Fintech

The future of fintech is in the palm of users’ hands, literally

An interesting and in-depth conversation with Abdallah Abu Sheikh, founder of Astra Tech and CEO of Botim. He walks us through the strategy behind Palm Pay and provides insights into the region’s fintech sector. It emphasizes innovation, financial inclusion and the use of artificial intelligence (AI) for social impact.

Astra Tech is at the forefront of the digital revolution in the MENA region. As a founder, what do you think are the biggest challenges MENA tech companies face?

To achieve a significant digital revolution it is necessary to ensure that no one is left behind, this is especially necessary in the context of how quickly the technological landscape is evolving, which means that the solutions for which they are created must be accessible to the masses.

Therefore, I see two main challenges for technology companies. First, it is essential to ensure widespread access to technology and digital solutions. Reliable and affordable internet access is vital to digital adoption. While the GCC boasts a commendable internet penetration rate of 92%, the North African region lags far behind, standing at just 64.5%. This discrepancy highlights the need to bridge the digital divide to ensure equitable access to technology across the region.

Second, addressing financial inclusion is critical to the advancement of technology companies, particularly in the fintech sector. Despite the rapid growth of fintech in the region, 32% of the UAE population remains unbanked. This disparity highlights the importance of expanding access to digital financial services and overcoming barriers to financial inclusion. By tackling these challenges head-on, we can create a more inclusive and prosperous digital future for everyone in the MENA region.

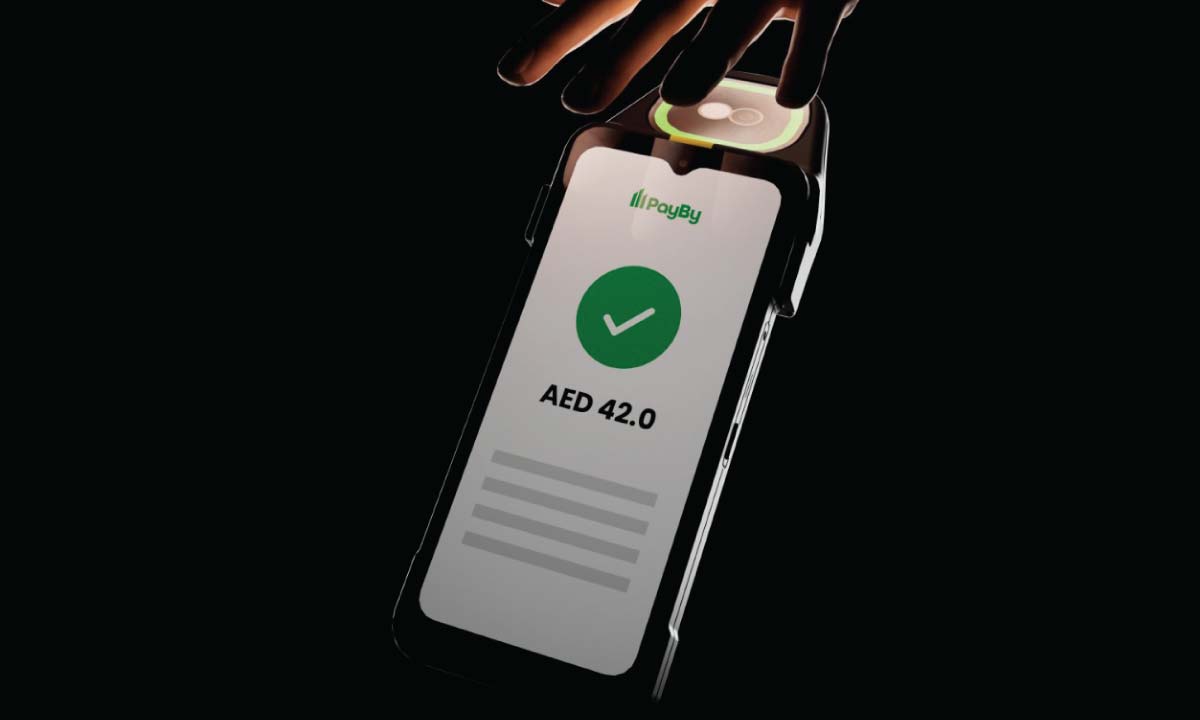

You recently launched Palm Pay at the Dubai Fintech Summit. Can you share with us how this contactless palm recognition service could revolutionize the payment process?

Palm Pay is more than just a way to make payments – it’s a bold step towards a cashless future in the UAE. By introducing secure palm recognition alongside other digital methods such as cards and phones, we are rewriting the rules of the game.

The essence of Palm Pay’s contribution lies in the use of biometric authentication, which guarantees unparalleled security. Our goal has always been to facilitate seamless, secure and inclusive payment experiences by decreasing reliance on physical currency and improving the efficiency and security of transactions on a global scale. Palm Pay’s success has the potential to spark further advancements in biometrics and contactless payment technologies.

Our vision is to work towards a future where payments are seamless and where technology serves people, making life smoother, safer and significantly easier. Palm Pay is part of this vision coming to life.

Security is a major concern for digital payment users. Can you elaborate on the security measures employed by Palm Pay, especially in terms of biometric authentication?

Security is paramount in the design of Palm Pay, and our commitment to protecting user data is unmatched. Palm Pay stands out for its use of advanced biometric authentication, using your unique palm print as a highly secure identifier.

Biometric authentication has been proven to be 1,300 times more secure than other methods, significantly reducing the risk of fraud and unauthorized transactions. For example, while phones or cards can be stolen, hacked or damaged, biometric payment ensures that the payment comes directly from the user. Therefore, the human palm, with its many unique identifiers, offers exceptional security. And we hope to make this functionality readily available to our employees so they can potentially enjoy greater peace of mind, knowing that their financial transactions are better protected.

Looking ahead, what are the next big technological horizons in the MENA region and how does Astra Tech intend to take part in these developments?

Given the rapid wave of AI, I think it’s fair to say that the next big thing in the MENA region would be its widespread adoption. At Astra Tech, we are fully committed to leveraging AI to drive innovation and move the region forward. Our focus on integrating AI into our platform, for example through conversational AI within our app, is testament to this commitment.

Ensuring that our AI-based solutions are creative and tailored to the uniqueness of the market, we introduced “Arabic ChatGPT”, which was the first Arabic language conversational AI in the world from the United Arab Emirates.

Furthermore, this year during Ramadan, we also launched “CharityGPT” in collaboration with Ma’an on the Botim app, allowing users to donate in a simple ChatGPT style. With simple text commands, users could contribute to the cause, demonstrating our commitment to using AI for social impact. This initiative also highlights our belief in the power of technology to drive positive change in the communities where we operate.

Read more: Driving customer-centric value with fintech

How do your subsidiaries, Botim, Payby and Rizek, complement each other under the Astra Tech umbrella?

With AstraTech, we are building an ecosystem of ecosystems, driving various fintech innovations and consumer products that fuel significant technological advancement in the region. All our branches are an integral part of this ecosystem. Therefore, Botim, Payby and Rizek are not stand-alone entities but rather essential components of a foundation that drives transformative change both regionally and globally.

At the center of this ecosystem, we positioned Botim, transforming it to become the world’s first ultra app. Through this transformation, Botim’s social services, such as VoIP and instant messaging, integrate seamlessly with Astra Tech’s fintech services, including PayBy, as well as other essential offerings provided by Rizek. This technological fusion facilitates a smooth flow of transactions and services, enhancing user experience through a connected approach.

Could you explain how Palm Pay fits into the broader ecosystem of services offered by Astra Tech?

Palm Pay is an integral part of Astra Tech’s vision to disrupt the financial ecosystem. In the near future, Palm Pay will integrate seamlessly with other Astra Tech services, allowing users to make transactions within the Ultra app through various features. However, the patented technology also aims to urge other market players to innovate, as we have seen a stagnant approach lately. In any case, this integration will transform the Ultra App into a centralized hub for all financial activities, making money management easier for users.

In particular, all our efforts are promoting inclusivity and accessibility, helping people who may not have access to traditional banking channels to participate in the digital economy. As we prepare to launch Palm Pay, we remain committed to constant innovation. We understand that the world is incredibly diverse and that a one-size-fits-all approach won’t always work.

For more interviews, click Here.