Fintech

Why fintech upstarts have failed to unseat UK banks

In a 2018 letter to new staff members, digital bank Monzo outlined a lofty series of ambitions. The company said it aimed “to do for personal finance what Facebook has done for keeping up with your friends, or Google for finding information”.

The company, barely three years old at the time, also set a “long-term goal” of reaching a billion customers worldwide. Alongside a new cohort of challengers that also included Starling and Revolut, it was on a mission to usurp “legacy” banks, particularly the Big Four of HSBC, Barclays, Lloyds and NatWest that dominate the UK market.

A decade after these fintechs burst on to the scene, they have arguably succeeded in their mission of setting new standards for digital banking; features such as foreign currency transactions and bill-splitting, along with reliable, smartphone-friendly technology, are loved by younger customers.

“They have been amazing at challenging some of the norms in the industry,” says Tom Merry, a partner at consultancy Accenture.

But they are now being tested in a downturn. The plentiful venture capital that financed their heady growth — globally, the sector attracted $102bn in investment in 2021 — is drying up. Yet they are still burning through cash to acquire new customers while higher interest rates are driving increased competition for consumer deposits.

Traditional high-street banks have raised their game by upgrading their own digital banking services, with the result that about 60 per cent of adults living in Britain now use a mobile banking app, up from 33 per cent in 2015, according to trade body UK Finance

Critics say consumers are using neobanks as a convenient payment management service, rather than as a replacement for traditional current accounts.

Investors in fintechs are increasingly scrutinising the neobanks’ differing business models and assets, looking for proof they can be durably profitable and attract sufficient deposits to fund lending.

Their managers are working out alternative ways to generate revenue, including monetising data and licensing technology to others.

“Are neobanks an evolution or are they a revolution? They feel like an evolution,” says Tom Mendoza, fintech partner at EQT venture.

“Many of them are good companies but they will not fundamentally disrupt the fabric of retail banking.”

Launched within a year of each other between 2014 and 2015, the UK’s three leading digital challengers all benefited from ready access to venture capital funding.

The companies quickly reached “unicorn” status — defined as a private valuation of above $1bn — and valuations ballooned higher still during the mania for tech stocks. Revolut became the UK’s top fintech in 2021 after a funding round led by Japanese investment group SoftBank implied a $33bn valuation, though two of its investors last year reduced the carrying values of their stakes.

All have enjoyed a decade of rapid growth in customer numbers but pursued increasingly differentiated strategies.

Revolut is Europe’s largest neobank with 40mn customers worldwide. It has opted for rapid expansion across multiple markets and attracted users with a broad suite of services including multi-currency current accounts, cheap foreign exchange and cryptocurrency trading.

The fintech is based in London, where its offices are emblazoned with neon signs exhorting staff to “get shit done”, but licensed as a bank in Lithuania. Its application for a licence in the UK, its single biggest market, has been stalled for more than three years; the departure of several senior executives and a warning from auditors that it may have “materially misstated” its revenues on its 2021 accounts have not helped.

Anne Boden, chief executive of Starling. Its focus on banking for small businesses has helped it to reach an almost 10 per cent share of that market © Geoff Caddick/AFP/Getty Images

Anne Boden, chief executive of Starling. Its focus on banking for small businesses has helped it to reach an almost 10 per cent share of that market © Geoff Caddick/AFP/Getty Images

Starling and Monzo secured UK banking licences in 2016 and 2017, respectively. But the two banks, which split from the same company following a row between founders Anne Boden and Tom Blomfield, have also pursued divergent paths.

Monzo has focused on retail customers, while Starling has also expanded into banking for small businesses and built up a 9 per cent share of that market.

Starling is also the only one of the three that is currently profitable, posting a £195mn pre-tax profit in the year to March 2023. Monzo and Revolut say they expect to do so in their next set of accounts.

Profitability has moved to the top of the agenda for the sector as higher interest rates and an investment slowdown in the last two years forced companies to drop their “growth at all costs” mindset.

Global fintech investment has dropped by nearly 50 per cent in 2023 compared with the previous year, according to trade body Innovate Finance.

Neobanks have undeniably achieved one of their mission statements: making digital banking easy. Their designed-for-mobile interfaces attracted a new generation of customers while clever graphics, clear copywriting and intuitive budgeting tools helped foster transparency around personal finance.

Features such as the ability to split bills, temporarily freeze bank cards, move money and get payment notifications in real time within an app have become staples of modern-day banking.

Unlike traditional banks, whose IT often comprised multiple layers of mostly server-based systems, further complicated by mergers and acquisitions, fintechs have relied on newer, cloud-based applications.

They were also run like start-ups. Managers encouraged staff to move quickly to build and test new products. Lucas Johnston, a former software engineer at Starling and Monzo who now works in the FT’s consulting arm, recalls the nascent industry embracing “the Silicon Valley mantra of constantly talking to customers and iterating on [their] products”.

“That, combined with a relatively young team typically from a tech background working with a modern tech stack, meant that they found the core features that consumers wanted,” he says.

Within a few years of existence, the new banks had forced some of the nation’s largest and oldest financial institutions to pour millions of pounds into the development of their own apps in order to compete with their younger peers. The big banks not only borrowed some of the fintechs’ flagship features, they also poached staff from their ranks.

“The progress that has been made by the incumbent high street banks would not have happened absent the intervention that these neobanks have made,” says Merry.

But the ability to quickly open accounts and make transfers has also proved a boon for criminals. Britons lost £1.2bn to financial fraud last year, according to trade body UK Finance, with experts pointing to the country’s digitised banking industry as a factor.

The start-ups struggled to scale up their anti-financial crime capacities at the same speed they were attracting new users, while a wave of new sanctions imposed after Russia’s 2021 invasion of Ukraine increased the amount of due diligence banks had to conduct on new customers.

The Financial Conduct Authority in 2022 warned that a spike in “suspicious activity reports” to the National Crime Agency had raised “concerns about the adequacy of [neobanks’] checks when taking on new customers”. The year before, the watchdog launched an investigation into Monzo over potential breaches of financial crime regulations.

“There cannot be a trade-off between quick and easy account opening and robust financial crime control,” FCA executive director Sarah Pritchard said at the time.

Tom Blomfield co-founded Monzo in 2015. Higher interest rates and a recent investment slowdown has forced fintechs to drop their ‘growth at all costs’ mindsets © Charlie Bibby/Financial Times

Tom Blomfield co-founded Monzo in 2015. Higher interest rates and a recent investment slowdown has forced fintechs to drop their ‘growth at all costs’ mindsets © Charlie Bibby/Financial Times

A separate report from the UK’s Payment Systems Regulator said that Monzo and Starling had some of the highest fraud rates in 2022, with only 6 per cent of those who reported fraud to Monzo fully reimbursed by the bank — compared to 44 per cent for Starling, 70 per cent for NatWest and 91 per cent for Nationwide.

Revolut’s compliance has also raised concerns. A flaw in its payment system in the US allowed criminals to steal more than $20mn of company funds over several months in 2022, the FT has previously reported.

The FCA has also investigated Revolut over allegations it allowed money to be released from accounts flagged by the National Crime Agency as suspicious.

The push for profitability will require the challengers to tweak their business models away from simply acquiring more customers.

“The neobanks recognise they will not survive at scale and be sustainably profitable without a two-sided balance sheet [with loans and deposits] that’s deep, but they are not there yet,” said Accenture’s Merry.

Conventional banks have traditionally offered current accounts at little or no profit to attract customers and provide deposits that can then be recycled into mortgages and personal loans.

The differential between the interest paid on those deposits and that charged on loans — the so-called net interest margin — underpins their profits. Customers are also upsold other products, such as credit cards, insurance and investment services.

£1.2bnAmount Britons lost to financial fraud last year, according to trade body UK Finance

By contrast, and despite attempts to push into new areas including buy-to-let mortgages for Starling and passive investing for Monzo, fintechs still derive most of their revenue from transaction fees and interest on cash deposited with central banks.

“Outside of the current account, there hasn’t really been any other game-changing propositions [from neobanks],” says Julian Sawyer, who co-founded Starling but left the bank in 2019 and now works in crypto.

Many of their customers still rely on a traditional bank account to receive salary payments, then use the convenient functionality of a neobank to manage payments.

Jayne Opperman, chief executive of consumer relationships at Lloyds Banking Group, says that while many Lloyds customers hold multiple bank accounts, they still want “a trusted bank” and tend to rely on the legacy institutions for big life transactions such as buying a home.

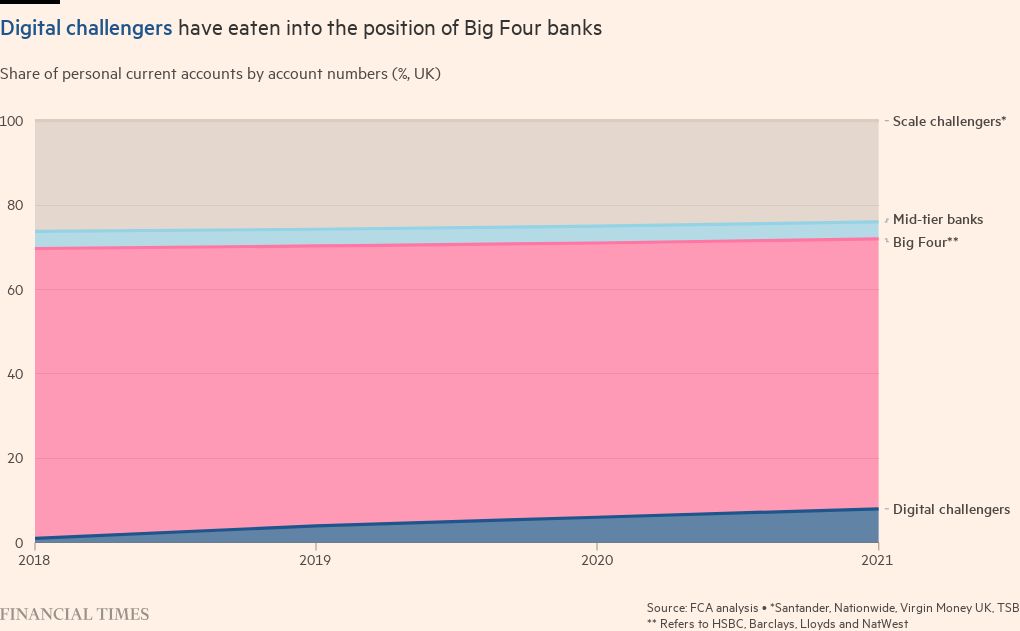

Investors are closely watching the fintechs’ shares of “primary bank accounts” — typically those that receive salary payments. An FCA review in 2022 estimated that UK neobanks had a market share of about 8 per cent of personal current accounts.

But the same review found that relative to big banks, a smaller proportion of those were primary accounts. “This results in lower balances, lower volumes of transactions, and lower overdraft usage [leading] to lower funding benefits and less scope to generate fee income.”

Fintechs downplay the importance of primacy. Revolut’s head of growth, Antoine Le Nel, says that while “we may not have too many people bringing their salaries . . . we have a lot of people who move all their money to Revolut the day after”.

Its customers move about £2,000 to their Revolut account every month, Le Nel says. The company estimates that more than a third of its customers use Revolut as their primary bank account for day-to-day payments.

Revolut chief executive Nikolay Storonsky. The digital bank is thinking of diversifying its revenue sources by moving into areas such as advertising © Charlie Bibby/FT

Revolut chief executive Nikolay Storonsky. The digital bank is thinking of diversifying its revenue sources by moving into areas such as advertising © Charlie Bibby/FT

Monzo chief executive TS Anil told the FT in March that while it does not publish the percentage of salaries paid into its current accounts, “the quality of engagement” of its users was “off the charts” relative to the UK market.

Monzo and Starling rank ahead of other banks when it comes to how likely customers would be to recommend them to friends and families, according to an industry-wide survey conducted by Ipsos.

“Whether you look at weekly transactions, bank retention, customer love, net promoter score, it’s no accident that the largest share of our user growth comes from word of mouth and organic channels,” said Anil.

Even if digital banks can convince customers to trust them with a larger portion of their money, they will have to contend with wider structural changes in the UK banking market.

Analysts say that customers who would once have relied on a single institution for many of their financial needs — a frequent quip used to be that Britons were more likely to change their spouse than their bank — are increasingly using a potpourri of services from various providers.

One person may use Starling or Monzo to buy groceries while holding a mortgage with NatWest, sending cross-border payments via listed fintech Wise and trading crypto on Revolut.

60%Percentage of adults living in Britain that now use a mobile banking app, up from 33 per cent in 2015

Neobanks are also rushing to explore new sources of revenue beyond the traditional business of banking. Starling is betting that franchising its technological knowhow will boost its valuation, Monzo is expanding into the US, while Revolut is diversifying into areas such as advertising.

In addition to the reinvigoration of high-street banks, fintechs are also facing competition from digital challenger Chase UK, which has attracted more than 2mn customers since its launch in 2021 by offering market-leading interest rates, cashback promotions and a slick app.

Backed by US banking giant JPMorgan Chase, it is expected to launch a credit card this year and expand into Europe. Chief executive Kuba Fast says Chase UK was in “a unique position”, able to offer a fintech-like experience “with the reassurance of an established and trusted bank”.

Merry considers it unlikely that a large bank would acquire a fintech, even though their valuations have moderated. A purchaser would have to put in heavy investment, and the operational risks of adapting tech platforms designed for a smaller pool of customers and business lines to a wider product range and many more clients would be significant, he says.

Alex Barkley, head of strategic partnerships at HSBC Ventures, agrees most big banks would not want to write “a cheque that large”. Listing a fintech on the stock market would also be difficult, given that most still lose money and that the share price performance of challenger banks such as Metro has been poor.

Sir Ron Kalifa, who authored a government-commissioned review into the competitiveness of fintech in the UK, says collaboration between big banks and fintechs would benefit the industry as this would allow the latter to combine their tech and agility with the scale, customer bases and regulatory expertise of traditional banks.

But others argue that the main beneficiaries of the investment that has poured into fintechs have been consumers. “It’s silly to suggest that neobanks have materially challenged the hegemony of traditional institutions,” says Barkley.

“Arguably, their only lasting impact is pushing big banks to improve their own digital platforms.”

Fintech

US Agencies Request Information on Bank-Fintech Dealings

Federal banking regulators have issued a statement reminding banks of the potential risks associated with third-party arrangements to provide bank deposit products and services.

The agencies support responsible innovation and banks that engage in these arrangements in a safe and fair manner and in compliance with applicable law. While these arrangements may offer benefits, supervisory experience has identified a number of safety and soundness, compliance, and consumer concerns with the management of these arrangements. The statement details potential risks and provides examples of effective risk management practices for these arrangements. Additionally, the statement reminds banks of existing legal requirements, guidance, and related resources and provides insights that the agencies have gained through their oversight. The statement does not establish new supervisory expectations.

Separately, the agencies requested additional information on a broad range of arrangements between banks and fintechs, including for deposit, payment, and lending products and services. The agencies are seeking input on the nature and implications of arrangements between banks and fintechs and effective risk management practices.

The agencies are considering whether to take additional steps to ensure that banks effectively manage the risks associated with these different types of arrangements.

SUBSCRIBE TO THE NEWSLETTER

And get exclusive articles on the stock markets

Fintech

What changes in financial regulation have impacted the development of financial technology?

Exploring the complex landscape of global financial regulation, we gather insights from leading fintech leaders, including CEOs and finance experts. From the game-changing impact of PSD2 to the significant role of GDPR in data security, explore the four key regulatory changes that have reshaped fintech development, answering the question: “What changes in financial regulation have impacted fintech development?”

- PSD2 revolutionizes access to financial technology

- GDPR Improves Fintech Data Privacy

- Regulatory Sandboxes Drive Fintech Innovation

- GDPR Impacts Fintech Data Security

PSD2 revolutionizes access to financial technology

When it comes to regulatory impact on fintech development, nothing comes close to PSD2. This EU regulation has created a new level playing field for market players of all sizes, from fintech startups to established banks. It has had a ripple effect on other markets around the world, inspiring similar regulatory frameworks and driving global innovation in fintech.

The Payment Services Directive (PSD2), the EU law in force since 2018, has revolutionized the fintech industry by requiring banks to provide third-party payment providers (TPPs) with access to payment services and customer account information via open APIs. This has democratized access to financial data, fostering the development of personalized financial instruments and seamless payment solutions. Advanced security measures such as Strong Customer Authentication (SCA) have increased consumer trust, pushing both fintech companies and traditional banks to innovate and collaborate more effectively, resulting in a dynamic and consumer-friendly financial ecosystem.

The impact of PSD2 has extended beyond the EU, inspiring similar regulations around the world. Countries such as the UK, Australia and Canada have launched their own open banking initiatives, spurred by the benefits seen in the EU. PSD2 has highlighted the benefits of open banking, also prompting US financial institutions and fintech companies to explore similar initiatives voluntarily.

This has led to a global wave of fintech innovation, with financial institutions and fintech companies offering more integrated, personalized and secure services. The EU’s leadership in open banking through PSD2 has set a global standard, promoting regulatory harmonization and fostering an interconnected and innovative global financial ecosystem.

Looking ahead, the EU’s PSD3 proposals and Financial Data Access (FIDA) regulations promise to further advance open banking. PSD3 aims to refine and build on PSD2, with a focus on improving transaction security, fraud prevention, and integration between banks and TPPs. FIDA will expand data sharing beyond payment accounts to include areas such as insurance and investments, paving the way for more comprehensive financial products and services.

These developments are set to further enhance connectivity, efficiency and innovation in financial services, cementing open banking as a key component of the global financial infrastructure.

General Manager, Technology and Product Consultant Fintech, Insurtech, Miquido

GDPR Improves Fintech Data Privacy

Privacy and data protection have been taken to another level by the General Data Protection Regulation (GDPR), forcing fintech companies to tighten their data management. In compliance with the GDPR, organizations must ensure that personal data is processed fairly, transparently, and securely.

This has led to increased innovation in fintech towards technologies such as encryption and anonymization for data protection. GDPR was described as a top priority in the data protection strategies of 92% of US-based companies surveyed by PwC.

Financial Expert, Sterlinx Global

Regulatory Sandboxes Drive Fintech Innovation

Since the UK’s Financial Conduct Authority (FCA) pioneered sandbox regulatory frameworks in 2016 to enable fintech startups to explore new products and services, similar frameworks have been introduced in other countries.

This has reduced the “crippling effect on innovation” caused by a “one size fits all” regulatory approach, which would also require machines to be built to complete regulatory compliance before any testing. Successful applications within sandboxes give regulators the confidence to move forward and address gaps in laws, regulations, or supervisory approaches. This has led to widespread adoption of new technologies and business models and helped channel private sector dynamism, while keeping consumers protected and imposing appropriate regulatory requirements.

Co-founder, UK Linkology

GDPR Impacts Fintech Data Security

A big change in financial regulations that has had a real impact on fintech is the 2018 EU General Data Protection Regulation (GDPR). I have seen how GDPR has pushed us to focus more on user privacy and data security.

GDPR means we have to handle personal data much more carefully. At Leverage, we have had to step up our game to meet these new rules. We have improved our data encryption and started doing regular security audits. It was a little tricky at first, but it has made our systems much more secure.

For example, we’ve added features that give users more control over their data, like simple consent tools and clear privacy notices. These changes have helped us comply with GDPR and made our customers feel more confident in how we handle their information.

I believe that GDPR has made fintech companies, including us at Leverage, more transparent and secure. It has helped build trust with our users, showing them that we take data protection seriously.

CEO & Co-Founder, Leverage Planning

Related Articles

Fintech

M2P Fintech About to Raise $80M

Application Programming Interface (API) Infrastructure Platform M2P Financial Technology has reached the final round to raise $80 million, at a valuation of $900 million.

Specifically, M2P Fintech, formerly known as Yap, is closing a new funding round involving new and existing investors, according to entrackr.com. The India-based company, which last raised funding two and a half years ago, previously secured $56 million in a round led by Insight Partners, earning a post-money valuation of $650 million.

A source indicated that M2P Fintech is ready to raise $80 million in this new funding round, led by a new investor. Existing backers, including Insight Partners, are also expected to participate. The new funding is expected to go toward enhancing the company’s technology infrastructure and driving growth in domestic and international markets.

What does M2P Fintech do?

M2P Fintech’s API platform enables businesses to provide branded financial services through partnerships with fintech companies while maintaining regulatory compliance. In addition to its operations in India, the company is active in Nepal, UAE, Australia, New Zealand, Philippines, Bahrain, Egypt, and many other countries.

Another source revealed that M2P Fintech’s valuation in this funding round is expected to be between USD 880 million and USD 900 million (post-money). The company has reportedly received a term sheet and the deal is expected to be publicly announced soon. The Tiger Global-backed company has acquired six companies to date, including Goals101, Syntizen, and BSG ITSOFT, to enhance its service offerings.

According to TheKredible, Beenext is the company’s largest shareholder with over 13% ownership, while the co-founders collectively own 34% of the company. Although M2P Fintech has yet to release its FY24 financials, it has reported a significant increase in operating revenue. However, this growth has also been accompanied by a substantial increase in losses.

Fintech

Scottish financial technology firm Aveni secures £11m to expand AI offering

By Gloria Methri

Today

- To come

- Aveni Assistance

- Aveni Detection

Artificial intelligence Financial Technology Aveni has announced one of the largest Series A investments in a Scottish company this year, amounting to £11 million. The investment is led by Puma Private Equity with participation from Par Equity, Lloyds Banking Group and Nationwide.

Aveni combines AI expertise with extensive financial services experience to create large language models (LLMs) and AI products designed specifically for the financial services industry. It is trusted by some of the UK’s leading financial services firms. It has seen significant business growth over the past two years through its conformity and productivity solutions, Aveni Detect and Aveni Assist.

This investment will enable Aveni to build on the success of its existing products, further consolidate its presence in the sector and introduce advanced technologies through FinLLM, a large-scale language model specifically for financial services.

FinLLM is being developed in partnership with new investors Lloyds Banking Group and Nationwide. It is a large, industry-aligned language model that aims to set the standard for transparent, responsible and ethical adoption of generative AI in UK financial services.

Following the investment, the team developing the FinLLM will be based at the Edinburgh Futures Institute, in a state-of-the-art facility.

Joseph Twigg, CEO of Aveniexplained, “The financial services industry doesn’t need AI models that can quote Shakespeare; it needs AI models that deliver transparency, trust, and most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, and reviewed by financial services experts for specific financial services use cases. Generative AI is the most significant technological evolution of our generation, and we are in the early stages of adoption. This represents a significant opportunity for Aveni and our partners. The goal with FinLLM is to set a new standard for the controlled, responsible, and ethical adoption of generative AI, outperforming all other generic models in our select financial services use cases.”

Previous Article

Network International and Biz2X Sign Partnership for SME Financing

IBSi Daily News Analysis

SMBs Leverage Cloud to Gain Competitive Advantage, Study Shows

IBSi FinTech Magazine

- The Most Trusted FinTech Magazine Since 1991

- Digital monthly issue

- Over 60 pages of research, analysis, interviews, opinions and rankings

- Global coverage

subscribe now

-

DeFi12 months ago

DeFi12 months agoDeFi Technologies Appoints Andrew Forson to Board of Directors

-

Fintech12 months ago

Fintech12 months agoUS Agencies Request Information on Bank-Fintech Dealings

-

News1 year ago

News1 year agoBlock Investors Need More to Assess Crypto Unit’s Earnings Potential, Analysts Say — TradingView News

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

News1 year ago

News1 year agoBitcoin and Technology Correlation Collapses Due to Excess Supply

-

Fintech12 months ago

Fintech12 months agoWhat changes in financial regulation have impacted the development of financial technology?

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni secures £11m to expand AI offering

-

Fintech12 months ago

Fintech12 months agoScottish financial technology firm Aveni raises £11m to develop custom AI model for financial services

-

News1 year ago

News1 year agoValueZone launches new tools to maximize earnings during the ongoing crypto summer

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

Videos6 months ago

Videos6 months ago“Artificial intelligence is bringing us to a future that we may not survive” – Sco to Whitney Webb’s Waorting!