News

How far will Ethereum (ETH) go?

2.30pm ▪ 10 minute reading ▪ by Thomas A.

Crypto bull markets generally benefit altcoins in a second phase. In May, Ethereum (ETH) recorded a performance of more than 15%, and almost 65% since the beginning of the year. This resurgence of Ethereum comes after the SEC approved the establishment of ETFs on the world’s second largest cryptocurrency. Although the correlation between Bitcoin and Ethereum remains high, the cyclicality of Ethereum’s price appears to be operating with the same precision in the structure of this bull market. Decoding Ethereum Price Indicators and Dynamics.

An ETF soon to revive the market?

As with Bitcoin (BTC), the US Securities and Exchange Commission has approved the establishment of an ETF on Ethereum. Therefore, this decision will allow major global managers to expand the cryptocurrency offering to their clients. However, the SEC has yet to approve its marketing…

“This follows the successful introduction of Bitcoin ETFs in January, which quickly attracted $13.3 billion in net inflows, setting performance records for ETFs upon their launch. The arrival of ETFs on Ethereum could be similarly successful, attracting a new inflow of capital to the second largest cryptocurrency.”

This same announcement for Bitcoin had particularly favored the increase in prices to all-time highs. The arrival of an ETF on Ethereum therefore leaves the potential for a return to the November 2021 highs of $4,868. In May 2024, ETH therefore represents almost 17.7% of the market capitalization. This market share is still far behind Bitcoin, with a dominance close to 53%.

The approval of ETFs on Ethereum could therefore trigger a catch-up effect compared to Bitcoin. Furthermore, these ETFs could also be used in the future to create ETFs representing a basket of cryptocurrencies.

A look at fractals: the rise persists

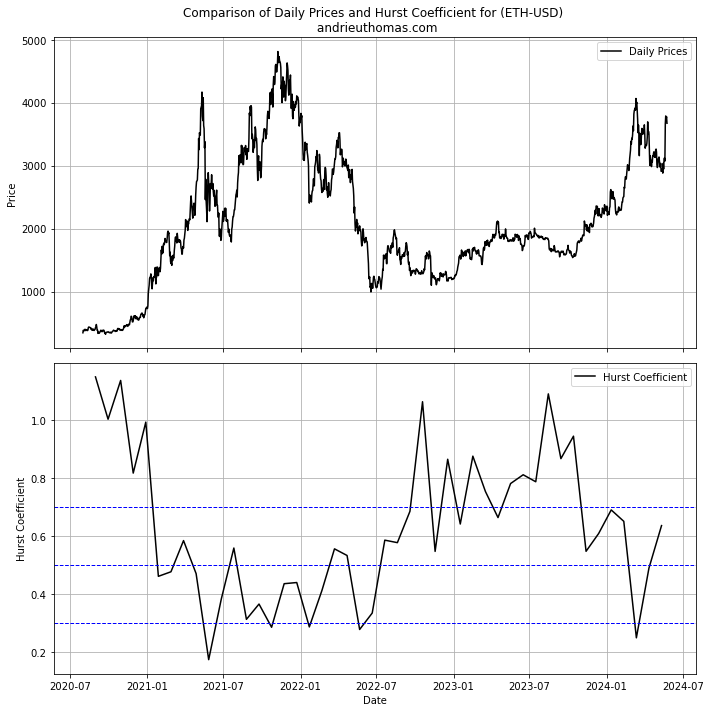

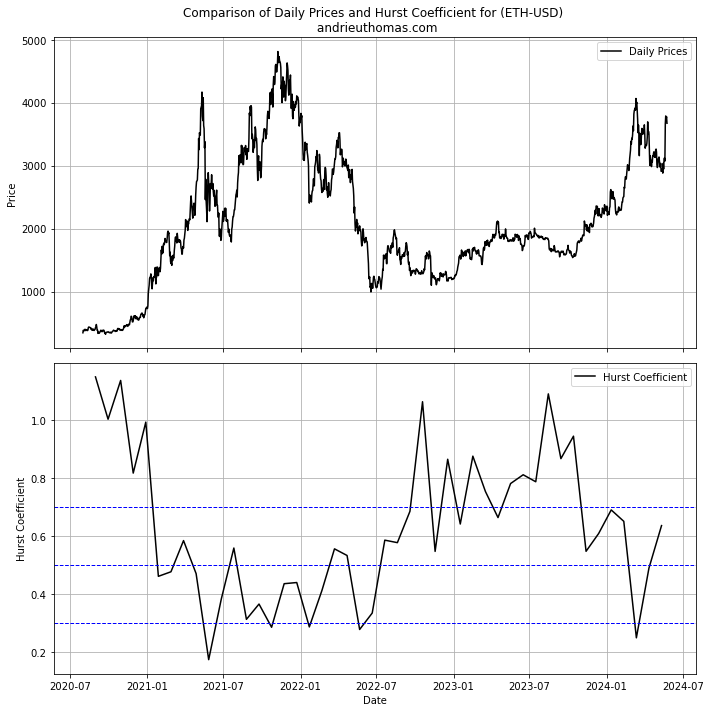

An important indicator to measure the feasibility of the trend on ETH is the use of fractals. In fact, the Hurst exponent (to know more) allows you to measure the degree of persistence of the trend from one time scale to another. Furthermore, the Hurst exponent is ideally between 0 and 1. With Ethereum, a Hurst exponent close to 1 indicates significant upside potential and consequently good symmetry with important lows. Conversely, a Hurst exponent close to 0 will indicate that the trend is anti-persistent and will likely turn downward.

Ethereum (ETH) price (top chart) and Hurst exponent (bottom chart). Measures the positive (>0.5) or negative (<0.5) persistence of the trend. Chart and data by Thomas ANDRIEU.

Ethereum (ETH) price (top chart) and Hurst exponent (bottom chart). Measures the positive (>0.5) or negative (<0.5) persistence of the trend. Chart and data by Thomas ANDRIEU.

Graphically, we see that ETH gained significant upside potential in mid-2022, reconfirming it in early 2023. The resulting bull market, according to the theory, was accompanied by a decrease in the Hurst exponent, signaling the loss of upside potential. In March 2024, the Hurst exponent was below 30%, indicating downside risk, or at least the absence of upside potential. However, Ethereum’s recent rebound appears to reaffirm a renewal of upside potential, thus limiting the downside risks seen in Spring 2024.

Nonetheless, this approach encourages us to be more cautious about the nature of the bull market with respect to 2023. Indeed, it seems clear that the bull market has exhausted a significant portion of its overall potential.

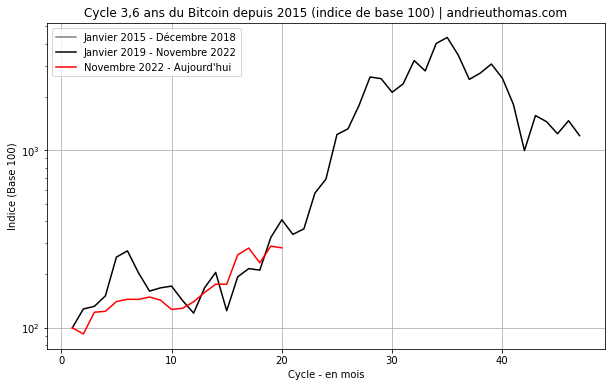

The cycles that act on ETH

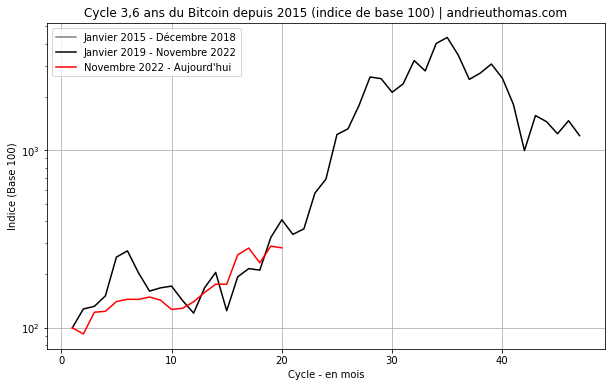

In several articles we have had the opportunity to highlight a cycle close to 3.6 years on Ethereum. Furthermore, this ruling cycle corresponds to the same ruling cycle as Bitcoin (BTC). The timing of this cycle therefore allows us to judge and compare different bull or bear markets. For examplethe bull market observed on Bitcoin since 2023 is highly symmetrical to previous bull markets.

“In fact, we know that two cycles of 4 and 22 months synchronized in February 2018. We are now looking for the time period needed to make the next constructive interference happen. Calculating the LCM(4,22), we get 44 months (3.6 years)which is strongly correlated to the cyclicality of stocks and Bitcoin (Cyclicality of Bitcoin (BTC) – Cointribune).”

Technical indicators: constructive interference and destructive interference – Cointribune

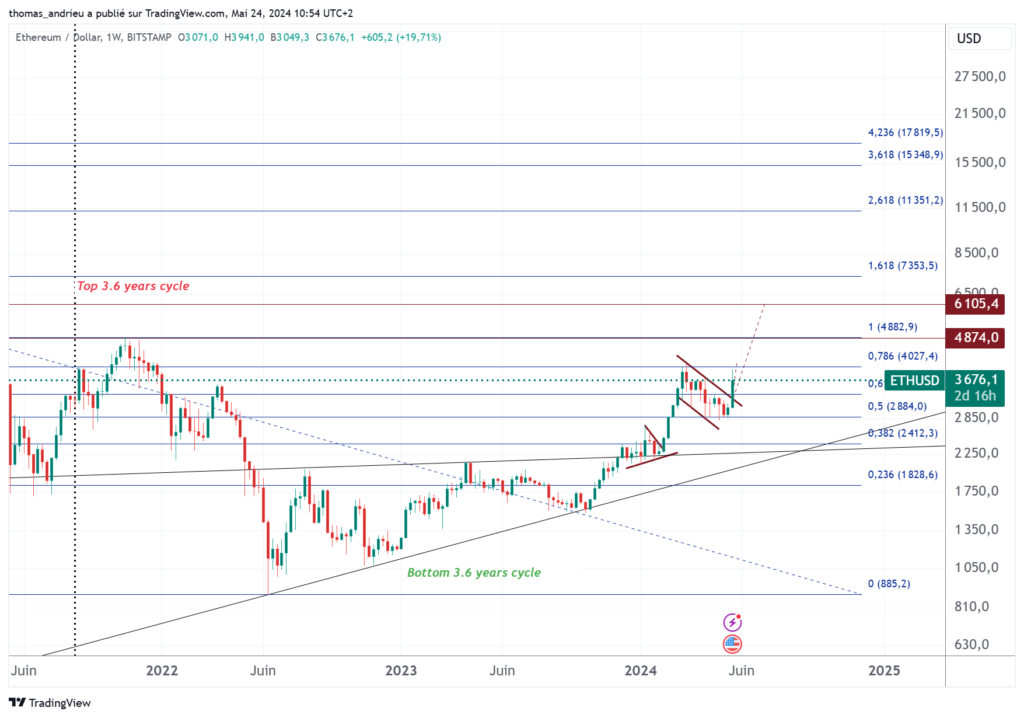

Just over 3.6 years therefore separate the major peak of 2018 from that of 2021 on Ethereum. Likewise, 3.6 years separates the early 2019 main bottom from the mid-2022 main bottom, etc. We see a clear cyclical dynamic here, fueled mainly by the correlation of Ethereum with Bitcoin. From this perspective, certainly theoretical, we could expect Ethereum to peak around mid-2025. Finally, we will mention the good symmetry observed so far between the current bull market and the previous bull market.

Current cycle for Ethereum and previous cycle

Current cycle for Ethereum and previous cycle

ETH remains correlated with Bitcoin

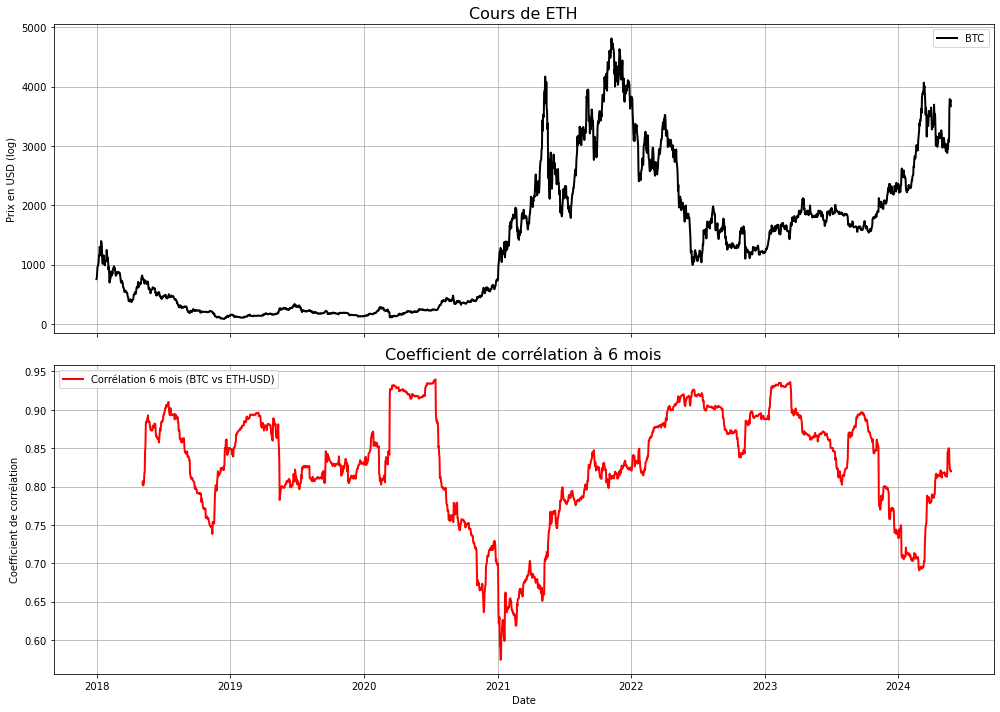

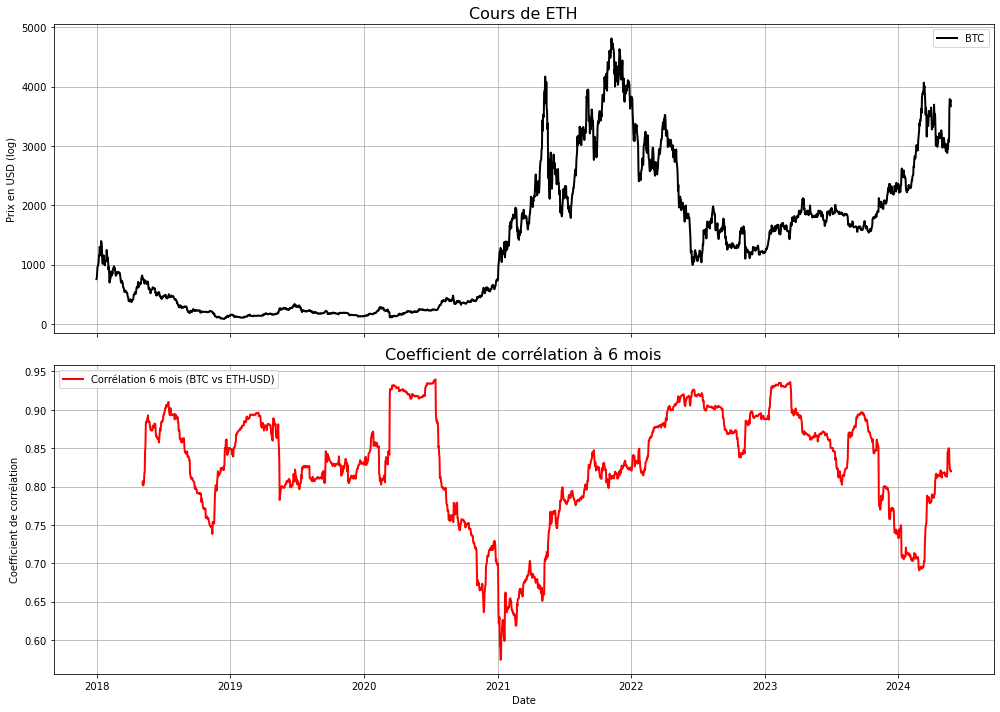

In our previous document, we highlighted the importance of the correlation between Ethereum and Bitcoin. The minimums and major minimums of the cryptocurrency market are in fact linked to the relationship that exists between the two main cryptocurrencies.

“We note in our case that a high correlation coefficient between Bitcoin and Ethereum is favorable for the translation of important lows on Bitcoin. Conversely, a low correlation coefficient (very low coefficient) will likely translate a strong weakening of market strength and major peaks. One major explanation could be that, during bull markets, the dependence of altcoins on Bitcoin decreases.”

ETH price (top graph) and 6-month correlation coefficient with the Bitcoin price (bottom graph). Graphic by Thomas ANDRIEU.

ETH price (top graph) and 6-month correlation coefficient with the Bitcoin price (bottom graph). Graphic by Thomas ANDRIEU.

Graphically, we can verify that the important lows on ETH are connected by a very high correlation with Bitcoin. However, ahead of the major bull markets on ETH, we note that the BTC/ETH correlation is minimal. In March 2024 the 6-month correlation between Bitcoin and Ethereum therefore reached a minimum of around 70%. By symmetry, this effectively signaled the likely arrival of an intense bull market on ETH. The study of the correlation between the two assets, however, does not allow us to effectively judge the probable maximums of Ethereum.

Despite everything, we see that the correlation between the two assets remains generally high. It’s mostly above 80%, which is significant.

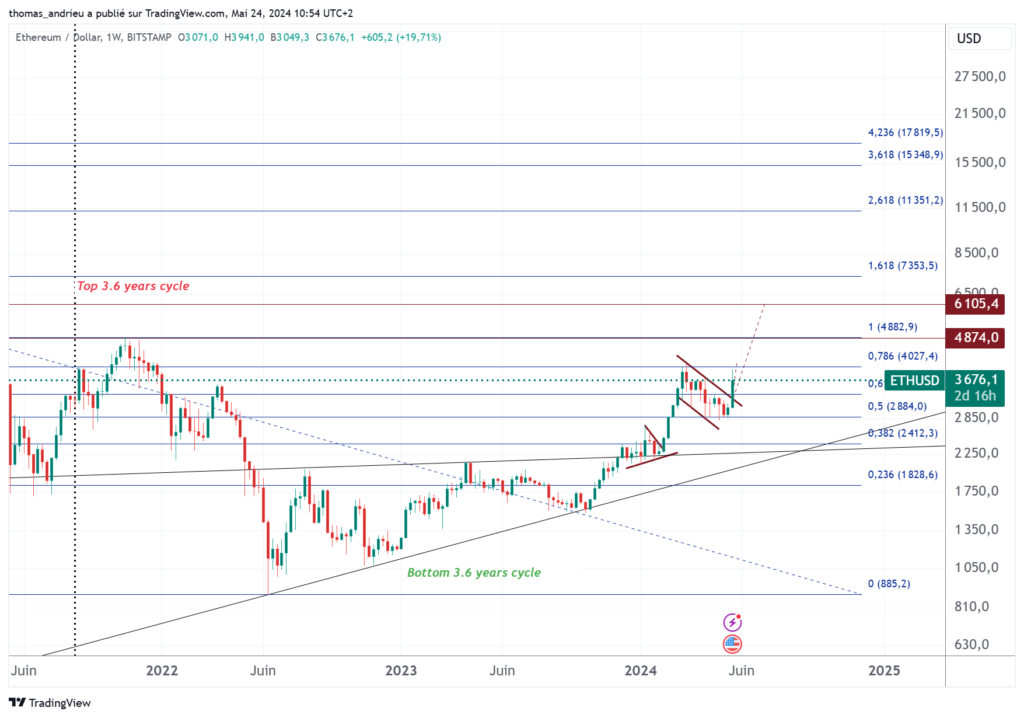

Towards $6,000?

The Technical Analysis of the price of Ethereum can provide us with further elements. In fact, we note that the consolidation of March/April 2024 does not compromise the bullish trend that began in 2023. On the contrary, the recent bullish breakout allows us to set an initial target (almost reached) towards the recent highs around $4,000.

Price of Ethereum (ETH).

Price of Ethereum (ETH).

Then, as we have highlighted, it would be consistent, given the correlation with Bitcoin, to reach historical highs at $4,800. In the continuation of this theoretical bullish move, the next extended target of the consolidation pattern (flag, logarithmic scale) would be near $6,000. This level doesn’t look graphically or statistically impossible. On the contrary, continued difficulties in breaking out of recent highs, or a prolonged drop below $3,000, would signal a likely exit from the uptrend.

We also mentioned the good timing of this dynamic, similar to that of Bitcoin. However, we see that a continued upward trend would have less basis than the 2023 and early 2024 increase. This necessarily encourages greater attention to indicators of market strength.

In short

The approval of Ethereum ETFs appears to have triggered a break in the consolidation since March. The bullish trend on Ethereum continues thus:

- With an extension of demand to ETFs and the rebound in the price of Bitcoin.

- A weakening of the bullish strength in terms of fractals. However, the upside potential appears to be maintained in April/May regarding the price rebound.

- Furthermore, the timing and cyclicality of the market still seems relevant. So far, a certain symmetry persists between the current bull market and the previous one. The bullish dynamic is therefore accompanied by structural market cycles.

- Correlation with Bitcoin is maintained despite a decorrelation in March 2024. This signal indicates that the bull market on ETH is likely to continue in line with Bitcoin.

- Finally, technical analysis clearly shows continuation potential. Targeting previous highs, then historical highs, would then be likely in a bull market. If the bullish strength is maintained, some extended targets are around $6,000, and above by extension.

Maximize your Cointribune experience with our “Read to Earn” program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning benefits.

Click here to sign up to “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Thomas A.

Author of various books, financial and economic editor for numerous websites, I have developed a true passion for the analysis and study of markets and the economy.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be relied upon as investment advice. Do your research before making any investment decisions.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

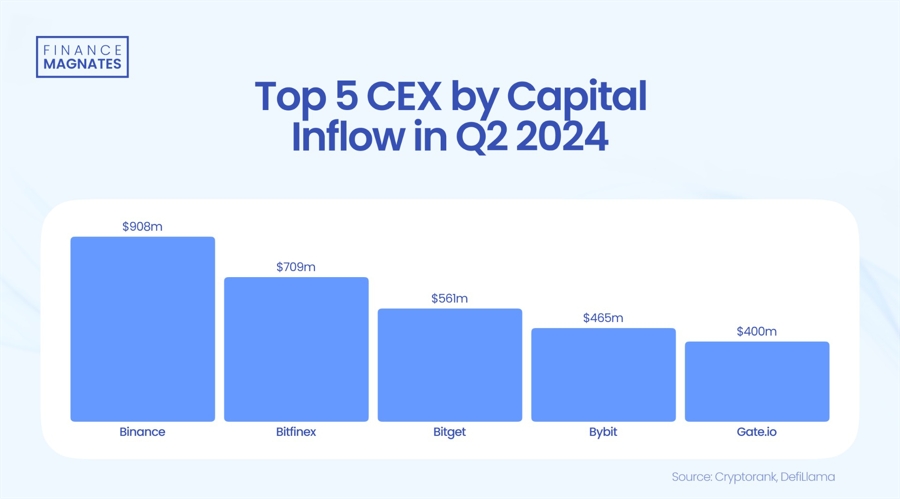

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto