Markets

What’s next for Ethereum and other cryptocurrencies?

What factors are driving the downtrend in altcoins and when can we expect a turnaround?

Last month, the crypto market, especially altcoinsfaced a prolonged recession, with many recording staggering losses.

Ethereum (ETH), the second largest crypto by market valueIt has lost nearly 10% of its value over the past 30 days, trading at around $2,960 on May 13.

However, ordinals (ORDI) was hit the hardest, dropping 40% and now trading at just $36.80.

This market downturn aligns with global economic trends such as recent decision by the Federal Reserve (Fed) to maintain its interest rates between 5.25% and 5.50%.

The Fed’s cautious approach to monetary policy, aimed at tackling inflation and economic growth, may have created uncertainty among crypto investors, leading them to favor more established assets like Bitcoin (Bitcoin).

BTC has largely traded above $60,000 levels during this recession, with BTC domain even peaking at almost 57% in April, a huge increase from last year’s levels of 45-46%. On May 13, BTC dominance was over 55%.

BTC Dominance Chart | Source: TradingView

Additionally, the Fed’s announcement about its strategy of reducing bond holdings, slowing the pace that allows yields from maturing bonds to be eliminated without reinvestment, could indicate potential future economic challenges.

This signal may have further reduced investor confidence in altcoins, diverting attention and capital away from riskier assets.

As the crypto market faces this recession, the question arises: when will altcoins recover? Let’s explore.

What do the experts think?

Analysts have offered a variety of perspectives on the current state of the altcoin market. Here’s what they think

Patric H. | CryptointelligenceX

Patric H. remains bullish on the overall market, anticipating a continuation of the bull market until mid-Q3/Q4 2024.

🚨 Opposite opinion: The bottom is not in.

May will be emotionally difficult for many #Bitcoin It is #Altcoins investors.

Sometime in the next 2 to 6 weeks, we will witness the final shake before the breakout.

🧵Here’s what to expect in this turbulent time.

– Patric H. | CryptelligenceX (@CryptelligenceX) April 30, 2024

However, he warns of a turbulent phase in the short term, especially in May. He predicts a final move in the next 2 to 6 weeks, possibly revisiting $52K for Bitcoin and $2 trillion for total market cap.

He attributes the delay in bottoming out to the lack of sufficient pain in the market, indicating that sentiment remains too euphoric.

Patric advises monitoring the Fear and Greed Index for signs of a shift toward “fear.” He also mentions keeping a tab on divergence in sentiment and trading volumes, which could suggest a possible reversal.

Benjamin Cowen

Benjamin Cowen draws parallels to the previous cycle, noting that ALT/BTC pairs tend to capitulate just before rate cuts. He suggests that ALT/BTC pairs could fall another 40% from current levels in the coming months.

In the last cycle, we saw #ALT /#BTC peers capitulate just before rate cuts.

Maybe this time will be no different? This would mean ALT/BTC pairs would fall another 40% from here in the coming months.

Contrary short-term trends do not invalidate this view. pic.twitter.com/BK3VIrCBJ2

-Benjamin Cowen (@intocryptoverse) April 30, 2024

Cowen attributes altcoins’ continued struggles to a decline in social interest, comparing the current market movement to that of 2019.

Altcoins continue to struggle as social risk is plummeting. People just don’t seem to care.

All this change still feels like 2019 to me. Social interest rates also fell just before the rate cuts arrived, and then ALT/BTC finally bottomed as the Fed pivoted pic.twitter.com/SEKbLRMTaX

-Benjamin Cowen (@intocryptoverse) April 29, 2024

He points out that social interest rates have declined before rate cuts in the past, suggesting a potential bottom for ALT/BTC pairs, coinciding with a change in Fed policy.

Michael van de Poppe

Michaël van de Poppe notes that altcoins are experiencing a regular correction in dollar valuations, but in BTC valuations, they have fallen sharply, approaching cycle lows.

O #Altcoin market capitalization is seeing a regular correction (in dollar valuations).

In BTC valuations, they have fallen a lot and are at cycle lows.

Undervaluation vs. Reality.

This is not the time to abandon crypto, but to attack the riskiest markets. pic.twitter.com/h298e63ory

-Michaël van de Poppe (@CryptoMichNL) May 12, 2024

He suggests that this undervaluation represents an opportunity to attack riskier markets rather than move away from crypto.

What to do with this?

These analyzes suggest a cautious outlook for the altcoin market in the near term, indicating that more corrections may be on the horizon.

However, they also point to a possible upward trend in the medium and long term. This means you must remain alert and flexible as the market evolves.

The next few weeks will be important for the altcoin market, with factors such as sentiment, trading volumes and external economic events likely to have a major impact.

Potential catalysts for market recovery

The crypto market is at a critical juncture, with potential catalysts that could restore normalcy and revive bullish sentiment.

A major development is the progress of the Financial Innovation and Technology for the 21st Century (FIT21) Act in the U.S. House, which aim to bring regulatory clarity to digital assets.

If passed (could be in May), the bill could establish federal standards for digital assets, clarify the jurisdiction of regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), and establish a regulatory framework . for digital asset markets.

The crypto industry has long sought regulatory clarity, and the FIT21 Act could offer much-needed certainty to market participants and investors, potentially increasing confidence and investment in the sector.

Furthermore, the bill’s provisions to allow secondary market trading of digital commodities and impose requirements on registered entities could improve transparency and market integrity.

Another potential market driver is the SEC’s upcoming ruling on VanEck’s spot ETH exchange-traded fund (ETF). applicationscheduled for May 23, 2024. A favorable decision could trigger a rally in ETH prices, similar to the ETF-driven surge in Bitcoin in early 2024.

Concerns persist regarding the SEC’s classification of ETH as a commodity or security, which could impact the approval of spot ETH ETFs.

Current sentiment surrounding the launch of spot ETH ETFs in the US is largely bearish, with concerns about regulatory uncertainty and the position of the SEC under Chairman Gary Gensler.

However, industry experts believe that a spot ETH ETF will eventually get the green light, mirroring the path of spot BTC ETFs, which initially faced rejections before prevailing in a lawsuit against the SEC.

In the short term, a rejection of the spot ETH ETF could trigger greater price volatility and a decline in ETH prices as the market absorbs the news.

Meanwhile, regulatory clarity and approval of spot ETH ETFs could drive altcoin market recovery and uptrends in the coming months.

ETH Price Analysis

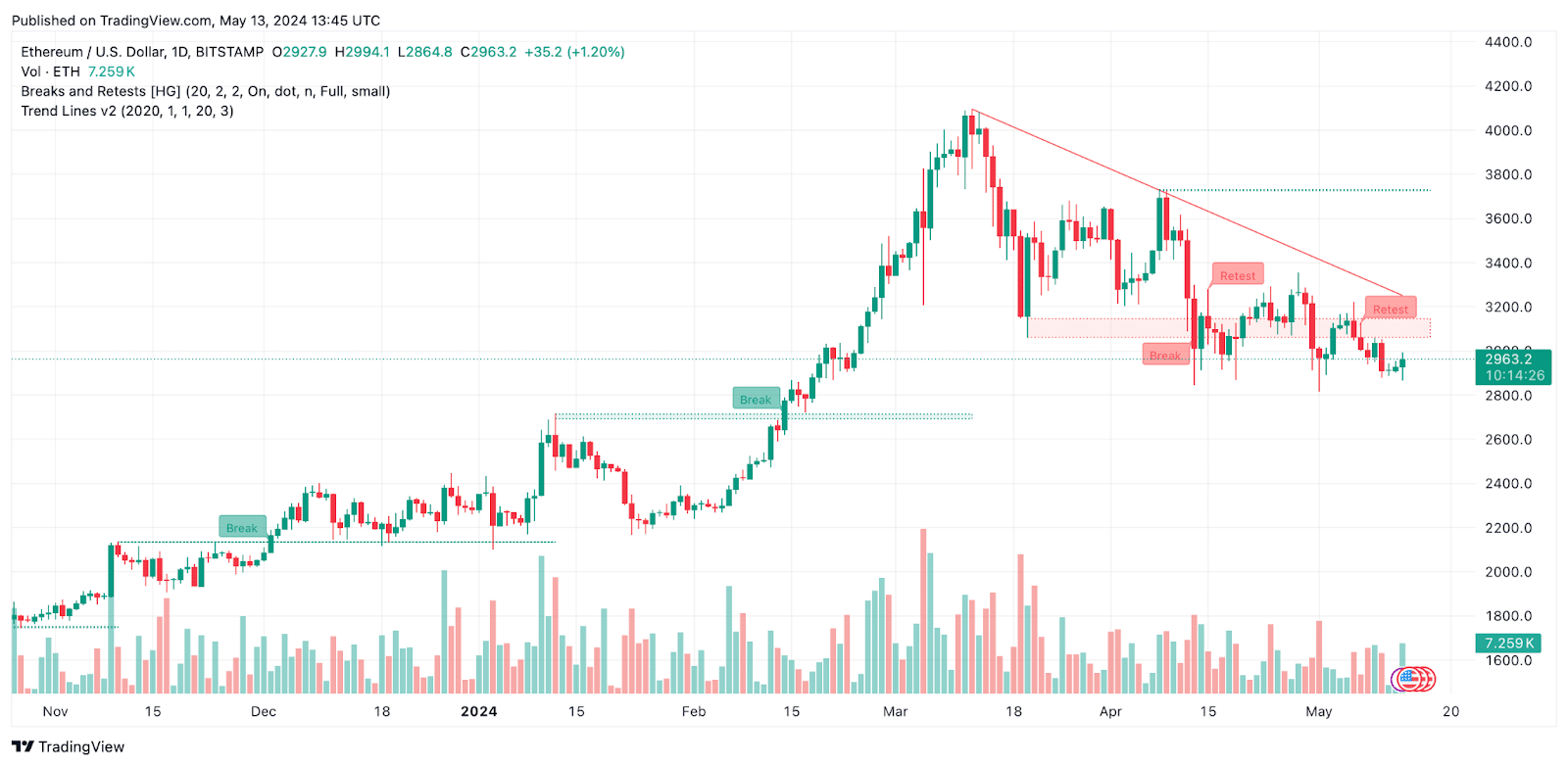

On May 13, Ethereum was trading for around $2,970. ETH has been following a descending pattern, leading to concerns that it could fall below the $2,500 mark.

The recent trend in ETH prices has been bearish, with weekly trading opening below the previous week’s close, suggesting a lack of upside momentum.

ETH Price Analysis | Source: TradingView

Over the past 24 hours, the ETH/USD pair has been trading positively, breaking above $2,900 levels but facing solid resistance around the EMA50 at $2,990. For a downtrend to resume, ETH needs to break below $2,900, potentially heading towards the $2,800 and $2,620 levels.

On the other hand, a continuation of the rise and a break of $2,990 could lead to further gains towards $3,130 levels.

The expected trading range for ETH is between $2,800 (support) and $3,050 (resistance), with the forecast trend remaining bearish.

ETH analysis suggests that prices may face continued downward pressure, also impacting other altcoins in the market.

Markets

Crypto Markets Rebound as Spot Bitcoin ETFs Attract Massive Inflows

This week saw $722 million worth of Bitcoin spot ETF inflows, including the largest daily inflow in a month.

Cryptocurrency markets rallied on Wednesday, driven by inflows into spot Bitcoin exchange-traded funds (ETFs).

The price of Bitcoin (BTC) is up 3% over the past 24 hours to last change hands at $65,200, according to CoinGecko. Ethereum (ETH) is up 2% and is trading at $3,471. Solana (SUN) and Polkadot (POINT) increased by 4%.

Bitcoin spot ETFs saw $422 million in daily inflows on Tuesday, the highest in the past 30 days, according to Far side data, . The all-time record for a single day was $1.05 billion on March 12.

Among Tuesday’s top contributors, BlackRock’s IBIT led with $260 million in inflows, followed by Fidelity’s FBTC with $61 million. This week has already seen more than $722 million in inflows.

Among the top 100 cryptocurrencies by market cap, Worldcoin (WLD) led with a 28% increase, followed by Helium (HNT) with 20% and Lido DAO (LDO) with 15%.

Worldcoin, a decentralized identity project led by OpenAI CEO Sam Altman, announced is extending the lockups for early investors and team members. This means that tokens will be gradually released through 2029, instead of the original 2027 plan. Token unlocks are generally seen as a negative because they increase supply and early investors can sell their tokens for profit.

Meanwhile, XRP, the token of the XRP Ledger network, jumped 8% after the CME and CF benchmarks introduced new indices and reference rates for XRP.

U.S. stocks faced a downturn on Wednesday. The S&P 500 fell 1%, while the Nasdaq Composite and Dow Jones Industrial Average both fell 2%.

Markets

Altcoins on the cusp of a major breakout – WLD, AR, and INJ prices could surge by 20% in the coming days

Crypto markets appear to have been taken over by the bulls as major tokens have surged above their crucial resistance zone. Bitcoin surged above $65,000 while Ethereum was above $3,500, and XRP, which had remained passive for quite some time, surged over 40% in the past few days to hit $0.6. The uptrend has been captured in most altcoins, with Worldcoin (WLD), Arweave (AR), and Injective (INJ) leading the rally. Here’s what to expect for these tokens in the coming days.

Worldcoin (WLD) Price Analysis

O Worldcoin Price has been trading inside a descending wedge since it marked a new ATH near $12 in the final days of Q1 2024. The recent price action helped the price break out of the upper resistance of the wedge, breaking above the crucial resistance zone between $2.21 and $2.39. Market sentiments have changed, but technicals suggest that the bulls may remain passive for a while, which could offer some room for a bearish pullback.

The price broke out of the wedge with a significant increase in volume, but the current volume suggests that the bulls have taken a step back. Meanwhile, the RSI is about to reach the upper boundary, which could attract bearish forces. Additionally, the DMI has undergone a bullish crossover, but the decline in the ADX suggests that the rally may remain consolidated above the gains. Therefore, the WLD price is expected to maintain a horizontal consolidation between $3 and $3.3 and trigger a fresh rally to $4.4 during the next bullish rally.

Arweave (AR) Price Analysis

Arweave formed a strong base around $25, which helped the rally trigger a recovery during the bearish attack. Mt. Gox and German terror forced the price to fall below $20. However, the recent price action has brought the altcoin within the bullish range and raised expectations of maintaining a decent uptrend for a few more days.

AR price has hit one of the major resistances around $30 to $31.5, which could act as a strong base once overcome. The buying volume is slowly increasing, which could keep the bullish hopes for the rally high. Moreover, the supertrend has just flashed a buy signal, indicating a clean reversal of the trend. Therefore, AR price seems primed to maintain a healthy uptrend and rally above $40. However, if the bulls maintain a similar trend, making new highs above $50 may not be a tedious task for the bulls.

Price Analysis of Injective (INJ)

Injective price has been showing sharp strength since the beginning of the year and hence, the recent turnaround is expected to revive a good uptrend going forward. The bears engulfed the rally to a large extent, but the recent price action suggests that the bulls have regained their dominance. Therefore, INJ price is expected to maintain a strong uptrend with a bearish interference on the way down.

INJ price has surged above the lower support zone and has registered consecutive bullish candles. Although the volume is below the required levels, the OBV is maintaining a sharp uptrend. Furthermore, the Ichimoku cloud lead span B is heading towards the lead span A and a healthy crossover indicates the start of a new uptrend. However, INJ price may be out of the bears’ reach once it secures the resistance zone between $30.77 and $32.12, which seems to be on the horizon.

Markets

Ethereum at $3.5K, Exchange Supply Hits 34-Month High

Ethereum (ETH) supply on exchanges has hit a 34-month high as the asset’s price surpassed the $3,500 mark.

ETH has risen 2.3% over the past 24 hours and is trading at $3,490 at the time of writing. The second-largest cryptocurrency — with a market cap of $419 billion — briefly touched an intraday high of $3,517 earlier today.

ETH Price, Whale Activity, RSI, and Exchange Supply – July 17 | Source: Santiment

Ethereum’s daily trading volume also increased by 7.6% to reach $19.8 billion.

According to data provided by Santiment, the supply of Ethereum on exchanges has reached $19.52 million ETH. This level was last seen in September 2021, when the asset was trading around the same price.

On the other hand, data from the market intelligence platform shows that the number of whale transactions has fallen by 12% in the last day — falling from 8,730 to 7,629 unique transactions per day.

The move shows that the supply of Ethereum on exchanges has been increasing with small deposits rather than large transactions from whales.

Additionally, the ETH Relative Strength Index (RSI) is currently hovering at the 60-mark, per Santiment. The indicator shows that Ethereum is slightly overbought at this price point, but it may not be in a critical position due to its large market cap.

One of the main drivers of Ethereum price increase is ETH spot expectations ETFs in the US Investment products are scheduled to start trading on July 23rd.

Markets

Bits + Beeps: How to Play the ‘Trump Trade’ in Cryptocurrencies After the Assassination Attempt

Also, how much will the Fed cut rates (and when)? What will be the inflows into ETH ETFs? And what is the near future for Bitcoin?

Posted on July 17, 2024 at 12:00 PM EST.

Listen to the episode at Apple Podcasts, Spotify, Capsules, Source, Podcast Addict, Pocket molds, Amazon Musicor on your favorite podcast platform.

In this episode of Bits + Bips, hosts James Seyffart, Alex Kruger and Joe McCann, joined by guest Jack Platts, dive into the market reaction to the recent assassination attempt on former President Donald Trump, analyzing how this event will influence the 2024 US presidential election and the cryptocurrency markets.

They also cover potential rate cuts: Could there be a cut in July? How big could the September rate cut be? Could the decision be influenced by the upcoming election?

They also give their predictions on what percentage of BTC ETF inflows the ETH ETFs will reach, and James talks about what he expects for Grayscale’s ETHE (hint: his outlook would be positive for ETH).

Finally, they delve into what’s next for Bitcoin as the German government runs out of BTC and Mt. Gox distributions begin. Just now?

Program Highlights:

- Whether Trump’s shooting decided the election and whether the event caused a “flight to safety”

- How election markets are becoming a place to watch election probabilities and whether cryptocurrencies “lean right”

- Whether rate cuts will occur in July or September and by how much they will cut: 25 bps or 50 bps

- How Joe sees the relationship between global liquidity cycles, rate cuts, and the potential rise of Bitcoin

- What are the new updates about Ethereum ETFs and their expected launch?

- Why Solana Hasn’t Performed Significantly Better Since Trump News

- What Market Breadth Indicates About the Current Market Rally and the Impact of Rates on Small Caps

- Everyone’s predictions on ETH ETF inflows and how much outflow we’ll see on Grayscale’s ETHE

- What’s Next for BTC After German Government Exits Bitcoin and Mt. Gox Giveaways Starting This Week

Hosts:

Guest:

- Jack PlattsCo-Founder and Managing Partner of Hypersphere Ventures

-

DeFi11 months ago

DeFi11 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech11 months ago

Fintech11 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News12 months ago

News12 months agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi11 months ago

DeFi11 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi11 months ago

DeFi11 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News12 months ago

News12 months agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech11 months ago

Fintech11 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech11 months ago

Fintech11 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

Videos5 months ago

Videos5 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto