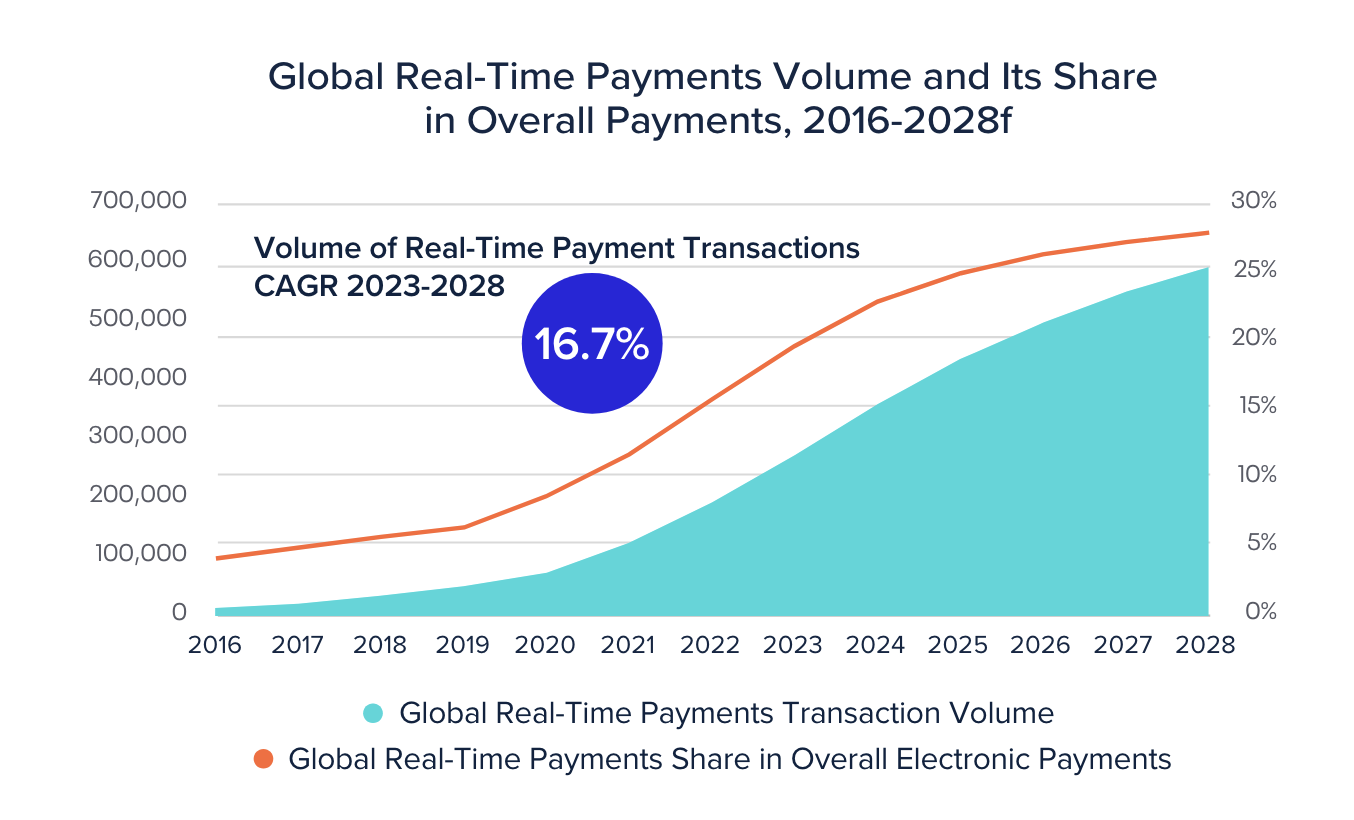

In 2023, RTPs continued to rise to new all-time highs, totaling 266.2 billion transactions and recording year-on-year (YoY) growth of 42.2%, according to an industry report from ACI Worldwide and GlobalData show. The figure gives RTPs a 19.1% share of all electronic transactions globally. By 2028, that share is expected to rise to 27.1% and reach a total of 575.1 billion transactions, representing a 16% annual growth rate.

Another growth factor highlighted in the report is the integration of blockchain technology. Fintech companies are increasingly using distributed ledger technology (DLT) to address the challenges associated with cross-border payments by improving transparency and traceability, reducing the risk of fraud and improving security.

A survey conducted in 2022 by PYMNTS.com found that 37% of businesses were already using blockchain for cross-border payments, while a further 13% expressed a desire to adopt this technology in the future.

The use of blockchain for cross-border transactions is expected to grow rapidly, with projections from Statista pointing a significant increase in B2B transactions on blockchain by 2025, mainly driven by the Asian market.

Globally, the Bank for International Settlements (BIS) collaborates with central banks on several DLT projects aimed at improving the speed, transparency and interoperability of cross-border payments.

Agora Projectfor example, it seeks to integrate tokenized commercial bank deposits with central bank tokenized wholesale money using smart contracts for instant settlement. mBridge project aims to create a unified platform for the issuance and wholesale trading of central bank digital currencies (CBDCs) by multiple central banks, reducing cross-border transfer times from days to seconds. Finally, Dunbar Project focuses on developing a common platform for issuing and trading CBDCs to address interoperability challenges.

Embedded finance is another driver of cross-border payments outlined in the report. Embedded finance, which refers to the integration of financial services or instruments into non-financial platforms, apps, or ecosystems, represents a significant evolution in the financial services landscape, building on concepts such as open banking, open finance, modular banking, and banking-as-a-platform (BaaS).

The approach is now used in various industries to improve shopping experiences and mobile services. It is also used in supply chain operations to streamline processes and facilitate trade finance. For businesses with international operations, embedded finance simplifies currency exchange in cross-border transactions.

Estimates to suggest that the global opportunity for integrated finance will reach $7.2 trillion over the next decade, double the combined value of the world’s 30 largest banks today.

Cross-border payments revenues are expected to reach $260 billion by 2030, led by the B2B segment ($220.5 billion). Consumer-to-business cross-border transactions will generate revenues of $34 billion, followed by business-to-consumer ($13.4 billion) and consumer-to-consumer ($12.3 billion).

Featured image credit: edited by freepik

Receive the most interesting news from Fintech Switzerland once a month in your inbox