Fintech

Global fintech funding fell 16% in Q1 2024, lowest quarterly drop in 7 years

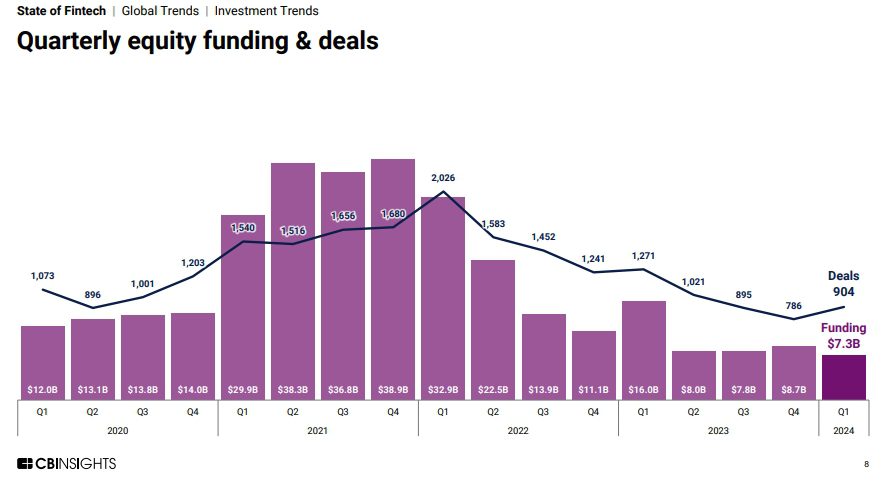

Global fintech funding suffered a sharp decline in the first quarter of the year, plunging by an exceptional 16% in the first three months of 2024. This was revealed in a State of Fintech report from tech startup analytics firm, CB Insights.

According to the report, financial technology companies around the world were able to attract $7.3 billion in the quarter, a decline of 16% compared to the $8.7 billion attracted in the third quarter of 2024. The collapse represents the largest quarterly decline in fintech funding since 2017.

The report finds that the decline in global fintech funding stands in stark contrast to gains made in the broader venture capital market.

However, while the value of deals may have suffered a sharp quarterly decline, the total number of deals enjoyed a 15% increase, with a total of 904 deals versus 724 recorded in the last quarter of 2023. This indicates that Investors remain active in the market but focused on smaller operations.

Aside from total deal value, the average deal size in 2024 also saw a decline, averaging $11.1 million year-to-date. This represents an 18% decline from the average of $13.6 million recorded in 2023.

“The paucity of successful deals is driving the decline: in the first quarter of 2024, there were just 12 mega rounds (deals worth more than $100 million) representing 26% of total funding, the lowest share since the second quarter of 2023. Despite the decline in deal size, UK-based challenger bank Monzo still raised a $431 million Series I round – the largest fintech deal of the quarter“, the report notes.

Startups with the largest fintech funding worldwide

At the top of the global fintech funding pile, the UK’s Monzo led global fintech funding for the quarter, raising $431 million in a Series I funding round in March. The round led by Capital G and supported by Tencent and Google Ventures meant the startup contributed 5.1% of total fintech funding in the quarter, giving the startup a valuation of $5.1 billion.

US-based Flexport is next after raising $260 million in convertible notes in January. Funding provided by Shopify means Flexport contributed 3.6% of total fintech funding in the quarter.

American fintech Bilt Rewards raised $200 million in a Series C round in January. The round led by General Catalyst set the startup’s valuation at $3.1 billion and a 2.8% contribution to the quarter’s global total.

Next up is another American fintech, Kore.ai, which in January raised $150 million in a Series D round led by FTV Capital. The funding means that Kore contributed 2.1% of total global quarterly funding in the fintech sector.

Britain’s Flagstone raised $139 million in a private equity round funded entirely by Estancia Capital Partners in March. As a result, Flagstone contributed 1.9% of the sector’s total funding between January and March.

Mews, a financial technology company operating in the Netherlands, contributed 1.5% to global fintech funding in the quarter after raising $110 million in Series D funding in March. The round, led by Kinnevik and Goldman Sachs Asset Management, brought Mews’ valuation to $1.2 billion.

Next up is Germany’s Solaris, which raised $104 million in a Series F round in March led by SBI Group. Solaris contributed 1.4% of total global quarterly funding.

Nigeria’s Moove, Netherlands’ DataSnipper, US FundGuard and Watershed, and Hong Kong’s HashKey all raised $100 million in equity funding during the quarter under review.

See also: Nigerian Moove enters top 10 global fintech funding in Q1 2024 with $100 million raised