Fintech

Global FinTech Revenues Expected to Reach $1.5 Trillion by 2030 – Fintech Schweiz Digital Finance News

Free Newsletter

Get the latest Swiss Fintech news once a month in your inbox

Recent advances in technologies such as generative artificial intelligence (AI), coupled with the large number of people around the world who are unbanked or underbanked, offer significant opportunities for the global fintech sector.

According to a new report from Boston Consulting Group and QED Investors, the industry is expected to reach $1.5 trillion in revenue by 2030, five times the current market size.

The report, titled “Global Fintech 2024: Prudence, Profits, and Growth,” provides an overview of the evolution of the sector, drawing on insights from industry leaders and investors. It discusses future developments in fintech, mentioning the potential of technologies such as genAI, and outlines trends shaping the sector, including embedded finance, open banking, and connected commerce.

Embedded Finance Will Become Pervasive by 2030

The first major theme highlighted in the report is the rise of embedded finance, where financial services are integrated into non-financial interactions to eliminate friction and enable highly personalized customer experiences.

Initially, embedded finance use cases focused primarily on payments, lending, and insurance in both business-to-business (B2B) and business-to-consumer (B2C) contexts, but key players including Stripe and Adyen are expanding these use cases into areas such as bank-based payments, cryptocurrency payments, and digital assets. These two leading embedded finance companies have surpassed the trillion-dollar mark in total payments volume in 2023, showing substantial growth in embedded payments.

Embedded lending has also seen robust growth, with buy now, pay later (BNPL) leaders Klarna and Affirm processing significant transaction volumes of $90 billion and $20 billion, respectively. Embedded insurance has similarly shown rapid expansion, with premiums reaching approximately $8 billion in Europe last year.

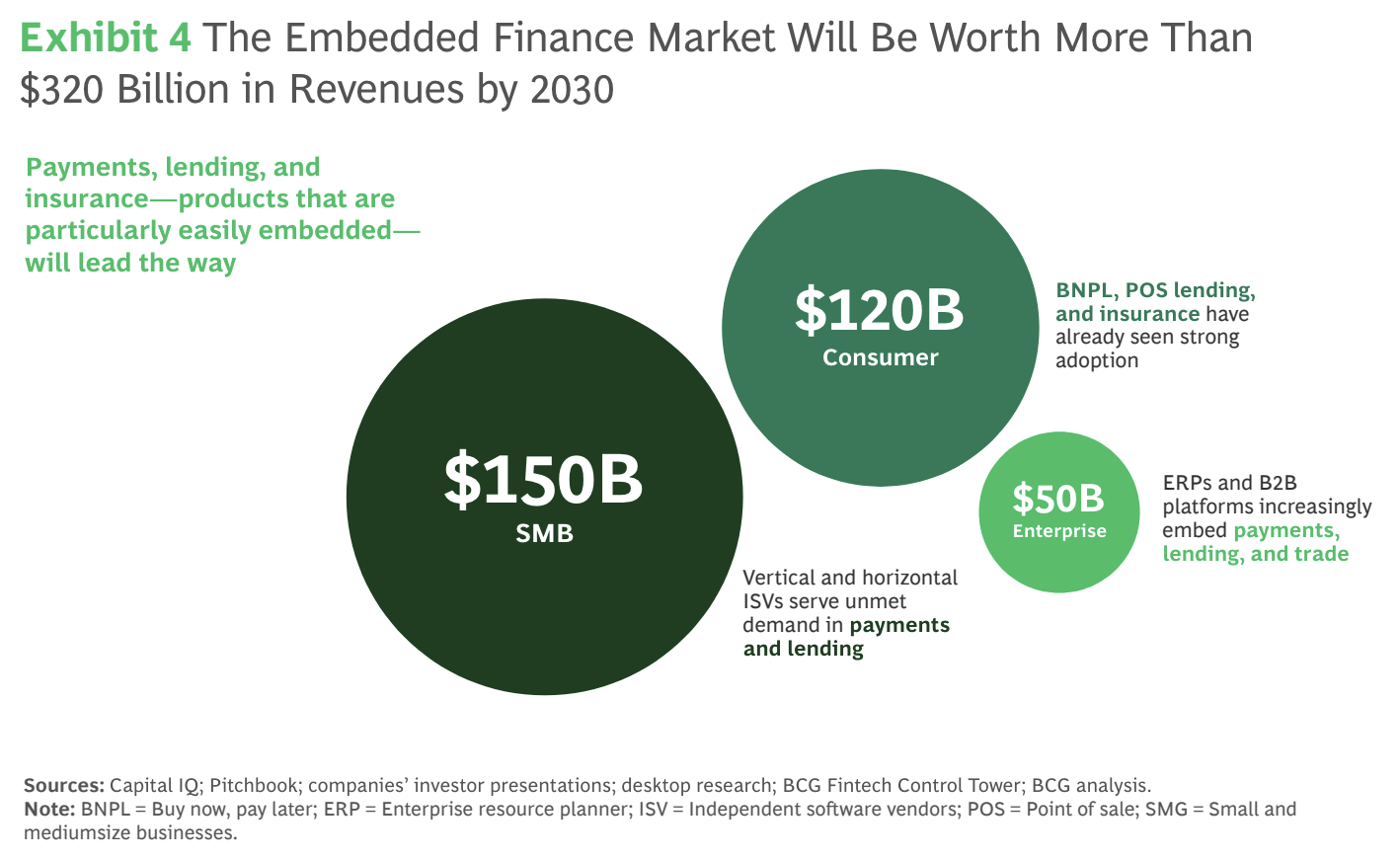

Looking ahead, the global embedded finance market is expected to surpass $320 billion in revenue by 2030, with the small and medium-sized business (SMB) segment accounting for nearly half ($150 billion) of that sum. This growth will be driven by increased adoption of vertical and horizontal software solutions that meet the payments and lending needs of SMBs.

The consumer segment is also expected to contribute substantially to the rise of integrated finance, which is expected to reach $120 billion in revenue by 2030, with increasing adoption of BNPL, point-of-sale (POS) lending and integrated insurance.

Finally, the corporate vertical is expected to account for $50 billion in embedded financial revenue. This growth will be driven by the integration of payment, lending, and commerce capabilities into horizontal software solutions, aimed at addressing pain points in accounts payable and accounts receivable.

Connected commerce ready to take off

Connected commerce, which refers to the integration of online and offline shopping experiences into a unified and seamless customer journey, represents a major opportunity for traditional banks to capitalize on their customer data. The approach enables new revenue streams and increased customer loyalty through personalized marketing. It also allows incumbents to serve as a platform for SMBs and enterprises.

Major banks and some fintechs are already investing in connected commerce. Examples include ventures like JPMorgan’s Chase Media Solutions, Capital One Shopping, and Citi Shop. Some fintechs, including Klarna, are also entering the connected commerce space, while others like Revolut and PayPal are launching advertising businesses.

Connected commerce adoption is expected to increase, emerging as a key application for incumbent banking players. As core revenue streams continue to come under pressure and deposits risk becoming commoditized in a high-yield environment, connected commerce offers a promising future model for traditional financial institutions.

Open banking will continue to expand

Open banking will continue to expand as more countries implement authorized customer access to their financial data, enabled by application programming interfaces (APIs). To date, over 65 countries have established open banking, with more expected to follow suit.

However, the report notes that while open banking will drive innovation and increase financial access, it is unlikely to change the basis of competition in the banking sector. Indeed, in countries where open banking has had a decade or more to mature, no killer use cases have emerged and the impact has been modest.

In the UK, open banking has been live for six years and yet consumer adoption has plateaued at 12% of monthly active users. In the Nordics, a region that has traditionally led the way in digital adoption, open banking user penetration is well below 50%, sitting at around 30% in Sweden and 25% in Norway.

According to the report, open banking will continue to be relevant in the future, but will not revolutionize financial services and fintech for consumers and SMEs.

GenAI emerges as a game changer

Finally, genAI is already proving its value in the financial services space, delivering tangible productivity gains in customer service and support, software coding, testing and documentation, regulatory compliance, and targeted, automated digital marketing.

Looking ahead, the applications and impact of genAI will only grow. In terms of cost of goods sold (COGS), genAI will increase productivity for development and service operations. In sales and marketing, the technology will increase output velocity for content creation and improve sales force effectiveness. And in general administrative expenses, it will optimize third-party spend, simplify the technology stack, and automate support functions.

GenAI is expected to have a much greater impact on fintechs than traditional banks in the near future. This is because fintechs have “digital first” cost structures that are heavily weighted toward areas where genAI is generating huge gains, such as coding, customer support, and digital marketing.

Fintech Revenues Rise Despite Decline in Funding

Global fintech funding declined significantly in 2023, falling 71% from an all-time high of $144 billion in 2021 to $42 billion. Despite funding challenges, global fintech revenues continued to grow at a healthy pace, increasing 14% annually over the past two years to reach $320 billion in 2023, according to the report.

In particular, challenger banks have performed excellently in 2023. Brazil’s Nubank, for example, got through the milestone of 100 million users in May 2024 and achieved record financial results in 2023 with over $1 billion in net income and over $8 billion in revenue. In Europe, Monzo reached up operating profitability in the first half of 2023 and has received GBP 340 million (US$430 million) in additional financing to fuel its global growth plans. In the U.S., Chime achieved profitability in the first quarter of 2024 and is now preparing for a possible initial public offering in 2025, Bloomberg reported in March.

Featured image credit: edited by free

Get the latest Swiss Fintech news once a month in your inbox