Markets

Is It About to Burst?

Last updated:

May 28, 2024 11:49 EDT

| 9 min read

Critics, both inside and outside the crypto community, contend that the Bitcoin bubble could burst at any time. But is there a bubble at all, or is Bitcoin a store of value against inflationary fiat currencies? Perhaps both could be true, with Bitcoin’s value running ahead of inflation but ultimately being safer than holding cash.

In this guide, we’ll investigate the alleged cryptocurrency bubble, poking at the arguments to see if or when the Bitcoin bubble burst might occur. Let’s talk crypto bubbles.

What is a Bubble?

In financial markets, a bubble refers to an overinflated market that could create massive losses for investors if the bubble pops. The term implies that the price is higher than the underlying value and that when the asset’s price returns to its intrinsic value, many investors — specifically those who invested late — will lose money.

Cryptocurrencies like Bitcoin are seen by many as a speculative bubble because the intrinsic value isn’t always obvious. They’re also intangible. Michael Saylor, a well-known Bitcoin investor, can’t roll around in his bitcoins. It’s all numbers on a screen.

Reasons Why Bitcoin Could Be a Bubble

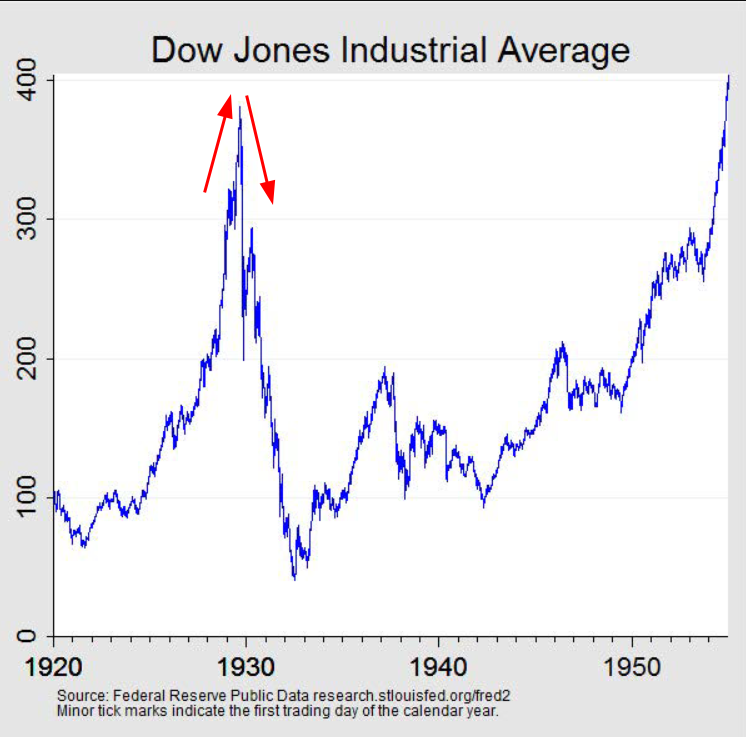

Those who think BTC +0.77%is overpriced often point to the speculative nature of cryptocurrencies and of Bitcoin in particular. Bitcoin’s spectacular crashes lend some credence to the notion that there are Bitcoin bubble cycles. In an extended fall from grace, BTC dropped from its previous $69,000 all-time high in November 2021 to a dustlike $15,500 a year later. Skeptics point to the lack of fundamental value. Let’s discuss all of these elements.

Lack of Intrinsic Value

Intrinsic value refers to the natural or real value of an asset. For example, when discussing stocks, you can consider cash flow and assets to determine the intrinsic value. For real estate, you could again measure cash flow or resale value. If a property is priced above its cash flow or retail potential, it’s priced above its intrinsic value; you’ll likely have to wait longer for the investment to pay off.

In itself, Bitcoin doesn’t have yields or cash flow. It just sits there being numbers on a screen. The whole thing is code, open-source code, in fact. Anyone can copy Bitcoin’s code and make another cryptocurrency that works in the same way. Thus far, over 35,000 people have forked the project, meaning they made a copy that can be studied, tweaked, or rebranded. Given the ease of making a carbon copy, why does Bitcoin have value at all?

Price Driven by Speculation

Free markets excel at price discovery, but not without overshooting or undershooting first in most cases. At first, trading markets are guesses at value or, at best, speculation.

The perils of wild speculation aren’t unique to cryptocurrency bubbles. The dot-com bubble of the late 1990s sent any stock with a dot-com in its name to stratospheric heights. Similarly, the real estate market in the US exploded in the early 2000s. By the late 2000s, housing exploded in a different way, leading to the Great Financial Crisis (GFC).

Many wonder how the price of Bitcoin is determined and what logic lies behind bidding up the price of numbers on a screen and “coins” you can’t hold. To the average person living outside the crypto bubble, it might even seem a bit absurd. Fair point. After all, these are the same traders who speculate on the price of tokens featuring a frog or a dog, none of which are real. Before meme coins, we had Bitcoin, one of the earliest speculative digital assets, and some might say it was the biggest meme coin of all.

Prone to Huge Price Crashes

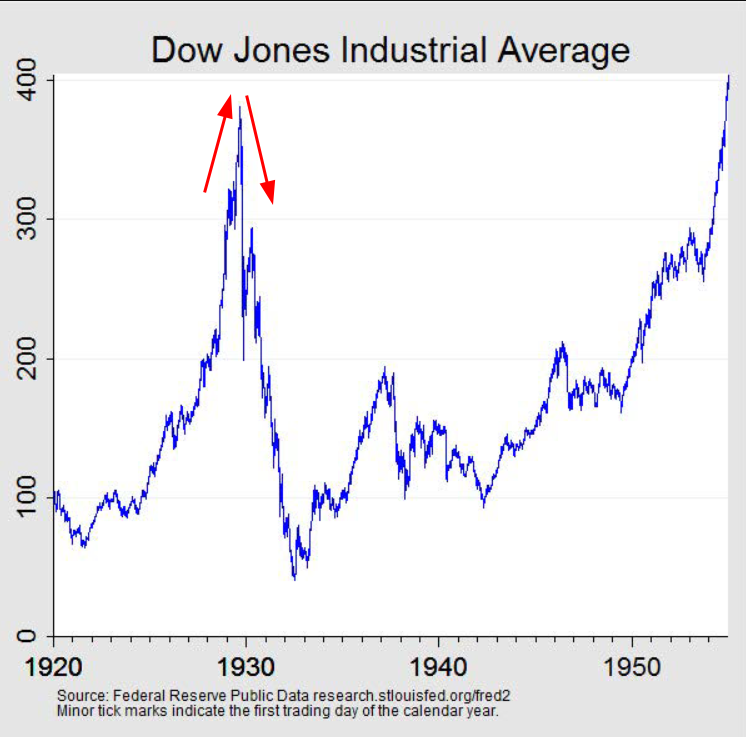

During the beginning of the stock market crash in 1929, the DOW fell by 12% in a single day. The world was horrified, and as the dominoes of an interconnected and overleveraged financial system fell, the Great Depression began.

In a crypto context, a sizable pullback isn’t unusual. In a few hours, the entire crypto market might be raging again to erase losses.

But that volatility can and does lead to much larger crashes. When a 12% loss becomes a 20% loss, followed by another down day, everyone starts selling. Leverage trades keep the crash moving downward as long positions get liquidated, forcing even more sales.

Bitcoin is a digital asset — just numbers on a screen. But when the crypto market crashes, its lower value in USD is real.

Arguments Against Bitcoin Being a Bubble

Okay, so Bitcoin is an intangible digital asset with no intrinsic value that’s crash-prone due to rampant speculation and leveraged positions. Or is it? The arguments against a Bitcoin bubble aren’t so outlandish once you consider the data points. While it’s easy to find crashes on a chart, Bitcoin has been an outstanding hedge against inflation — on a long enough time horizon.

Buyers in 2013 watched Bitcoin rise from under $10 to nearly $14,000 by year-end 2017. While Bitcoin’s price later rose to $69,000 in 2021 and fell thereafter during the bear market, there’s an underlying trend. Ignoring the larger peaks on the chart, bubbles perhaps, the chart slopes upward in a gentle curve. Over time, Bitcoin provided a safe haven against fiat currencies.

Some countries have even adopted Bitcoin as an alternative currency.

Increasing Adoption and Utility

El Salvador led the way in adopting Bitcoin as a legal tender and now even mines Bitcoin to add to the state coffers. The Central African Republic (CAR) also experimented with Bitcoin as a legal tender as well as a Bitcoin-backed currency. Ultimately, the effort failed, largely due to limited internet access. Only about 10% of the country’s population has online access.

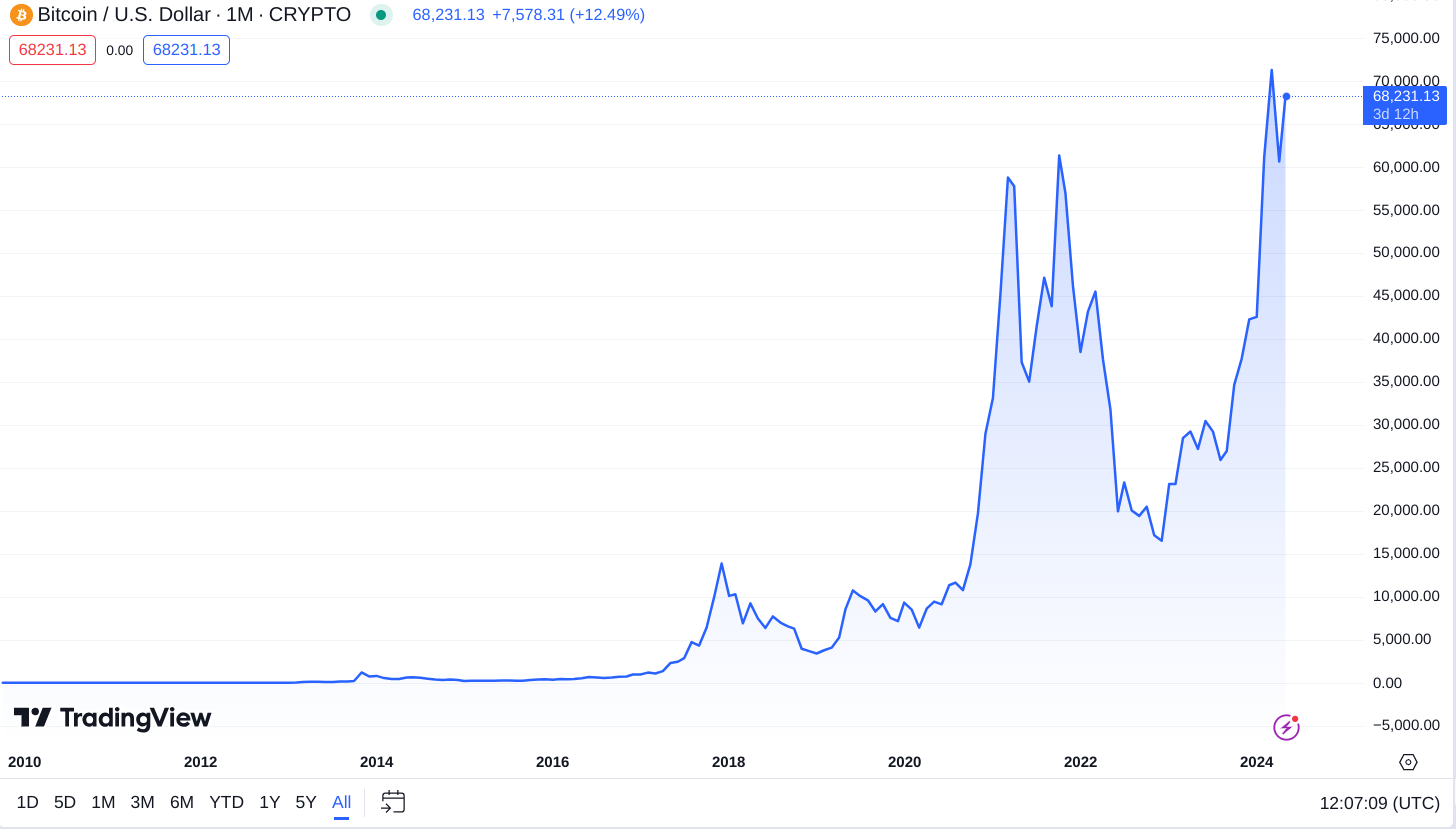

El Salvador remains the largest state-sponsored Bitcoin nation, but others are moving in a similar direction as the population itself adopts Bitcoin. Turkey is ranked 4th worldwide in cryptocurrency transactions. Part of this interest in Bitcoin and cryptocurrencies stems from the steep slide in the value of the Turkish Lira versus other currencies. The resulting price inflation makes cryptocurrencies like Bitcoin an attractive alternative despite the volatility.

Protocols like the Lightning Network make Bitcoin a usable currency for everyday transactions. A standard Bitcoin transaction can be costly, whereas the Lightning Network allows fast transactions that cost just a fraction of a penny. Newer protocols like Stacks promise to bring smart contract functionality to Bitcoin by adding an additional layer that uses the Bitcoin base layer to secure transactions.

Hedge Against Inflation

Turkey’s inflation rate rose to 67% in 2024, encouraging citizens to consider alternative stores of value. Some are trading their Liras for US dollars.

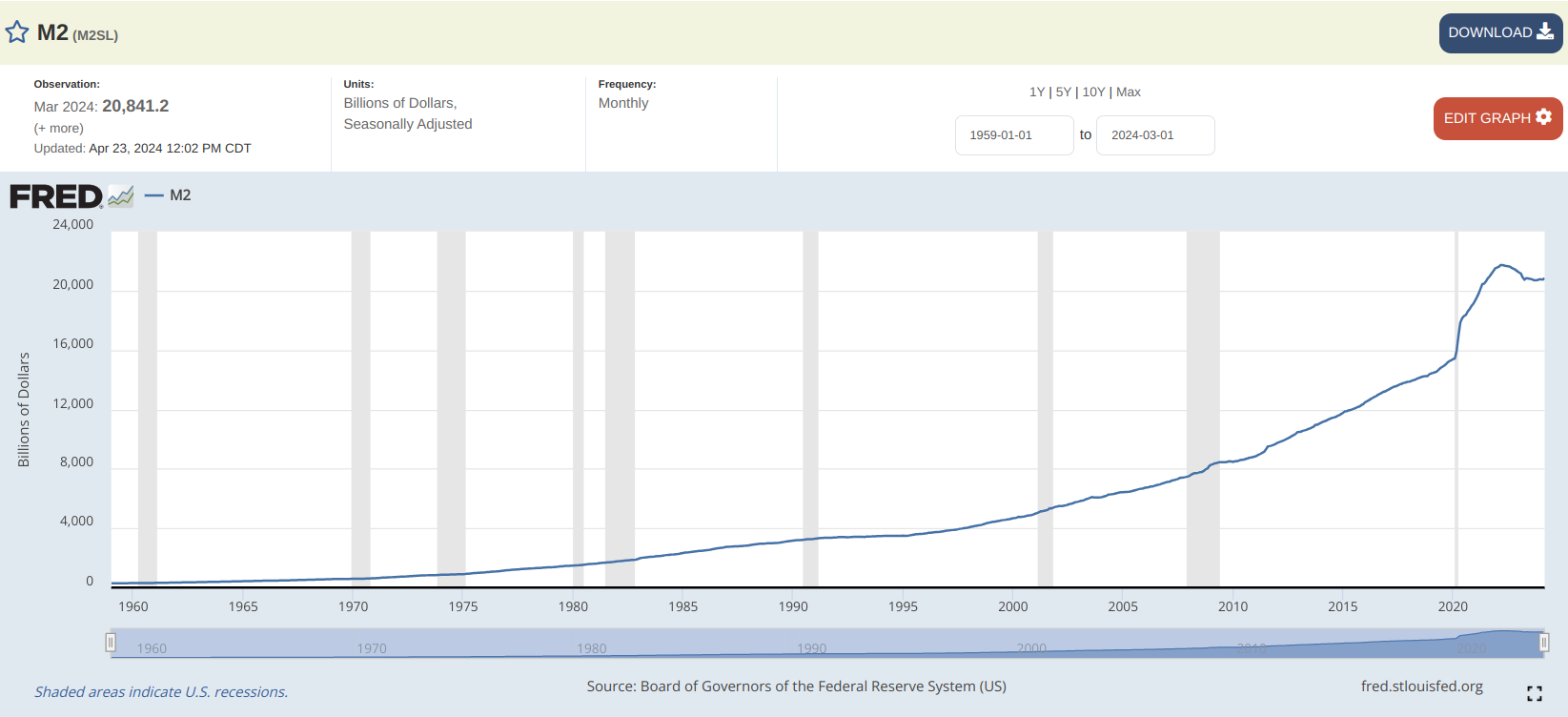

Bitcoin and other digital assets provide sanctuary for others as the US dollar itself is also inflationary. The M2 money supply steadily increased since the US cut its last ties to the gold standard in 1971.

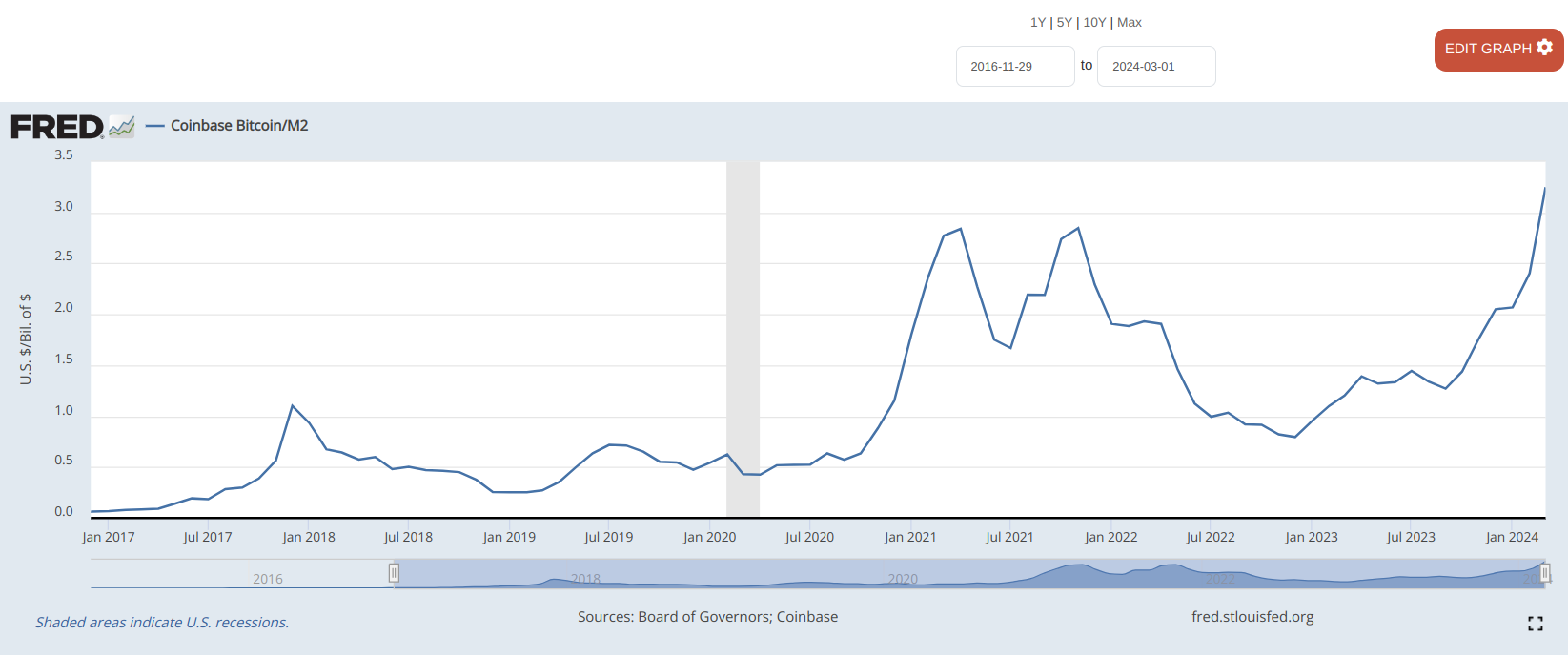

Another chart from the Federal Reserve shows Bitcoin’s price relative to the M2 money supply, with Bitcoin’s price far outpacing the money supply. However, we also have to account for all the other currencies in the world, many of which have seen much higher inflation compared to the US. Interestingly, when viewed against M2, Bitcoin’s peaks are lower relative to Bitcoin’s USD chart shown earlier.

The value of Bitcoin might be better measured by its relationship to world currency supplies rather than its value in units of a specific currency.

Limited Supply and Decentralization

The attraction to Bitcoin, in particular, centers on its limited supply and worldwide network. Bitcoins are still being mined, but the rate of new bitcoins produced by miners has recently halved, with these Bitcoin halvings occurring every four years.

By 2140, we’ll have about 21 million bitcoins, which is all that will ever exist. This hard cap is set in Bitcoin’s code, and while the code can change, a worldwide Bitcoin network of node operators enforces this limit by choosing which version of the code to run. An increase in supply would be against the economic interests of the Bitcoin community, so expect the limit to remain fixed.

By contrast, leading world currencies like the US dollar have no maximum limit. Traditional fiat currencies use debt issuance to create more currency, a process to which many attribute boom and bust cycles, including the Great Financial Crisis (GFC). Bitcoin was released in the aftermath of the GFC.

Will The Bitcoin Bubble Burst in 2024?

Our own Bitcoin price prediction doesn’t see a bubble burst in the near future. Instead, we expect steady growth, with the chart showing fewer parabolic peaks as the market grows and Bitcoin usage worldwide continues to see adoption.

- In 2024, we see Bitcoin’s price reaching as high as $90,000 with a low-end price of $42,000.

- By 2025, our analysis shows that Bitcoin trading will be between $55,000 and $101,000.

- Longer term, we see Bitcoin trading as high as $160,000 by 2030.

Of note, our long-term Bitcoin price predictions favor more conservative projections. Cathie Wood, CEO for ARK Invest, sees Bitcoin reaching as high as $3.8 million by 2030.

Even Bitcoin’s rise in 2024 showed a more cautious approach from investors. Current Bitcoin prices have the token at a level close to the previous high set in 2021. However, the Bitcoin market now benefits from wider use and additional ways to invest through Bitcoin spot ETFs (exchange-traded funds). The role of ETFs could be key in keeping Bitcoin’s price less volatile as the asset reaches a broader audience of investors.

Conclusion

The Bitcoin market can become overbought like other assets, including stocks and real estate. However, this doesn’t always indicate a Bitcoin bubble. Instead, the market got ahead of itself in regard to real-world usage. Speculation and fear of missing out drive the peaks in the Bitcoin market. If the market gets ahead of demand, the price suffers when the market regains its sanity. This often results in oversold conditions and much lower prices as the market cycle runs its course.

Beneath the peaks and valleys of the Bitcoin chart, an underlying pattern tracks just north of the growth in the supply of fiat currencies. The speculation-driven peaks in the chart were bubbles by any definition, but the demand for a sound alternative to fiat currencies remains. For many, Bitcoin is that alternative.

FAQs

What is a crypto bubble?

A crypto bubble refers to periods during which speculation and euphoria combine to create parabolic price movements. Arguably, 2021’s peak represented a speculative bubble that ultimately popped. However, today’s market shows a more measured approach, particularly since the introduction of Bitcoin ETFs that allow a wider market to have a voice in the price of Bitcoin.

Is Bitcoin a bubble?

Bitcoin’s current market doesn’t show the same signs of a bubble as those seen in 2021’s bull market. Leverage plays a role in bubbles, but the introduction of Bitcoin spot ETFs helps reduce the role of leverage in the Bitcoin market while also making crypto trading available to a wider audience of investors.

Does Bitcoin have intrinsic value?

Bitcoin’s value is in its limited supply and worldwide network. While Bitcoin doesn’t have a yield or provide cash flow, traditional ways to measure intrinsic value, it serves as a sound alternative to traditional inflationary fiat currencies. Bitcoin’s supply is fixed at a maximum of 21 million bitcoins.

References

About the Author

Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined with a consumer advocate stance brought Eric to the crypto industry, where he writes articles and guides aimed at making crypto easier to understand.

Markets

Crypto Markets Rebound as Spot Bitcoin ETFs Attract Massive Inflows

This week saw $722 million worth of Bitcoin spot ETF inflows, including the largest daily inflow in a month.

Cryptocurrency markets rallied on Wednesday, driven by inflows into spot Bitcoin exchange-traded funds (ETFs).

The price of Bitcoin (BTC) is up 3% over the past 24 hours to last change hands at $65,200, according to CoinGecko. Ethereum (ETH) is up 2% and is trading at $3,471. Solana (SUN) and Polkadot (POINT) increased by 4%.

Bitcoin spot ETFs saw $422 million in daily inflows on Tuesday, the highest in the past 30 days, according to Far side data, . The all-time record for a single day was $1.05 billion on March 12.

Among Tuesday’s top contributors, BlackRock’s IBIT led with $260 million in inflows, followed by Fidelity’s FBTC with $61 million. This week has already seen more than $722 million in inflows.

Among the top 100 cryptocurrencies by market cap, Worldcoin (WLD) led with a 28% increase, followed by Helium (HNT) with 20% and Lido DAO (LDO) with 15%.

Worldcoin, a decentralized identity project led by OpenAI CEO Sam Altman, announced is extending the lockups for early investors and team members. This means that tokens will be gradually released through 2029, instead of the original 2027 plan. Token unlocks are generally seen as a negative because they increase supply and early investors can sell their tokens for profit.

Meanwhile, XRP, the token of the XRP Ledger network, jumped 8% after the CME and CF benchmarks introduced new indices and reference rates for XRP.

U.S. stocks faced a downturn on Wednesday. The S&P 500 fell 1%, while the Nasdaq Composite and Dow Jones Industrial Average both fell 2%.

Markets

Altcoins on the cusp of a major breakout – WLD, AR, and INJ prices could surge by 20% in the coming days

Crypto markets appear to have been taken over by the bulls as major tokens have surged above their crucial resistance zone. Bitcoin surged above $65,000 while Ethereum was above $3,500, and XRP, which had remained passive for quite some time, surged over 40% in the past few days to hit $0.6. The uptrend has been captured in most altcoins, with Worldcoin (WLD), Arweave (AR), and Injective (INJ) leading the rally. Here’s what to expect for these tokens in the coming days.

Worldcoin (WLD) Price Analysis

O Worldcoin Price has been trading inside a descending wedge since it marked a new ATH near $12 in the final days of Q1 2024. The recent price action helped the price break out of the upper resistance of the wedge, breaking above the crucial resistance zone between $2.21 and $2.39. Market sentiments have changed, but technicals suggest that the bulls may remain passive for a while, which could offer some room for a bearish pullback.

The price broke out of the wedge with a significant increase in volume, but the current volume suggests that the bulls have taken a step back. Meanwhile, the RSI is about to reach the upper boundary, which could attract bearish forces. Additionally, the DMI has undergone a bullish crossover, but the decline in the ADX suggests that the rally may remain consolidated above the gains. Therefore, the WLD price is expected to maintain a horizontal consolidation between $3 and $3.3 and trigger a fresh rally to $4.4 during the next bullish rally.

Arweave (AR) Price Analysis

Arweave formed a strong base around $25, which helped the rally trigger a recovery during the bearish attack. Mt. Gox and German terror forced the price to fall below $20. However, the recent price action has brought the altcoin within the bullish range and raised expectations of maintaining a decent uptrend for a few more days.

AR price has hit one of the major resistances around $30 to $31.5, which could act as a strong base once overcome. The buying volume is slowly increasing, which could keep the bullish hopes for the rally high. Moreover, the supertrend has just flashed a buy signal, indicating a clean reversal of the trend. Therefore, AR price seems primed to maintain a healthy uptrend and rally above $40. However, if the bulls maintain a similar trend, making new highs above $50 may not be a tedious task for the bulls.

Price Analysis of Injective (INJ)

Injective price has been showing sharp strength since the beginning of the year and hence, the recent turnaround is expected to revive a good uptrend going forward. The bears engulfed the rally to a large extent, but the recent price action suggests that the bulls have regained their dominance. Therefore, INJ price is expected to maintain a strong uptrend with a bearish interference on the way down.

INJ price has surged above the lower support zone and has registered consecutive bullish candles. Although the volume is below the required levels, the OBV is maintaining a sharp uptrend. Furthermore, the Ichimoku cloud lead span B is heading towards the lead span A and a healthy crossover indicates the start of a new uptrend. However, INJ price may be out of the bears’ reach once it secures the resistance zone between $30.77 and $32.12, which seems to be on the horizon.

Markets

Ethereum at $3.5K, Exchange Supply Hits 34-Month High

Ethereum (ETH) supply on exchanges has hit a 34-month high as the asset’s price surpassed the $3,500 mark.

ETH has risen 2.3% over the past 24 hours and is trading at $3,490 at the time of writing. The second-largest cryptocurrency — with a market cap of $419 billion — briefly touched an intraday high of $3,517 earlier today.

ETH Price, Whale Activity, RSI, and Exchange Supply – July 17 | Source: Santiment

Ethereum’s daily trading volume also increased by 7.6% to reach $19.8 billion.

According to data provided by Santiment, the supply of Ethereum on exchanges has reached $19.52 million ETH. This level was last seen in September 2021, when the asset was trading around the same price.

On the other hand, data from the market intelligence platform shows that the number of whale transactions has fallen by 12% in the last day — falling from 8,730 to 7,629 unique transactions per day.

The move shows that the supply of Ethereum on exchanges has been increasing with small deposits rather than large transactions from whales.

Additionally, the ETH Relative Strength Index (RSI) is currently hovering at the 60-mark, per Santiment. The indicator shows that Ethereum is slightly overbought at this price point, but it may not be in a critical position due to its large market cap.

One of the main drivers of Ethereum price increase is ETH spot expectations ETFs in the US Investment products are scheduled to start trading on July 23rd.

Markets

Bits + Beeps: How to Play the ‘Trump Trade’ in Cryptocurrencies After the Assassination Attempt

Also, how much will the Fed cut rates (and when)? What will be the inflows into ETH ETFs? And what is the near future for Bitcoin?

Posted on July 17, 2024 at 12:00 PM EST.

Listen to the episode at Apple Podcasts, Spotify, Capsules, Source, Podcast Addict, Pocket molds, Amazon Musicor on your favorite podcast platform.

In this episode of Bits + Bips, hosts James Seyffart, Alex Kruger and Joe McCann, joined by guest Jack Platts, dive into the market reaction to the recent assassination attempt on former President Donald Trump, analyzing how this event will influence the 2024 US presidential election and the cryptocurrency markets.

They also cover potential rate cuts: Could there be a cut in July? How big could the September rate cut be? Could the decision be influenced by the upcoming election?

They also give their predictions on what percentage of BTC ETF inflows the ETH ETFs will reach, and James talks about what he expects for Grayscale’s ETHE (hint: his outlook would be positive for ETH).

Finally, they delve into what’s next for Bitcoin as the German government runs out of BTC and Mt. Gox distributions begin. Just now?

Program Highlights:

- Whether Trump’s shooting decided the election and whether the event caused a “flight to safety”

- How election markets are becoming a place to watch election probabilities and whether cryptocurrencies “lean right”

- Whether rate cuts will occur in July or September and by how much they will cut: 25 bps or 50 bps

- How Joe sees the relationship between global liquidity cycles, rate cuts, and the potential rise of Bitcoin

- What are the new updates about Ethereum ETFs and their expected launch?

- Why Solana Hasn’t Performed Significantly Better Since Trump News

- What Market Breadth Indicates About the Current Market Rally and the Impact of Rates on Small Caps

- Everyone’s predictions on ETH ETF inflows and how much outflow we’ll see on Grayscale’s ETHE

- What’s Next for BTC After German Government Exits Bitcoin and Mt. Gox Giveaways Starting This Week

Hosts:

Guest:

- Jack PlattsCo-Founder and Managing Partner of Hypersphere Ventures

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto