Markets

Polygon (MATIC) Traders Could Cause 20% Price Drop With This $129 Million Move

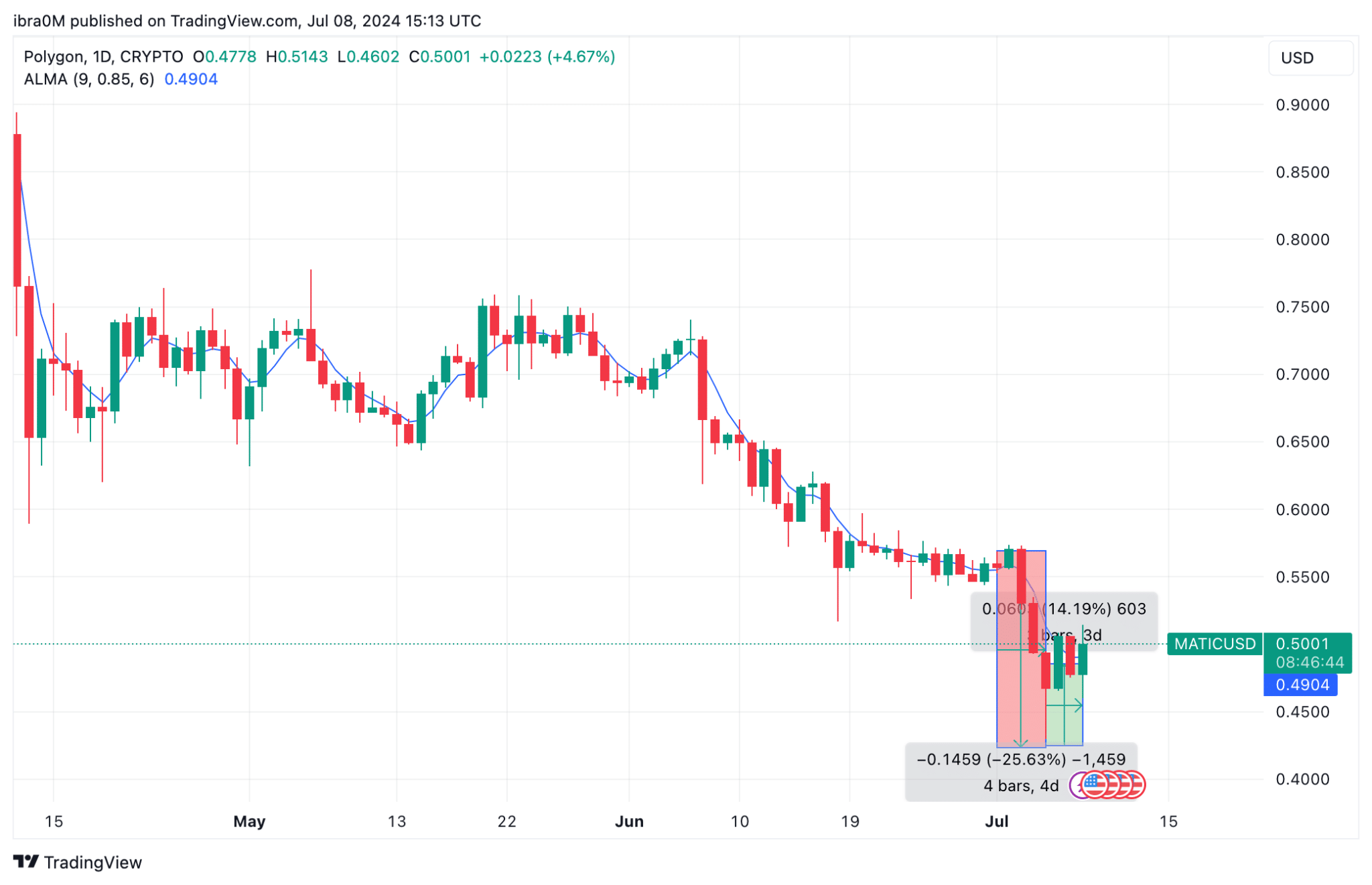

MATIC’s price recovery stalled at $0.49 on July 8 after rallying 14% over the weekend. Derivatives market data trends show that most MATIC traders are opting to close their positions amid rising volatility.

MATIC Price Nears $0.50 Retest as Bulls Show Resilience

MATIC’s price action mirrored this trend in the crypto market, which entered a downward spiral in the first week of July 2024. But following the positive Nonfarm Payrolls report released on Friday, Polygon (MATIC) flashed strong signs of recovery.

Built as a scaling solution for Ethereum, Polygon (MATIC) has struggled for traction since Ethereum migrated to Proof-of-Stake (PoS) consensus. This has led to an accelerated downturn as the crypto market sell-off intensifies.

During an intense crypto market sell-off, MATIC’s price has fallen below the $0.43 mark. Notably, this is the lowest value in over 2 years, since July 2022. But in comparison, most other altcoins in the top 20 crypto market rankings are still holding considerable gains on a yearly basis.

This highlights how much MATIC has underperformed amid fears of obsolescence since Ethereum completed its PoS migration in September 2023 and the expected migration to a new ‘POL’ token.

Over the past few months, the Polygon team has taken important steps to boost investor confidence. Marco partnerships with trending projects like Chainlink, it could open up new markets and expand the utility of the MATIC token in the coming months.

But recent trends observed in MATIC derivatives markets suggest that investors are not embracing these new initiatives.

The Coinglass chart below tracks changes in the total capital invested in futures contracts for a specific crypto asset. When analyzed against current price trends, it reveals insights into the direction of investor sentiment.

As illustrated in the chart above, MATIC’s open interest stood at $176.9 million on July 1. But since the frenzied liquidations in the spot market that led to a 24% drop in prices, MATIC derivatives traders have shown little resilience.

At the time of writing on July 8, MATIC’s open interest had fallen to $129 million. This $47.9 million decline represents a 27% decline in capital invested in MATIC’s derivatives markets.

When an asset’s open interest falls faster than its price during a market decline, it signals increasing bearish momentum for a number of reasons.

First, it indicates that traders are closing their positions, either voluntarily due to loss-cutting strategies or through forced liquidations, which exacerbates downward pressure on prices.

This behavior suggests a lack of confidence among traders in the asset’s potential for recovery in the short term, leading to a reduction in speculative buying and hedging activities in the derivatives market.

Second, the significant drop in open interest as seen in MATIC implies that new capital is not entering the market to support the asset.

This lack of new investment indicates that traders are either reallocating their capital to other assets with more promising short-term prospects or remaining on the sidelines due to uncertainty.

Consequently, this reduction in open interest, coupled with the recent price drop, reinforces a bearish outlook for MATIC unless there is a notable shift in market sentiment or a resurgence of buying interest in both the spot and derivatives markets.

MATIC Price Prediction: $0.40 Retest Imminent?

MATIC has been experiencing a significant downtrend, as evidenced by the series of lower highs and lower lows on the daily chart. The price is currently trading at $0.4978, just above the ALMA (Arnaud Legoux Moving Average) at $0.4899, which is acting as a short-term support level. However, the broader bearish sentiment remains dominant, and the potential for further downside is considerable.

Recent price action has seen MATIC recover slightly from a low of $0.4602, gaining approximately 4.19% in the process. Despite this short-term bounce, the overall trend remains bearish.

The Fibonacci Auto Retracement levels indicate that the price is struggling to break above the 23.6% retracement level, which aligns with the $0.5143 resistance. If MATIC fails to sustain above this level, it could lead to another wave of selling pressure.

The key support levels to watch are $0.45 and the psychological level of $0.40. The $0.45 level has previously acted as support, and a break below it could signal a retest of the $0.40 level, which would mark a significant decline.

On the upside, the $0.5143 level acts as immediate resistance, followed by $0.55, which aligns with the 38.2% Fibonacci retracement level. A break above these levels would be needed to invalidate the bearish outlook and signal a potential reversal.

Disclaimer: This content is informative and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-