DeFi

Le rapport de recherche de Binance dévoile une croissance transformatrice sur les marchés DeFi

Binance Research a publié son dernier rapport complet, « Breakthrough DeFi Markets », révélant une croissance remarquable et des innovations transformatrices au sein du secteur de la finance décentralisée (DeFi) en 2024. Le rapport met en évidence un afflux important de capitaux, des expansions substantielles du marché et des tendances émergentes qui sont prêt à redéfinir le paysage DeFi

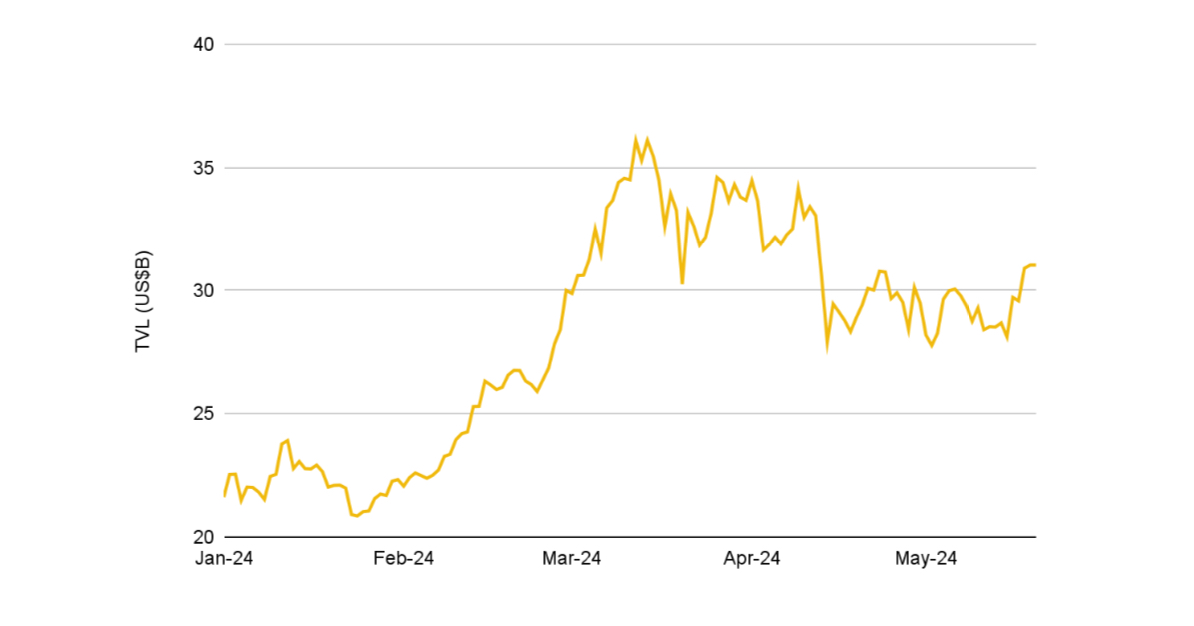

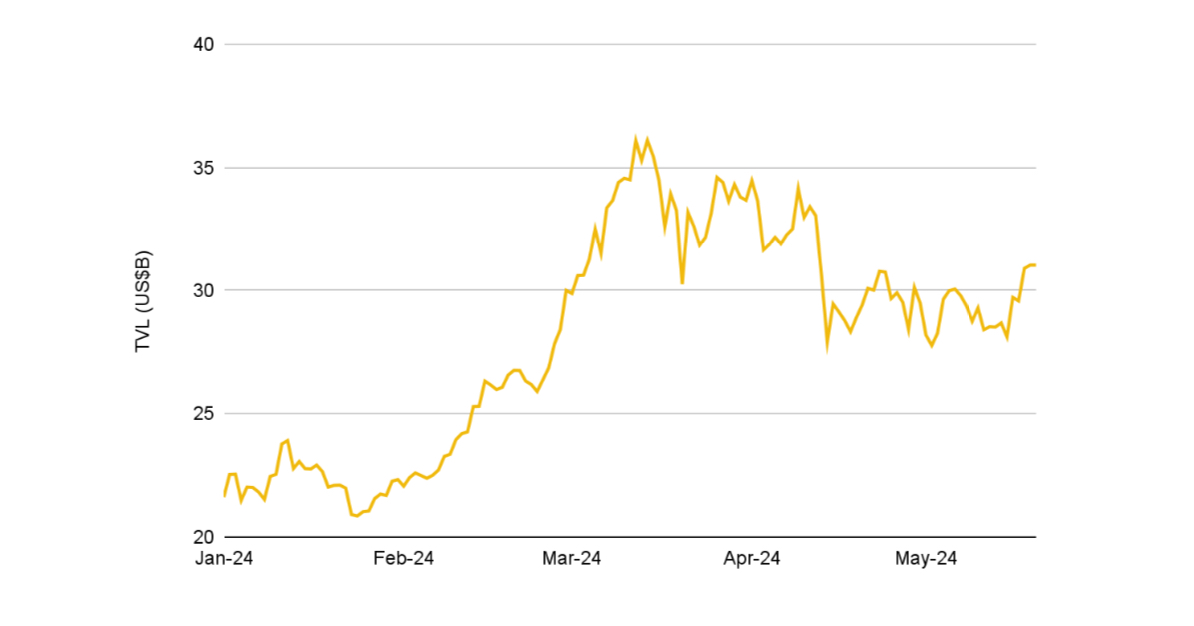

Croissance explosive de la valeur totale bloquée

La valeur totale verrouillée (TVL) dans DeFi a grimpé de 75,1 % depuis le début de l’année (YTD), atteignant le montant stupéfiant de 94,9 milliards de dollars. Cette croissance robuste souligne un afflux important de capitaux et une confiance croissante des investisseurs dans l’écosystème DeFi. Les investisseurs et les parties prenantes reconnaissent de plus en plus le potentiel et la résilience des plateformes DeFi, ce qui conduit à une adoption et une expansion généralisées de divers services financiers.

Graphique de croissance DeFi TVL. Source : DefiLlama, The Block, Binance Research, au 20 mai 2024

Graphique de croissance DeFi TVL. Source : DefiLlama, The Block, Binance Research, au 20 mai 2024

Expansion du marché des rendements

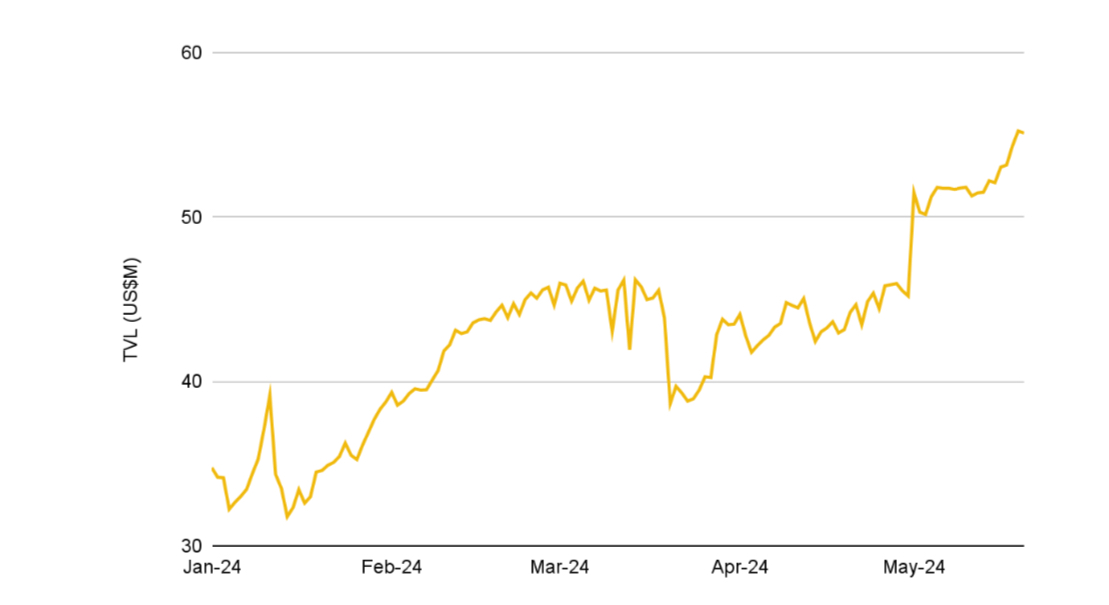

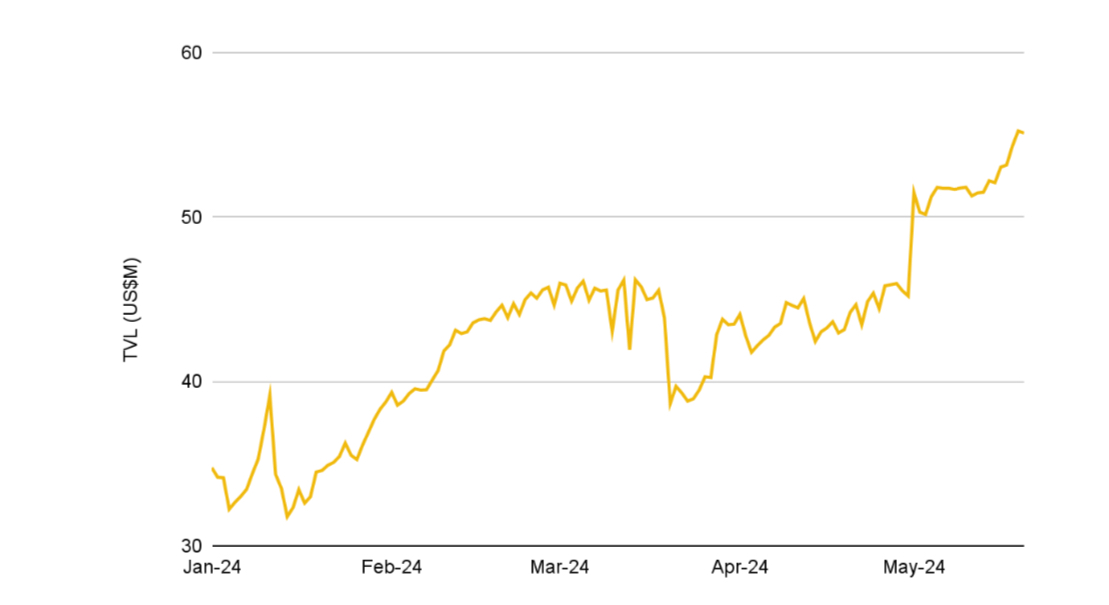

L’un des éléments marquants de cette croissance a été le marché des rendements, qui a connu une croissance impressionnante de 148,6 % pour atteindre 9,1 milliards de dollars en TVL. Pendle, un protocole de trading de rendement, a été à l’avant-garde de cette expansion. Le TVL de Pendle a grimpé en flèche de 1 962 % depuis le début de l’année, pour atteindre 4,8 milliards de dollars, sous l’effet de la hausse des actifs porteurs de rendement et de la volatilité accrue des taux. En symbolisant les actifs générateurs de rendement en jetons de rendement standardisés, Pendle a démocratisé l’accès aux dérivés de taux d’intérêt. Cela permet aux utilisateurs de spéculer, de couvrir et d’exécuter des stratégies avancées sur des actifs porteurs de rendement, améliorant ainsi considérablement la participation et la liquidité du marché.

Courbe de croissance de Pendle. Source : DefiLlama, Binance Research, au 20 mai 2024

Courbe de croissance de Pendle. Source : DefiLlama, Binance Research, au 20 mai 2024

L’approche innovante de Pendle permet aux utilisateurs d’obtenir des rendements fixes, de tirer parti du rendement d’un actif sous-jacent ou d’employer une combinaison de stratégies. Son succès témoigne de l’appétit croissant pour les instruments financiers sophistiqués dans l’espace DeFi, reflétant la maturation du secteur et la complexité croissante de ses offres.

Hausse du marché des pièces stables

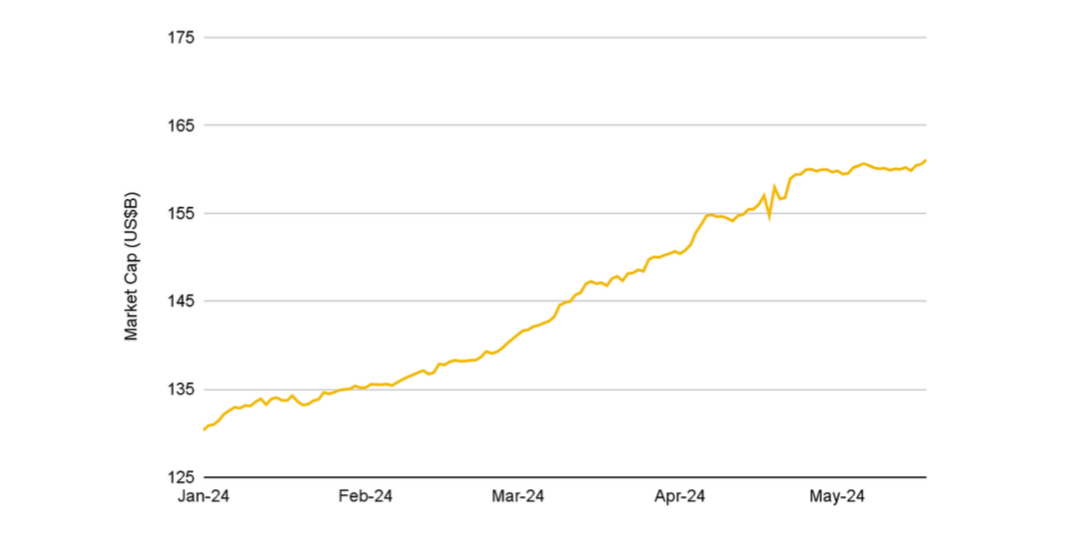

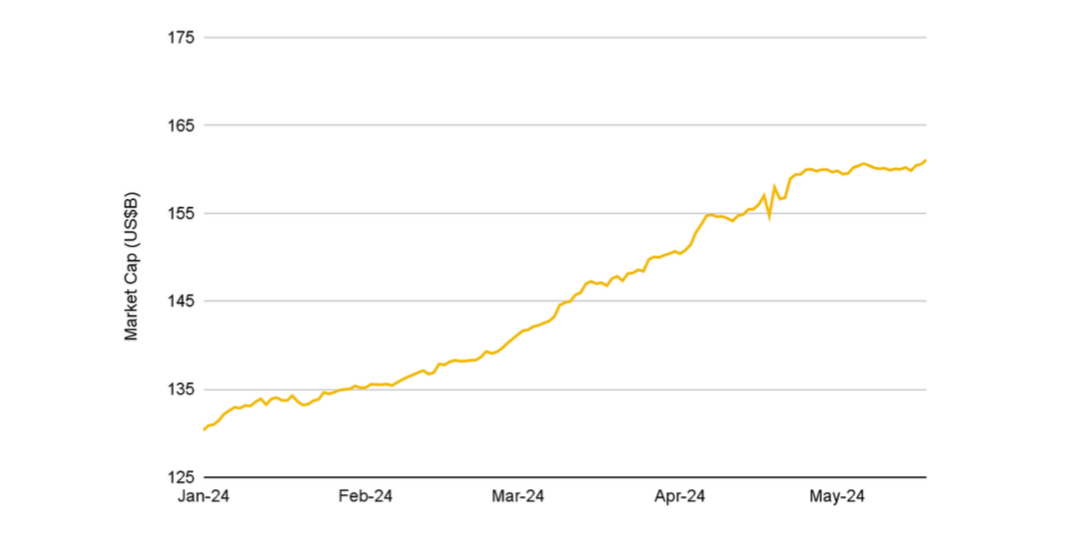

Dans le même temps, le marché des pièces stables a connu une expansion substantielle, la capitalisation boursière des pièces stables atteignant 161,1 milliards de dollars, la plus élevée depuis près de deux ans. Ethena, avec son stablecoin innovant USDe, a joué un rôle central dans cette croissance. L’USDe d’Ethena a connu une augmentation remarquable de 2 730,4 % de sa capitalisation boursière, pour atteindre 2,4 milliards de dollars. Le secret du succès d’Ethena réside dans sa stratégie unique delta neutre, qui combine des taux de financement d’ETH mis en jeu et de contrats à terme perpétuels, offrant des rendements attractifs et une pénétration substantielle du marché.

Graphique de la capitalisation boursière stable des pièces. Source : DefiLlama, Binance Research, au 18 mai 2024

Graphique de la capitalisation boursière stable des pièces. Source : DefiLlama, Binance Research, au 18 mai 2024

L’approche d’Ethena répond à la demande de longue date de pièces stables à rendement, à la fois efficaces en termes de capital et capables de s’intégrer de manière transparente à l’écosystème DeFi plus large. En tirant parti du rendement des ETH mis en jeu et des taux de financement positifs des contrats à terme perpétuels, Ethena a créé un stablecoin qui non seulement maintient son ancrage, mais génère également des rendements importants pour ses détenteurs. Ce modèle représente une avancée significative dans l’espace des stablecoins, offrant une alternative viable aux stablecoins traditionnels et centralisés et offrant aux utilisateurs une plus grande flexibilité et un plus grand potentiel de gains.

Évolution des marchés monétaires

Les marchés monétaires en chaîne ont également considérablement évolué, le TVL sur les marchés monétaires ayant augmenté de 47,2 %, totalisant 32,7 milliards de dollars. Cette croissance a été alimentée par la demande de produits de prêt plus flexibles. Morpho, un protocole de prêt modulaire, a été à l’avant-garde de cette évolution. Depuis le lancement de Morpho Blue et MetaMorpho en janvier 2024, Morpho a attiré plus de 1,2 milliard de dollars de dépôts. Ces protocoles mettent en valeur le potentiel des prêts modulaires, offrant un nouveau niveau de flexibilité et d’efficacité sur le marché des prêts.

Graphique de croissance TVL du marché monétaire. Source : DefiLlama, Binance Research, au 20 mai 2024

Graphique de croissance TVL du marché monétaire. Source : DefiLlama, Binance Research, au 20 mai 2024

Morpho Blue permet la création de marchés de prêts isolés avec des paramètres de risque personnalisés, offrant aux utilisateurs un meilleur contrôle sur leurs activités de prêt et d’emprunt. MetaMorpho s’appuie sur cela en permettant une gestion des risques sans autorisation et la création de coffres-forts de prêt qui regroupent les liquidités sur plusieurs marchés. Cette approche modulaire répond aux limites des pools de prêts multi-actifs traditionnels, telles que la fragmentation de la liquidité et l’inefficacité, en offrant une solution plus adaptée et plus efficace.

La conception innovante de Morpho a attiré une attention et des capitaux importants, soulignant la demande croissante de solutions de prêt plus flexibles et efficaces dans l’espace DeFi. À mesure que le marché continue d’évoluer, l’approche de Morpho est susceptible d’établir une nouvelle norme pour les protocoles de prêt en chaîne, stimulant ainsi l’innovation et la croissance du secteur.

Résurgence des marchés de prédiction

Un autre fait marquant de 2024 a été la résurgence des marchés de prédiction. TVL sur les marchés de prédiction a atteint un nouveau sommet, atteignant un record de 55,1 millions de dollars après une hausse de 57,7 % depuis le début de l’année. Polymarket, une plateforme leader sur Polygon, a vu les volumes de transactions passer de 6,1 millions de dollars en 2023 à un chiffre impressionnant de 42,0 millions de dollars en 2024. Cette croissance a été stimulée par des événements mondiaux majeurs, notamment la prochaine élection présidentielle américaine, qui a suscité un intérêt spéculatif important.

Graphique de croissance TVL du marché de prévision. Source : DefiLlama, Binance Research, au 20 mai 2024

Graphique de croissance TVL du marché de prévision. Source : DefiLlama, Binance Research, au 20 mai 2024

Les marchés de prédiction permettent aux utilisateurs de négocier et de spéculer sur l’issue d’événements futurs, créant ainsi un environnement de marché dynamique et interactif. Le succès de Polymarket a été alimenté par sa capacité à offrir un large éventail de marchés de prédiction, depuis les événements politiques jusqu’aux sports et divertissements. Cette diversité a attiré une large base d’utilisateurs et augmenté la liquidité, faisant de Polymarket une plateforme leader dans le domaine du marché de la prédiction.

La résurgence des marchés de prédiction met en évidence l’intérêt croissant pour les plateformes décentralisées qui offrent aux utilisateurs la possibilité de s’engager dans des activités de trading spéculatif et de couverture. À mesure que ces marchés continuent de mûrir, ils joueront probablement un rôle de plus en plus important dans l’écosystème DeFi, fournissant des informations et des données précieuses sur un large éventail de sujets.

Boom des produits dérivés en chaîne

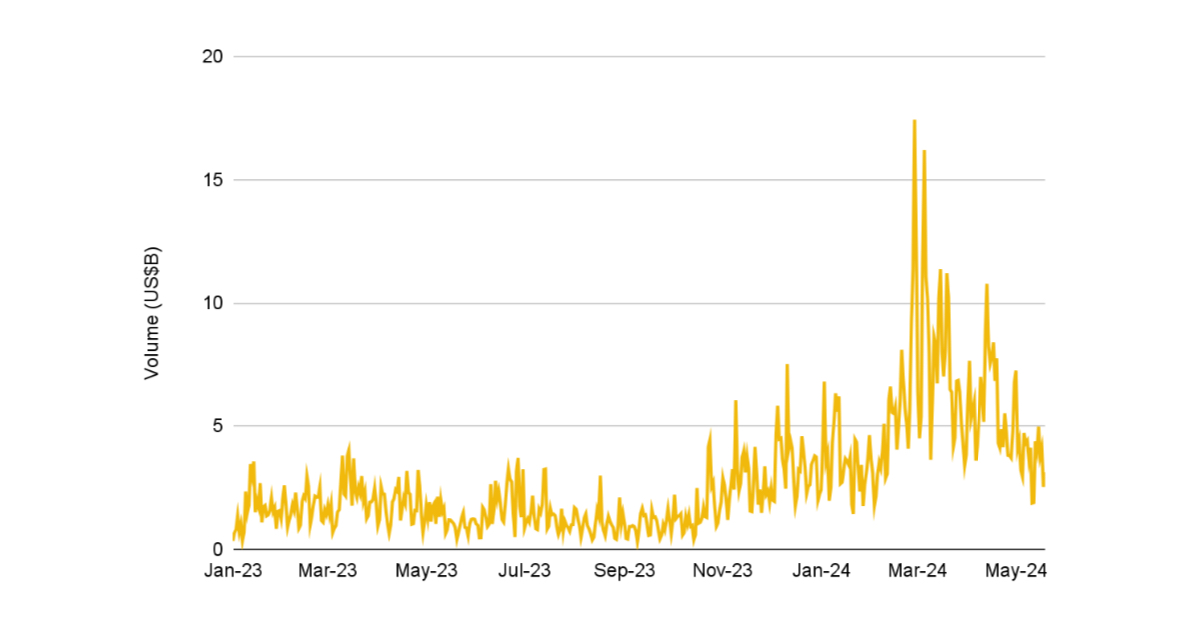

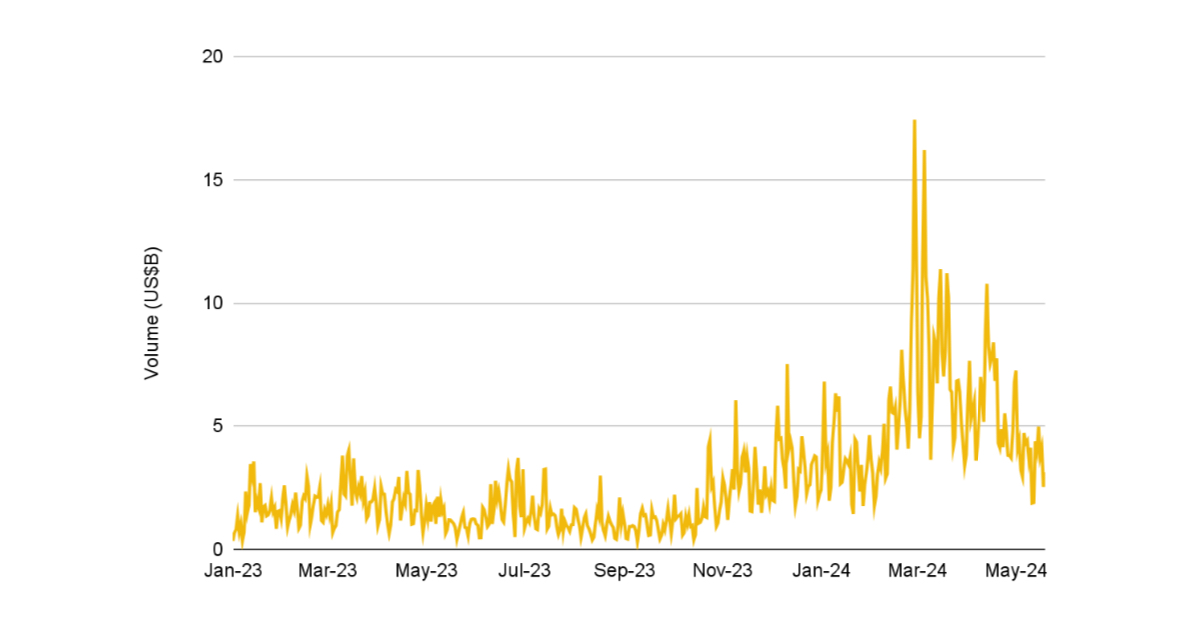

Dans le domaine des produits dérivés en chaîne, il y a eu un boom important. Les volumes quotidiens moyens de produits dérivés en chaîne ont considérablement augmenté, passant de 1,8 milliard de dollars l’année dernière à 5,4 milliards de dollars cette année. Hyperliquid, un DEX à terme perpétuel basé sur un carnet d’ordres L1, a capitalisé sur cette tendance, capturant une part de marché de 18,9 %. Avec des volumes quotidiens dépassant le milliard de dollars, Hyperliquid s’est imposé comme un acteur majeur sur le marché des produits dérivés, offrant des frais compétitifs et une expérience de trading centralisée de type bourse.

Graphique de croissance du volume des produits dérivés en chaîne. Source : Artemis, Binance Research, au 20 mai 2024

Graphique de croissance du volume des produits dérivés en chaîne. Source : Artemis, Binance Research, au 20 mai 2024

La plateforme Hyperliquid est conçue pour offrir aux traders une expérience de trading transparente et efficace, avec une exécution haute performance et une liquidité importante. En fonctionnant sur sa propre blockchain de couche 1, Hyperliquid garantit que toutes les transactions sont traitées rapidement et en toute sécurité, offrant ainsi aux utilisateurs la confiance et la fiabilité dont ils ont besoin pour s’engager dans des transactions à haute fréquence.

Le succès d’Hyperliquid reflète la demande croissante de plateformes de trading sophistiquées offrant les avantages de la décentralisation sans compromettre les performances ou l’expérience utilisateur. Alors que le marché des dérivés en chaîne continue de croître, Hyperliquid est bien placé pour conquérir une part importante de ce marché en expansion, stimulant ainsi l’innovation et la concurrence dans le secteur.

Pleins feux sur les protocoles clés

Pendle a été le pionnier du trading de rendement en chaîne, permettant aux utilisateurs de spéculer, de se couvrir et d’exécuter des stratégies avancées sur des actifs générateurs de rendement. En symbolisant ces actifs en jetons de rendement standardisés, Pendle a démocratisé l’accès aux dérivés de taux d’intérêt, ce qui a entraîné une croissance phénoménale. L’approche innovante de Pendle lui a permis de conquérir une part importante du marché du rendement, le positionnant comme un leader dans l’espace DeFi.

Ethena a introduit un stablecoin à delta neutre, USDe, qui exploite les taux de financement des ETH mis en jeu et des contrats à terme perpétuels pour offrir des rendements attractifs. Cette approche innovante a porté la capitalisation boursière d’Ethena à 2,4 milliards de dollars, ce qui en fait le cinquième plus grand stablecoin. Le succès d’Ethena met en évidence la demande croissante de pièces stables à rendement offrant à la fois stabilité et potentiel de revenus.

Morpho a redéfini le marché des prêts grâce à son approche modulaire, permettant la création de marchés de prêts isolés avec des paramètres de risque personnalisés. Morpho Blue et MetaMorpho ont ensemble attiré une attention considérable, avec des dépôts dépassant 1,2 milliard de dollars. Ce modèle répond aux limites des pools de prêts multi-actifs traditionnels en offrant une flexibilité et une efficacité inégalées, faisant de Morpho un acteur clé dans le domaine des prêts DeFi.

Polymarket, l’une des principales plateformes de marché de prédiction sur Polygon, a connu une croissance substantielle des volumes de transactions et de l’engagement des utilisateurs. Avec des volumes mensuels moyens atteignant 42,0 millions de dollars en 2024, Polymarket a capitalisé sur des événements majeurs comme l’élection présidentielle américaine, suscitant un intérêt spéculatif important. Le succès de Polymarket reflète l’intérêt croissant pour les plateformes décentralisées qui offrent aux utilisateurs la possibilité de s’engager dans des activités de trading spéculatif et de couverture.

Hyperliquid exploite un DEX à terme perpétuel hautes performances entièrement en chaîne sur sa propre blockchain de couche 1. Avec des volumes quotidiens dépassant le milliard de dollars, Hyperliquid a surpassé de nombreux concurrents, offrant des frais compétitifs et une expérience de trading de type CEX. Sa part de marché est passée à 18,9 %, démontrant sa forte position sur le marché des produits dérivés. La plateforme Hyperliquid est conçue pour offrir aux traders une expérience de trading transparente et efficace, avec une exécution haute performance et une liquidité importante.

Perspectives d’avenir

Le rapport de Binance Research souligne le potentiel de transformation de DeFi, en mettant en avant les protocoles innovants et les expansions du marché qui devraient stimuler la prochaine phase de croissance. À mesure que DeFi continue d’évoluer, les marchés et protocoles révolutionnaires identifiés dans ce rapport joueront un rôle crucial dans l’avenir du secteur. Les développements en cours de DeFi sont susceptibles de conduire à une plus grande inclusion financière, à une efficacité accrue et à des opportunités d’investissement plus diversifiées pour les utilisateurs du monde entier.

Le rapport souligne également l’importance de la clarté réglementaire et des progrès technologiques pour stimuler la croissance durable du secteur DeFi. À mesure que de plus en plus d’investisseurs institutionnels entrent dans l’espace et que les cadres réglementaires évoluent, l’écosystème DeFi est sur le point de se développer davantage et d’être adopté par le grand public.

Pour plus de détails et accéder au rapport complet, visitez Recherche Binance

DeFi

DeFi Technologies Appoints Andrew Forson to Board of Directors

TORONTO, July 31, 2024 /PRNewswire/ – DeFi Technologies Inc. (the “DeFi Technologies”)Business” Or “DeFi Technologies“) (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company pioneering the convergence of traditional capital markets with the world of decentralized finance (“Challenge“), is pleased to announce the appointment of Andrew Forson to its Board of Directors (the “Advice“).

Andrew Forson is a financial and risk engineer, software architect, and trusts and estates specialist. He currently serves as Head of Investments and Ventures for Hashgraph Group, the commercialization and enablement arm of Hedera, where he has been instrumental in driving strategic investments and driving innovation in the digital asset sector.

Mr. Forson brings a wealth of experience gained through his extensive background in developing structured financial products and his deep knowledge of the digital asset landscape. His expertise will be invaluable as DeFi Technologies continues to expand its suite of innovative financial products and services.

“We are thrilled to welcome Andrew to our Board of Directors,” said Olivier Roussy Newton, CEO of DeFi Technologies. “His extensive background in financial engineering and forward-thinking approach to digital assets will be a tremendous asset to our company as we continue to lead the way in the digital asset space.”

Andrew Forson holds an MBA from the prestigious Edinburgh Business School. His arrival on the board is part of DeFi Technologies’ drive to strengthen its management team and enhance its strategic capabilities in the evolving digital finance sector.

About DeFi Technologies

DeFi Technologies Inc. (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT) is a financial technology company that is at the forefront of the convergence of traditional capital markets with the world of decentralized finance (DeFi). By focusing on cutting-edge Web3 technologies, DeFi Technologies aims to provide investors with widespread access to the future of finance. Backed by a team of esteemed experts with extensive experience in financial markets and digital assets, we are committed to revolutionizing the way individuals and institutions interact with the evolving financial ecosystem. Join the DeFi Technologies digital community on Linkedin And Twitterand for more details visit https://defi.tech/

About Valour

Valor Inc. and Valor Digital Securities Limited (together, “Value“) issues exchange-traded products (“AND P”) that allow retail and institutional investors to access digital assets like Bitcoin simply and securely through their traditional bank account. Valor is part of DeFi Technologies Inc.’s (CBOE CA: CHALLENGE) (GR: R9B) (OTC: DEFAULT).

In addition to their new digital asset platform backed by physical media, which includes 1Valour Carbon Neutral Physical Bitcoin AND P, 1Valour Ethereum Physical StakingAnd 1Valor Internet Computer Physical StakingValour offers fully hedged digital asset ETPs with low to no management fees, with product listings on European exchanges, banks and brokerage platforms. Valour’s existing product range includes Valour Uniswap (United), Cardan (ADA), Peas (POINT), Solana (GROUND), Avalanche (AVAX), Cosmos (ATOM), Binance (BNB), Ripple (XRP), Toncoin (TONNE), Internet computer (PCI), Chain link (LINK), Heart (HEART), Close (CLOSE), Enjin (ENJ), Valor Bitcoin Staking (Bitcoin), Bitcoin Carbon Neutral (BTCN), Hedera (HBAR), Valor 10 Digital Asset Basket (VDAB10) And 1Valour STOXX Bitcoin Suisse Digital Asset Blue Chip ETPs with low management fees. Valour’s flagship products are Bitcoin Zero and Ethereum Zero, the first passive investment products fully hedged with Bitcoin (Bitcoin) and Ethereum (ETH) as underlyings which are completely free of fees.

For more information about Valour, to subscribe, or to receive updates and financial information, visit valor.com.

Caution regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, the appointment of Mr. Forson; the regulatory environment regarding the growth and adoption of decentralized finance; the Company’s and its subsidiaries’ pursuit of business opportunities; and the potential merits or returns of such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but are not limited to, the growth and development of the decentralized finance and digital asset industry; the rules and regulations relating to decentralized finance and digital assets; and general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results to differ from those anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update forward-looking statements, except in accordance with applicable securities laws.

CBOE CANADA EXCHANGE ACCEPTS NO RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

![]() Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

Show original content to download multimedia:https://www.prnewswire.com/news-releases/defi-technologies-appoints-andrew-forson-to-board-of-directors-302210849.html

SOURCE DeFi Technologies Inc.

DeFi

Is Zypto Wallet a Reliable Choice for DeFi Users?

Zypto wallet is a newcomer in the crypto landscape and has already made waves for its exclusive benefits and security features.

In this article, we will take a look at the Zypto crypto wallet and how it can help users securely manage their digital assets, interact with Web3 applications, and explore the world of Challenge.

What is Zypto Wallet?

Zypto App is a newly launched versatile crypto wallet that supports a wide range of coins and tokens, along with seamless access to Web3 applications, token exchanges, virtual crypto cards, a gift card marketplace, and a payment gateway.

What are the pros and cons of Zypto Wallet?

Benefits

- User-friendly: Zypto’s user interface is very intuitive with a simple setup process.

- Multi-Chain DEX Swaps: Zypto facilitates trading between thousands of cryptocurrencies, thanks to its versatile multi-chain token swap feature.

- Built-in dApp Browser: You can access Web3 applications directly in your wallet using the in-app dApp browser.

- Live Customer Support: The wallet has an in-app live customer support team that responds quickly to all your queries.

- Rewards Program: Zypto has a loyalty program that allows you to earn rewards, improving the overall user experience.

- Virtual crypto cards: The wallet makes it easy and reliable to use digital currencies for everyday transactions through its range of virtual cryptocurrency cards.

The inconvenients

- Limited analysis tools: Zypto offers advanced charting features and limited technical analysis tools that might not appeal to experienced cryptocurrency traders.

What DeFi products and services does Zypto Wallet offer?

Zypto allows you to securely manage a wide range of cryptocurrencies across multiple blockchains, acting as a user-friendly entry point into the Web3 ecosystem.

Multi-Chain Wallet

As a multi-chain wallet, Zypto supports hundreds of thousands of digital assets across different blockchains. Zypto is also committed to adding support for more chains in the coming months, expanding its universe of explorable assets.

Multi-Chain Exchange Functionality

Instead of the tedious process of selling one token on one exchange and buying another of the same type hosted on a different blockchain, Zypto offers a cross-chain swap feature.

DApp Browser

Another easy-to-use feature is the in-app dApp browser. Simply bring up the browser from the small globe icon at the bottom of your screen and it will first take you to the Zypto homepage.

The browser provides all the features under one application so you don’t miss anything that warrants opening a separate browser.

Zypto DeFi Wallet Review

User experience

Zypto’s ease of use is one of its main advantages. Once the app is downloaded, you can view your wallet from the home screen. Other buttons at the bottom of your screen will take you to prepaid virtual cards, an Explore Zypto page, where you can send, receive, exchange, buy and sell tokens, or access the dApp browser and your contact list.

Zypto requires KYC information before processing cards, as it is part of regulatory compliance. Contacts are another benefit: instead of tediously copying and pasting long addresses, simply save them under a contact name.

How to set up your Zypto wallet?

To start using Zypto, simply download the app. Once installed, you’re ready to go.

You can create a new wallet by pressing the Create Wallet button or import an existing wallet by writing (or pasting) your passphrase to verify your identity. You can also import it in read-only mode, in which case you only need the wallet name and address.

Conclusion: The Verdict

Zypto is relatively new in the DeFi space, but it’s already gaining popularity among different types of users. Those who prefer everything neatly organized in one place will find the app appealing, as will those who prefer its rich features and integration with fiat payment methods over on- and off-ramp cryptocurrencies.

DeFi

Switchboard Revolutionizes DeFi with New Oracle Aggregator

Switchboard, a leading oracle network known for its permissionless and fully customizable features, has launched a revolutionary oracle aggregator. This new tool enables seamless integration of data across multiple oracle networks, including household names like Chainlink and Pyth Network. In doing so, it provides users with access to a wide range of data sources, improving the versatility and reliability of decentralized finance (DeFi) applications.

Addressing security and cost challenges in DeFi

The Oracle Aggregator is designed to address significant security and cost challenges in the DeFi sector. In 2023, the Web3 industry saw losses exceeding $500 million due to price manipulation attacks, a notable increase from $403.2 million in 2022. These attacks accounted for 33% of the total value lost due to hacks. By expanding the diversity and volume of data sources, Switchboard aims to strengthen the resilience of data streams against such malicious activities, thereby improving the overall security of DeFi platforms.

Empowering developers with customizable data streams

Switchboard’s new Oracle Aggregator allows developers to design custom data feeds that draw from a wide range of sources, both within and outside of the Switchboard platform. This flexibility allows developers to create tailored feeds that meet their specific needs, moving away from rigid templates. The platform’s permissionless nature and lack of gatekeepers ensure developers have complete control over the data feeds they create.

Switchboard CEO Chris Hermida noted that the company’s philosophy has always been to empower developers rather than constrain them. By launching Oracle Aggregator, Switchboard allows developers to use data from a variety of sources, including Pyth and Chainlink, enabling innovation and customization of their projects. Hermida noted that this new capability allows developers to break away from traditional models and take a more personalized approach to data integration.

Plug-and-Play approach for enhanced security

Switchboard’s Oracle Aggregator offers a plug-and-play approach that allows users to leverage multiple Oracle networks, enhancing data security and reliability. By aggregating data from multiple sources, developers can improve the scalability and redundancy of their data feeds, setting a new industry standard as the first generalized Oracle aggregator. This scalability ensures that projects can mitigate risks associated with data manipulation and other vulnerabilities.

One of the most notable features of Oracle Aggregator is its customizable nature. Developers can selectively choose trusted data sources, eliminating those that do not meet their standards. This level of control is crucial for projects that aim to protect their operations from potential threats.

Innovative use of secure execution environments

Switchboard uses Trusted Execution Environments (TEEs) to ensure that data aggregation occurs entirely off-chain. This innovative approach minimizes gas costs associated with on-chain operations while preserving data integrity. Aggregated data is then shared with users in a single on-chain transaction, simplifying the process and reducing operational expenses.

Mitch Gildenberg, Switchboard’s CTO, highlighted the platform’s developer-centric design. He noted that the platform is designed to put developers in control, allowing them to fine-tune each data flow to their specific needs. This approach reflects Switchboard’s commitment to understanding and meeting developer needs.

Expansion and impact on the industry

Since its launch in 2021, Switchboard has seen significant growth, amassing over 180,000 users and achieving a total valuation of $1.6 billion. The company’s commitment to user autonomy and inclusion has been a driving force behind its rapid expansion in the Web3 ecosystem. Earlier this year, Switchboard raised $7.5 million in a Series A funding round co-led by Tribe Capital and RockawayX, with additional support from leading investors including the Solana Foundation, Aptos Labs, Mysten Labs, Subzero Ventures, and Starkware.

Conclusion

As the DeFi industry continues to evolve, tools like Switchboard’s Oracle Aggregator will play a crucial role in building robust and secure decentralized applications. By giving developers the ability to integrate and customize data feeds from multiple sources, Switchboard is setting new industry standards, driving innovation, and improving the overall security of the Web3 ecosystem.

DeFi

Bitcoin is the solution to inevitable hyperfinancialization

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial team.

If there is one thing that is becoming clear, it is that hyperfinancialization is inevitable, and our best chance of achieving it successfully is through Bitcoin (Bitcoin). This decentralized cryptocurrency, known for its fixed supply and robust security, offers a unique solution to the coming problem of wealth inequality and concentrated power. By embracing Bitcoin, we can create a more transparent and resilient financial future, or we risk losing our financial sovereignty to a handful of corporations.

The hyper-financialization of the world has already begun, with the financial sector becoming a relatively larger part of the economy, in terms of size and importance. Financial structures are also expanding rapidly in other sectors.

For example, in 2023, Americans spent more than $100 billion on state-run lotteries, according to According to The Economist, the poorest citizens spent huge amounts on tickets. In addition, the online sports betting market, valued at more than $100 billion, is projected to generate nearly $46 billion in revenue this year, with a user penetration rate of 3.9%.

Moreover, Robin HoodRobinhood, a commission-free investment platform popular with retail investors, saw its funded customers climb to 23.9 million and its assets under custody soar to $129.6 billion, another prime example of the hyper-financialization trend. Robinhood began to gain traction during the COVID-19 pandemic in 2020, and the hyper-financialization trend was exacerbated. For people stuck at home, the online world became their primary means of entertainment and social interaction.

Governments then injected billions of dollars into the market, encouraging people to bet their money on the markets. The subsequent surge in inflation and the weakness of the global economy further intensified this trend, with people having to bear the burden of survival.

This has led to an increased proliferation of financial structures in different spheres of life, meaning that both manufacturers and consumers are taking this route.

As we can see, cryptocurrency has grown from less than $150 billion in March 2020 to $2.7 trillion today. This explosive growth not only accelerates the trend towards the hyperfinancialization of finance with yield farming, resttaking, points, rewards and meme coins, but also that of art via NFTs, social dynamics via social tokens and platforms like Friendtech, game with play-to-win conceptsand physical assets through tokenization.

There are also prediction markets that allow people to bet on all sorts of events. These range from the outcome of the 2024 US presidential election to whether Bitcoin will hit $100,000 by the end of the year, whether Drake’s verse in “Wah Gwan Delilah” is an AI, what the opening weekend box office of “Bad Boys: Ride or Die” will be, or whether the Fed will raise rates this year.

This growing trend towards hyper-financialization is detrimental to society because it widens already large wealth gaps by increasing wealth concentration and contributing to economic inequality. Not to mention that it will lead to even larger asset bubbles, a focus on the short term at the expense of the long term, and an increased interest in speculative investments.

Here, cryptography can help find a better way to address hyperfinancialization. After all, the wealth is in the middlemen, and using blockchain technology removes this third party from the equation, bringing reliability, traceability, and immutability to the market. Blockchain actually allows hyperfinancialization to be fair and transparent.

Before the advent of cryptocurrencies, not everyone was allowed to participate in markets. But through disintermediation and permissionlessness, cryptocurrencies have made markets more efficient and accessible. Not to mention, everyone gains full control over their data, mitigating the risk of data manipulation and privacy violations.

This is where Bitcoin offers the perfect solution. This decentralized peer-to-peer network enables financial inclusion and censorship resistance, which is critically important in today’s world where organizations and governments are encroaching on people’s rights. This network has a decade-and-a-half-old history behind it, providing a robust and secure platform for people to achieve financial sovereignty.

This trillion-dollar asset class also serves as a hedge against inflation, allowing holders to preserve their wealth over time. Unlike fiat currencies, which are devalued by politicians, Bitcoin’s fixed supply and decentralization protect it from such pressures, making it the perfect asset to own in a world where everyone is competing to extract value.

The largest crypto network is now also seeing experimentation, as developers and investors use it as a foundation to build a truly decentralized future of finance and value.

For so long, Bitcoin has been a low-activity blockchain, with its key role being to store value. While Bitcoin has played a passive role in the blockchain world for all these years, it has finally changed with Taproot Upgrade which brought NFTs into the Bitcoin world. Then there was a growing interest in tokenization, also from institutions like Blackrock.

This drive to expand Bitcoin’s utility has sparked a wave of innovation, and the day is not far when BTC could dethrone Ethereum as the go-to blockchain for decentralized finance. Several aspects, including Bitcoin’s robust security framework, widespread acceptance, and institutional interest, position Bitcoin at the forefront of defi innovation.

So, with these developments, Bitcoin is now evolving to begin its new era of utility and innovation after realizing its original vision of being a peer-to-peer electronic currency system.

As everything becomes a financial asset and tradable, attention, which is a scarce resource, will become even more crucial. Bitcoin has already cemented its position in the attention economy, and the newfound interest in regulatory complaints and widespread adoption of BTC to boost productivity will allow it to lead the future of digital economies. This portends a world where crypto leads the charge towards hyperfinancialization, with BTC in the driver’s seat.

So, to conclude, the resilient Bitcoin network that has spectacularly survived the test of time may have started as a means to facilitate the seamless flow of monetary value, but today, it has become a foundation of hope not only to protect against a future that is going to be super fixated on the financial aspect, but also to take advantage of it to create wealth and prosper.

Jeroen Develter

Jeroen Develter is the Chief Operating Officer at Persistence Labs and a seasoned professional in financial and tech startup environments. With a decade of international consulting, management, entrepreneurship and leadership experience, Jeroen excels at analyzing complex business cases, establishing streamlined operations and creating scalable processes. With Persistence, Jeroen oversees all product and engineering efforts and is deeply passionate about improving the adoption of Bitcoin defi, or BTCfi, and using intents to develop scalable, fast, secure and user-friendly solutions. His work at Persistence Labs addresses the significant interoperability challenges between Bitcoin L2s. In addition, Jeroen is also a co-host of the Stacked Podcast, a platform to gain knowledge about Bitcoin and cryptography from prominent Bitcoin creators.

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

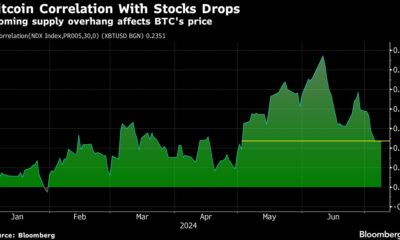

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos5 months ago

Videos5 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto