Markets

Impact of Regulatory Changes on Cryptocurrency Prices

Regulatory changes profoundly impact the cryptocurrency market, influencing prices and investor behavior. Understanding these changes is crucial for making informed investment decisions. Platforms like Oriole Insights’ price prediction platform provide valuable insights into how regulations affect cryptocurrency prices.

Oriole Insights is a premier cryptocurrency price prediction platform that helps users stay ahead of regulatory impacts.

Overview of Cryptocurrency Regulation

Cryptocurrency regulation involves government policies and legal frameworks designed to oversee the use and trading of digital assets. These regulations aim to protect investors, ensure market integrity, and foster the adoption of cryptocurrencies while maintaining financial stability.

Importance of Understanding Regulatory Impact

Understanding the impact of regulation on cryptocurrency prices is vital for making informed investment decisions. Regulatory changes can lead to significant market volatility, affecting the value of digital assets.

Key Takeaways

- Regulatory clarity enhances investor confidence.

- Stricter regulations can reduce market manipulation.

- Regulatory changes can drive or hinder market growth.

Advantages of Cryptocurrency

Decentralization and Security

Cryptocurrencies offer decentralized financial transactions, reducing reliance on traditional banking systems and enhancing security through blockchain technology.

Potential for High Returns

Investing in cryptocurrencies can yield high returns due to their volatile nature and the potential for significant price appreciation.

Reasons for Regulatory Changes in Crypto

Investor Protection

Regulations aim to protect investors from fraud and scams prevalent in the crypto market.

Market Integrity

Ensuring market integrity through regulations prevents manipulation and promotes fair trading practices.

Legitimacy and Adoption

Regulatory frameworks legitimize cryptocurrencies, encouraging broader adoption by businesses and consumers.

Regulatory Clarity

Clear regulations provide a stable environment for innovation and investment in the crypto space.

Government Policies on Crypto

U.S. SEC Regulations

The U.S. Securities and Exchange Commission (SEC) plays a significant role in regulating cryptocurrencies, focusing on investor protection and market integrity.

European Union’s Approach

The European Union (EU) has proactively developed comprehensive regulatory frameworks for cryptocurrencies. The EU’s approach aims to balance innovation and risk mitigation, fostering a secure environment for crypto assets while ensuring market integrity and investor protection. Key regulations include the Markets in Crypto-Assets (MiCA) regulation, which provides a harmonized framework for issuing and trading crypto assets across EU member states.

MiCA addresses various aspects of the crypto market, including the issuance of stablecoins, governance of crypto-asset service providers, and anti-money laundering (AML) measures. By standardizing regulations across the EU, MiCA aims to reduce regulatory fragmentation, promote legal certainty, and enhance consumer protection. The EU’s approach reflects a commitment to integrating cryptocurrencies into the broader financial system while safeguarding against systemic risks.

Asia-Pacific Regulatory Trends

The Asia-Pacific region exhibits diverse regulatory approaches to cryptocurrencies, reflecting varying levels of acceptance and control. Countries like Japan and South Korea have embraced cryptocurrencies and established regulatory frameworks to support their growth. Japan, for instance, was one of the first countries to recognize Bitcoin as legal tender and implement licensing requirements for crypto exchanges.

Conversely, China has adopted a stringent stance on cryptocurrencies, banning ICOs and restricting crypto trading activities. However, China has shown interest in blockchain technology and is actively developing its digital currency, the Digital Yuan. Other countries in the region, such as Singapore and Australia, have taken a balanced approach, implementing regulations that encourage innovation while addressing risks related to fraud and financial stability.

Historical Context of Crypto Regulation

Early Regulatory Actions

The early days of cryptocurrency saw minimal regulatory oversight, with Bitcoin and other digital assets operating in a largely unregulated space. This lack of regulation led to a proliferation of crypto-related activities, including ICOs, which raised funds from investors without adhering to traditional securities laws. However, as the market grew and instances of fraud and scams emerged, regulatory bodies began to take action.

Initial regulatory responses included warnings from financial authorities about the risks associated with cryptocurrencies and measures to prevent money laundering and terrorist financing. These early actions laid the groundwork for more comprehensive regulatory frameworks as the market matured and the need for investor protection became apparent.

Major Crypto Scandals

The cryptocurrency market has been marred by several high-profile scandals that have highlighted the need for robust regulatory oversight. One notable example is the collapse of Mt. Gox, once the world’s largest Bitcoin exchange, which filed for bankruptcy in 2014 after losing approximately 850,000 Bitcoins due to hacking and mismanagement. This incident underscored the vulnerabilities in the crypto ecosystem and prompted calls for greater regulation and security measures.

Another significant scandal involved the ICO boom of 2017, where numerous projects raised millions of dollars through token sales, only to disappear or fail to deliver on their promises. This wave of fraudulent ICOs led to substantial investor losses and attracted the attention of regulatory bodies, resulting in stricter enforcement actions and clearer guidelines for token offerings.

Landmark SEC Cases

The U.S. Securities and Exchange Commission (SEC) has been at the forefront of regulating the cryptocurrency market, with several landmark cases shaping the regulatory landscape. One such case is the SEC’s action against the messaging app Telegram, which raised $1.7 billion through an ICO in 2018. The SEC argued that Telegram’s token, GRAM, constituted an unregistered security offering, leading to a legal battle and the eventual halting of the token’s distribution.

Another significant case involved the SEC’s charges against Ripple Labs, the company behind the XRP token. The SEC alleged that Ripple conducted an unregistered securities offering by selling XRP, sparking a contentious legal dispute. These landmark cases demonstrate the SEC’s commitment to enforcing securities laws in the crypto space and provide important precedents for future regulatory actions.

Effects of Crypto Regulation

Market Volatility

Regulatory changes and announcements can have a profound impact on cryptocurrency market volatility. Positive regulatory developments, such as the approval of a Bitcoin ETF or favorable legal rulings, can boost investor confidence and drive prices upward. Conversely, negative news, such as regulatory crackdowns or bans, can trigger panic selling and sharp price declines.

The crypto market’s sensitivity to regulatory news underscores the importance of staying informed about policy developments and understanding their potential implications. Investors and traders must navigate this volatility by adopting risk management strategies and remaining vigilant to regulatory changes that could affect their portfolios.

Investor Confidence

Regulatory clarity and robust oversight play a crucial role in building investor confidence in the cryptocurrency market. Clear regulations provide a framework that ensures transparency, accountability, and protection for investors. When investors feel confident that regulatory measures safeguard their investments, they are more likely to participate in the market, contributing to its growth and stability.

Conversely, regulatory uncertainty and inconsistent enforcement can erode investor confidence and deter participation. The development of comprehensive and transparent regulatory frameworks is essential for fostering a healthy and sustainable crypto market that attracts both retail and institutional investors.

Long-Term Market Stability

While regulatory changes can introduce short-term volatility, they are also critical for achieving long-term market stability. Comprehensive regulations help establish a level playing field, prevent market manipulation, and ensure fair practices. Over time, a well-regulated market can attract more participants, including institutional investors, who seek a stable and secure environment for their investments.

Regulatory measures that address systemic risks and promote market integrity contribute to the overall health of the crypto ecosystem. As the market matures and regulatory frameworks evolve, the long-term stability and resilience of the cryptocurrency market are likely to improve.

Legal Issues in Cryptocurrency

Compliance and Enforcement

Compliance with regulatory requirements is a fundamental aspect of operating within the cryptocurrency market. Cryptocurrency exchanges, wallet providers, and other market participants must adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations to prevent illicit activities. Failure to comply with these regulations can result in severe penalties, including fines and the suspension of operations.

Regulatory enforcement actions are becoming more prevalent as authorities seek to uphold market integrity and protect investors. These actions can range from fines and legal proceedings to the suspension of services for non-compliant entities. The increasing focus on compliance underscores the importance of robust internal controls and adherence to regulatory standards for market participants.

Legal Frameworks Across Different Jurisdictions

Cryptocurrency regulations vary significantly across different jurisdictions, reflecting the diverse approaches taken by governments worldwide. Some countries, such as Japan and Switzerland, have established clear and supportive regulatory frameworks that encourage innovation and adoption. Others, like China, have implemented strict restrictions on cryptocurrency activities, including bans on trading and mining.

Navigating the complex landscape of global regulations requires a thorough understanding of the legal frameworks in different jurisdictions. Market participants must stay informed about the regulatory environment in the regions where they operate and ensure compliance with local laws. The diversity of regulatory approaches highlights the need for international cooperation and harmonization to address the global nature of the cryptocurrency market.

The Howey Test and Cryptocurrencies

Application of the Howey Test

The Howey Test, established by the U.S. Supreme Court, is a critical tool used to determine whether a financial instrument qualifies as a security. Under the Howey Test, an instrument is considered a security if it involves an investment of money in a common enterprise with an expectation of profits derived from the efforts of others. This test has significant implications for the classification of cryptocurrencies and token offerings.

Cryptocurrency projects and ICOs must carefully assess whether their tokens meet the criteria of the Howey Test. If a token is deemed a security, it must comply with securities regulations, including registration with the SEC and adherence to disclosure requirements. The application of the Howey Test helps ensure that investors receive adequate information and protection when participating in token offerings.

SEC’s Interpretation and Actions

The SEC has applied the Howey Test to various cryptocurrency projects, resulting in enforcement actions and legal proceedings. The SEC’s interpretation of the Howey Test has led to the classification of certain tokens as securities, requiring compliance with securities laws. Projects that fail to meet these requirements may face legal challenges and penalties.

The SEC’s actions underscore the importance of regulatory compliance for cryptocurrency projects. By adhering to securities regulations and providing transparent disclosures, projects can mitigate legal risks and build investor trust. The SEC’s ongoing efforts to enforce securities laws in the crypto space highlight the need for clarity and adherence to regulatory standards.

Potential Future Regulatory Changes

Predicted Actions by Regulatory Bodies

Regulatory bodies worldwide are continuously evaluating and updating their approaches to cryptocurrency regulation. Predicted future actions may include stricter AML and KYC requirements, enhanced investor protection measures, and increased scrutiny of DeFi platforms and stablecoins. These actions aim to address emerging risks and ensure the continued integrity of the cryptocurrency market.

Regulatory bodies may also focus on developing frameworks for the regulation of central bank digital currencies (CBDCs) and the integration of digital assets into traditional financial systems. These developments could shape the future landscape of the crypto market and influence the regulatory environment for years to come.

Impact on Crypto Market

Future regulatory changes are likely to have a significant impact on the cryptocurrency market. Enhanced regulations can increase investor confidence, attract institutional participation, and promote market stability. However, regulatory actions that are perceived as overly restrictive or punitive may lead to market volatility and reduced innovation.

Market participants must stay informed about potential regulatory developments and adapt their strategies accordingly. Proactive engagement with regulators and compliance with evolving standards are essential for navigating the changing regulatory landscape and ensuring long-term success in the crypto market.

Crypto Market Regulation

Current Regulatory Environment

The current regulatory environment for cryptocurrencies is characterized by a mix of supportive, restrictive, and evolving frameworks. Countries like the United States, Japan, and Switzerland have established regulatory measures that balance innovation with risk mitigation. These frameworks provide legal clarity and support the growth of the crypto market.

In contrast, other jurisdictions have implemented stringent regulations or outright bans on cryptocurrency activities. This diversity in regulatory approaches reflects varying levels of acceptance and control, highlighting the need for global cooperation and harmonization to address the complexities of the crypto market.

Future Trends in Crypto Compliance

Future trends in crypto compliance are likely to focus on enhancing transparency, security, and investor protection. Regulatory authorities may introduce measures to address emerging risks, such as those associated with DeFi platforms and stablecoins. The development of international standards and best practices for crypto compliance can facilitate global cooperation and ensure a consistent regulatory approach.

Innovations in compliance technology, such as blockchain analytics and AI-driven monitoring systems, can enhance the effectiveness of regulatory enforcement. These advancements can help detect and prevent illicit activities, ensuring a safer and more secure environment for cryptocurrency investments.

Regulation and Crypto ETFs

Approval Process

The approval process for crypto exchange-traded funds (ETFs) involves rigorous scrutiny by regulatory authorities, such as the SEC. The process includes evaluating the proposed ETF’s structure, underlying assets, and compliance with securities laws. Approval is contingent on demonstrating that the ETF meets regulatory standards and provides adequate investor protection.

The approval of crypto ETFs can significantly impact the market by providing a regulated and accessible investment vehicle for retail and institutional investors. It can enhance market liquidity, attract new participants, and promote broader acceptance of cryptocurrencies as an asset class.

Market Impact

The approval of crypto ETFs can have a positive impact on the cryptocurrency market by increasing investor confidence and participation. ETFs provide a regulated and convenient way for investors to gain exposure to cryptocurrencies without directly holding the assets. This can attract a wider range of investors, including those who may have been hesitant to invest in the unregulated crypto market.

Crypto ETFs can also contribute to market stability by providing a regulated investment vehicle that adheres to stringent standards. This can reduce the risk of market manipulation and enhance transparency, benefiting all market participants.

Oriole Insights – Price Prediction Platform

Overview of Oriole Insights

Oriole Insights is a leading price prediction platform that leverages advanced analytics and machine learning to provide accurate and timely cryptocurrency price forecasts. The platform offers a comprehensive suite of tools and features designed to help investors make informed decisions and maximize their returns.

Oriole Insights utilizes data from various sources, including market trends, sentiment analysis, and historical price movements, to generate precise predictions. The platform’s user-friendly interface and powerful analytics capabilities make it an essential resource for both novice and experienced traders.

Advantages of Using Oriole Insights

Using Oriole Insights offers several advantages for cryptocurrency traders and investors. The platform’s advanced analytics provide valuable insights into market trends and price movements, enabling users to make informed decisions. Oriole Insights’ accurate predictions can help investors identify profitable opportunities and manage risks effectively.

Additionally, Oriole Insights offers real-time data and updates, ensuring that users stay informed about the latest market developments. The platform’s comprehensive suite of tools and features allows users to customize their strategies and optimize their investment outcomes.

Why Choose Oriole Insights for Crypto Predictions

Oriole Insights is a trusted and reliable platform for cryptocurrency price predictions, offering unparalleled accuracy and comprehensive analytics. The platform’s advanced features and user-friendly interface make it an essential tool for traders and investors looking to navigate the volatile crypto market.

Choosing Oriole Insights provides users with access to cutting-edge technology and expert insights, helping them stay ahead of market trends and make informed decisions. The platform’s commitment to accuracy and transparency ensures that users can trust and leverage the predictions to optimize their investment strategies.

Conclusion

The impact of regulatory changes on cryptocurrency prices is profound and multifaceted. Understanding the regulatory landscape and staying informed about potential changes is crucial for navigating the volatile crypto market. Comprehensive regulations can enhance investor confidence, promote market stability, and foster the growth of the crypto ecosystem.

Platforms like Oriole Insights play a vital role in helping investors navigate the complexities of the cryptocurrency market. By providing accurate price predictions and advanced analytics, Oriole Insights empowers users to make informed decisions and optimize their investment outcomes. As the regulatory environment continues to evolve, staying informed and leveraging innovative tools and platforms will be essential for success in the dynamic world of cryptocurrencies.

Markets

Crypto Markets Rebound as Spot Bitcoin ETFs Attract Massive Inflows

This week saw $722 million worth of Bitcoin spot ETF inflows, including the largest daily inflow in a month.

Cryptocurrency markets rallied on Wednesday, driven by inflows into spot Bitcoin exchange-traded funds (ETFs).

The price of Bitcoin (BTC) is up 3% over the past 24 hours to last change hands at $65,200, according to CoinGecko. Ethereum (ETH) is up 2% and is trading at $3,471. Solana (SUN) and Polkadot (POINT) increased by 4%.

Bitcoin spot ETFs saw $422 million in daily inflows on Tuesday, the highest in the past 30 days, according to Far side data, . The all-time record for a single day was $1.05 billion on March 12.

Among Tuesday’s top contributors, BlackRock’s IBIT led with $260 million in inflows, followed by Fidelity’s FBTC with $61 million. This week has already seen more than $722 million in inflows.

Among the top 100 cryptocurrencies by market cap, Worldcoin (WLD) led with a 28% increase, followed by Helium (HNT) with 20% and Lido DAO (LDO) with 15%.

Worldcoin, a decentralized identity project led by OpenAI CEO Sam Altman, announced is extending the lockups for early investors and team members. This means that tokens will be gradually released through 2029, instead of the original 2027 plan. Token unlocks are generally seen as a negative because they increase supply and early investors can sell their tokens for profit.

Meanwhile, XRP, the token of the XRP Ledger network, jumped 8% after the CME and CF benchmarks introduced new indices and reference rates for XRP.

U.S. stocks faced a downturn on Wednesday. The S&P 500 fell 1%, while the Nasdaq Composite and Dow Jones Industrial Average both fell 2%.

Markets

Altcoins on the cusp of a major breakout – WLD, AR, and INJ prices could surge by 20% in the coming days

Crypto markets appear to have been taken over by the bulls as major tokens have surged above their crucial resistance zone. Bitcoin surged above $65,000 while Ethereum was above $3,500, and XRP, which had remained passive for quite some time, surged over 40% in the past few days to hit $0.6. The uptrend has been captured in most altcoins, with Worldcoin (WLD), Arweave (AR), and Injective (INJ) leading the rally. Here’s what to expect for these tokens in the coming days.

Worldcoin (WLD) Price Analysis

O Worldcoin Price has been trading inside a descending wedge since it marked a new ATH near $12 in the final days of Q1 2024. The recent price action helped the price break out of the upper resistance of the wedge, breaking above the crucial resistance zone between $2.21 and $2.39. Market sentiments have changed, but technicals suggest that the bulls may remain passive for a while, which could offer some room for a bearish pullback.

The price broke out of the wedge with a significant increase in volume, but the current volume suggests that the bulls have taken a step back. Meanwhile, the RSI is about to reach the upper boundary, which could attract bearish forces. Additionally, the DMI has undergone a bullish crossover, but the decline in the ADX suggests that the rally may remain consolidated above the gains. Therefore, the WLD price is expected to maintain a horizontal consolidation between $3 and $3.3 and trigger a fresh rally to $4.4 during the next bullish rally.

Arweave (AR) Price Analysis

Arweave formed a strong base around $25, which helped the rally trigger a recovery during the bearish attack. Mt. Gox and German terror forced the price to fall below $20. However, the recent price action has brought the altcoin within the bullish range and raised expectations of maintaining a decent uptrend for a few more days.

AR price has hit one of the major resistances around $30 to $31.5, which could act as a strong base once overcome. The buying volume is slowly increasing, which could keep the bullish hopes for the rally high. Moreover, the supertrend has just flashed a buy signal, indicating a clean reversal of the trend. Therefore, AR price seems primed to maintain a healthy uptrend and rally above $40. However, if the bulls maintain a similar trend, making new highs above $50 may not be a tedious task for the bulls.

Price Analysis of Injective (INJ)

Injective price has been showing sharp strength since the beginning of the year and hence, the recent turnaround is expected to revive a good uptrend going forward. The bears engulfed the rally to a large extent, but the recent price action suggests that the bulls have regained their dominance. Therefore, INJ price is expected to maintain a strong uptrend with a bearish interference on the way down.

INJ price has surged above the lower support zone and has registered consecutive bullish candles. Although the volume is below the required levels, the OBV is maintaining a sharp uptrend. Furthermore, the Ichimoku cloud lead span B is heading towards the lead span A and a healthy crossover indicates the start of a new uptrend. However, INJ price may be out of the bears’ reach once it secures the resistance zone between $30.77 and $32.12, which seems to be on the horizon.

Markets

Ethereum at $3.5K, Exchange Supply Hits 34-Month High

Ethereum (ETH) supply on exchanges has hit a 34-month high as the asset’s price surpassed the $3,500 mark.

ETH has risen 2.3% over the past 24 hours and is trading at $3,490 at the time of writing. The second-largest cryptocurrency — with a market cap of $419 billion — briefly touched an intraday high of $3,517 earlier today.

ETH Price, Whale Activity, RSI, and Exchange Supply – July 17 | Source: Santiment

Ethereum’s daily trading volume also increased by 7.6% to reach $19.8 billion.

According to data provided by Santiment, the supply of Ethereum on exchanges has reached $19.52 million ETH. This level was last seen in September 2021, when the asset was trading around the same price.

On the other hand, data from the market intelligence platform shows that the number of whale transactions has fallen by 12% in the last day — falling from 8,730 to 7,629 unique transactions per day.

The move shows that the supply of Ethereum on exchanges has been increasing with small deposits rather than large transactions from whales.

Additionally, the ETH Relative Strength Index (RSI) is currently hovering at the 60-mark, per Santiment. The indicator shows that Ethereum is slightly overbought at this price point, but it may not be in a critical position due to its large market cap.

One of the main drivers of Ethereum price increase is ETH spot expectations ETFs in the US Investment products are scheduled to start trading on July 23rd.

Markets

Bits + Beeps: How to Play the ‘Trump Trade’ in Cryptocurrencies After the Assassination Attempt

Also, how much will the Fed cut rates (and when)? What will be the inflows into ETH ETFs? And what is the near future for Bitcoin?

Posted on July 17, 2024 at 12:00 PM EST.

Listen to the episode at Apple Podcasts, Spotify, Capsules, Source, Podcast Addict, Pocket molds, Amazon Musicor on your favorite podcast platform.

In this episode of Bits + Bips, hosts James Seyffart, Alex Kruger and Joe McCann, joined by guest Jack Platts, dive into the market reaction to the recent assassination attempt on former President Donald Trump, analyzing how this event will influence the 2024 US presidential election and the cryptocurrency markets.

They also cover potential rate cuts: Could there be a cut in July? How big could the September rate cut be? Could the decision be influenced by the upcoming election?

They also give their predictions on what percentage of BTC ETF inflows the ETH ETFs will reach, and James talks about what he expects for Grayscale’s ETHE (hint: his outlook would be positive for ETH).

Finally, they delve into what’s next for Bitcoin as the German government runs out of BTC and Mt. Gox distributions begin. Just now?

Program Highlights:

- Whether Trump’s shooting decided the election and whether the event caused a “flight to safety”

- How election markets are becoming a place to watch election probabilities and whether cryptocurrencies “lean right”

- Whether rate cuts will occur in July or September and by how much they will cut: 25 bps or 50 bps

- How Joe sees the relationship between global liquidity cycles, rate cuts, and the potential rise of Bitcoin

- What are the new updates about Ethereum ETFs and their expected launch?

- Why Solana Hasn’t Performed Significantly Better Since Trump News

- What Market Breadth Indicates About the Current Market Rally and the Impact of Rates on Small Caps

- Everyone’s predictions on ETH ETF inflows and how much outflow we’ll see on Grayscale’s ETHE

- What’s Next for BTC After German Government Exits Bitcoin and Mt. Gox Giveaways Starting This Week

Hosts:

Guest:

- Jack PlattsCo-Founder and Managing Partner of Hypersphere Ventures

-

DeFi11 months ago

DeFi11 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech11 months ago

Fintech11 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News11 months ago

News11 months agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi11 months ago

DeFi11 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi11 months ago

DeFi11 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News11 months ago

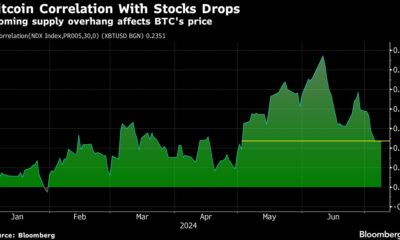

News11 months agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech11 months ago

Fintech11 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos4 months ago

Videos4 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

Markets1 year ago

Markets1 year agoCrypto Expert Provides Analysis of Top Altcoins, Market Sees Slight Rise