Fintech

Q&A: How Can Fintech Close the Finance Gap for the Region’s Smallest Businesses?

The significance of the smallest businesses in Asia and the Pacific belies their size. In many countries they form the backbone of the economy, and employ most of the labor force. These micro, small and medium-sized enterprises (MSMEs) are a particularly important way for women to earn incomes, often providing finance for their own and their children’s education and healthcare.

Despite their central role in the wellbeing of economies and families, many of these businesses face severe difficulties obtaining the finance and credit they need to grow. The COVID pandemic made this challenge even more acute, making it hard for potential small businesses to begin and existing ones to expand operations, enhance product offerings, or enter new markets. This leaves families worse off, and harms job creation.

Lotte Schou-Zibell

Advisor, Finance Sectors Group

Asian Development Bank

Lotte Schou-Zibell, an Advisor, Finance Sectors Group at the Asian Development Bank, explains how smart fintech solutions can help MSMEs at all stages of their evolution, with compelling benefits as well for any economy’s ability to create jobs and lift incomes for the neediest communities.

What are the main challenges for MSMEs in the Asia-Pacific in terms of finance and access to credit?

Image

Approximately 90% of enterprises in the Asia and the Pacific, both formal and informal, are MSMEs, which serve as the region’s economic backbone. They foster local resilience, add to economic diversity, stimulate domestic demand, create jobs, innovate, and compete on national and potentially regional levels.

The characteristics of MSMEs differ significantly across various parts of the region. For instance, Central Asia and the Pacific are dominated by agrarian-based MSMEs, East Asia by industrialized manufacturing, and South Asia by service-oriented enterprises.

Banking preferences also vary; for example, Pacific banks tend to maintain higher liquidity levels and often choose to invest in liquid assets like government securities instead of extending credit to MSMEs. The Pacific region’s legal and regulatory frameworks are generally underdeveloped, posing additional challenges for MSMEs seeking credit for expansion.

Access to finance and markets is critical to the growth of MSMEs. Traditionally, MSMEs in the region excel in sectors like wholesale, retail, agribusiness, food processing, and other service-related industries. However, they frequently encounter difficulties securing financing, limiting their potential to expand or hire more employees.

Challenges faced by MSMEs in accessing financial tools and credit include a lack of collateral, insufficient credit history, and the complexity of financial products that may not meet their specific needs. Financial information asymmetry, stringent regulatory requirements, and the high costs associated with processing small loans further complicate access to finance.

The limited geographical reach of financial institutions, particularly in rural or underdeveloped areas, restricts access to financial services. Women-owned or led businesses face additional cultural and institutional barriers.

Recognizing these issues, there is increasing acknowledgment of the importance of developing financial policies and products tailored to MSMEs’ unique needs. This includes embracing fintech solutions that offer alternative credit assessment methods and more flexible financial services.

How do these challenges affect their growth?

Image

Limited access to finance and credit significantly hampers the growth of MSMEs in Asia and the Pacific. This restriction curtails their ability to expand operations, enhance product offerings, or enter new markets, directly impacting their operational capacity—particularly for those with fluctuating revenue, which complicates cash flow management. Furthermore, inadequate funding prevents MSMEs from embracing innovation and new technologies, which are essential for staying competitive in the market. This stunts the growth of individual MSMEs and affects the region’s economic health and technological progress.

Additionally, job creation, a critical function of MSMEs, is adversely affected due to insufficient financing. Expansion and scaling, often reliant on credit, are vital to generating employment opportunities. Thus, constrained growth can lead to limited job prospects. Access to credit is also essential for MSMEs to develop resilience against economic and environmental disruptions. Without sufficient financial resources, these businesses are more vulnerable to crises, leading to business failures and broader economic instability.

Addressing these financial barriers is crucial for fostering sustainable economic development and achieving long-term goals in the region. Enhancing access to finance for MSMEs is essential for promoting robust economic growth and stability across the region.

How are MSMEs changing, and how can financial services providers meet their needs?

This evolving landscape demands a comprehensive approach from financial service providers to support MSME digitalization, provide customized financial products, improve access to credit, and assist MSMEs in integrating into broader markets

MSMEs in the region are navigating significant transformations as they recover from the global COVID pandemic and adjust to a new economic reality. The pandemic accelerated fintech adoption, which proved crucial for many MSMEs to stay afloat by providing quicker, more efficient, and cost-effective financial services than traditional banking. This shift has supported business continuity and spurred resilient growth through increased domestic demand, job creation, and innovation across various sectors.

Innovations in financial technology and digital payments are critical in enhancing MSME access to finance and supporting the achievement of Sustainable Development Goals. There is a recognized need to upgrade digital infrastructure to facilitate MSMEs’ transition to digital business models, ensuring they have access to advanced digital tools and services. Moreover, expanding access to financing is essential. MSMEs in the region often struggle to secure funding due to insufficient collateral, lack of credit history, or unavailability of appropriately designed financial products.

Financial service providers can play a transformative role by creating tailored financial products that utilize fintech solutions for more accurate credit assessments and offer microfinance options that suit the needs of smaller enterprises. This might include services like mobile banking and e-commerce platforms. For instance, in Thailand, Kasikornbank and Grab have collaborated to introduce GrabPay, a mobile wallet initiative. Similarly, Bank Rakyat Indonesia (BRI) has partnered with Alipay to enhance mobile payment options for Chinese tourists in Indonesia.

This evolving landscape demands a comprehensive approach from financial service providers to support MSME digitalization, provide customized financial products, improve access to credit, and assist MSMEs in integrating into broader markets. Such efforts are vital for fostering sustainable and inclusive growth in the post-COVID-19 era in Asia and the Pacific.

What is the role of fintech firms in helping MSMEs access finance for growth?

Fintech firms are essential to enhance the growth and resilience of MSMEs throughout Asia and the Pacific, especially in areas where traditional banking is less accessible. These companies have transformed MSME financing by prioritizing cash flow-based over asset-backed lending, which is crucial for businesses lacking substantial physical assets. For example, Capital Float in India rapidly provides collateral-free loans based on real-time cash flow analysis, helping MSMEs quickly leverage growth opportunities.

Digital lending platforms accelerate the process of assessing creditworthiness using algorithms and data analytics, facilitating quicker loan approvals with more relaxed criteria. Moreover, fintech enables MSMEs to effectively participate in global and regional markets, boosting their competitiveness. This is supported by digital platforms that assist with business registration, market access, and integration into global value chains. Digital payment solutions such as PayPal and Alipay transform business transactions, enhancing cash flow management and allowing for expansion into international markets.

Fintech also offers crucial tools for financial management, enabling better decision-making for MSMEs. The sector has been pivotal in promoting financial inclusion, significantly during the COVID-19 pandemic, by helping businesses continue operations and empowering women entrepreneurs with easier access to financial services.

Image

Fintech includes regulatory technology, or RegTech, solutions that help businesses navigate the often complex regulatory environments in which they operate and comply with regulations efficiently. This is especially important in regions with stringent financial regulations, as non-compliance can lead to heavy penalties. RegTech, including solutions like RegGenome, is vital to help businesses navigate complex regulatory landscapes and comply with regulations. RegGenome uses GenAI-optimized data and Large Language Models (LLMs) to streamline compliance processes, manage regulatory risks sustainably, and keep up with regulatory changes without extensive legal expertise.

In the realm of insurance technology, or Insurtech, fintech tailors products that utilize advanced technologies to meet the specific needs of MSMEs, which is critical as sectors like agriculture face the impacts of climate change across Asia and the Pacific.

By leveraging these advanced technologies, fintech firms not only support the operational needs of MSMEs but also empower them to scale and compete effectively in markets previously dominated by larger corporations. This integration of technology and finance is crucial for the ongoing growth and innovation of MSMEs in the region, ensuring they remain competitive and resilient.

How is the digitalization of banking changing the sector?

The digitization of banking tools is transforming the MSME sector in Asia and the Pacific by making financial services more accessible and fostering innovative business practices. This transformation is evident in how MSMEs increasingly utilize digital platforms for operations, transactions, and customer engagement.

As digital banking becomes more prevalent, a large majority of consumers prefer online and mobile banking over traditional branch visits, prompting banks to improve their digital offerings and incorporate AI and machine learning to enhance customer service and product offerings. This digital-first strategy boosts customer interaction and increases banks’ operational efficiency and competitiveness.

In the Philippines, the surge in e-commerce and digital platforms significantly drives the digital transformation of MSMEs. Government and private sector partnerships are pivotal in this shift, as they provide digital literacy programs and technological resources to help MSMEs expand their market presence and enhance operational efficiency. With e-commerce expected to grow substantially by 2025, MSMEs are poised to become more competitive in a digital-first market.

Indonesia offers another example where the government has partnered with major technology firms to promote digital tools specifically designed for small businesses, especially in the food and beverage sector, through platforms like GrabMerchant. Social media and mobile commerce have also become essential channels for these businesses, with ongoing initiatives to enhance MSME resilience and digital capabilities. However, challenges like uneven digital literacy and geographical barriers must be overcome to ensure effective digital adoption across all regions.

In Cambodia, the Bakong system promotes financial inclusion among the unbanked and financially excluded MSMEs through a mobile payment and banking app that offers interoperability among e-wallets, mobile payments, online banking, and payment apps. This initiative has created a comprehensive payment platform that integrates a vast network of local banks and financial institutions, facilitating seamless peer-to-peer transfers and enabling MSMEs to manage sales more effectively through electronic payments in an increasingly digital environment.

These instances underscore the significant impact of digital banking tools on the MSME sector, promoting financial inclusion and innovative practices crucial for the ongoing growth and competitiveness of MSMEs in Asia and the Pacific.

Are AI and cloud services prominent among MSMEs?

Image

AI and cloud services are increasingly being utilized by MSMEs in Asia and the Pacific, enhancing customer service, risk management, and operational efficiency. The vast potential of these technologies is being harnessed to drive business efficiency, scalability, and innovation.

In the Philippines, the adoption of cloud services is accelerating, and this is supported by government policies and the growing availability of affordable solutions. A notable example is Cantilan Bank, which, with support from the Asian Development Bank and Oradian has implemented cloud-based technology to enhance its financial services and extend them to the unbanked and underserved in remote areas. This demonstrates the transformative impact of cloud services in regions with limited traditional banking infrastructure.

The pandemic underscores the importance of digital transformation, which led to many MSMEs shutting down, highlighting the necessity of digital adaptation for survival and competitiveness. With the Philippine government reinforcing its “cloud-first” policies initiated in 2017, a significant shift towards cloud adoption is evident.

Cloud services also offer enhanced cybersecurity, which is a vital benefit as 57% of Philippine MSMEs experienced costly cyberattacks in 2023. Cloud solutions provide robust security features at cost-effective prices and are inherently resilient to physical disasters since they do not rely on on-site servers.

AI is revolutionizing customer interaction within financial services by facilitating data-driven, personalized services. AI-powered chatbots and virtual assistants offer 24/7 customer support, handling various inquiries efficiently and reducing operational costs. Robotic Process Automation (RPA) is being employed to automate repetitive tasks such as loan processing and claims management, minimizing human error and boosting efficiency.

Furthermore, AI is critical in enhancing compliance and fraud detection by analyzing transaction data to identify and flag suspicious activities, thereby improving Anti-Money Laundering efforts and overall regulatory adherence.

AI’s capability to analyze both structured and unstructured data supports better credit risk assessment, allowing financial service providers to manage risks more effectively. For instance, AI algorithms that analyze market data and social media help to make informed investment and trading decisions.

As these technologies become more accessible and awareness among MSMEs increases, their adoption is expected to rise, enhancing the competitive and operational capabilities of businesses in the region. However, challenges such as the initial costs of technology adoption, the learning curve associated with new technologies, concerns over data security, and the need for reliable internet connectivity can hinder broader implementation. Nonetheless, with appropriate human oversight and governance, the benefits of AI and cloud services can significantly outweigh these challenges.

How can these technologies help MSMEs grow their business?

Image

AI and cloud technologies are significantly boosting the capabilities of MSMEs to grow and stay competitive. These advancements streamline operations, enhance customer interactions, and improve decision-making. Here’s how these innovations are supporting MSME development:

AI-powered chatbots deliver 24/7 customer service, efficiently managing queries, and reducing the need for large customer service teams. These chatbots handle everything from order inquiries to providing product information, thereby boosting customer satisfaction and loyalty.

AI also plays a crucial role in enhancing credit risk assessments by analyzing both traditional and non-traditional data sources. This helps MSMEs make more informed lending decisions, manage credit risks more effectively, and potentially reduce default rates by evaluating data like customer behavior and social media activity to create detailed risk profiles.

Cloud computing and AI enable the automation of repetitive tasks such as accounting, payroll, and inventory management. This allows MSMEs to utilize sophisticated tools without substantial upfront investments in IT infrastructure, thus reducing operational costs and focusing resources on core business activities.

Additionally, AI aids in fraud detection by analyzing transaction patterns to identify anomalies. This is particularly crucial for e-commerce businesses that are more susceptible to payment fraud. AI systems highlight unusual transactions for further investigation, helping protect both revenue and business reputation.

AI tools also process large datasets to glean insights on market trends and consumer behavior, empowering MSMEs to make strategic decisions, tailor marketing efforts, and discover new market opportunities. For example, retailers can use AI to track the most popular products and adjust inventory accordingly to maximize sales.

In regions with significant unbanked populations, such as rural areas in the Philippines, cloud-based banking services like those provided by Cantilan Bank have made financial services more accessible to MSMEs, facilitating their growth and sustainability.

By leveraging AI and cloud technologies, MSMEs can compete on equal footing with larger companies, enabling them to innovate and expand in ways previously not feasible. These technologies enhance MSMEs’ agility, efficiency, and customer engagement, propelling them toward success in an increasingly digital marketplace.

How can fintech firms help scale up B2B payments in the region?

Fintech firms are revolutionizing B2B payments in Asia and the Pacific by digitizing payment processes and enhancing cross-border capabilities, which are vital for the growth of MSMEs. A key example is the partnership between Visa and SAP, which integrates payment systems into SAP’s Business Technology Platform to accelerate B2B transactions across regional supply chains. This initiative is particularly beneficial for smaller businesses that lack the resources to digitalize payment acceptance and are critical in closing the supply chain capital gaps in the region.

Linkages like the one between Singapore’s PayNow and Thailand’s PromptPay facilitated by the Monetary Authority of Singapore are also pivotal. They enable instant cross-border transactions using just a mobile number, significantly cutting down wait times and improving cash flow management for MSMEs involved in international dealings.

However, digitalizing cross-border B2B payments poses challenges, primarily in terms of trust and cost. High compliance costs across the different regulators in Asia and the Pacific make scaling difficult. In contrast, in the European Union, a single license allows expansion across the countries, simplifying market entry.

In regions like Indonesia and the Philippines, where traditional banking can be cost-prohibitive, alternative payment solutions such as e-wallets and mobile wallets are becoming prevalent. These platforms provide essential services to areas underserved by traditional banks.

Overall, these fintech innovations modernize business transactions and expand MSMEs’ operational scope and market reach, fostering greater global competitiveness and operational efficiency.

How are regional regulators enabling the efficient development of fintech for MSMEs?

Ensuring the sustainability of MSMEs through adequate governmental support and accessible financing is crucial for inclusive economic growth. Regulators across Asia and the Pacific increasingly recognize the need to promote fintech innovations to assist MSMEs while safeguarding financial stability and consumer protection. To this end, several countries have adopted regulatory sandboxes, allowing fintech companies to test and refine their services within a controlled environment.

Singapore was an early starter in this area, establishing its regulatory sandbox in 2016. This model permits fintech startups to experiment with new technologies in real-world settings without full regulatory compliance, facilitating rapid development and testing while maintaining regulatory oversight.

Similarly, Malaysia and Thailand have implemented frameworks that encourage fintech solutions aimed at expanding financial services to underserved parts of the economy, including MSMEs. These sandboxes have proven crucial in allowing the launch of various fintech services, such as digital payments and alternative lending, tailored specifically to the needs of MSMEs.

In the Philippines, the regulatory landscape has particularly supported digital banking and payment systems, which have grown substantially due to efforts to enhance financial inclusion. The Bangko Sentral ng Pilipinas (BSP) has granted several digital banks Certificates of Authority, creating a competitive environment that benefits both consumers and businesses, including MSMEs.

These initiatives demonstrate a commitment to fostering a regulatory environment that balances innovation with risk management, ensuring that fintech developments benefit both MSMEs and the wider economy without compromising the financial system’s integrity.

Countries

- Cambodia

- India

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

Subjects

- Finance sector development

- Financial inclusion and microfinance

- Small and medium enterprise (SME) financing

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

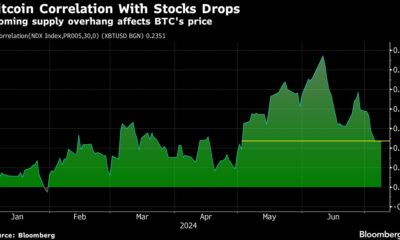

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto