Fintech

In quest of perceived transaction cost’s impact on fintech users’ intention: the moderating role of situational factors

Theoretical development

Innovation diffusion theory

In contrast to other investigations, this one is unique. Instead of extending the TAM to look at the elements affecting user intention to use fintech, it primarily focuses on researching the components driving fintech use intention by combining IDT, TCE, and Belk’s theory.

IDT is a broad social psychology theory that seeks to expound adoption criteria, pinpoint processes, and assist in foretelling if or how innovations will be successful (Rogers 2010).

The concept has been the subject of a significant amount of study in several domains (Leerapong 2013), and it has consistently led to positive results in all of them, from studies related to journalism and health communication, therefore validating the diffusion process. Regarding the Diffusion of Innovation Theory’s limitations, adopted behavior performs better than halted or prevented behaviors. A person’s capacity to adapt to novel behavior (or creativity) is not considered (MacVaugh and Schiavone 2010; Miller 2015). IDT assists companies in comprehending how consumers engage with and use novel products or technology as time passes. Companies will employ it when introducing a novel product or service, changing an old product, or entering an emerging market (Leerapong 2013). The diffusion of innovation hypothesis’s most important feature is the idea of peer networks, which is essential to the theory. The critical mass reached via the impact of early adopters and pioneers who serve as decision leaders trigger the initial “take-off” moment in adopting innovation. To assess the usage of fintech and consider IDT for the given hypothetical situation, IDT is employed in the study (Fig. 1).

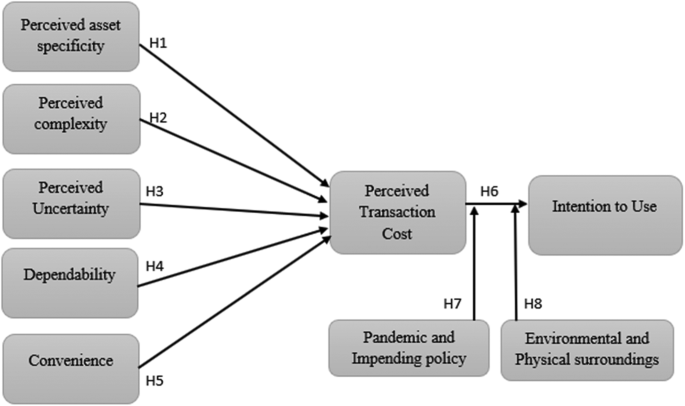

Positive and negative associations with PTC and IU. Five antecedents affect PTC, which in turn influences IU, with PIP and EPS moderating IU.

Transaction cost economics

Williamson (1979) developed his theory of transaction cost economics (TCE), which considers the interplay of two fundamental principles of human behavior (i.e., bounded rationality and opportunism) and three key transaction characteristics (i.e., frequency, uncertainty, asset specificity). TCE explains why a person who engages in transactions favors one transactional activity over another (Williamson 1996). Steinfield and Whitten (1999), who argued that TCE might be used to define the attraction of e-business to customers, broadened TCE literature (comprising consumers from institutions and individuals).

Belk’s theory

Belk coined the phrase “situational considerations” concerning consumer buying behavior to illustrate how various factors influence customers’ purchase decisions. Belk categorized these effects into situational and non-situational components gleaned from “a revised stimulus-organism-response paradigm” (Belk 1975). Non-situational elements signify universal and long-lasting peculiarities, such as a person’s character, intelligence, gender, and ethnicity, or a product’s brand recognition, endurance, size, and usefulness. Situational factors are portrayed as “all those elements relevant to a time and place of observation that is not generated from specific experience and sensory qualities and has a demonstrable and systematic influence on current behavior” (Ashraf et al. 2014). Situational elements entail the physical surroundings, temporal perspective, social surroundings, task specification, and antecedent states. A stimulus item’s physical surroundings comprise its geographic and organizational location, furnishings, sounds, odors, lighting, weather, and visual displays of objects or other materials. The social environment comprises other people, their presence, visible roles, and related reactions. Aspects of circumstances, such as temporal perspective, may be categorized in basic dimensions based on the time of day and the year. Task definitions are aspects of situations, like a purpose or need to choose, procure, or acquire information on a generic or particular buy. Antecedent states are fleeting feelings, conditions, or states that influence purchase decisions, including anxiety, pleasure, anger, having money on hand, being exhausted, and being ill. Then, some researchers offered up-to-date situational components (Fiedler 1964; Nicholls et al. 2002; Nicholls et al. 1996; Zhuang et al. 2006) and included these new variables in their model parameters for their field of study.

According to this study, we added certain situational elements to the use of fintech, such as EPS, and new elements depending on the world’s situation today, including a PIP. Other theories have also been put forward, such as “the contingency theory of leadership” (Shala et al. 2021). The Innovation Diffusion Theory claims consumers are more open to innovative ideas and new technologies (Branstad and Solem 2020). However, customers’ (or prospective users’) choice to accept or reject an innovation depends on their attitudes or views about the invention. Here, an experimental approach will study elements affecting purchasers’ expectations of how well Fintech would be received concerning situational factors.

This research combines IDT, TCE, and Belk’s theory to study the causes of PTC and how they affect customers’ IU. This study also advances theory in other ways (i.e., from TAM to IDT and TCE). Using “perceived asset specificity (PAS)” and “perceived uncertainty (PUC)” for the specified theoretical model, this work also evaluated TCE (Fig. 1).

Antecedents of perceived transaction cost

Positive and negative associations with the PTC and IU elements are shown in this research. The elements that make a transaction more costly positively correlate with the PTC. It implies that the PTC is increased. On the other hand, a negative association between a variable and the PTC indicates that the factor does not raise the PTC. This study has taken five antecedents, which are given below.

Perceived asset specificity

Long-term investments in favor of particular transactions are referred to as perceived asset specificity (PAS) (Cuypers et al. 2021). Investments have a lower potential return or opportunity cost than potential consumers’ prospective alternatives (Pan et al. 2022). There are two types of asset specificity: physical and human asset specificity. Purchasing specialized devices for online shopping, like laptops, smartphones, and modems, falls under physical asset specificity. Human asset specificity addresses the additional time and struggle required to develop online buying competence (Wang et al. 2019). Most users in Pakistan may thus devote a lot more finance, time, and energy to acquiring the necessary tools and abilities to participate in fintech usage than users in developed countries. These expenses result in higher transaction costs and lower adoption intentions due to customers’ perceptions of increasing asset specificity. The outcomes are as follows:

H1: PAS has a positive relationship with PTC.

Perceived complexity

Perceived complexity (PCX) (Huong et al. 2021) measures how challenging it is to grasp and apply a certain invention. The polar dissimilarity to ease of use measures how pleasant a person finds using a system (Al-Rahmi et al. 2019). Thus, in this research, PCX is exemplified as the user’s assessment of how difficult it is to utilize fintech. Users may have difficulties with innovation if it is thought to be complicated due to a want of user skill and knowledge (Ashta and Herrmann 2021; Le 2021). Users are less likely to accept an innovation if they perceive it as a complex system. The PTC increases when a client devotes time to something valued as money or if it seems bothersome. As a consequence, this research tests the following hypothesis:

H2: PCX has a positive relationship with PTC.

Perceived uncertainty

Perceived uncertainty (PUC) results from problems or complications in judging the actions or behavior of the other trader due to opportunism, restricted thinking, and information asymmetry (Ryu and Ko 2020). Transaction costs are significantly increased when there is a high level of PUC since both trade players have to invest more time and effort in the quest for goods and pertinent details, as well as inspecting and viewing the trading process. According to a researcher, there are two different forms of online purchase uncertainty: product uncertainty and online store behavioral uncertainty (Ashrafi et al. 2022). Because of perceived product uncertainty, evaluating the quality of purchased goods might be challenging. Consumers often wonder if the goods they buy will meet their goals before or during the buying process. When shopping in person, shoppers may examine an item before choosing whether or not to purchase it. When purchasing a product or service online, they focus on the quality assessment websites or apps do. Customers often express concern about the unpredictability of the performance of online-purchased goods (Wu et al. 2020). Product uncertainty results in higher transaction costs.

The behavioral uncertainty of shopping websites relates to buyers’ inherent issues when mistakenly appraising online businesses’ contractual or commercial performance, similar to the idea of performance ambiguity (Bhardwaj and Ketokivi 2021). Due to the parties’ inclination for opportunism, perceived behavioral ambiguity occurs inside the trading framework (Kim et al. 2021). Consumers are worried about online retailers making false claims, poor customer service, and a lack of vendor assurances, which are significant barriers to online purchasing.

H3: PUC has a positive relationship with PTC.

Dependability

Dependability (DPND) is the ability of a vendor or fintech network operator to provide the purchaser or user with outcomes that correspond to whatever they have ever promised or stated (Swan et al. 1988). DPND is the cornerstone upon which trust is formed. When using fintech for online shopping or services, consumers depend on weblogs and apps to complete respective financial activities and transactions, including assessing the particularity of items and providing after-sale inquiries. Customers that rely on the fintech program won’t have to spend additional hours and conscientiousness verifying the buying orders if they think fintech programs are trustworthy or reputable; if not, their PTC won’t increase (Teo et al. 2004), and vice versa.

H4: There is a negative relationship between the DPND of fintech and PTC.

Convenience

According to the research of Zhang and Kim (2020) on IU, we apprehend convenience (CONV) as the privileges (i.e., reducing time and energy required and buying whenever) that consumers experience via online shopping. Online shopping as a substitute for in-person browsing or shopping benefits customers since it saves them time and effort on product research. Additionally, clients may always make purchases from internet merchants. Therefore, we suggest the following idea:

H5: There is a negative relationship between CONV and PTC.

Perceived transaction cost and intentions to use fintech

The unit cost that a customer believes he pays while engaging in a certain activity, such as browsing or purchasing, is known as the PTC. Costs of discovering and gathering information, haggling, examining, and enforcing laws are examples of transaction costs (Alwi 2021). Businesses favor transactions with low transaction costs (Rangaswamy et al. 2020). Fintech is used by certain consumers when they purchase online since it cuts down on the time they need to spend finding product information. Consequently, adopting fintech for online buying has lower apparent transaction costs. Others, on the contrary, are against using fintech for online shopping or payment because it necessitates them spending extra time checking websites or apps to ensure their purchases or transactions are successful. Because of this, many consumers think that using fintech for online commerce or purchasing has a more significant transaction cost. Their desire to utilize fintech is affected by this (IU). The outcomes are as follows:

H6: There is a negative relationship between PTC and IU.

The moderating effect of situational factors

Pandemic and impending policy

A pandemic is seen negatively as a factor in an economy’s growth. Since the end of 2019, COVID-19 has spread like a global pandemic. About 724,000 individuals have died due to its spread to 213 countries (Sumaedi et al. 2020). Many individuals have reduced their time outside the house because of the corona. Fewer people are in the market, and fewer people engage in physical activity. People remain incapable of entirely using technology despite incorporating it into every aspect of modern life. People have begun working from home owing to the fear of coronavirus (De Haas et al. 2020). The pandemic has severely influenced conventional retail, but people still need to buy things to meet their necessities; therefore, they are turning to fintech platforms to conduct their business. So, it can be claimed that present situational circumstances, such as the PIP, have encouraged individuals to use fintech and allowed consumers to have experience using it despite any other issues, like PTC, that may impede consumers from using it. As a result, we suggest the following:

H7: The PIP moderates the relationship between PTC and IU.

Environmental and physical surroundings

This group of persons engages in less physical activities due to environmental issues such as difficult access to facilities, unfavorable neighborhood conditions, bad weather, and safety risks like heavy traffic, a lack of secure spaces, high levels of crime nearby, or unattended canines (Leung et al. 2021). Therefore, if a user finds himself in a situation where none of his demands for going outside are satisfied, he will probably stay home and do business using an online platform. Consumers will likely do this even if they have never utilized internet services or fintech. To put it another way, the scenario makes it necessary for customers to use fintech for virtual transactions or purchasing. This further modifies the nexus between the PTC and the inclination to use fintech. According to earlier research, consumers’ impulsive purchase behavior is influenced by situational variables such as time, money, and task availability (Jung Chang et al. 2014). The association between attitude and intention to utilize technology-based self-service is moderated by situational elements like time, according to Dabholkar and Bagozzi (2002). Similar findings have been made by E. Kim et al. (2017), who discovered how contextual variables, including proximity and CONV, modify the association between relative benefits, compatibility, complexity, and propensity to utilize online services. Crowding may limit or obstruct people’s objectives and discourage shoppers from visiting a busy aisle or making the intended transaction. The “butt-brush” effect caused the consumer to leave the congested area and give up looking for a specific item (Shekhawat and Dahima, 2016). Based on previous studies, we thus propose that:

H8: EPS moderates the relationship between PTC and IU.

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

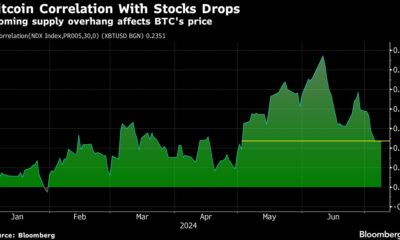

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!