News

What is The Future of Crypto in The Next 5 Years?

Last updated:

May 16, 2024 12:23 EDT

| 21 min read

In 2009, the Bitcoin network launched, bringing digital sound money to the world. About 5 years later, the Ethereum network went live, introducing smart contracts at scale and forging the way for decentralized finance, blockchain gaming, and web3 social platforms. What’s next for the crypto landscape? In this guide, we’ll explore the future of crypto in the next 5 years by examining trends and promising new tech.

We’ll also discuss how crypto reaches mainstream adoption, ranging from individual investors to institutions. Regulation likely plays a key role in building a safe and sustainable future of cryptocurrency. Governments themselves may be getting on board the crypto train through central bank digital currencies and by embracing blockchain for both efficiency and transparency.

Summary: The Future of Crypto in The Next 5 Years

- Crypto will likely see better regulatory clarity, clearing the way for institutional adoption of key assets.

- The volatility of market-leading cryptocurrencies will decrease with a larger user base; prices are expected to increase.

- Decentralized finance will continue to evolve, making financial tools available to a broader audience in a more accessible way.

- Artificial intelligence will help make crypto safer by analyzing smart contracts and tokens. The use of AI will also grow a tool to optimize trades and rebalance portfolios.

- Real-world assets will be tokenized on the blockchain, allowing easy transfers and fractional ownership.

What is The Current State of Crypto?

When Bitcoin launched, only a handful of people knew what it was and how it worked. Some early adopters are now millionaires. Others spent it on pizza, which itself represented a major step forward in adoption. Today, according to Statista, as many as 30% of people in specific countries and regions own or transact in crypto.

Bitcoin now boasts a market capitalization of more than $1.2 trillion, a figure six times higher than the entire crypto market in 2019, which ended the year at about $200 billion. A lot can happen in 5 years.

We also saw the dawn of decentralized finance (DeFi), which allows anyone to access crypto markets to earn yields or borrow against collateral without an intermediary. DeFi revenue is expected to top $26 billion in 2024, and we’re likely just getting started.

However, the crypto community still faces significant challenges. Not all governments have warmed to the idea of digital assets, leading to fines, lawsuits, and even convictions. The largely unregulated industry is also as rife with fraud and market manipulation as it is burgeoning with opportunities. We have our work ahead of us to make crypto safer, but the best days may still be ahead.

The future of crypto in the next 5 years likely includes a vastly larger market, with increased adoption both by individuals and institutions. We’re also likely to see a regulatory framework, perhaps on a global scale, that provides clarity for investors and people who use crypto to transact. Industry players will find ways to make crypto easier for average households, and a resourceful community will develop safeguards to fight fraud in the crypto space.

Let’s explore some of the changes we expect to see in the coming years.

What Will Change in Crypto in the Next 5 Years?

Even with the parabolic growth of the crypto industry, the market remains small relative to traditional finance. Bitcoin’s market capitalization at $1.2 trillion is less than half that of Apple (AAPL) and similar to Facebook’s (META) market value. The US government just passed a spending bill equal to the worldwide bitcoin market value. The relatively low valuation of the world’s leading cryptocurrency suggests that there’s room to grow from here.

Regulatory clarity, regulatory developments, and institutional adoption will help propel crypto to new heights and drive innovation. These changes will bring sidelined investors into the fray, unlocking massive amounts of liquidity for crypto markets.

1) Regulatory Clarity

Crypto markets and the Bitcoin blockchain are largely unregulated in much of the world. In the UK, the FCA has begun to crack down on crypto marketing. In the US, debate still rages over whether digital assets like Ethereum are securities (investments with the expectation of return from the efforts of others) or commodities (goods that can exchanged for like-kind).

This distinction governs which agencies have jurisdiction over cryptocurrencies. In the interim, the US Securities and Exchange Commission has sued several crypto projects, including Ripple (XRP), as well as crypto exchanges like Coinbase, alleging that these entities sold unregistered securities with token sales. These and other court battles continue.

Understandably, many investors and institutions are waiting on the sidelines for some clarity. An investment made now could suffer if falls into the crosshairs of government regulators.

Legislators in the US House of Representatives are advancing a bill called FIT21 to provide clarity and investor protection when it comes to crypto projects, exchanges, and investors by better defining the roles of the SEC and the Commodities and the Commodity Futures Trading Commission (CFTC) regarding digital assets. Should this bill or similar efforts pass, much of the stigma surrounding crypto markets will also fade, creating new opportunities worldwide.

Much like worldwide Know Your Customer (KYC) rules for financial institutions, which follow a familiar template, crypto regulation will likely take a similar form in legislation in other major markets.

2) Institutional Adoption

A handful of companies hold BTC on their balance sheet, notably including Tesla (TLSA) and MicroStrategy, the latter of which now owns about 1% of the world’s Bitcoin. However, BTC is currently seen by regulators as a commodity due to its fair launch (no token sale) and decentralized network of miners.

The classification of other assets, like Ethereum, remains in doubt. CFTC Chairman Tarbert sees Ether (ETH), the cryptocurrency used by the Ethereum blockchain, as a commodity. However, the SEC is currently investigating the Ethereum Foundation and may deem ETH to be a security. With ETH as the leading smart contract blockchain, expect fireworks — and plenty of lawsuits until the issue is resolved.

Institutional adoption of blockchain assets hangs in the balance. The status of ETH and similar assets will drive institutional investors’ decisions. Without clarity, many can’t participate in crypto markets and limit their exposure to private blockchains. However, with ETH as the second largest cryptocurrency by market cap and many other projects following a similar structure, what happens with ETH will cause sweeping changes across the cryptocurrency market.

If ETH is a commodity, institutions can freely enter the market. A broad range of digital assets similar to ETH would also benefit. Financial institutions may also use crypto and blockchain to bring many of DeFi’s innovations to the mainstream market.

3) Central Bank Digital Currencies (CBDCs)

Governments around the world already have their sights on digital assets of a different kind: Central Bank Digital Currencies (CBDCs). A CBDC is a digital form of fiat currency, an alternative to today’s banknotes. Think of it as virtual coins.

The topic stirs controversy, with privacy advocates concerned about the potential for surveillance or censorship in transactions. The counterargument is that CBDCs could warm investors and consumers to the idea of blockchain-based digital assets.

The US Federal Reserve is weighing the benefits and risks of CBDCs as an alternative to cash. However, such a move would require an act of Congress. Several countries, including Nigeria, Jamaica, and The Bahamas, have already introduced CBCDs. Politicians in Ghana are also looking at a possible CBDC rollout, and Ghana’s Vice President, Dr. Mahamudu Bawumia, is a proponent of blockchain-based government as a tool to thwart corruption.

Expect an evolving landscape surrounding the implementation of CBDCs, with several developing nations to watch as test cases. While not central bank digital currencies are not cryptocurrencies, their digital nature makes them a space to watch as it relates to the future of crypto in the next 5 years.

4) Expansion of Decentralized Finance (DeFi)

DeFi brought permissionless access to crypto-based financial services. The advent of smart contracts lets anyone with a crypto wallet borrow against crypto collateral, lend for a yield, or stake their crypto assets to earn staking rewards. The availability of these opportunities levels the playing field while protecting users’ privacy by using pseudonymous wallet addresses as identities.

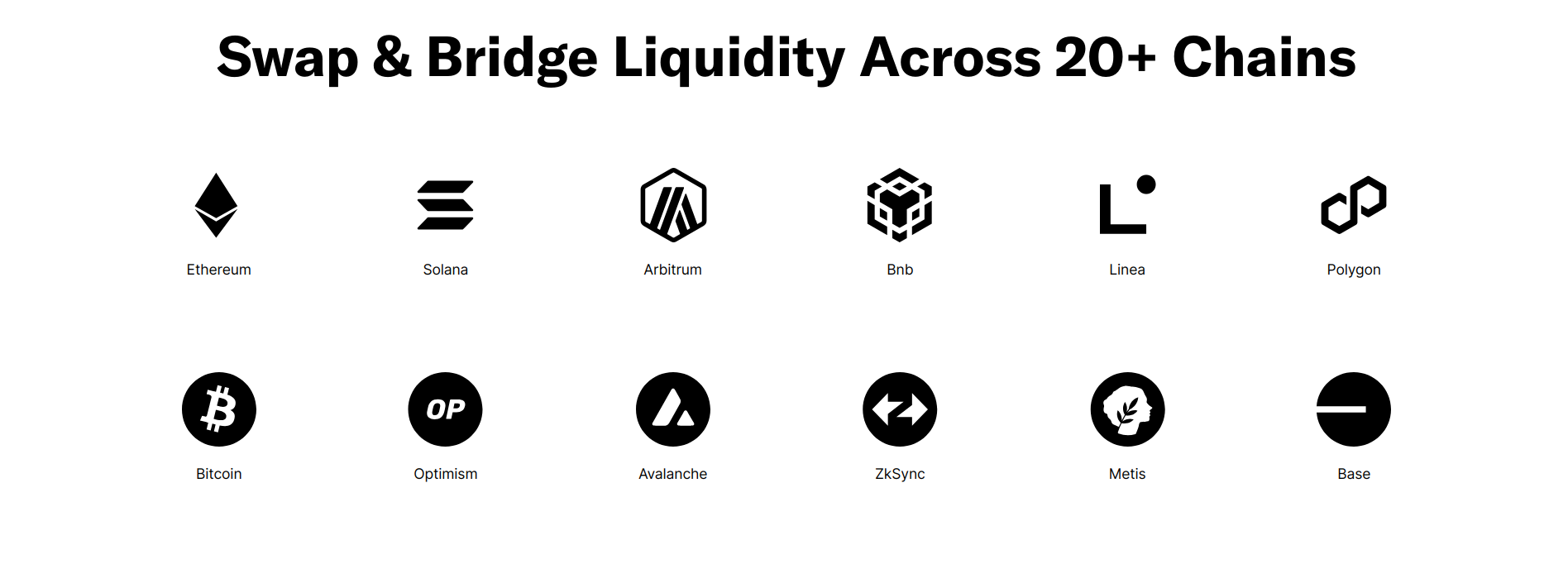

DeFi 2.0 expands on the early success of DeFi and learns from its drawbacks by introducing cross-chain bridges and a growing number of Layer-2 and even Layer-3 blockchains. Bridging assets from chain to chain used to take several harrowing minutes, with considerable cost and risk. Now, protocols like Across and LI.FI can complete the transfer in seconds, often for less than a penny.

The future of crypto in the next 5 years likely includes more innovations that bring your assets within easy reach and even connect to traditional finance platforms. Projects like Chainlink are already connecting private blockchains to public blockchains, and Hedera offers tokenized real-world assets (RWA) as a leading use case. This continued evolution would chip away at the wall between TradFi and the blockchain economy, making DeFi a universal and permissionless way to control many finance tasks.

5) Improved Environmental Sustainability

Crypto has a poor reputation when it comes to energy usage. Not all of this is deserved. Many leading protocols use energy-efficient proof of stake to validate transactions. Bitcoin, which uses energy-intensive proof of work for its validation, remains a target for critics.

However, Bitcoin mining reached a recent milestone by utilizing nearly 55% renewable energy sources. The mining community made that decision independently. While comparisons showing Bitcoin mining’s global energy usage exceeds that of some single nations (Argentina) are common, Bitcoin mining is making moves to become greener.

Miners are also moving towards using stranded energy, which means energy that can’t be utilized due to its location or a lack of infrastructure to transport or store it. Bitcoin mining can also be utilized in areas where there is an energy surplus and can even help balance energy grids. Bitcoin mining rigs are portable, so miners can set up shop wherever needed.

As the leading cryptocurrency, the future of the broader crypto market is largely dependent on the future of Bitcoin. The industry is making moves to improve sustainability and will continue to innovate in the coming years. Many other leading protocols use proof of stake or proof of history to validate transactions, both of which are energy-efficient by design.

6) Growing Role of AI

Artificial intelligence turned a corner with the release of ChatGPT and similar generative AI tools. The future of crypto is deeply connected to AI through blockchains that can host AI systems, such as Internet Computer (ICP) and Artificial Superintelligence (ASI), the merger of three AI-focused protocols (Fetch.ai, Ocean Protocol, and SingularityNET).

However, AI will also play a role in the crypto trading, investing, monitoring portfolios, and even dodging crypto scams and rug pulls.

- Predicting market movements: AI excels at identifying patterns. AI tools can recognize patterns in trading much sooner than the average trader, offering suggestions to optimize trades. Platforms like OKX already offer trading bots that can put your trades on autopilot.

- Token analysis: Today’s meme coin market is flooded with scam coins that prevent sales or implement a tax or whitelist. AI tools of the future will be able to identify warning flags and explain how a token can put your investment at risk or green light those that are safe.

- Faster development for protocols: Humans are still part of the process, but AI can build a working framework for proposed improvements or new features in seconds.

- Smart contract analysis: AI will help users choose protocols safely by flagging smart contracts with functions that create risk. AI will also optimize the use of smart contracts by suggesting when to use the contract to save on gas fees or reduce slippage in crypto transactions.

- Portfolio management: As AI improves, specialized AI tools will automatically rebalance portfolios for crypto investors, taking profits and reinvesting in other cryptocurrencies or moving to stablecoins, depending on market conditions.

Where Will Bitcoin Be in The Next 5 Years?

Although launched as a peer-to-peer electronic cash system, Bitcoin has instead become a store of value for many investors, a digital gold. Layer-2 networks like the Lightning Network make Bitcoin inexpensive to use but also require the proper infrastructure from participants. Newer cryptocurrencies like Kaspa may be better suited to Bitcoin’s original use case, sending money from A to B quickly and with negligible transaction costs.

Within the next 5 years, we’ll also see another Bitcoin halving, in which the mining rewards drop by 50%. This increases Bitcoin’s scarcity, making each bitcoin worth more. In the coming years, Bitcoin will continue in its current role as a store of value, with the next leg up initially fueled by investor-friendly exchange-traded funds (ETFs). These ETFs also allow businesses to invest in the cryptocurrency sector without the huge learning curve that comes with Bitcoin self-custody wallets.

Bitcoin is the most likely cryptocurrency to be adopted by institutions due to its status as a commodity and recent approvals for Bitcoin ETFs. More providers will enter the custody market as well, providing a way for spot Bitcoin investors to safeguard their wealth as it grows.

There’s also a possibility that Bitcoin could become a secondary — or even primary — reserve currency, providing a way to transact across borders at scale without the risk that comes with an inflationary currency controlled by a single government. However, we may have to wait more than 5 years for this to occur.

Emerging Use Cases of Crypto in The Next 5 Years

Early adopters are already using blockchain technology to improve efficiency in several industries, ranging from gaming to healthcare. Blockchain also plays an important role in supply chain management, creating a ledger of transactions as products are assembled or goods move through the supply chain.

Many of these functions occur on private blockchains now, but some applications are better suited to public blockchains or hybrid blockchains that make some data publicly available while protecting sensitive data.

Identity Verification and Management

Traditional identity verification methods are fraught with peril, much of which stems from the potential for breaches. They’re also cumbersome, as anyone who has ever had to get a replacement ID can attest.

Decentralized networks provide an immutable record and a way to digitally sign to verify your digital identity (DID) as it relates to the task at hand. Crypto wallets have provided this functionality from day one by using pseudonymous wallet addresses as the identity in transactions.

However, the concept has evolved, most recently with Sam Altman’s project, Worldcoin. More than 5 million people worldwide have a World ID, a proof-of-humanness project that preserves user privacy while using your ID to access a growing library of applications. Expect to see this concept evolve further in the coming years, providing a secure, ID-verified way to transact and interact.

Supply Chain Management

Information is crucial to efficiency in a global or even a local supply chain. Blockchains allow individual participants to update the data, including moving from ingredient to product or from factory to common carrier. As crypto and blockchain adoption grows, expect to see more transparency in supply chains. The benefit to providers is efficiency and accountability. The benefits to consumers are cost savings and increased availability of goods.

The IBM Food Trust runs on blockchain technology, tracking food distribution from farm to store. This technology can also help providers and government agencies pinpoint the source of contamination in the event of health risks.

Real-World Asset Tokens

Any asset you can think of can be tokenized on the blockchain, and many will be in the coming years. Imagine a non-fungible token (NFT) for your home, car, laptop, or even a tokenized money market fund. Buying, selling, or proving ownership could be a crypto wallet transaction. Tokenized real-world assets are already on-chain, although the market is still fragmented, and it’s possible that new token standards will emerge specifically for this use case.

Tokenization also allows for fractional ownership. In a recent deployment on Hedera, abrdn, a UK wealth management company, tokenized the Lux Sterling Money Market Fund. Strategies like this make real-world assets more accessible, bypassing intermediaries and minimum purchase requirements.

Blockchain in Healthcare

Blockchain is already in use in healthcare, tracking the pharmaceutical supply chain, securing patient data, and much more. Legacy systems were data silos filled with papers and antiquated servers, making it difficult, expensive, and time-consuming to access medical records from other providers.

Blockchain technology promises to make data available when needed while protecting patient privacy. For example, the UK’s Medicalchain network tracks health records in an immutable ledger, allowing health professionals to access data on demand. At the same time, the blockchain prevents third parties from accessing it to protect patient privacy.

Anonymized blockchain data will also streamline outbreak response and help health professionals spot actionable health trends. Expect to see dynamic growth of blockchain usage in this and similar fields.

Rise of Crypto Gaming

The gaming market is expected to grow to nearly $700 billion by 2030. However, existing gaming platforms suffer from one primary drawback: players don’t own the in-game assets. Buy a pink bunny suit for your avatar, and the game company keeps the money. If you leave the game — or get banned from the platform — your in-game purchases are gone.

Crypto games aim to change that dynamic — and already have. Web3 games allow players to use a crypto wallet address to access the game. In-game assets become NFTs, which can then be sold or monetized within the game. Can you see who’s winning the game now?

Blockchain games like Star Atlas rival the graphics quality of the best game-studio titles and provide an in-game economy. When you buy or earn an NFT, you keep the NFT in your crypto wallet. Many web3 games also support taking to earn passive income. Expect a gradual shift to crypto games as more titles become available and players become comfortable using crypto wallets and decentralized exchanges for swapping assets.

Crypto Price Predictions Over Next 5 Years

Blockchain growth in the coming years will be explosive, assuming the industry gets better clarity on regulation. Overly burdensome regulations will chase innovation to friendlier jurisdictions. Still, despite the unknowns, some well-known people in the space have offered bold predictions on the price of key crypto assets.

Kathie Wood, CEO of ARK Invest, offers a top-end prediction for Bitcoin at $3.8 million by 2030. As of this writing, BTC trades at about $66,000. Kathie Wood also sees a bullish price outlook for Ethereum, predicting the second-largest cryptocurrency could rise as high as $166,000 per ETH by 2030. ETH just topped $3,000.

In the short term, Rich Dad author Robert Kiyosaki sees Bitcoin reaching $100,000 in 2024.

Let’s explore the bull and bear cases for the future of crypto in the next 5 years.

Crypto Over The Next 5 Years: Bullish or Bearish?

Blockchain trends are easier to predict than blockchain asset prices. Prices for crypto assets are likely to move swiftly in the coming years, but there are also some potential headwinds.

Potential catalysts to boost markets include eased regulations — or at least better clarity — as well as mainstream adoption and better use cases. However, it may not be smooth sailing for crypto enthusiasts and HODLers. Factors ranging from scalability issues to war could pose a threat to crypto markets.

The Bull: Why Crypto Has a Bright Future

First, let’s explore the reasons why crypto’s best days may be yet to come. If crypto can solve real-world problems, the stigma of being a digital casino will disappear, and mainstream investors will become less skeptical.

- Technological innovation: For many applications, blockchain offers better and more transparent solutions compared to proprietary databases. As blockchains and similar technologies like directed acyclic graphs (DAGs) become more efficient, these platforms become more attractive.

- Mainstream adoption: In some countries, as much as 30% of the population uses or holds crypto. However, crypto remains confusing or untrustworthy in much of the world. ETFs could help overcome this stigma and bring broader adoption as investors start with BTC and then explore other digital assets.

- More sophisticated use cases: Crypto is often seen as traders selling meme coins to each other. The analogy often isn’t far off, but there’s also an entire world of DeFi, GameFi, and SocialFi to explore and builders continue to innovate. Expect more real-world solutions for both consumers and businesses in the coming years.

- Planet-friendly protocols: Bitcoin mining itself has become more eco-friendly, and many newer protocols use energy-efficient consensus mechanisms such as proof of stake.

- Ease of entry: Crypto wallets and exchanges can be difficult to navigate for new users. Expect improvements in ease of use with newer wallets like Coinbase’s Smart Wallet, which uses simple passkeys to secure the wallet.

- Easing regulation: Governments have been tough on the crypto market in recent years, some of which was deserved, and some of which may have been heavy-handed. Eased regulation or improved clarity will help onboard new users and boost institutional adoption.

The Bear: Why Crypto Might Struggle

Crypto markets may have mountains to climb, however. Black swan events could derail progress, and the industry still has some problems to solve, including scalability. To be balanced, let’s discuss some of crypto’s potential challenges ahead.

- Black swan events: Wars, pandemics, or even the threat of a financial collapse could cause crypto markets to sell off.

- Scalability issues: While Ethereum is the largest smart contract network, it’s still slow and expensive to use. Layer-2 networks help solve the speed and cost issues but can be intimidating for new users. Crypto needs to solve its scalability concerns in an accessible way to attract a larger user base. Without that, traditional financial systems remain a more usable option for many.

- Draconian regulation: Countries around the world have severely limited the use of crypto, with some, such as Iraq and Kuwait, banning crypto altogether. Similar draconian regulation of crypto transactions in other parts of the world would harm crypto markets.

- Pressure from environmental groups: Crypto is becoming much greener, but real-world data never gets in the way of politics. Pressure from environmental groups could lead politicians to restrict crypto mining or its use.

- Ease of use: Crypto wallets remain difficult to use, and DeFi or staking protocols can be confusing for new users. If the industry doesn’t solve its usability problems, crypto will remain a fringe asset.

- Slow institutional adoption: If institutions are slow to take advantage of blockchain’s benefits, crypto’s overall growth will suffer.

Conclusion: What is the Future of Crypto in 5 Years?

Crypto’s future in the coming years depends on both the industry itself and how governments worldwide respond to calls for regulatory clarity. Cryptocurrency and decentralized applications have the potential to bring equal access to financial services through community-governed digital assets and protocols.

However, the industry has its work ahead in the form of making crypto safer and easier to use. Governments around the world also bear some responsibility for the future of the crypto sector. Clear regulatory guidelines provide a framework for builders and will bring new innovations. On the other hand, if governments worldwide move to restrict crypto rather than foster innovation, the industry will have trouble reaching a wider market.

FAQs

How many new cryptocurrencies will there be in the next 5 years?

Expect hundreds of new blockchains and more tokens than can be counted. Tokens are crypto assets that exist on a host blockchain and only take minutes to create. Blockchains are much more complex projects. However, most of these crypto projects ultimately won’t survive. Network effects and features will guide the market to the projects with staying power.

What will the total crypto market be in 5 years?

The total crypto market cap is currently $2.5 trillion, according to estimates. In the next five years, many expect the total crypto market to exceed $25 trillion, with much of the growth expected in key assets like BTC and ETH.

Which crypto will boom in the next 5 years?

BTC and ETH are both expected to see continued growth in the next 5 years. Other altcoins, such as Solana, Internet Computer, and Hedera, could also see dramatic growth. However, much of the expected growth hinges on increased adoption.

Will Crypto outperform the stock market over 5 years?

BTC and ETH are both expected to outperform the stock market over the next five years.

References

- CoinEx Celebrates Bitcoin Pizza Day with “One Bite of Bitcoin” Campaign (finance.yahoo.com)

- Owned or used cryptocurrencies in 56 countries and territories worldwide (statista.com)

- CoinGecko Yearly Report for 2019 (coingecko.com)

- President Biden signs $1.2 trillion US spending bill (reuters.com)

- FCA warns about common issues with crypto marketing (fca.org.uk)

- US SEC seeks $2 billion from Ripple Labs, chief legal officer says (reuters.com)

- SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency (sec.gov)

- House to Consider Financial Innovation and Technology for the 21st Century Act (house.gov)

- MicroStrategy Owns About 1% of All Bitcoin With Latest Purchase (bloomberg.com)

- Chairman Tarbert Comments on Cryptocurrency Regulation at Yahoo! Finance All Markets Summit (cftc.gov)

- Central Bank Digital Currency Development Enters the Next Phase (imf.org)

- Ghana to become Africa’s first blockchain-powered government (businessinsider.com)

- Connecting enterprises to the blockchain economy (chain.link)

- Real-World Asset Tokenization on Hedera (hedera.com)

- Bitcoin mining’s green mile: 54.5% sustainable energy use (finance.yahoo.com)

- Can Cryptocurrency Rein In its Massive Energy Consumption? (pbs.org)

- Bitcoin Mining: A Path To Electrifying The World (nasdaq.com)

- Bitcoin: A Peer-to-Peer Electronic Cash System (bitcoin.org)

- World ID 2.0 – A more human passport for the internet (worldcoin.com)

- abrdn is using distributed ledger technology to democratize investment opportunities (hedera.com)

- Kevin O’Leary Responds To Cathie Wood’s Bitcoin Prediction (finance.yahoo.com)

- Cathie Wood’s Bullish Ethereum (ETH) Prediction (finance.yahoo.com)

- Robert Kiyosaki Says He Expects Bitcoin To Hit $100K (finance.yahoo.com)

About the Author

Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined with a consumer advocate stance brought Eric to the crypto industry, where he writes articles and guides aimed at making crypto easier to understand.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

News

Block Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

Block, a payments technology company led by Jack Dorsey square could become a formidable player in the cryptocurrency mining industry, but Wall Street will need details on profit margins to gauge the positive impact of the business on earnings, analysts said.

Block signed its first large-scale cryptocurrency mining hardware pact on Wednesday, agreeing to supply its chips to bitcoin miner Core Scientific CORZbut no financial details were disclosed.

JP Morgan estimates the deal could net Block between $225 million and $300 million, but said more information will be needed to assess the hardware business’s long-term earnings potential.

“We still have a lot to learn in terms of the margins of this business, so we are hesitant to underwrite this transaction until we know more about the cadence and economics,” J.P. Morgan said.

The deal marks a major step for the payments company, which started out as “Square” in 2009 before rebranding in 2021 in a nod to its focus on crypto and blockchain technologies.

Dorsey, who co-founded and ran Twitter (now known as “X”), has long been bullish on Bitcoin. Block began investing 10% of its monthly gross profit from Bitcoin products into Bitcoin in April.

In the first quarter, nearly 9% of the company’s cash, cash equivalents, and marketable securities consisted of bitcoin.

“This development (the deal with Core Scientific) is further evidence of Block’s role as an emerging leader in the crypto hardware ecosystem,” Macquarie analysts Paul Golding and Emma Liang wrote in a note.

Analysts say similar deals to follow could further validate Block’s reputation in the industry.

But J.P. Morgan said the stock’s performance will be determined by Block’s other segments, such as Square and Cash App.

Block shares have lost nearly 17% this year.

News

This Thursday’s US Consumer Price Index could be a game-changer for cryptocurrencies!

3:30 PM ▪ 4 minute read ▪ by Luc Jose A.

This Thursday, attention will be focused on the United States with the anticipated release of the Consumer Price Index (CPI). This economic indicator could trigger significant movements in the markets, especially for the U.S. dollar and cryptocurrencies. While investors remain vigilant, speculation is rife about the potential impact of these key figures.

The Consumer Price Index: The Cornerstone of the American Economy

The Consumer Price Index (CPI) is a key measure of inflation which reflects changes in the price of goods and services purchased by American households. This index is calculated monthly by the Bureau of Labor Statistics (BLS) and serves as a barometer for the cost of living. The consumer price index covers a wide range of products, including food, clothing, housing, health care, and entertainment. Economists and policy makers closely monitor this data to anticipate economic trends and adjust monetary policies accordingly.

The June CPI data is due to be released this Thursday at 2:30 p.m., and is highly anticipated by investors. The current consensus is for headline annual inflation to decline to 3.1%, from 3.3% the previous month, while core inflation is expected to remain stable at 3.4%.

THE BIGGEST EVENT THIS WEEK 🚨

The U.S. Consumer Price Index is expected to

PUBLICATION TODAY AT 8:30 AM ET.EXPECTATIONS ARE 3.1% WHILE

LAST MONTH THE CONSUMER PRICE INDEX (CPI) WAS 3.3%HERE ARE SOME SCENARIOS 👇

1) CPI above 3.1%

THIS WILL BE A DAMAGE TO THE MARKET

GIVEN THAT THE LAST TIME THE CPI DATA… photo.twitter.com/yudjPLPl8g— Ash Crypto (@Ashcryptoreal) July 11, 2024

Consumer Price Index Release: What Does It Mean for the Dollar and Bitcoin?

Inflation as measured by the consumer price index is a key determinant of the value of the US dollar. If the consumer price index declines more than expected, it could reinforce expectations of a rate cut by the Federal Reserve in September, thus weakening the dollar. A weaker dollar could benefit GBP/USD, which recently broke a major resistance level, and Bitcoin, which could see its price rise due to increased demand from institutional investors.

Current forecasts suggest that headline inflation will decline to 3.1%, with core inflation holding steady at 3.4%. However, a surprise increase in the consumer price index could upset these expectations. Fed Governor Lisa Cook has mentioned the possibility of a soft landing for the economy, with inflation falling without a significant increase in unemployment, which could lead the Fed to consider rate cuts. This outlook is particularly favorable for stock markets and cryptocurrencies, including Bitcoin, which could benefit from a more accommodative monetary policy.

According to experts at 10x Research, especially their CEO Markus Thielen, Bitcoin could see a significant increase if the CPI data confirms a decline in inflation. Thielen indicated that Bitcoin could reach almost $60,000, a prediction that has already been reflected with a rise to $59,350 before the data was released.

Therefore, Thursday’s CPI data could determine the future direction of financial and cryptocurrency markets. High inflation could strengthen the US Dollarwhile a drop in inflation could pave the way for rate cuts by the Fed, thus giving a boost to Bitcoin and other digital assets.

Enhance your Cointribune experience with our Read to Earn program! Earn points for every article you read and access exclusive rewards. Sign up now and start earning rewards.

Click here to join “Read to Earn” and turn your passion for cryptocurrencies into rewards!

Luke Jose A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of the news, decipher market trends, convey the latest technological innovations and put into perspective the economic and social issues of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Do your own research before making any investment decisions.

News

Crowd Expects Bitcoin Bounce Suggests Further Losses, As RCO Finance Resists Crash

Bitcoin is seeing a rebound after its recent price crash to $53,000. Other altcoins are subsequently recovering, with many cryptocurrency investors increasingly making new entries. However, Santiment warned against this hopium, suggesting that Bitcoin could extend its price losses.

As the broader market anticipates Bitcoin’s next price action, RCO Finance (RCOF) demonstrates resilience, attracting thousands of people in influxes. Read on for more details!

RCO Finance challenges the market crisis

RCO Finance (RCOF) is approaching $1 million in funding raised, amid growing interest from institutional traders seeking stability from Bitcoin’s wild price swings. While much of the broader market has seen significant price losses, RCO Finance has remained resilient, experiencing a surge in its pre-sale orders.

As a result, the project seems oblivious to the current market conditions, leading top market experts to take a deep dive into its ecosystem. They identified why RCO Finance was able to withstand the bearish pressure and its potential to hold up even stronger during the impending broader market crash.

The main reason was related to the innovative use of RCO Finance AI Trading Tools as a Robo Advisor. This tool has been integrated into RCO Finance’s cryptocurrency trading platform, offering full automation and highly accurate market forecasts to help investors make informed decisions.

Read on to learn more about this tool and other exciting features of RCO Finance!

Bitcoin Bounces Amid Impending Crash

Bitcoin is bouncing back, rallying 8% after plunging to its lowest point since February on July 5. While this rebound has triggered a bullish wave in the broader market, many cryptocurrency analysts predict it could be short-lived as Bitcoin is poised for an imminent crash toward the $50,000 zone.

On a Post X (formerly Twitter)Santiment revealed that while the crowd is anticipating a Bitcoin rally, this potential crash could trigger FUD and panic, causing average traders to wither and give up on Bitcoin. The platform noted that Bitcoin rally has historically occurred after these weak hands sold their holdings.

In particular, these cryptocurrency analysts speculate that the previous and upcoming Bitcoin crash is largely the result of bearish market psychology, as opposed to large BTC sell-offs by the German government and Mt. Gox. In particular, Ki Young Ju, founder and CEO of CryptoQuant, noticed that “the sales were rather negligible, given the overall liquidity of Bitcoin.”

Enjoy seamless investing on RCO Finance

RCO Finance is making investing easier and easier, democratizing access to high-level tools and cryptocurrency earnings that were once reserved for professional and institutional investors. It has also prioritized accessibility, allowing investors of all levels to easily navigate its features through its intuitive interface.

Additionally, they can also maintain anonymity and privacy as the platform has no KYC requirements. To build trust, the platform has instead emphasized regular smart contract audits by respected security firm SolidProof.

Performance data shows massive adoption, indicating that it is doing its job effectively. Investors can also capitalize on RCO Finance’s fast transaction speeds and incredibly low transaction fees, with leverage options up to 1000x to further optimize their portfolios and maximize returns.

Leverage RCO Finance’s pre-sale earnings

An in-depth analysis of the RCO Finance ecosystem revealed that it has strong potential to rival and surpass major cryptocurrencies in the cryptocurrency industry. With a very limited total token supply and excellent tokenomics, RCO Finance is poised to reach its target of $1 billion in market cap upon its official launch.

RCO Finance has adopted a deflationary model, strategic burn mechanisms, and a vesting schedule. However, the project encourages long-term holding by focusing on sustained growth through incredibly high staking rewards.

RCOF tokens are currently available at an altcoin price of $0.01275 in progress Pre-sale Phase 1. This is likely the lowest price these coins will ever trade at, as they are expected to increase exponentially with each new presale phase.

With RCOF expected to be $0.4 at launch, investors jumping in now can expect a Return 30x on their investment!

For more information on RCO Finance (RCOF) presale:

Join the RCO Financial Community

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

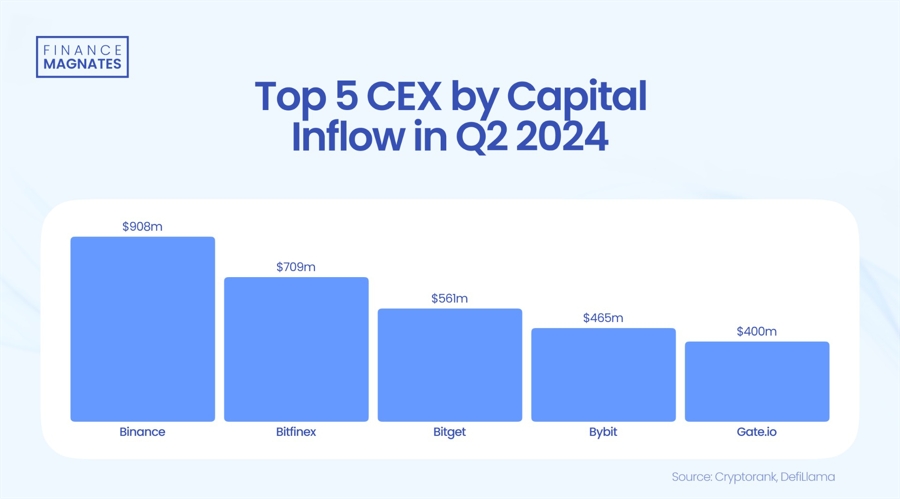

Bitget Ranks Third Among Cryptocurrency Exchanges by Capital Inflows in Q2

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming more and more intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

Although Bitget is not the largest cryptocurrency exchange in terms of total volumes, it closed a favorable quarter. From April to June, the platform ranked third in net capital inflows and showed the strongest growth in market share compared to its competitors.

In the second quarter, investors moved $700 million into Bitget, and activity on the platform increased by nearly 50%.

The exchange has seen a surge in user funds, with Bitcoin (BTC), Tether (USDT), and Ethereum (ETH) rising 73%, 80%, and 153%, respectively, in the first six months of the year. This growth coincided with adding 2.9 million new users to the platform.

This has positioned Bitget among the top exchanges with the highest positive net inflows in the last quarter. Only Binance, which remains the market leader, and Bitfinex have performed better in this category.

According to CCData’s latest H2 Outlook Report, the exchange also recorded the highest market share growth among centralized exchanges, increasing 38.4% from H2 2023 to H1 2024.

Bitget’s spot trading volume has also seen a visible increase, going from $28 billion in Q1 to $32 billion in Q2, marking an increase of over 10%. The platform’s monthly visitors have reached 10 million. Although its volumes are increasing, Bitget still does not rank among the top 10 cryptocurrency exchanges in terms of spot trading.

The changes taking place in the centralized cryptocurrency exchange market show that competition is becoming increasingly intenseAn example of this is the recent surge in popularity of Bybit, which has become the second largest exchange in terms of spot trading volumes.

Sports Sponsorships and New Products

Gracy Chen, Source: LinkedIn

Gracy Chen, CEO of Bitget, commented on the quarterly performance, saying, “Q2 2024 was a pivotal period for Bitget. Our collaboration with Turkish athletes, along with significant growth in users and website traffic, is part of our global expansion.”

In an effort to expand its global presence, Bitget has partnered with three Turkish national athletes as part of its #MakeItCount campaign, starring Lionel Messi. The deal with the famous footballer It was signed in Februaryto build brand presence in Latin America.

The exchange also launched a $20 million TON Ecosystem Fund in partnership with Foresight Ventures to support early-stage projects on The Open Network.

The exchange introduced two new initial token listing products, PoolX and Pre-market, which collectively launched over 100 projects. Additionally, Bitget’s native token, BGB, was recognized as the best-performing centralized exchange token in June and was ranked among the top 10 cryptocurrencies by Forbes.

In its latest move, the cryptocurrency exchange aimed to become a regulated player in IndiaThe announcement comes as the world’s most populous democracy grapples with the complexities of integrating cryptocurrencies into its financial ecosystem.

Even recently,

Bitget Wallet Announced a joint investment with cryptocurrency investment firm Foresight X in Tomarket, a decentralized trading platform. This initiative targets emerging asset classes and aims to expand the portfolio’s services beyond traditional decentralized exchanges (DEXs).

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!