Fintech

TransUnion Index Shows Philippines Growing Confidence in BNPL and Credit Products

Free Newsletter

Get the latest Philippines Fintech news once a month in your inbox

TransUnion, a global information and insights company that claims to be the first privately owned comprehensive credit reporting agency in the Philippines, has released its second annual Credit Perception Index.

This index explores Filipinos’ perceptions of credit, the factors that influence those perceptions, and the broader implications for the nation.

According to a statement from TransUnion, the study aims to promote discussions and actions to improve credit literacy and financial inclusion in the Philippines.

The current TransUnion Credit Perception Index for the Philippines is 69, up four points from the previous year. This increase indicates an improvement in the concept awareness, product knowledge, confidence and propensity towards credit products among Filipinos.

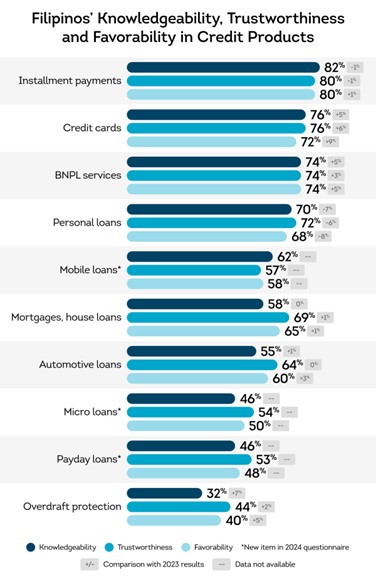

This year’s study reveals that 70% of Filipinos have general knowledge about credit. Among various credit products, Filipinos are the most knowledgeable about installment payments (82%), followed by credit cards (76%) and buy now pay later (BNPL) services (74%).

Awareness of both credit cards and BNPL services increased by five percentage points. Confidence in these products also increased, with credit cards and BNPL services recording increases of six and three percentage points in reliability, standing at 76% and 74% respectively, just behind instalment payments at 80%.

The index indicates that the propensity towards BNPL services and credit cards has also increased, with an increase of five and nine percentage points respectively.

Despite these improvements, knowledge gaps persist between the unbanked population and others. Currently, only 54% of unbanked Filipinos understand credita 16 percentage point deficit compared to the general population and a 29 percentage point gap compared to financial technology professionals.

This represents a widening of the knowledge gap, as last year the gap between the general population and the unbanked population was 11 percentage points.

Filipinos’ financial sentiment seems less optimistic this year. Nearly two-fifths of the population estimate their total wealth to be PHP 250,000 and below. Additionally, 75 percent of Filipinos surveyed consider themselves lower-middle class or below.

Optimism about financial improvement has declined: Fewer Filipinos (84%) expect their financial situation to improve next year, down six percentage points from 2023.

The number of Filipinos expecting their household income to increase (74%) and those who can easily afford daily necessities (68%) also decreased, by nine and four percentage points, respectively.

Filipinos without bank accounts are particularly hard-pressed, with nearly three-quarters of them often finding themselves short on cash at the end of the month. This contrasts with 62 percent of the general population and 46 percent of those in the fintech sector.

Despite these uncertainties, there is a clear shift toward diversification of financial instruments. Ownership of credit-based products and bank accounts has increased significantly. Ownership of credit cards has increased by 15 percentage points to 40% and personal loans have increased by four percentage points to 25%.

Debit cards, savings accounts, and virtual bank accounts also saw an increase. Additionally, 70% of Filipinos expressed willingness to explore digital products and fintech services in the next 12 months.

“We are pleased to see Filipinos proactively seeking ways to better manage their finances and unlock economic opportunities through responsible use of credit,”

said Weihan Sun, Director of Asia Pacific Research and Consulting at TransUnion.

“However, there are still disparities in credit literacy. Continued efforts are needed to further expand access and services to unbanked Filipinos, enabling them to realize the benefits of financial inclusion.”

The study also highlights a shift in perceptions of credit, with negative sentiments towards credit products decreasing. More people now see credit cards as convenient and BNPL services as useful. Concerns about overspending on credit products have decreased.

However, while a smaller number of Filipinos associate credit cards with risk, 46% are concerned about scams when using credit products. Over half of the general and unbanked population expressed concerns about scams and fraud.

To build trust in credit products, TransUnion data indicates that financial institutions must prioritize transparency, address security concerns, and establish a solid reputation. A quarter of Filipinos indicated they would prefer more product information, improved security measures, and institution trustworthiness.

“Upward trends in credit knowledge, product preferences, consumer confidence and favorability offer enormous opportunities for lenders,”

said Yogesh Daware, Chief Commercial Officer of TransUnion Philippines.

“As consumers become more aware and receptive to credit products, the formal financial sector must undertake efforts to build trust and change the perception of credit as a life-enhancing force for Filipinos, thereby promoting financial inclusion and national development.”

Featured image credit: modified by Freepik